Forex Technical Analysis 2010/11/15. EUR/USD, GBP/USD, USD/CHF, AUD/USD, NZD/USD Forecast FX.

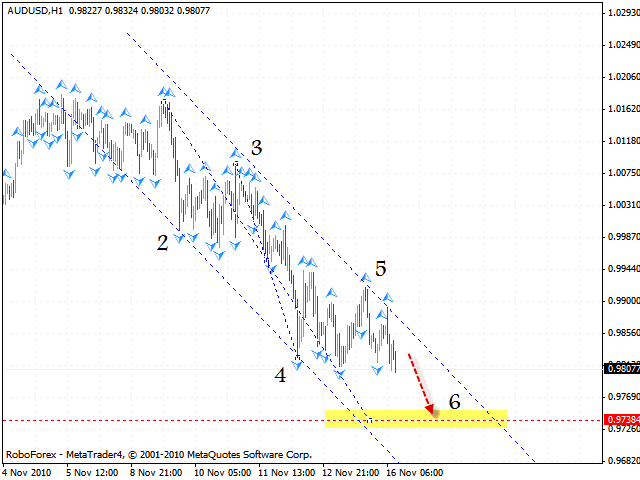

EUR USD Forecast Nov 17 2010

The EUR/USD currency pair is moving according to eurusd analysis. We recommend you to hold back from buying the positions that you have sold earlier with the target in the area of 1.3425. One can try to sell the pair with the stop above 1.3655. But if the rate is fixed outside the descending channel’s borders, one should consider buying the pair during a long-term period.

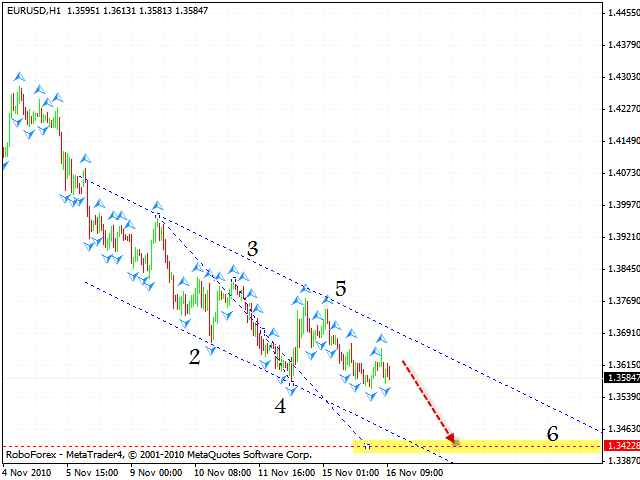

GBP USD Forecast Nov 17 2010

As you can see by gbpusd forecast, the GBP/USD currency pair keeps testing the lower side of the “triangle”. The descending pattern with the target in the area of 1.6010 has been completed. After the descending channel is broken, one can try to buy the pair with the stop below 1.6000.

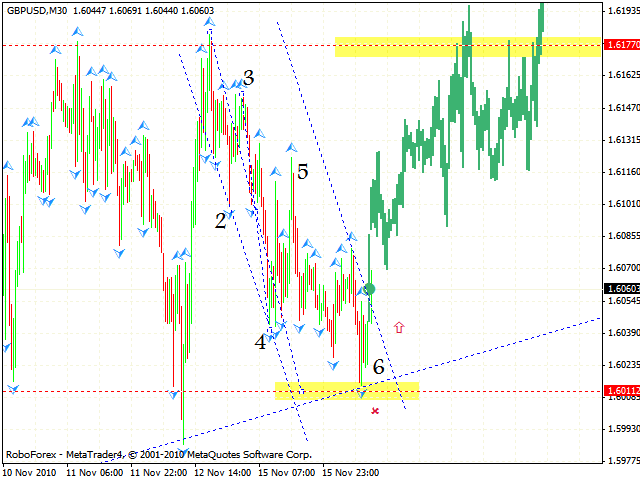

USD CHF Forecast Nov 17 2010

In case of Franc we have the rising pattern forming with the target in the area of 0.9924. Judging by technical analysis usd chf you can try to buy the USD/CHF currency pair with the tight stop below 0.9815. But if the price leaves the rising channel, we recommend you to close long positions.

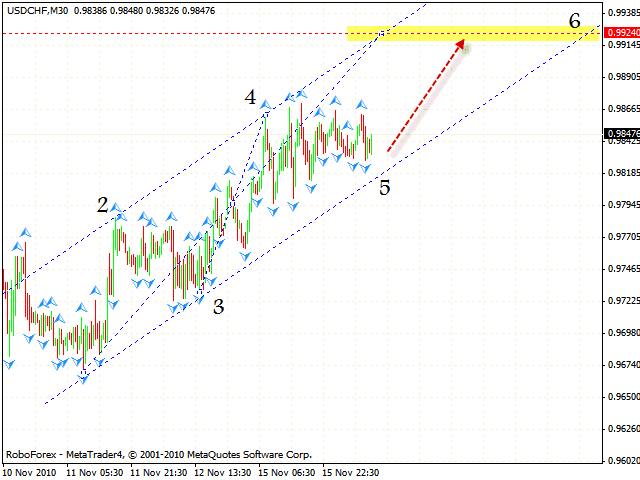

AUD USD Forecast Nov 17 2010

Australian Dollar is trying to follow other online forex currency pairs and is also moving as the descending pattern with the target in the area of 0.9738. According to aud usd analysis you can try to sell the pair with the stop above 0.9900.

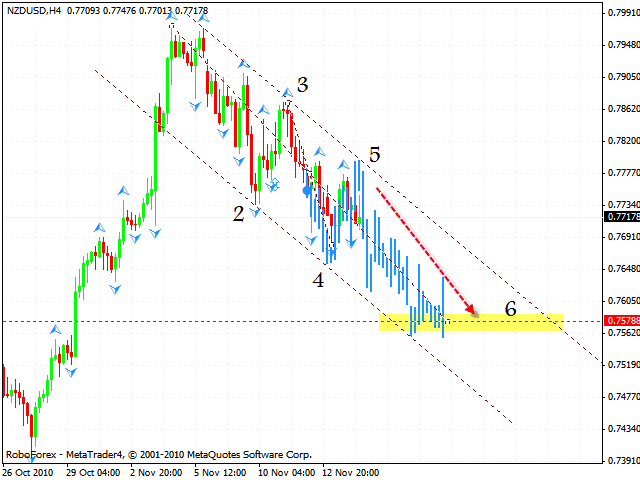

NZD USD Forecast Nov 17 2010

In case of New Zealand Dollar we can see the formation of the rising pattern’s 5th point of reference with the target of 0.7578. One should consider the tight stop sales. As we can see by nzdusd forecast, the current movement is likely to be a correction of the NZD/USD currency pair and in the nearest future we can expect the development of the rising trend.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.