The correction is coming to an end, AUDUSD is poised for a surge

The AUDUSD pair is completing a correction amid expectations of US economic data, with prices testing the 0.6985 level. Find out more in our analysis for 30 January 2026.

AUDUSD forecast: key takeaways

- Australia’s Q4 Producer Price Index (PPI): previously at 3.5%, currently at 3.5%

- Current trend: moving upwards

- AUDUSD forecast for 30 January 2026: 0.7085

Fundamental analysis

The AUDUSD outlook for today favours the Australian dollar, which has solid chances to continue recovering against the USD after the correction ends. At this stage, the pair is trading near the 0.6985 level.

The Producer Price Index is an inflation indicator that measures the average change in prices received by domestic producers for goods and services. It reflects prices from the sellers’ perspective and covers three production sectors: manufacturing, raw materials, and processing. Since higher production costs may be passed on to consumers, the PPI is often viewed as a leading indicator of consumer inflation.

The forecast for 30 January 2026 takes into account that Australia’s PPI remained unchanged at 3.5%. This is a positive factor for the Australian dollar, and when combined with broader Australian fundamental data, it supports the potential for continued upward momentum.

An additional trigger for AUDUSD growth could come from weak US economic data and the opening of new long positions after the recent pullback.

Technical outlook

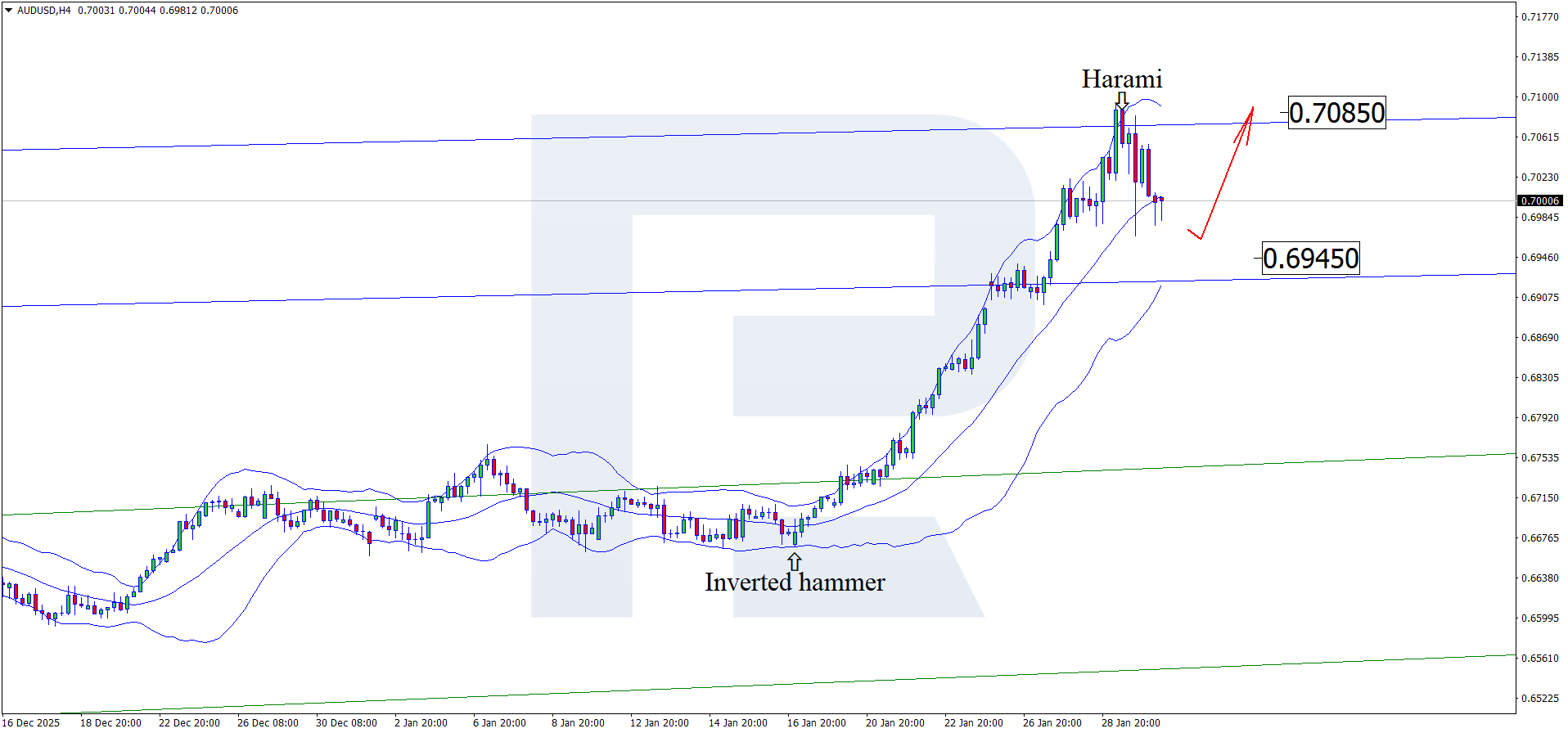

After testing the upper Bollinger Band, the AUDUSD rate formed a Harami reversal pattern on the H4 chart. At this stage, prices continue a corrective move following the signal, with the 0.6945 support level as a downside target for the pullback.

The AUDUSD forecast for 30 January 2026 also considers an alternative scenario in which prices continue the upward wave towards the nearest resistance level at 0.7085 without testing support.

AUDUSD overview

- Asset: AUDUSD

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 0.7085 and 0.7115

- Key support levels: 0.6910 and 0.6755

AUDUSD trading scenarios for today

Main scenario (Buy Limit)

A pullback towards the 0.6945 support level may signal the end of the correction phase and indicate the market’s readiness to resume growth. The scenario is supported by strong Australian macroeconomic data and rising expectations of a rate hike by the Reserve Bank of Australia.

The risk-to-reward ratio is around 1:3. Potential profit upon reaching the target is about 140 pips, while the risk is limited to roughly 45 pips.

- Buy Limit: 0.6945

- Take Profit: 0.7085

- Stop Loss: 0.6900

Alternative scenario (Sell Stop)

A corrective scenario becomes possible if the price breaks and consolidates below 0.6900, signalling weakening short-term momentum and a transition to a deeper correction after overbought conditions.

- Sell Stop: 0.6900

- Take Profit: 0.6735

- Stop Loss: 0.6945

Risk factors

Key risks for the bullish scenario include weak inflation data in Australia, which could reduce expectations of a rate hike, as well as a general deterioration in global risk appetite and a strengthening US dollar driven by macroeconomic or geopolitical factors.

Summary

While awaiting US economic data, the AUDUSD pair may complete its corrective wave. AUDUSD technical analysis suggests a potential rise towards the 0.7085 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.