Top 3 trade ideas for 19 January 2026

Trade ideas for XAGUSD, GBPUSD, and USDCHF are available today. The ideas expire on 20 January 2026 at 9:00 (GMT +3).

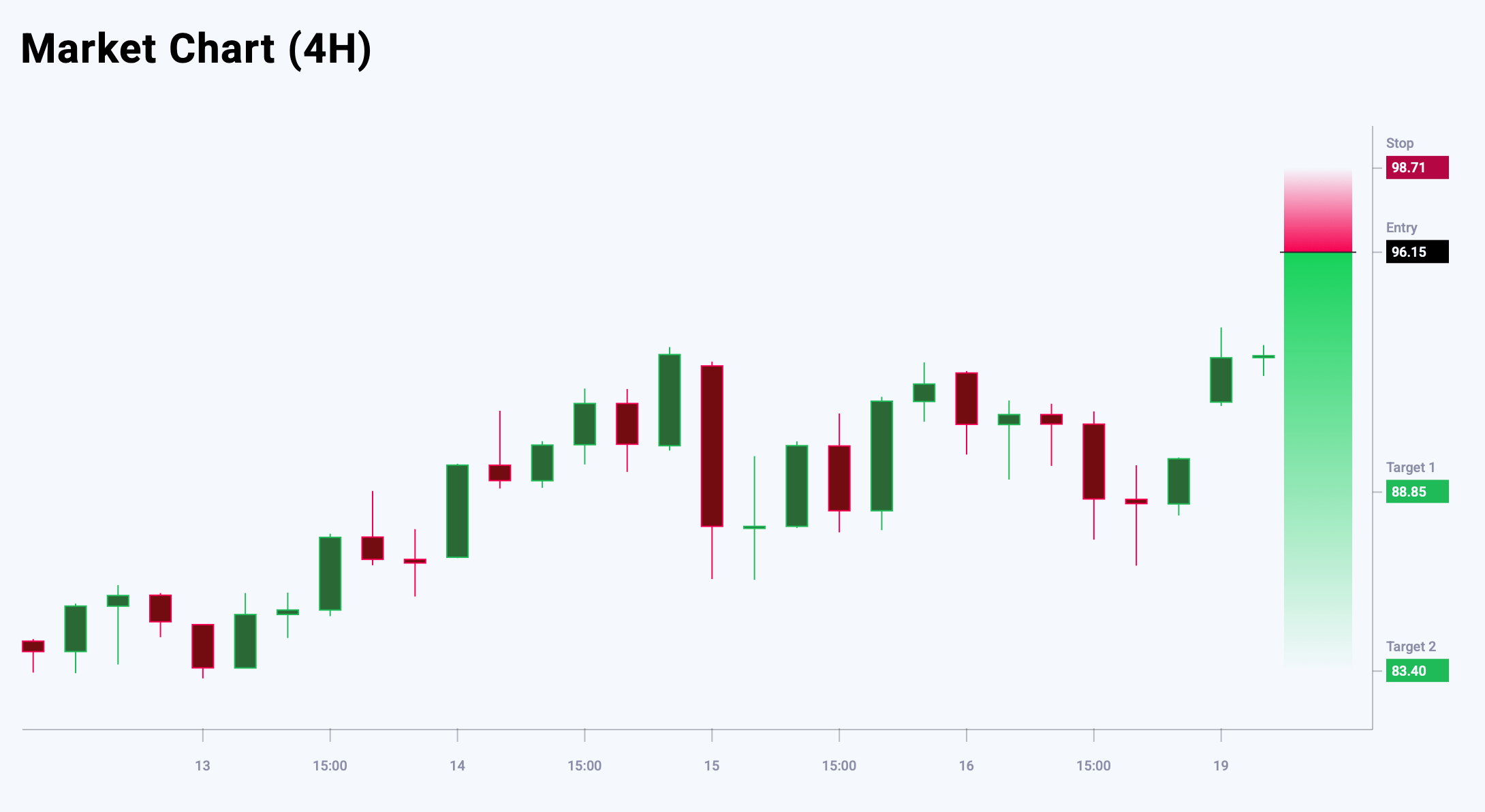

XAGUSD trade idea

Bulls continue to maintain control over XAGUSD; however, the slowdown in upward momentum signals a possible reversal in prices. Short-term sentiment is becoming more cautious, and amid weakening momentum, it is reasonable to look for opportunities to open short positions at attractive risk-to-reward levels. Today’s strategy is to sell XAGUSD on price rallies: each upward attempt may become an entry point for a corrective decline. The expected downward move is corrective, but it offers solid opportunities for traders. The key resistance level, where selling pressure is likely to resume, is located at 96.15. Today’s trading idea for XAGUSD suggests placing a pending Sell Limit order.

The information background for XAGUSD shows a dominance of bearish expectations – 54% versus 46%. The risk-to-reward ratio exceeds 1:4. Potential profit is 7,300 pips at the first take-profit level and 12,750 pips at the second, while possible losses are limited to 2,560 pips.

Trading plan

- Entry point: 96.15

- Target 1: 88.85

- Target 2: 83.40

- Stop-Loss: 98.71

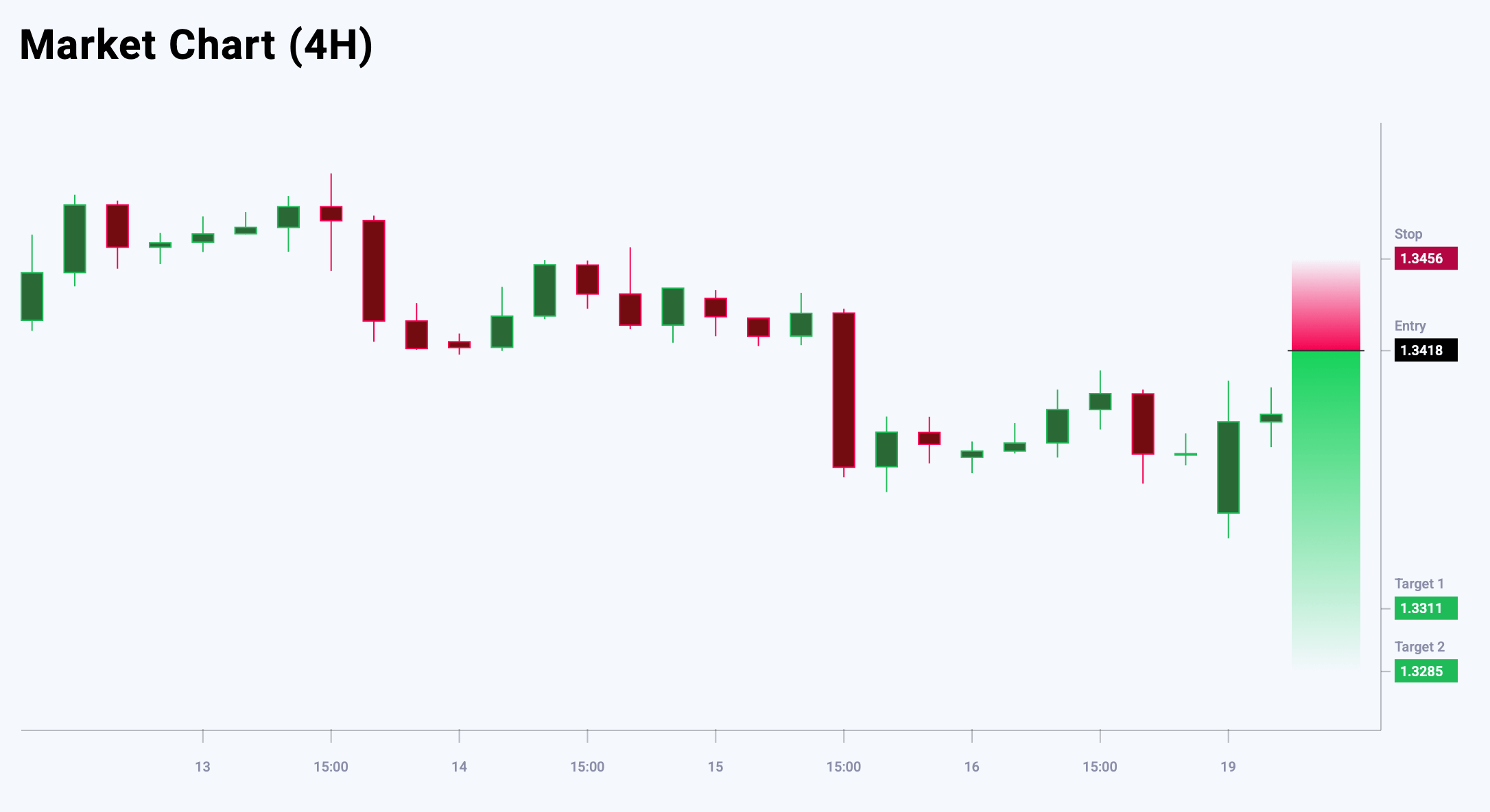

GBPUSD trade idea

Buying interest in the GBPUSD currency pair from the 1.3344 level led to a rebound from the recent low. The short-term price bias has shifted to the downside, so selling on rallies with a tight stop-loss is recommended in anticipation of renewed decline. The current upward movement is expected to continue in the near term; however, a subsequent downward move also remains likely. Selling opportunities should be sought on price advances towards the 1.3418 level. Today’s trading idea for GBPUSD suggests placing a pending Sell Limit order.

The news background for GBPUSD indicates a slight dominance of bearish sentiment – 55% versus 45%. The risk-to-reward ratio exceeds 1:3. Potential profit is 107 pips at the first take-profit level and 133 pips at the second, with possible losses capped at 38 pips.

Trading plan

- Entry point: 1.3418

- Target 1: 1.3311

- Target 2: 1.3285

- Stop-Loss: 1.3456

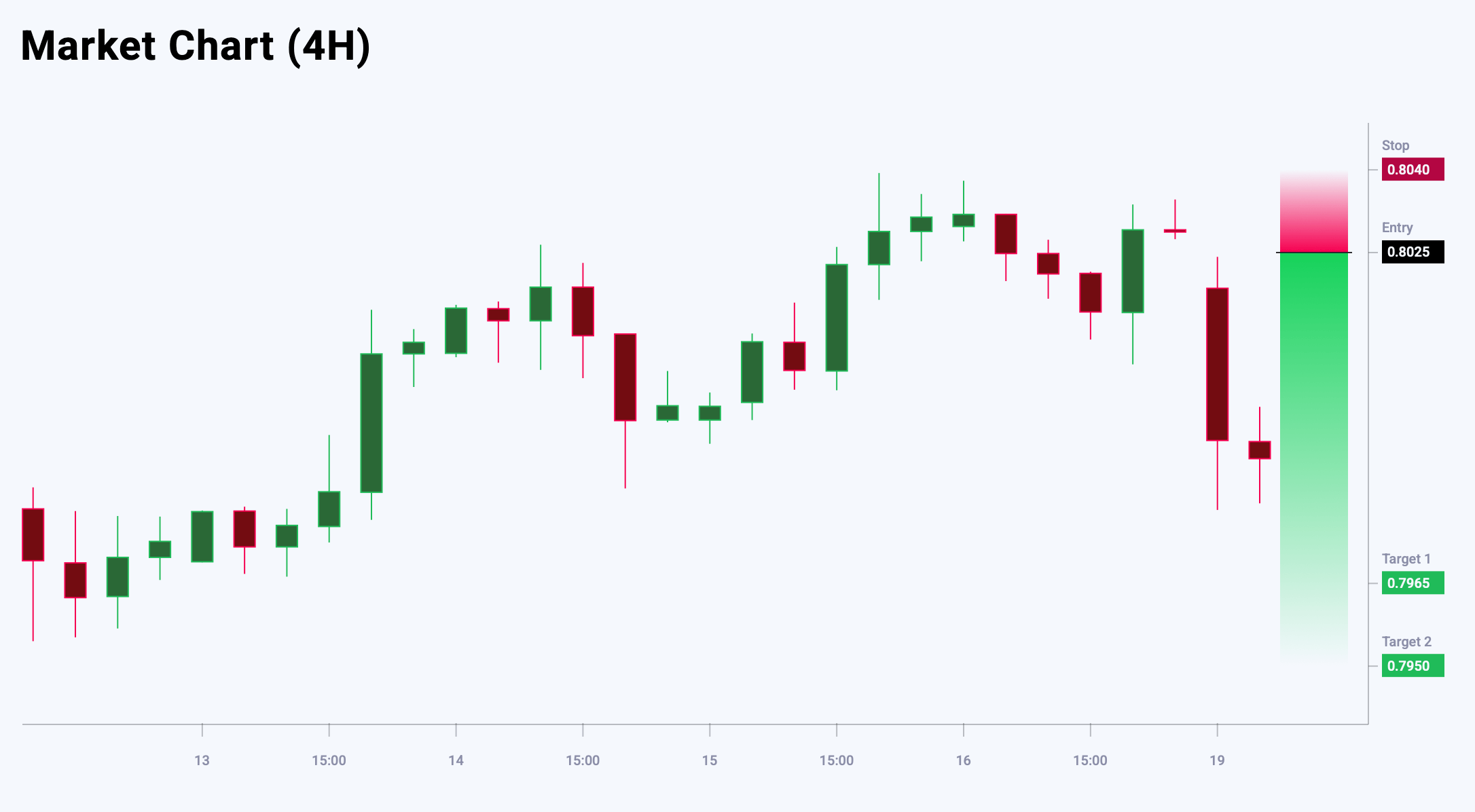

USDCHF trade idea

Although bulls continue to control the USDCHF currency pair, the slowdown in bullish momentum suggests a possible reversal, and current price action appears to be forming a local top. Opening short positions at current levels is unfavourable from a risk-to-reward perspective. The key resistance level is located at 0.8025, and the preferred strategy is to sell on price advances towards this area. Today’s trading idea for USDCHF suggests placing a pending Sell Limit order.

Market sentiment for USDCHF shows a balanced market sentiment – 50% versus 50%. The risk-to-reward ratio is 1:5. Potential profit is 60 pips at the first take-profit level and 75 pips at the second, with possible losses limited to 15 pips.

Trading plan

- Entry point: 0.8025

- Target 1: 0.7965

- Target 2: 0.7950

- Stop-Loss: 0.8040

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.