Forex Technical Analysis & Forecast 28.09.2017 (EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD, USD/RUB, GOLD, BRENT)

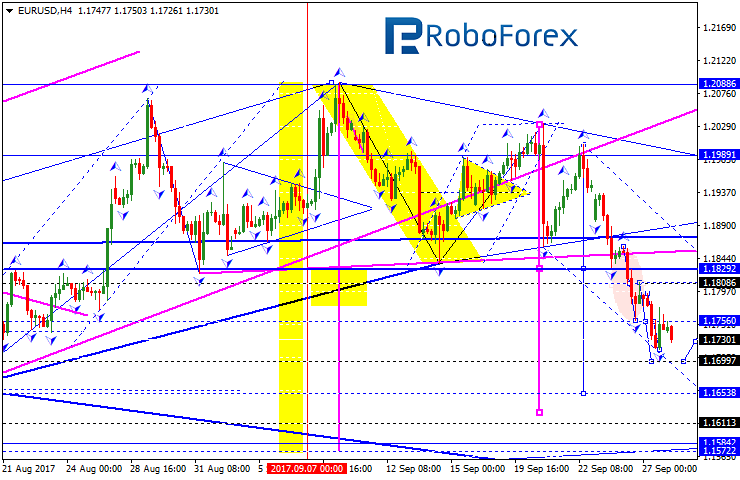

EUR USD, “Euro vs US Dollar”

Being under pressure, the EUR/USD pair is moving downwards. We think, today the price may reach 1.1699. Later, in our opinion, the market may grow towards 1.1756 and then start another decline with the target at 1.1654.

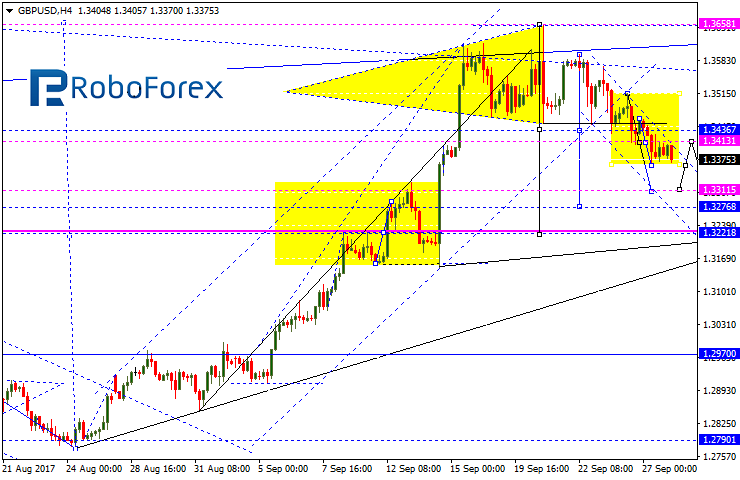

GBP USD, “Great Britain Pound vs US Dollar”

The GBP/USD pair is still falling. Possibly, today the price may reach 1.3311. After that, the instrument may test 1.3370 from below and then resume moving downwards with the target at 1.3276.

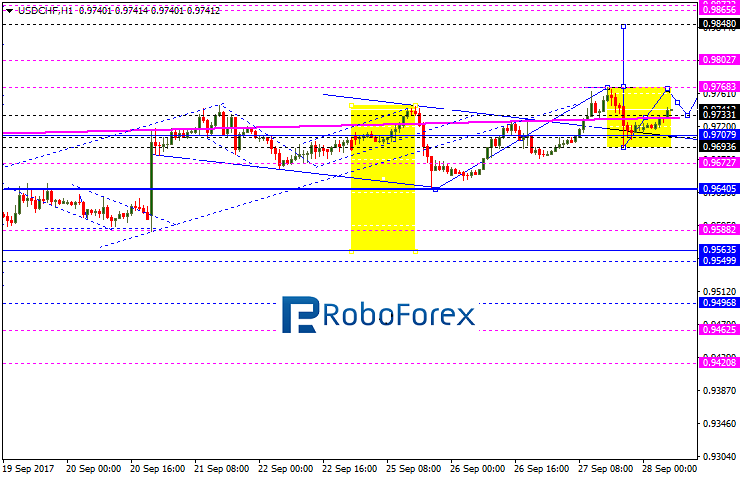

USD CHF, “US Dollar vs Swiss Franc”

The USD/CHF pair continue moving upwards. Possibly, today the price may reach 0.9768. Later, in our opinion, the market may fall towards 0.9733 and then form another ascending structure with the target at 0.9800.

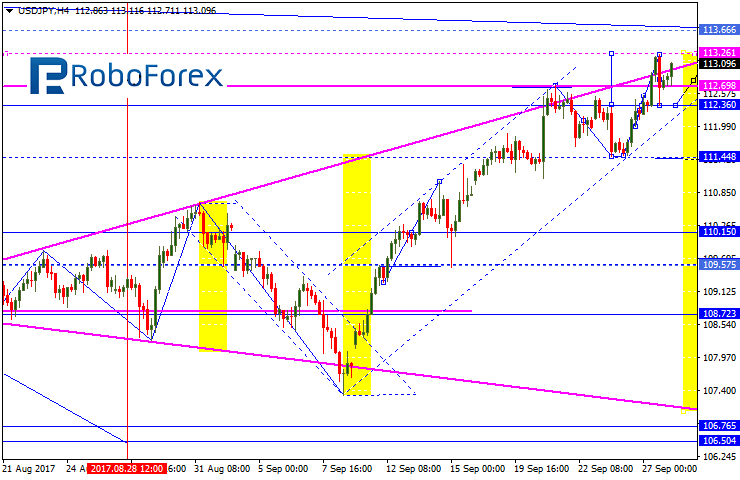

USD JPY, “US Dollar vs Japanese Yen”

The USD/JPY pair is trying to expand the Triangle pattern to the upside. We think, today the price may reach 113.27 and then fall towards 111.44. The market is expected to consolidate and form a reversal pattern to continue the downtrend.

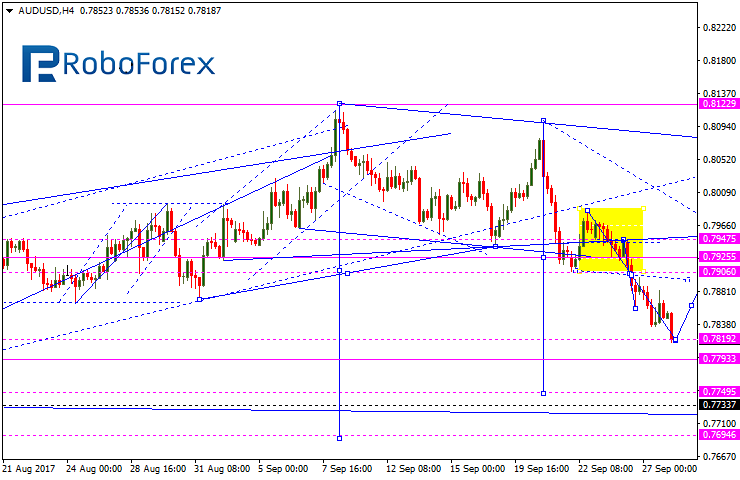

AUD USD, “Australian Dollar vs US Dollar”

The AUD/USD pair has completed the descending structure at 0.7819. Possibly, today the price may be corrected towards 0.7900 to test it from below. After that, the instrument may continue moving downwards with the local target at 0.7750.

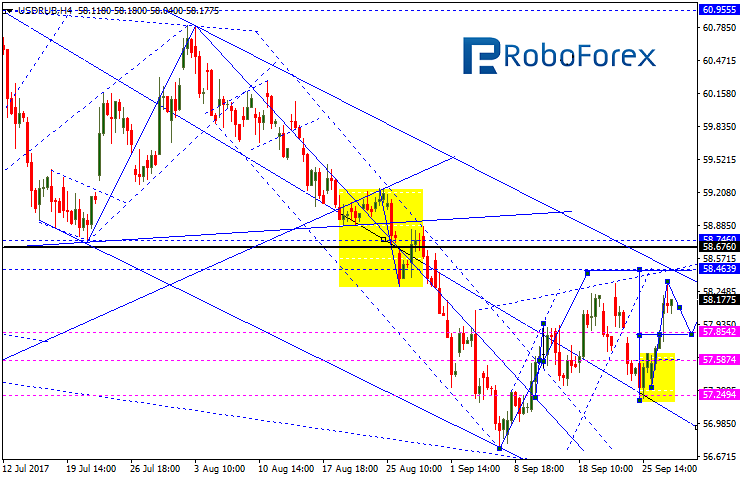

USD RUB, “US Dollar vs Russian Ruble”

The USD/RUB pair is trading at the top of the ascending wave. Possibly, the price may reach 58.46. The entire ascending wave may be considered as the fourth correctional wave. Later, in our opinion, the market may form the fifth descending wave with the target at 56.55.

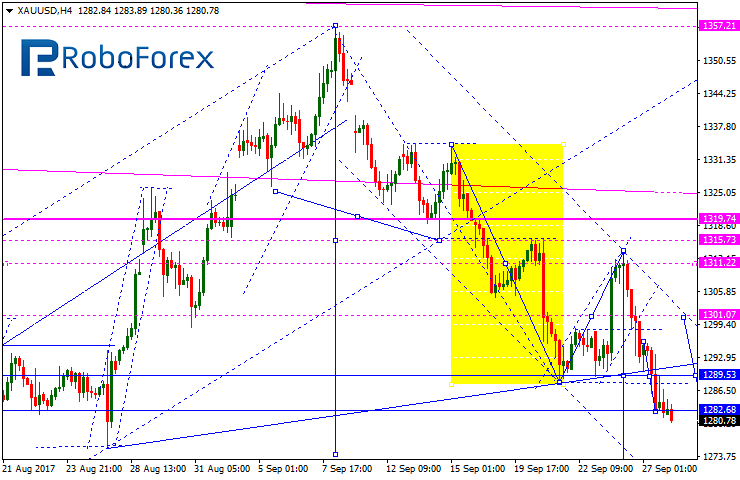

XAU USD, “Gold vs US Dollar”

Being under pressure, Gold is still moving downwards; it reached the predicted target at 1284.00, rebounded from 1289.50 and then formed a downside continuation pattern. We think, today the price may fall and extend this weave towards 1265.50.

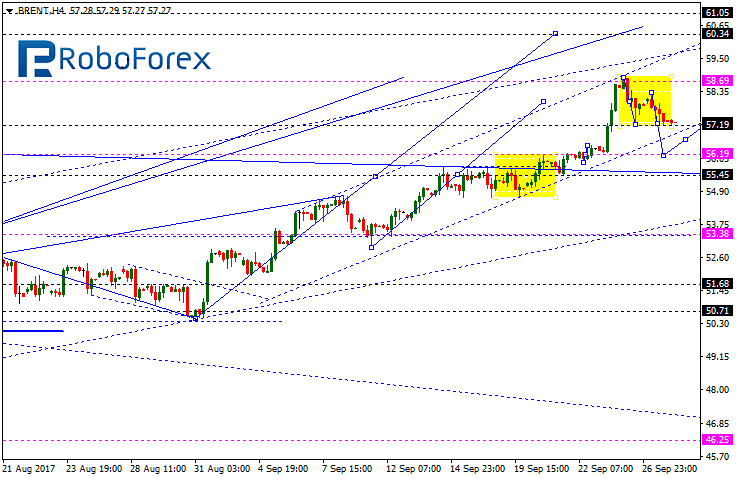

BRENT

Brent is consolidating above 57.20. If later the instrument breaks this consolidation channel to the downside, the market may be corrected towards 56.20; if to the upside – resume moving upwards with the target at 60.35.

RoboForex Analytical Department

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.