AUDUSD at the start of a rally: buyers are pushing prices higher

The AUDUSD pair is gaining upward momentum after rebounding from the key support level, with the price currently at 0.6956. Discover more in our analysis for 6 February 2026.

AUDUSD forecast: key takeaways

- Buyers held the 0.6905 support level and prevented a breakout

- The RBA signalled readiness for further policy tightening if inflation remains persistent

- The RBA Governor reiterated the need for restrictive policy to cool demand and reduce inflationary pressure

- AUDUSD forecast for 6 February 2026: 0.7085

Fundamental analysis

The AUDUSD pair resumed growth after two consecutive bearish sessions. Buyers confidently defended the 0.6905 support level, preventing a breakout and restoring the local bullish market structure.

The Australian dollar previously received fundamental support from the Reserve Bank of Australia, which raised the interest rate by 25 basis points to 3.85% and clearly signalled readiness for further tightening if inflation remains persistent. The RBA Governor emphasised that restrictive monetary policy remains necessary to cool domestic demand and reduce price pressures.

Market expectations reflect this stance. Investors estimate the likelihood of a 25-basis-point rate hike in May at around 70%, bringing the rate to 4.10%, while the probability of a 50-basis-point increase by the end of the year stands at about 50%. At the same time, pressure on the Australian dollar persists. A broad sell-off in equity, commodity, and cryptocurrency markets has boosted demand for safe-haven assets, strengthening the US dollar.

Technical outlook

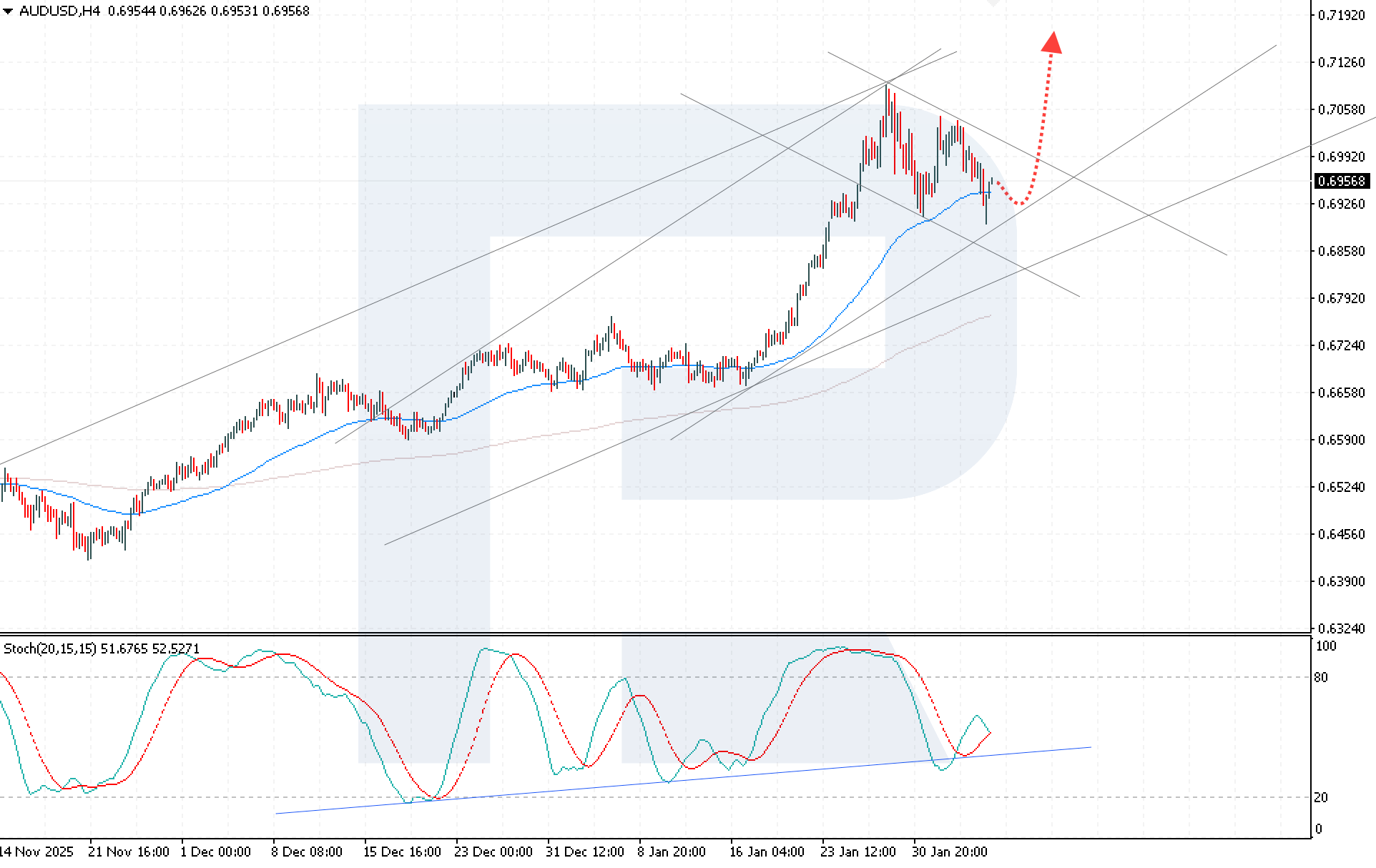

The AUDUSD pair is rising after a confident rebound from the 0.6905 support level. Buyers have consolidated above the EMA-65, indicating strengthening bullish pressure and continued upward momentum.

The AUDUSD forecast for today suggests further movement from the lower boundary of the bullish channel towards the 0.7145 level. The Stochastic Oscillator further confirms the positive scenario. Its signal lines tested the support line and formed a stable bullish crossover, increasing the likelihood of continued growth.

The key technical condition for the scenario remains consolidation above the 0.7010 level. This signal will confirm a breakout above the upper boundary of the descending corrective channel and significantly increase the probability of reaching the 0.7145 target in the near term.

AUDUSD overview

- Asset: AUDUSD

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 0.7085 and 0.6995

- Key support levels: 0.6905 and 0.6795

AUDUSD trading scenarios for today

Main scenario (Buy Limit)

A confident rebound from the lower boundary of the bullish channel at 0.6925 creates favourable conditions for opening long positions. Additional confirmation of the bullish scenario comes from the Stochastic Oscillator, which shows a stable bullish crossover.

The risk-to-reward ratio is about 1:3. The potential profit upon reaching the target is 220 pips, while the risk is limited to 30 pips.

- Take Profit: 0.7145

- Stop Loss: 0.6895

Alternative scenario (Sell Stop)

A bearish scenario is possible if the price breaks and consolidates below the 0.6875 level, indicating a breakout below the lower boundary of the bullish channel and signalling a bearish correction.

- Take Profit: 0.6705

- Stop Loss: 0.6935

Risk factors

The main risk factor for continued AUDUSD growth remains strengthening global demand for the US dollar amid sell-offs in equity, commodity, and cryptocurrency markets. Additional pressure may come from negative dynamics in global financial markets and a decline in investor risk appetite.

Summary

The combination of support from the RBA and the holding of the key 0.6905 level forms a solid bullish foundation for further growth of the currency pair. However, strengthening global demand for the US dollar remains the main limiting factor for a sustained upward move. Technical analysis of AUDUSD indicates that the bullish scenario remains intact, with a rebound from the 0.6905 support level, consolidation above the EMA-65, and a breakout above 0.7010 creating technical conditions for continued growth towards the 0.7145 target.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.