Forex Technical Analysis & Forecast 29.11.2018 (EURUSD, GBPUSD, USDCHF, USDJPY, AUDUSD, USDRUB, GOLD, BRENT)

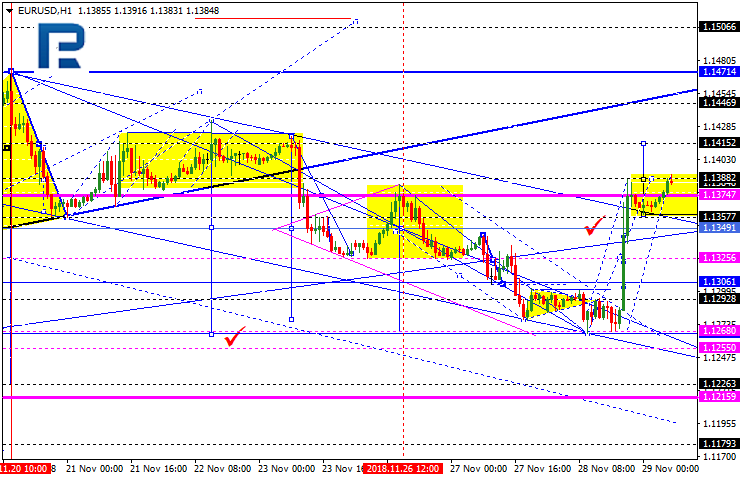

EURUSD, “Euro vs US Dollar”

EURUSD has reached the downside target and quickly returned to the center of the structure; right now, it is consolidating around 1.1375. If later the instrument breaks this range to the upside, the price may expand the range towards 1.1414; if to the downside – resume trading inside the downtrend with the target at 1.1325.

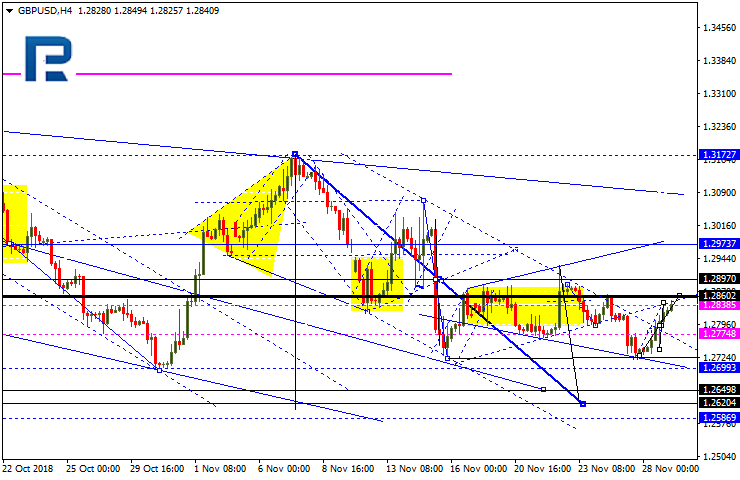

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has finished the first descending structure of the fifth wave; right now, it is being corrected towards 1.2860. After that, the instrument may form a new descending structure to break 1.2775 and then continue trading inside the downtrend with the target at 1.2699.

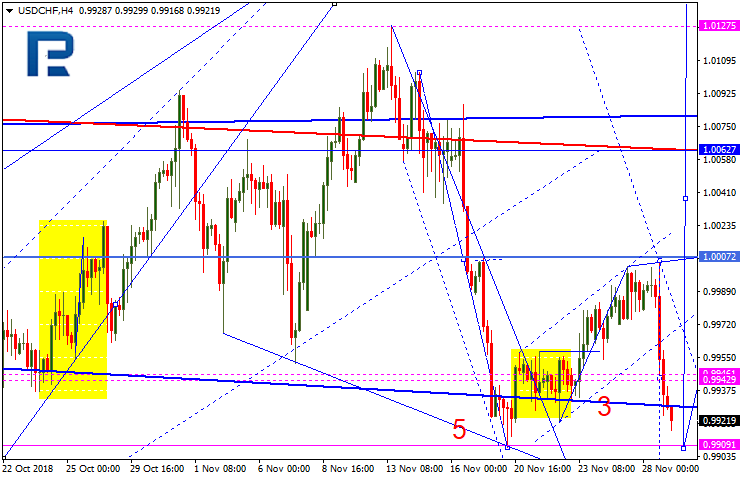

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has rebounded from the center of the descending structure. Possibly, the pair may form the fifth structure of the descending wave towards 0.9888 and then start another growth to reach the first target at 1.0007.

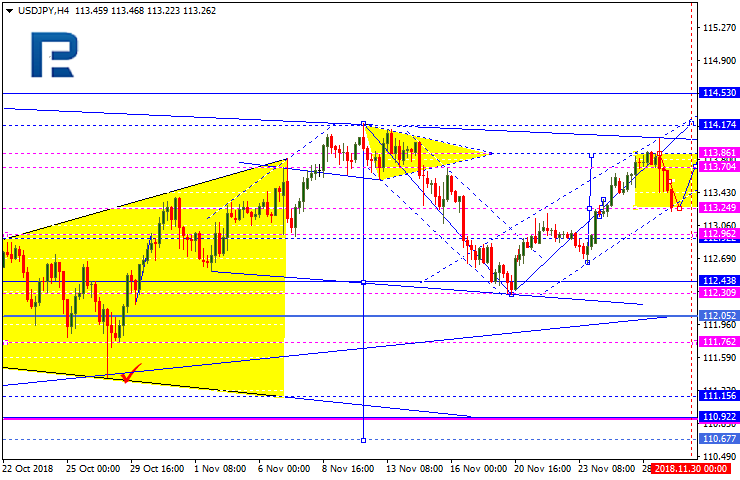

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has returned to 113.25. Possibly, the pair may extend this structure towards 112.97. Later, the market may resume trading upwards to reach 114.14.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has broken 0.7272 upwards; right now, it is still trading upwards. Today, the pair may form one more ascending structure to reach 0.7346 to complete the wave. After that, the instrument may resume falling inside the downtrend with the first target at 0.7188.

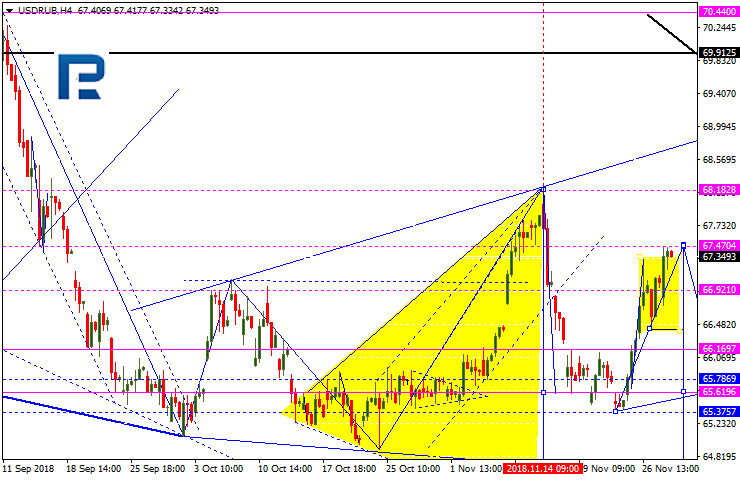

USDRUB, “US Dollar vs Russian Ruble”

USDRUB is consolidating at the top. Possibly, today the pair may fall to break 66.60 and then continue forming the third descending wave with the short-term target at 65.60.

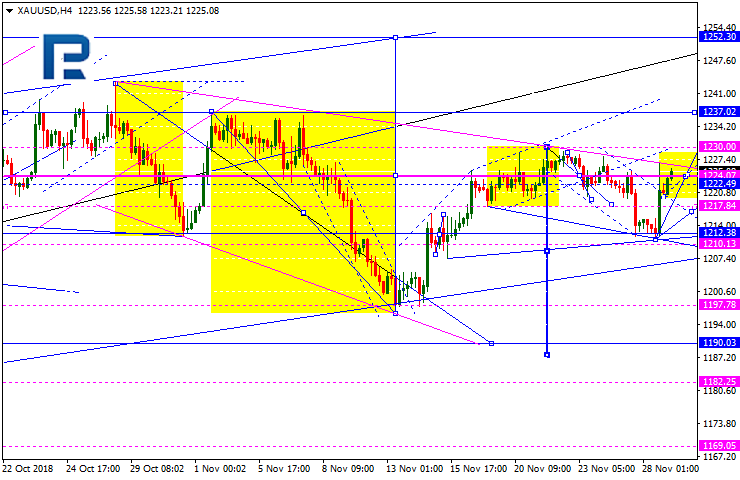

XAUUSD, “Gold vs US Dollar”

Gold has completed the ascending impulse at 1224.10; right now, it is consolidating. If later the instrument breaks this range to the upside, the price may start another growth to reach 1237.22; if to the downside – resume trading inside the downtrend with the target at 1217.40.

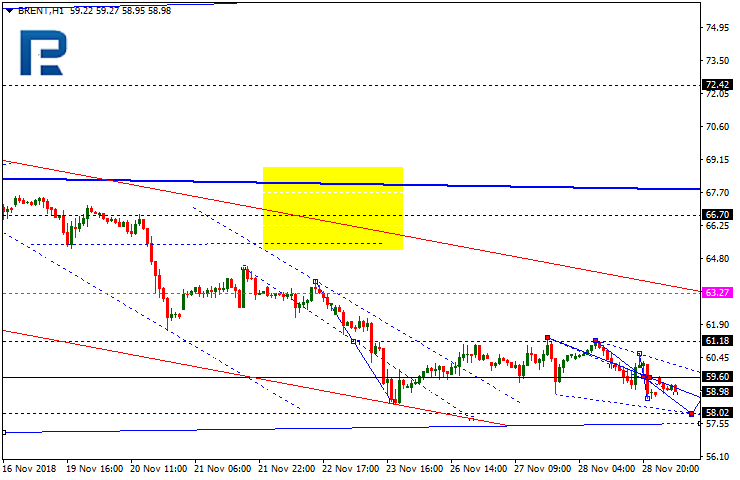

BRENT

Brent has broken 59.60 downwards and may form a new descending structure to reach 58.02. Later, the market may grow to return to 59.60 and then resume falling towards 57.80. After that, the instrument may form one more ascending structure with the target at 61.20.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.