Technical Analysis & Forecast 30.06.2023

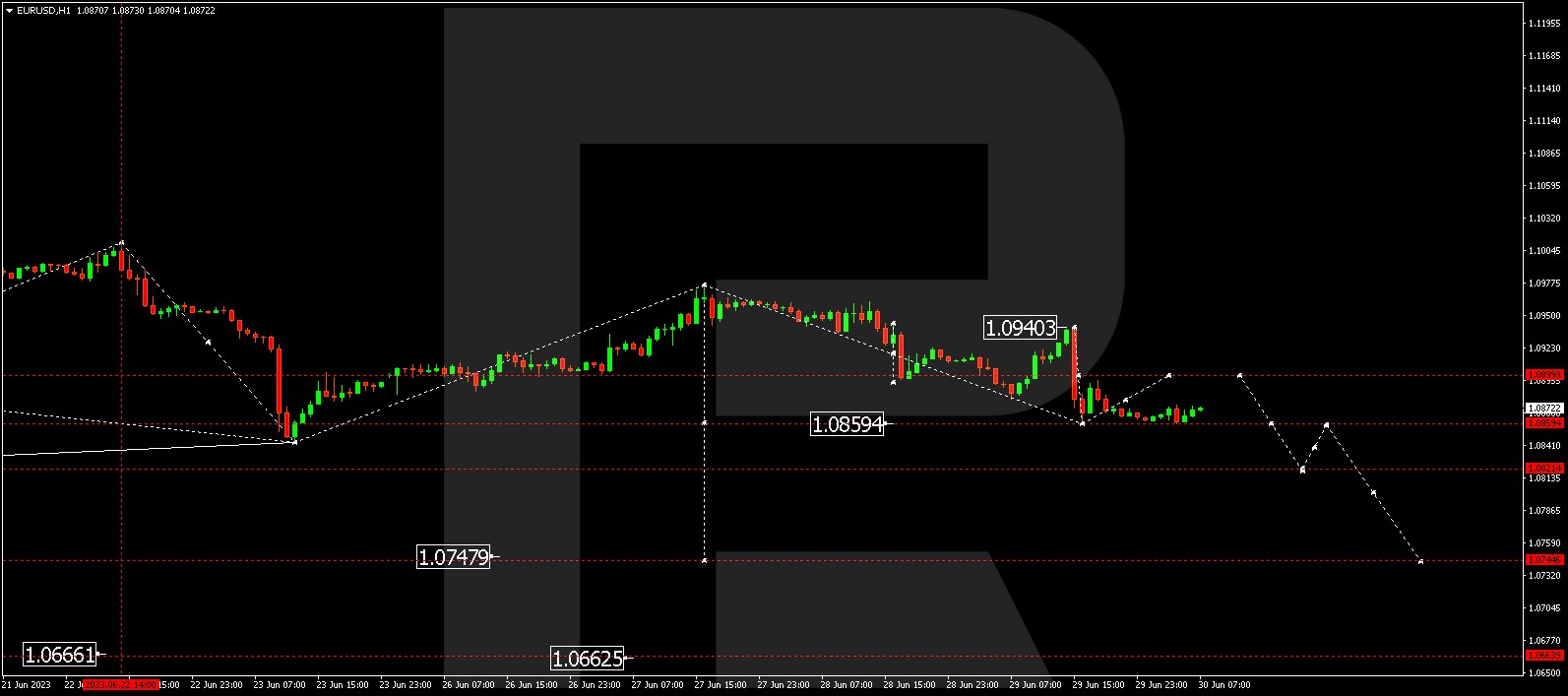

EURUSD, “Euro vs US Dollar”

EURUSD has completed a wave of decline to 1.0859. Today the market is forming a consolidation range above this level. The range might extend to 1.0899. Next, a decline to 1.0821 could follow, from where the decline could continue to 1.0744.

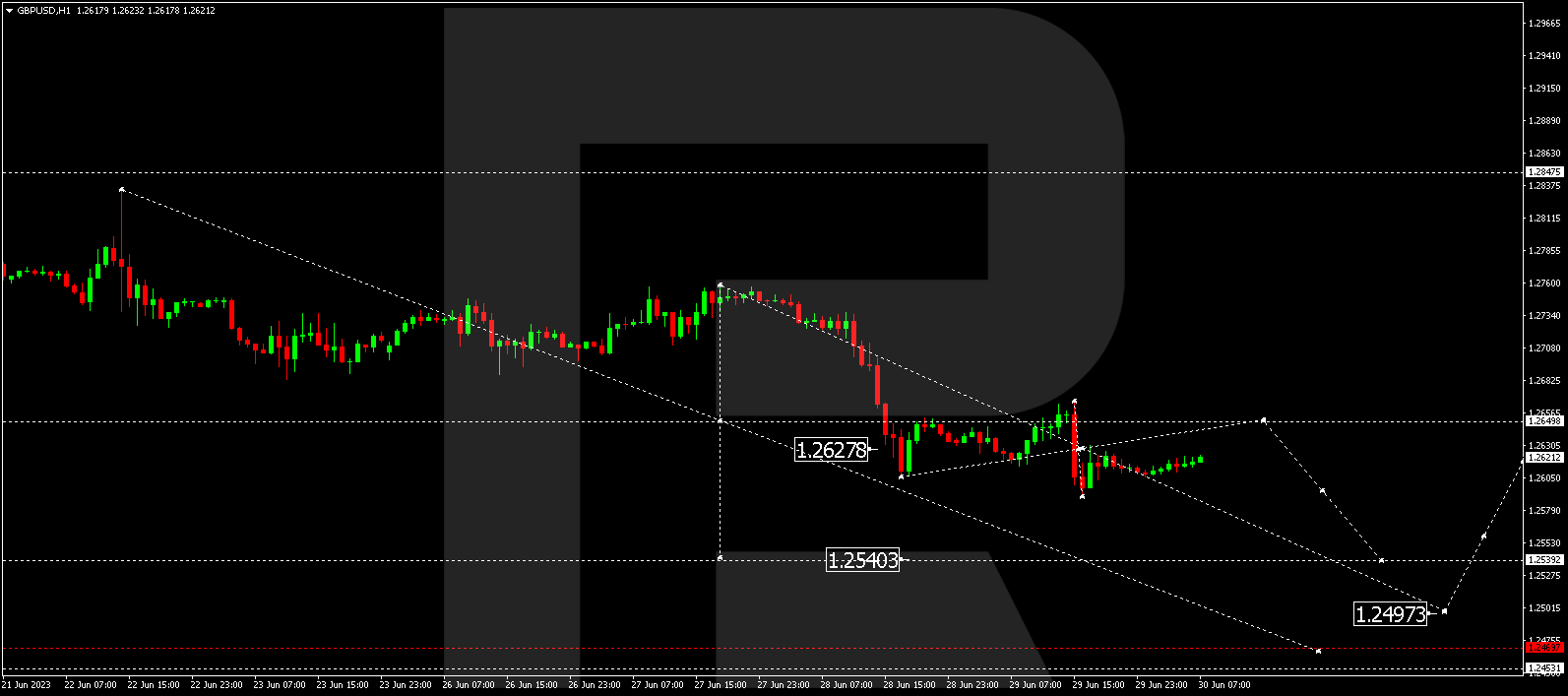

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD continues developing a consolidation range around 1.2628. With an escape from the range downwards, the potential for a wave of decline to 1.2540 could open, from where the range might continue to 1.2497.

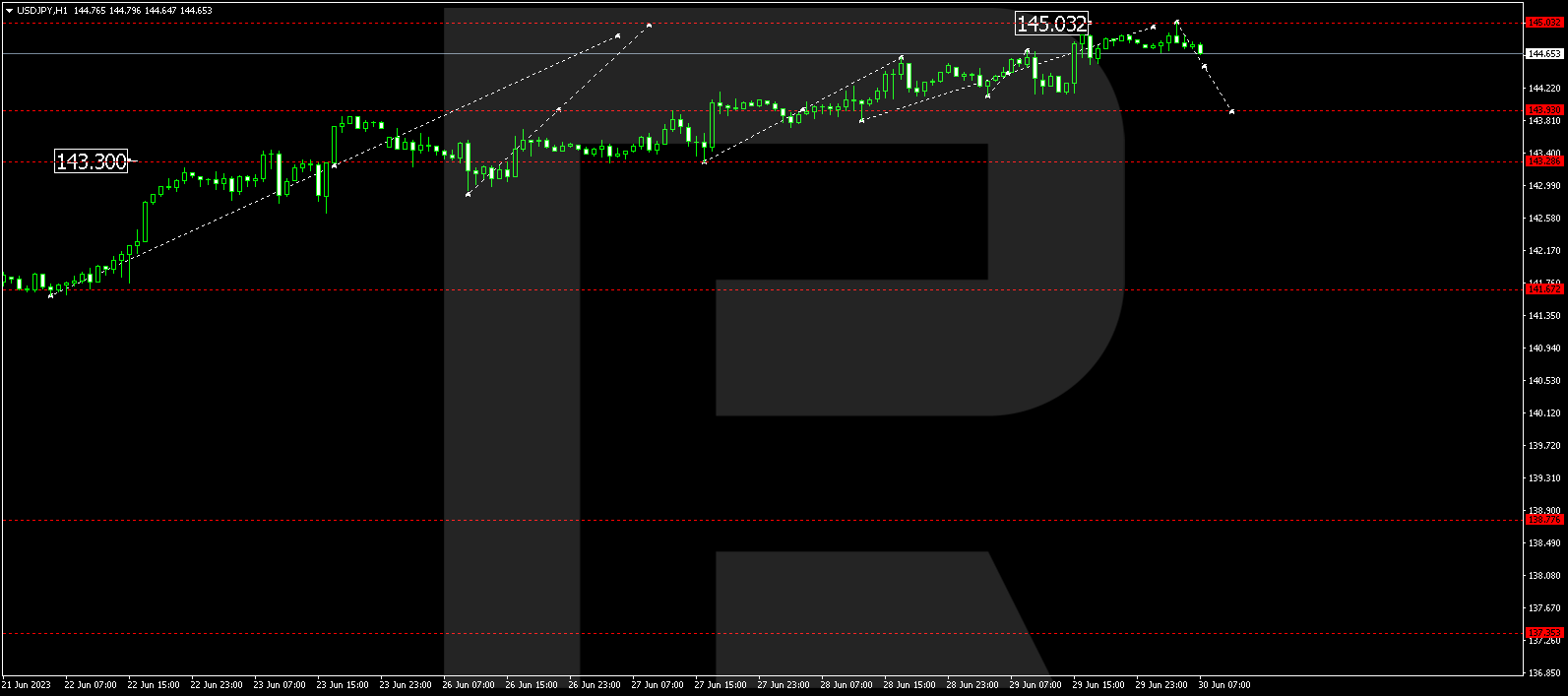

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a wave of growth to 145.03. A decline to 143.93 could form today. And if this level also breaks downwards, the potential for a drop to 143.30 might open.

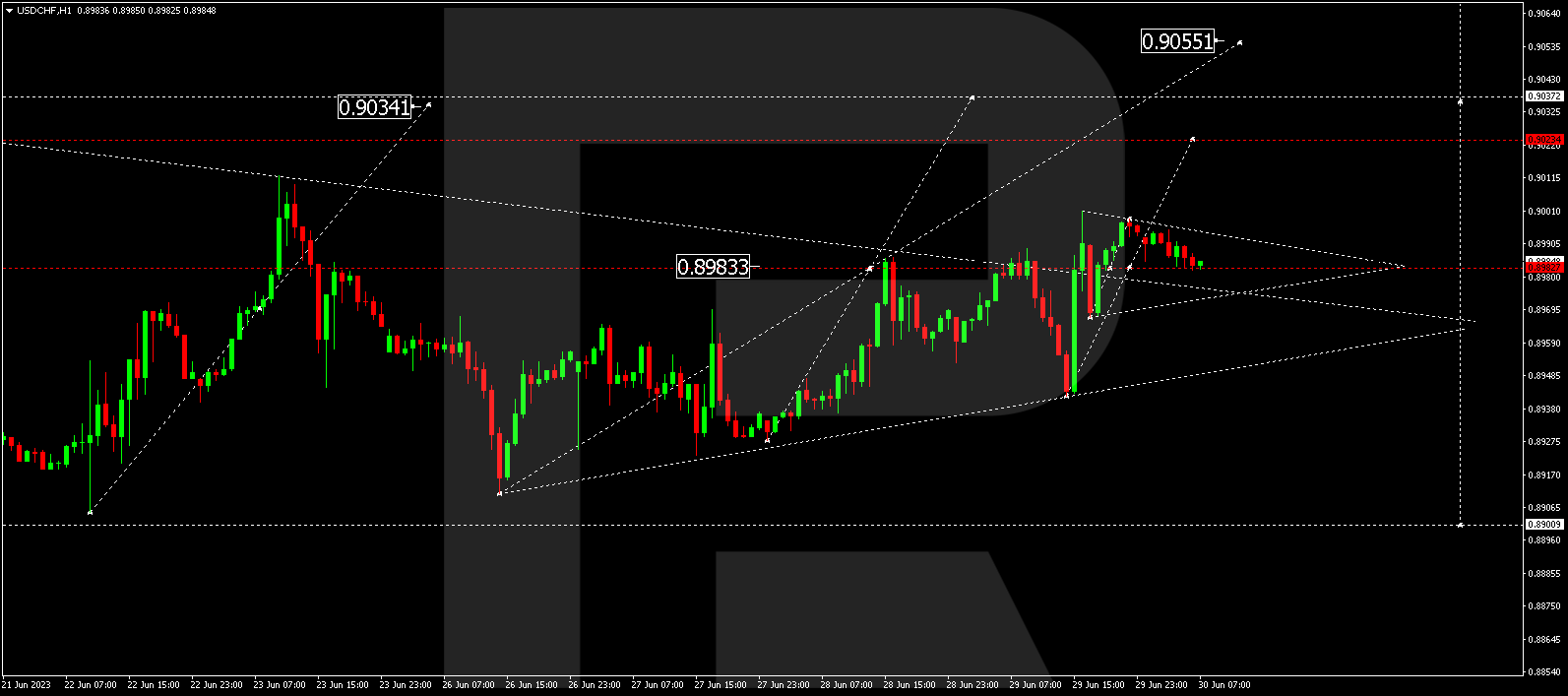

USDCHF, “US Dollar vs Swiss Franc”

USDHCF continues developing a consolidation range around 0.8983 without any expressed trend. A link of growth to 0.9024 could develop today. And if this level breaks upwards as well, the potential for a rise to 0.9055 could open. This is a local target.

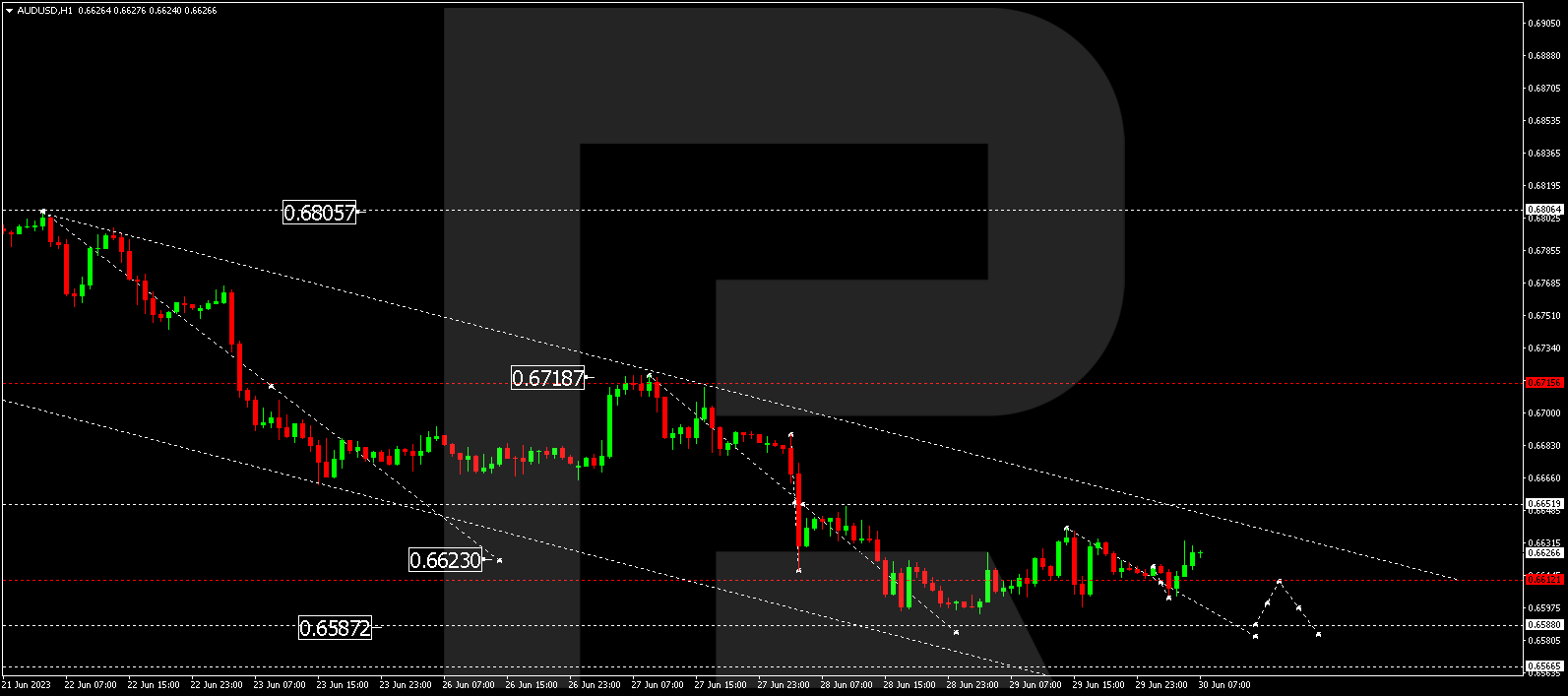

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is forming a consolidation range around 0.6612. Today the range could extend to 0.6650. Next, a decline to 0.6587 could follow, from where the trend might continue to 0.6565.

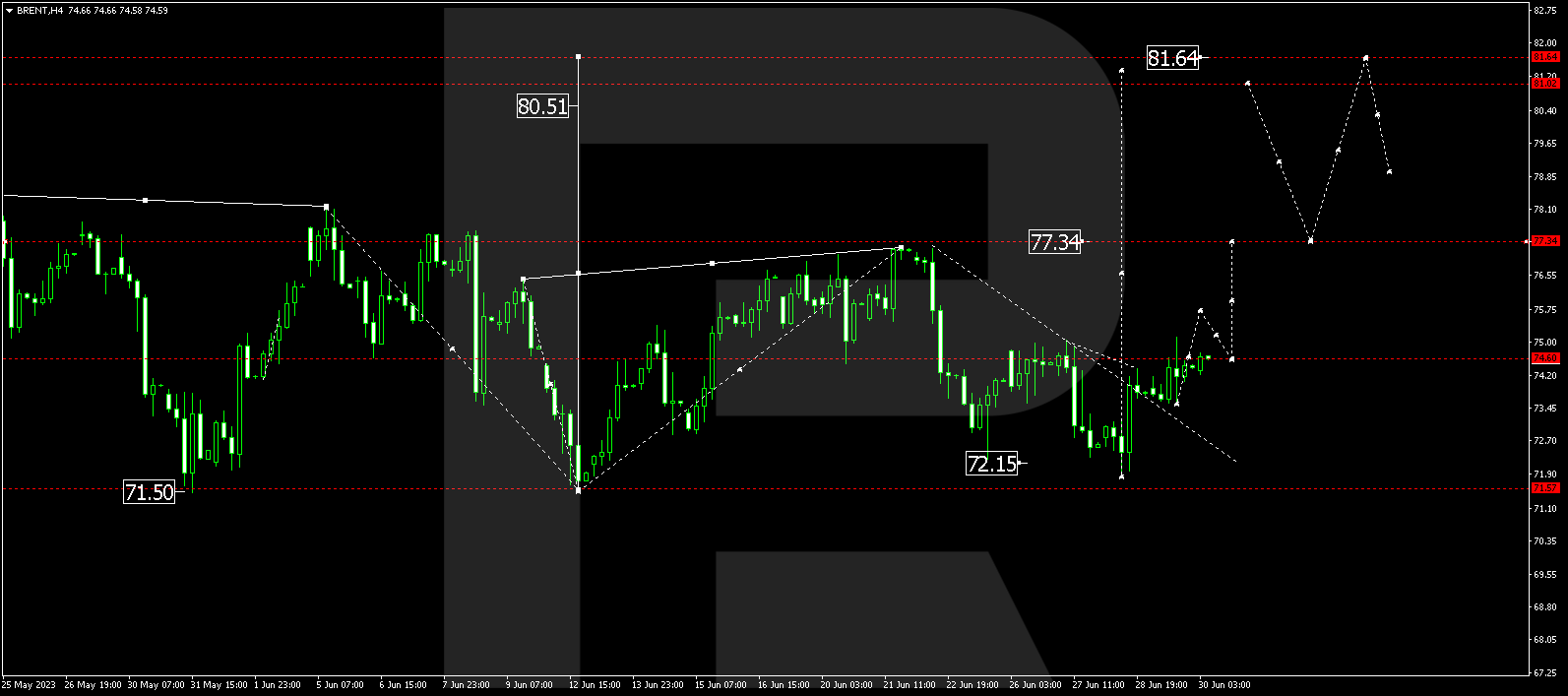

BRENT

Brent has completed a structure of a wave of growth to 74.60. Today the market is forming a consolidation range around this level. With an escape from the range upwards, the wave could continue to 77.34, from where the trend might extend to 81.60.

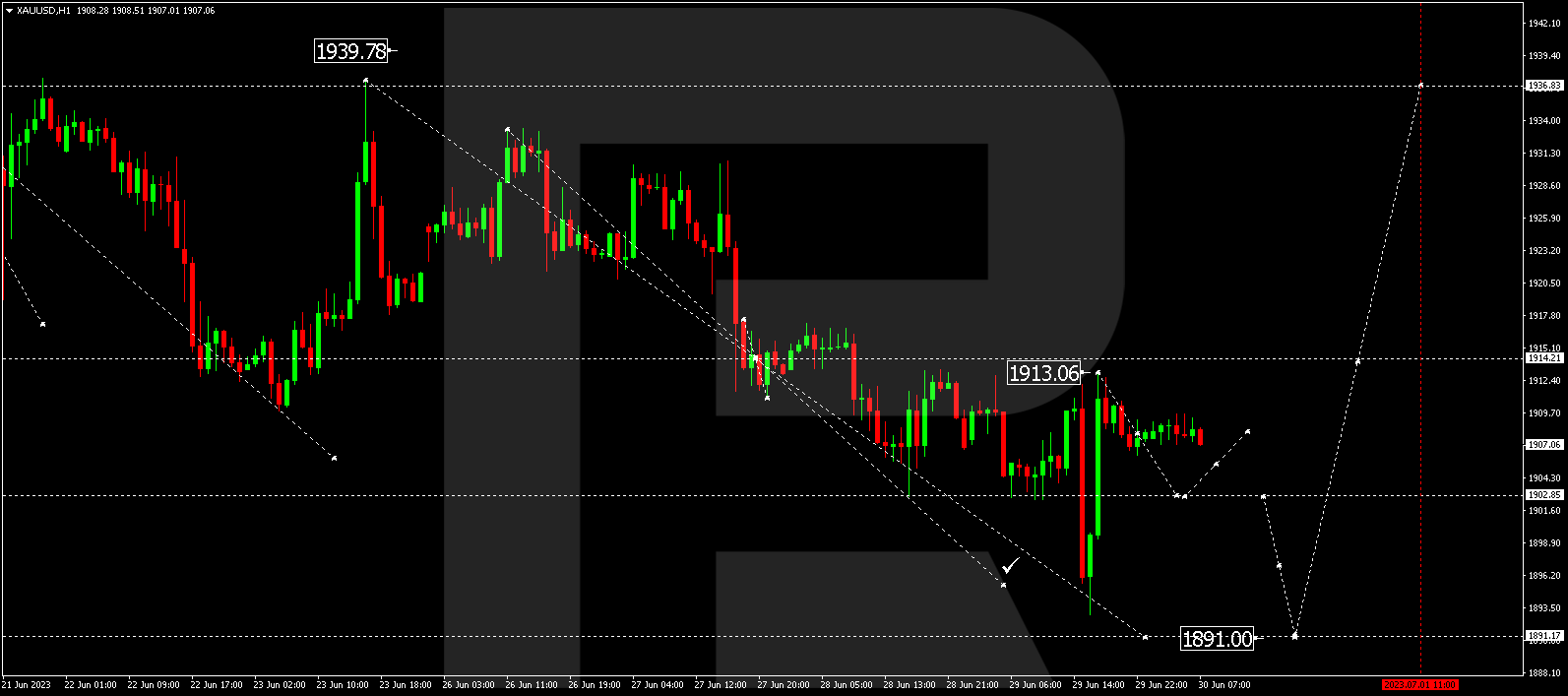

XAUUSD, “Gold vs US Dollar”

Gold completed a wave of decline to 1893.00. At a point, the market has formed a link of correction to 1913.00. Today the marker is forming a consolidation range under this level. The range is expected to extend to 1902.85. If the price escapes the range upwards, the correction might continue to 1936.85. With an escape from the range downwards, a new wave of decline might develop to 1891.00.

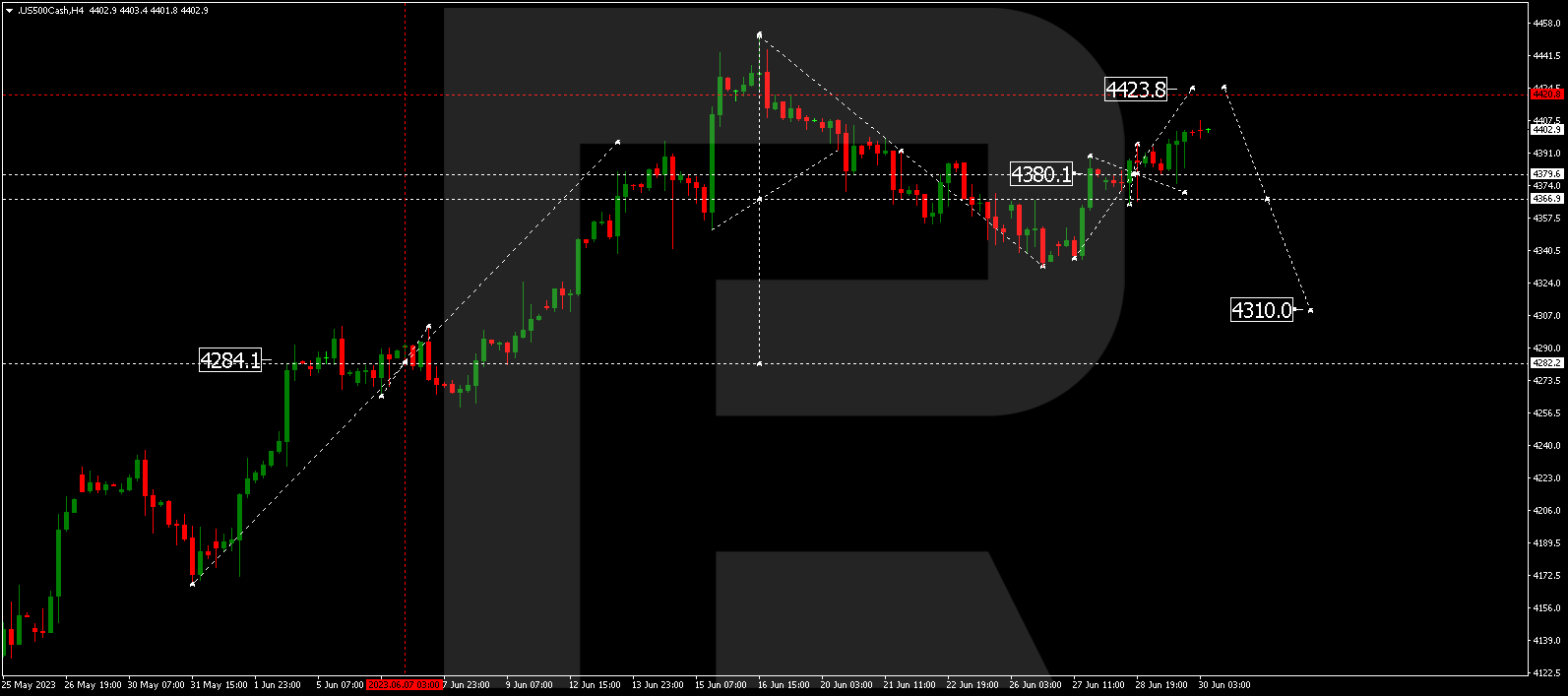

S&P 500

The stock index has completed a structure of growth to 4380.0. A consolidation range has formed around this level at a point. Today the market suggests escaping the range upwards to extend the structure of growth to 4423.8. After the price reaches this level, a new wave of decline to 4310.0 is expected to start.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.