Top 3 trade ideas for 10 December 2025

Trade ideas for USDCHF, GBPUSD, and XAGUSD are available today. The ideas expire on 11 December 2025 at 9:00 AM (GMT +3).

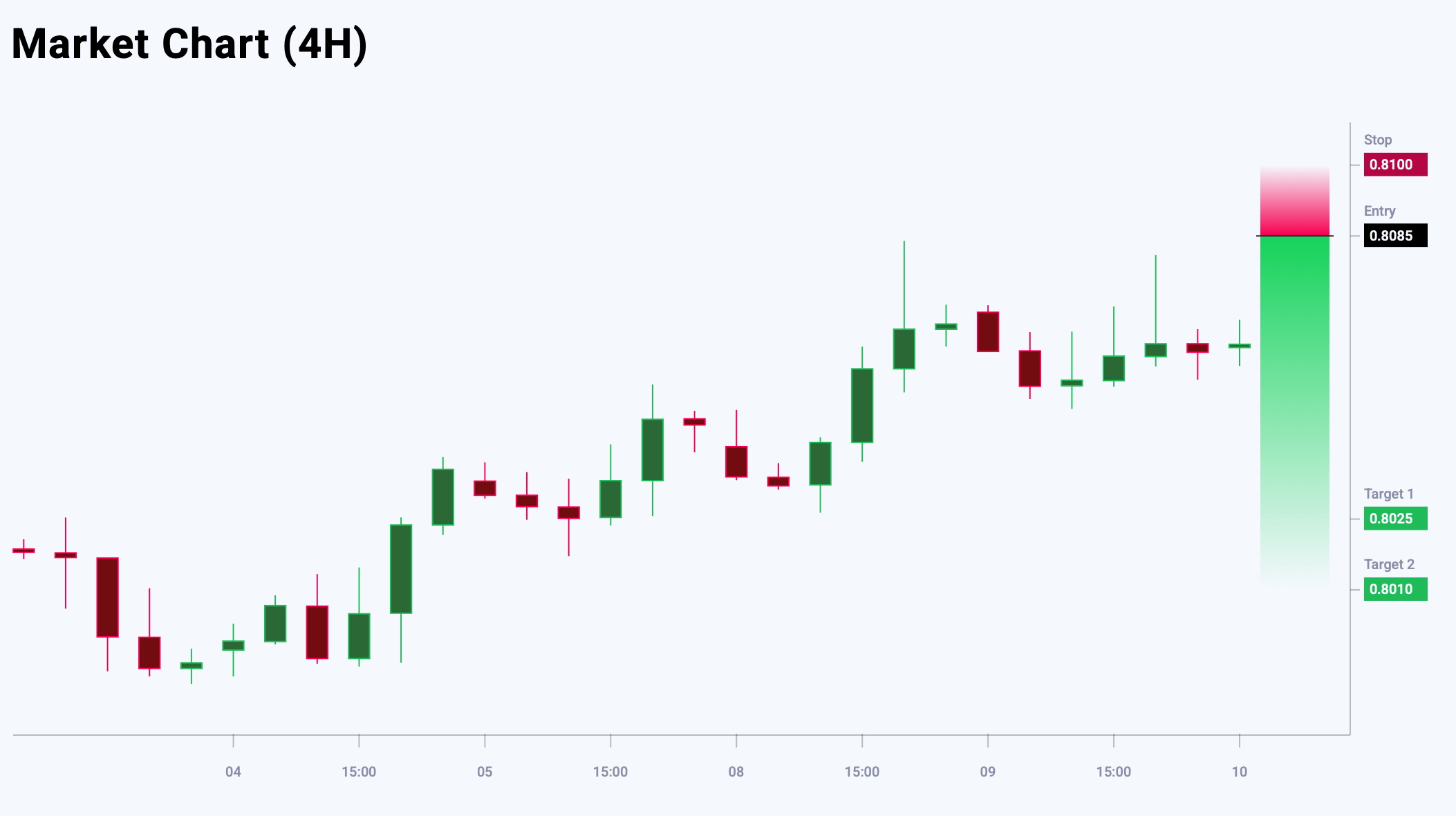

USDCHF trade idea

The USDCHF chart shows volatile movement, with a potential top forming. The key resistance level is located at 0.8085. Entering short positions at current levels carries an unfavourable risk-to-reward ratio. The preferred strategy is to sell on a rise towards resistance. Today’s USDCHF trade idea suggests placing a pending Sell Limit order.

Market sentiment for USDCHF shows a slight bearish advantage – 51% vs 49%. The risk-to-reward ratio is 1:5. Potential profit is 60 pips at the first take-profit target and 75 at the second, while possible losses are limited to 15 pips.

Trading plan

- Entry point: 0.8085

- Target 1: 0.8025

- Target 2: 0.8010

- Stop-Loss: 0.8100

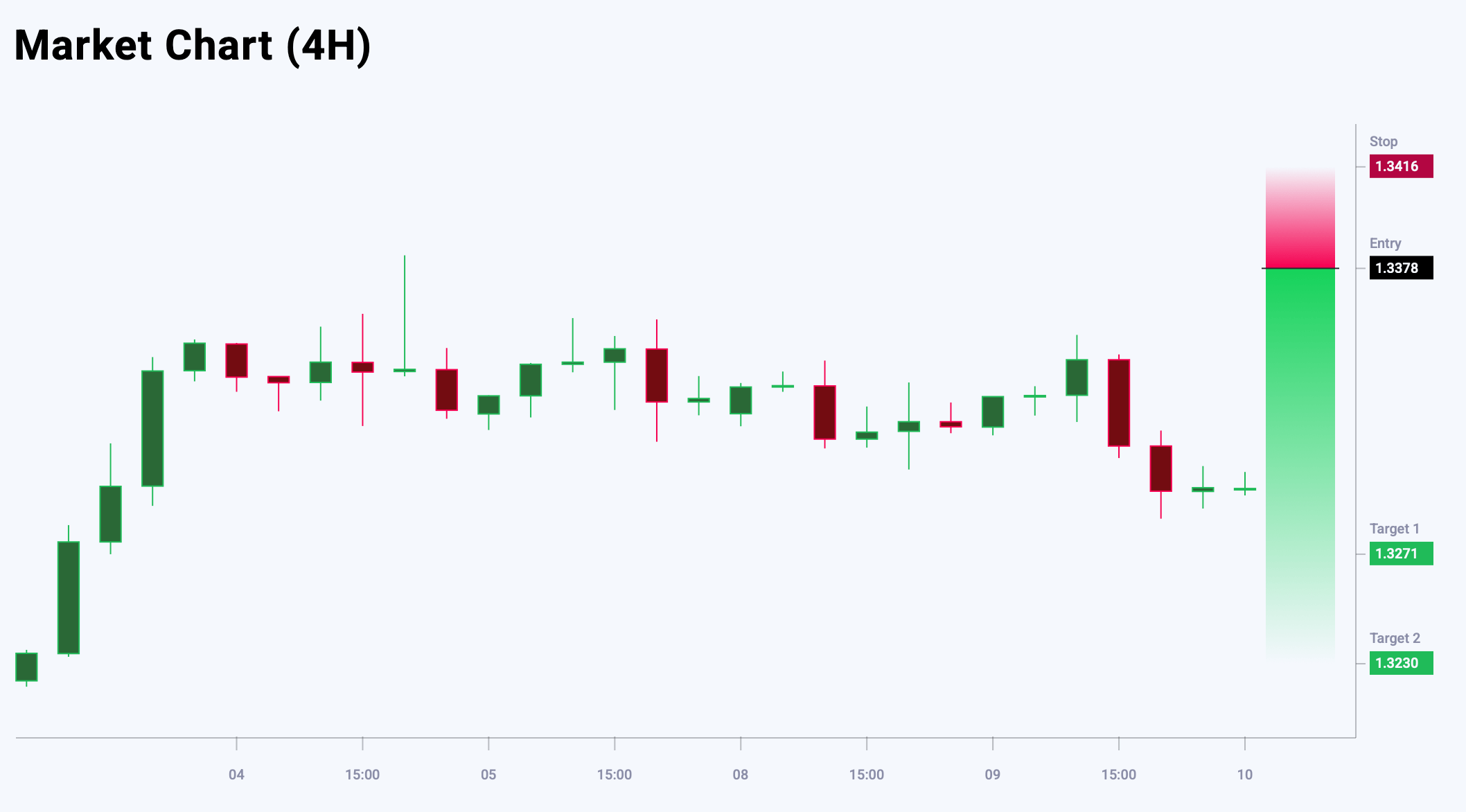

GBPUSD trade idea

The GBPUSD chart suggests the price may be forming a local bottom, and the current rise may continue. However, slowing bullish momentum – despite buyers’ advantage – signals a possible reversal. The preferred strategy is to sell on upward movement with a tight stop-loss, expecting the pair to resume its downward trajectory. The anticipated drop is corrective, but today it offers a favourable risk-to-reward setup. Today’s GBPUSD trade idea suggests placing a pending Sell Limit order.

Market sentiment for GBPUSD shows a bullish bias – 74% vs 26%. The risk-to-reward ratio exceeds 1:3. Potential profit is 107 pips at the first take-profit target and 148 at the second, with possible losses limited to 38 pips.

Trading plan

- Entry point: 1.3378

- Target 1: 1.3271

- Target 2: 1.3230

- Stop-Loss: 1.3416

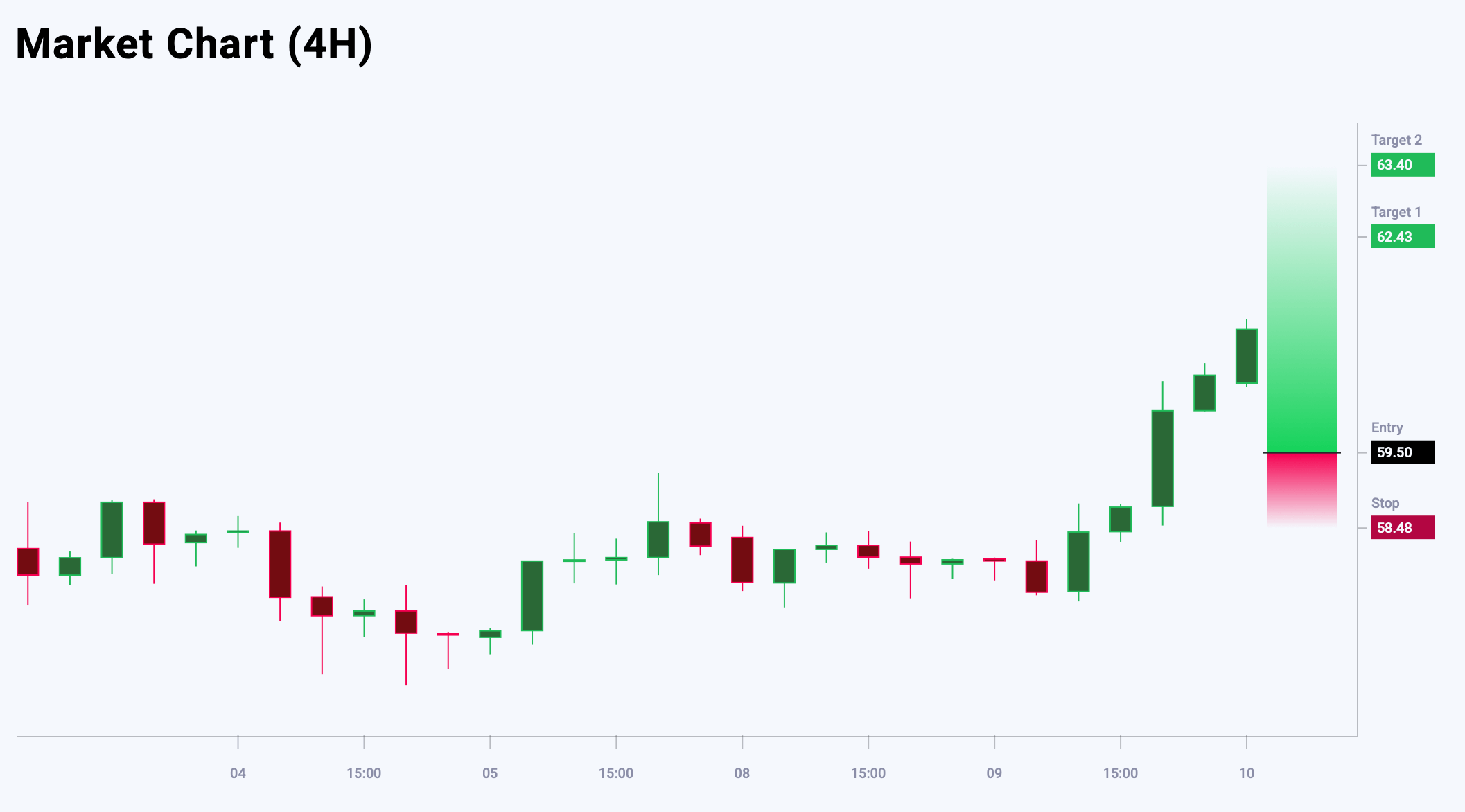

XAGUSD trade idea

XAGUSD quotes are trading in overbought territory. A bearish correction is now expected; however, the overall trend remains bullish. It is recommended to consider buying with a tight stop-loss in anticipation of continued growth near the 59.50 support level. Today’s XAGUSD trade idea is to place a pending Buy Limit order.

Market sentiment for XAGUSD shows a moderate bullish bias – 71% vs 29%. The risk-to-reward ratio is 1:3. Potential profit is 2,930 points at the first take-profit target and 3,900 at the second, with possible losses capped at 1,020 points.

Trading plan

- Entry point: 59.50

- Target 1: 62.43

- Target 2: 63.40

- Stop-Loss: 58.48

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.