AUDUSD on the verge of a major breakout: fundamentals align perfectly

The RBA continues to support the Australian dollar, and AUDUSD may extend its rise toward the 0.6710 level. Details — in our analysis for 12 December 2025.

AUDUSD forecast: key trading points

- The RBA kept the interest rate unchanged at 3.6%

- No near-term monetary policy easing is expected from the RBA

- Australia’s labor market remains stable

- AUDUSD forecast for 12 December 2025: 0.6710

Fundamental analysis

Today’s AUDUSD forecast favors the Australian dollar, which has strong chances to continue recovering against the USD. At this stage, the pair is trading near the 0.6660 level.

Key drivers behind the strengthening of the Australian dollar:

- The RBA’s stance remains more cautious compared to major central banks. The RBA once again kept the interest rate unchanged at 3.6%

- The regulator is not rushing toward monetary easing, leaving room for further AUD appreciation

- A resilient Australian labor market provides additional support for the AUD

- Persistently strong demand from China for raw materials supports Australia’s trade balance and strengthens the AUD

- Markets expect further rate cuts from the Federal Reserve, with several reductions anticipated in 2026

- A slowing US economy and rising unemployment increase pressure on the USD

Against this backdrop, AUDUSD may continue its two-week upward trend.

AUDUSD technical analysis

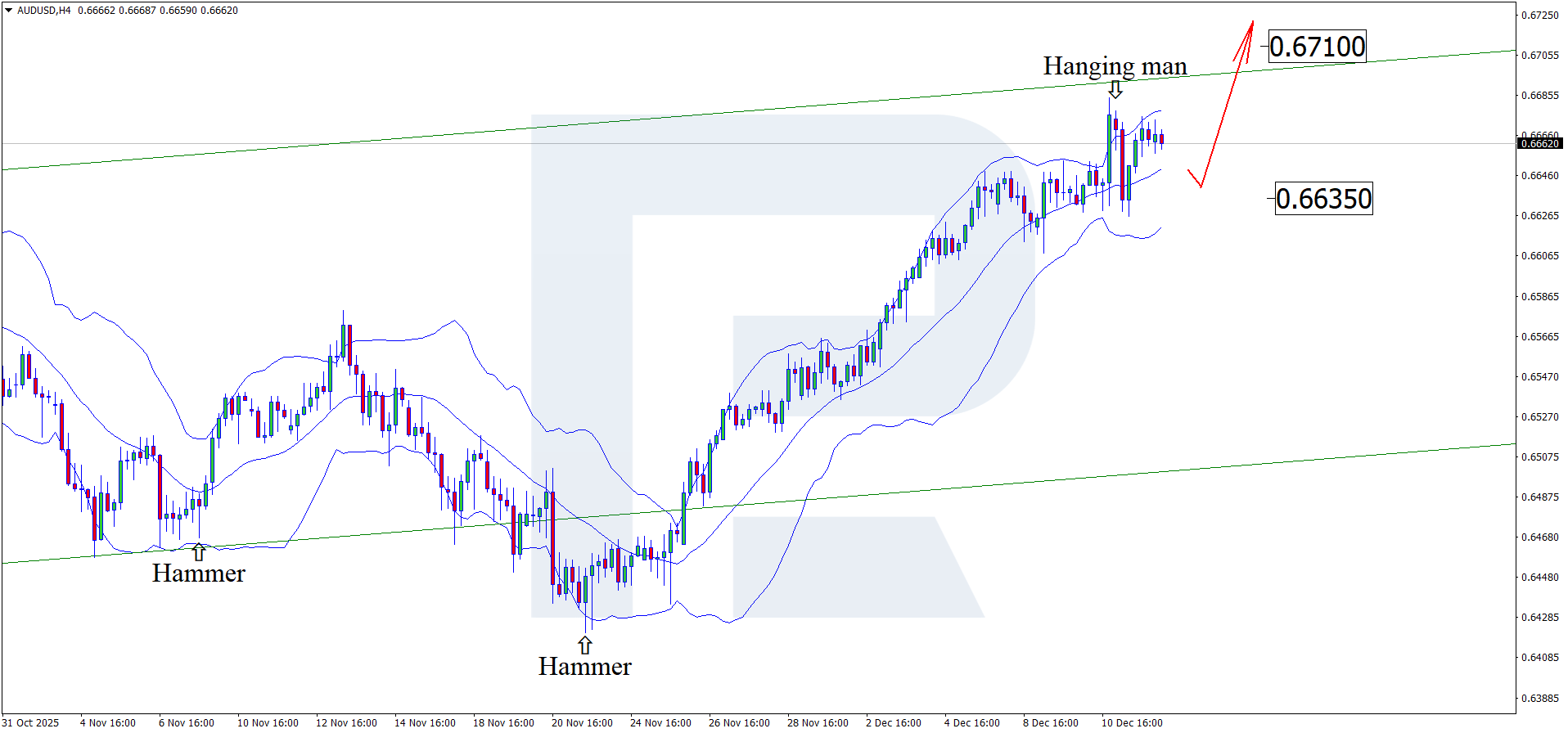

On the H4 chart, AUDUSD tested the upper Bollinger Band and formed a Hanging Man reversal pattern. At this stage, prices continue to develop a corrective wave as part of the pattern’s execution. The nearest pullback target is the support level at 0.6635.

However, the AUDUSD forecast for December 12, 2025, also allows for an alternative scenario in which the pair resumes its upward wave toward the nearest resistance at 0.6710 without testing support.

Summary

Overall, the AUDUSD outlook remains favorable for the Australian dollar. Technical analysis suggests considering a corrective pullback toward the 0.6635 support level before the continuation of the upward trend.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.