AUDUSD retreated from the all-time high

The AUDUSD rate is undergoing a moderate correction after reaching an annual high of 0.6765 amid rising geopolitical tensions. Find out more in our analysis for 16 January 2026.

AUDUSD forecast: key takeaways

- Market focus: Australian consumer inflation expectations stood at 4.6% in January 2026, compared with 4.7% a month earlier

- Current trend: correcting downwards

- AUDUSD forecast for 16 January 2026: 0.6765 or 0.6600

Fundamental analysis

Australian consumer inflation expectations in January 2026 stood at 4.6%, little changed from 4.7% in the previous month, signalling that households continue to anticipate rising price pressures.

The Australian currency, often seen as an indicator of global risk appetite, is experiencing some difficulties amid a series of geopolitical developments surrounding Iran.

Markets currently estimate the likelihood of an interest rate hike at the February RBA meeting at 27%, while expectations rise sharply to 76% by May. Additional support for the Australian dollar may come from growth in global equity markets, particularly Australian equities.

Technical outlook

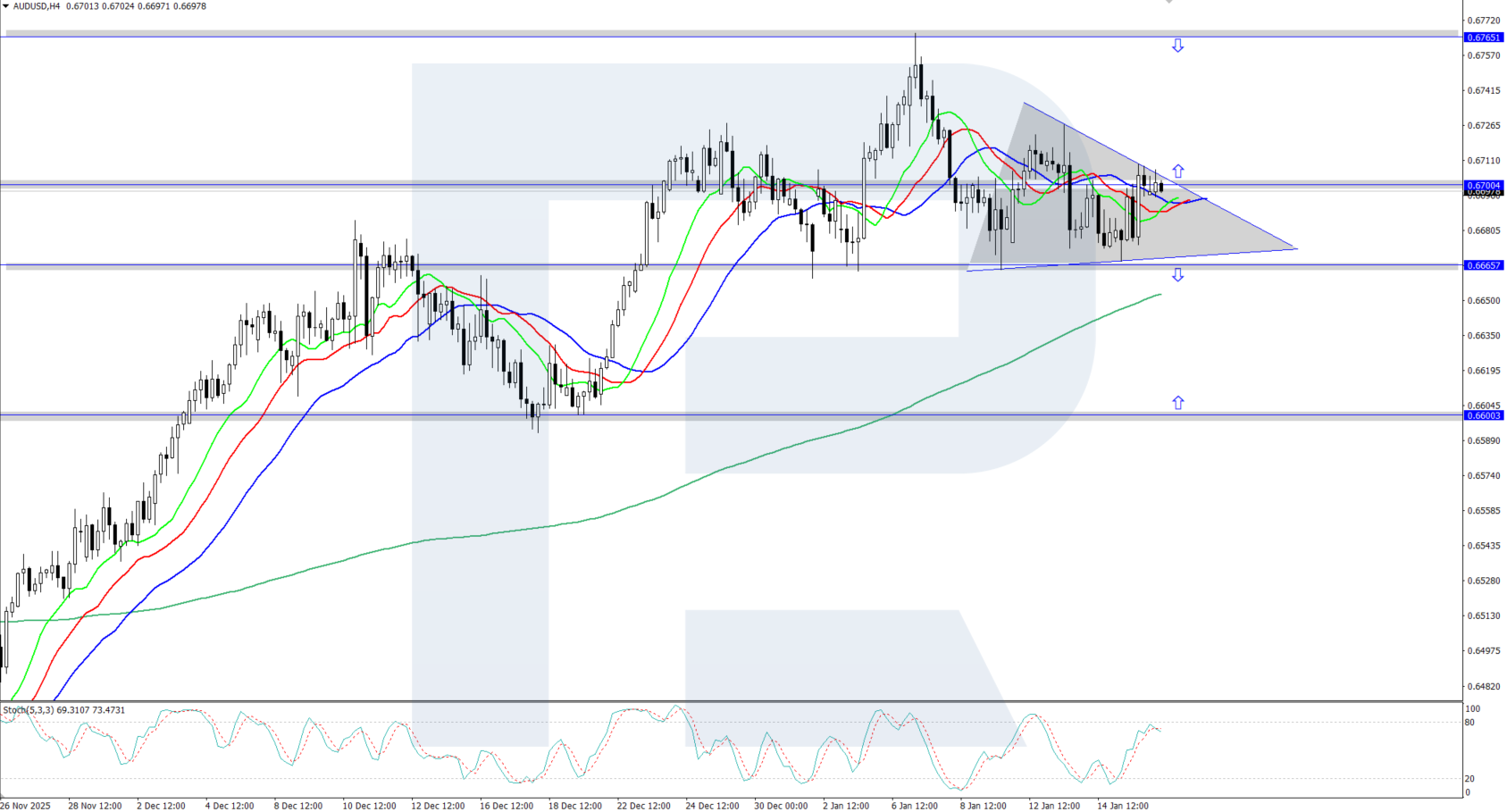

The AUDUSD pair is showing a downward correction following the recent strong rally. The Alligator indicator has turned downwards and continues to decline, so the correction may continue. The key support level is currently located at 0.6665.

The short-term AUDUSD price forecast suggests growth towards the annual high at 0.6765 if bulls regain the initiative and reverse quotes upwards. Conversely, if bears consolidate below 0.6665, the decline may extend towards the 0.6600 support level.

AUDUSD overview

- Asset: AUDUSD

- Timeframe: H4 (Intraday)

- Trend: upward

- Key resistance levels: 0.6700 and 0.6765

- Key support levels: 0.6665 and 0.6600

AUDUSD trading scenarios for today

Main scenario (Buy Stop)

A breakout and consolidation above 0.6700 may indicate that conditions are forming for a long scenario.

The risk-to-reward ratio stands at 1:3. Potential profit upon reaching the take-profit level amounts to 60 pips, while possible losses are capped at 20 pips.

- Take Profit: 0.6765

- Stop Loss: 0.6690

Alternative scenario (Sell Stop)

Short positions are possible if the price breaks and consolidates below the 0.6665 support level.

- Take Profit: 0.6605

- Stop Loss: 0.6780

Risk factors

A renewed sharp escalation of geopolitical tensions may act as a risk factor for the long scenario.

Summary

AUDUSD quotes are moderately correcting after reaching an annual high of 0.6765. The long-term trend remains upward, so the pair may continue its upward trajectory after the correction is complete.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.