Forex Technical Analysis 2011/02/24. EUR/USD,USD/CHF, AUD/USD, NZD/USD Forecast FX.

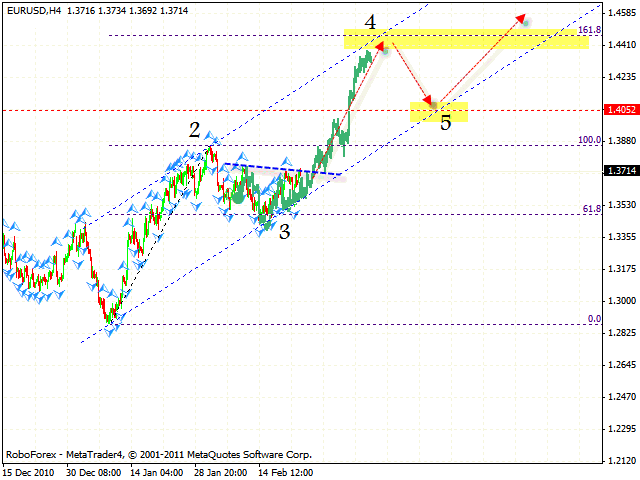

EUR USD Forecast Feb 24 2011

The EUR/USD currency pair is moving according to the eurusd forecast. By the moment the price has broken the neckline, so one can try to increase the amount of long positions. There is a potential for the rising symmetrical pattern to be formed. The target of the 4th point of reference is the area of 1.4430, where we should expect the correction to the level of 1.4050 and a final wave of growth.

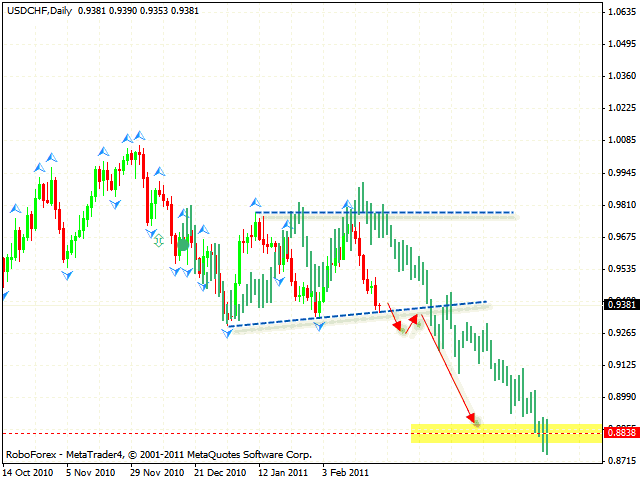

USD CHF Forecast Feb 24 2011

As it is seen from the technical analysis usd chf Franc has reached the targets defined earlier. At the daily online forex trading chart of the pair we have the “triangle” pattern forming. The closest target of the fall is the area of 0.8838, but it will happen only if the price breaks the “triangle’s“lower border.

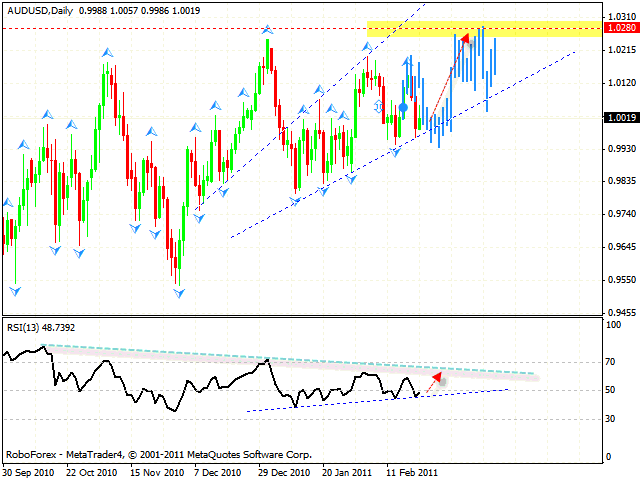

AUD USD Forecast Feb 24 2011

Australian Dollar is testing the rising channel’s lower border for the second time. The RSI indicator was supported by the trend’s rising line, and we should expect the pair to move up. The target of the growth is the area of 1.0280. Judging by the aud usd analysis you can try to buy the pair with the tight stop. But if the price breaks the channel’s lower border, this case scenario will be cancelled.

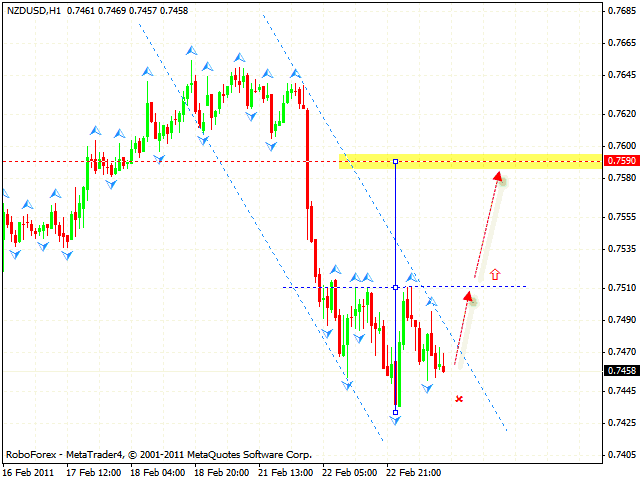

NZD USD Forecast Feb 24 2011

At the hourly chart of the NZD/USD currency pair we have “head & shoulders” reversal pattern forming with the target in the area of 0.7590. One can try to buy the pair only after the price breaks the neckline. According to the nzdusd forecast the stop must be below 0.7445.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.