AUDUSD on the verge of a breakout: how a decline in US CPI and RBA policy may strengthen the AUD

After testing the 2023 highs, the AUDUSD pair is forming a correction before a further rise. Quotes are hovering around 0.7050. Discover more in our analysis for 13 February 2026.

AUDUSD forecast: key takeaways

- US core Consumer Price Index: previously at 2.6%, projected at 2.5%

- Inflation above 3.0% in Australia is unacceptable, according to the RBA

- AUDUSD forecast for 13 February 2026: 0.7140

Fundamental analysis

Today’s AUDUSD forecast favours the Australian dollar, which has strong chances to continue recovering against the USD after completing the current correction. At this stage, the pair is trading around 0.7050.

The core CPI measures changes in the cost of goods and services from the consumer’s perspective. This index is a key gauge of consumer purchasing dynamics and inflation. Fundamental analysis for 13 February 2026 takes into account that the actual January core CPI reading may decline to 2.5% compared to the previous period, indicating easing inflationary pressure.

An RBA representative stated that inflation above 3.0% is unacceptable for Australia and that the regulator will take all necessary measures to bring it down.

Thus, a decline in US CPI and core CPI, combined with other macroeconomic indicators from the US and Australia, may add to pressure on the USD and push the AUDUSD pair higher.

Technical outlook

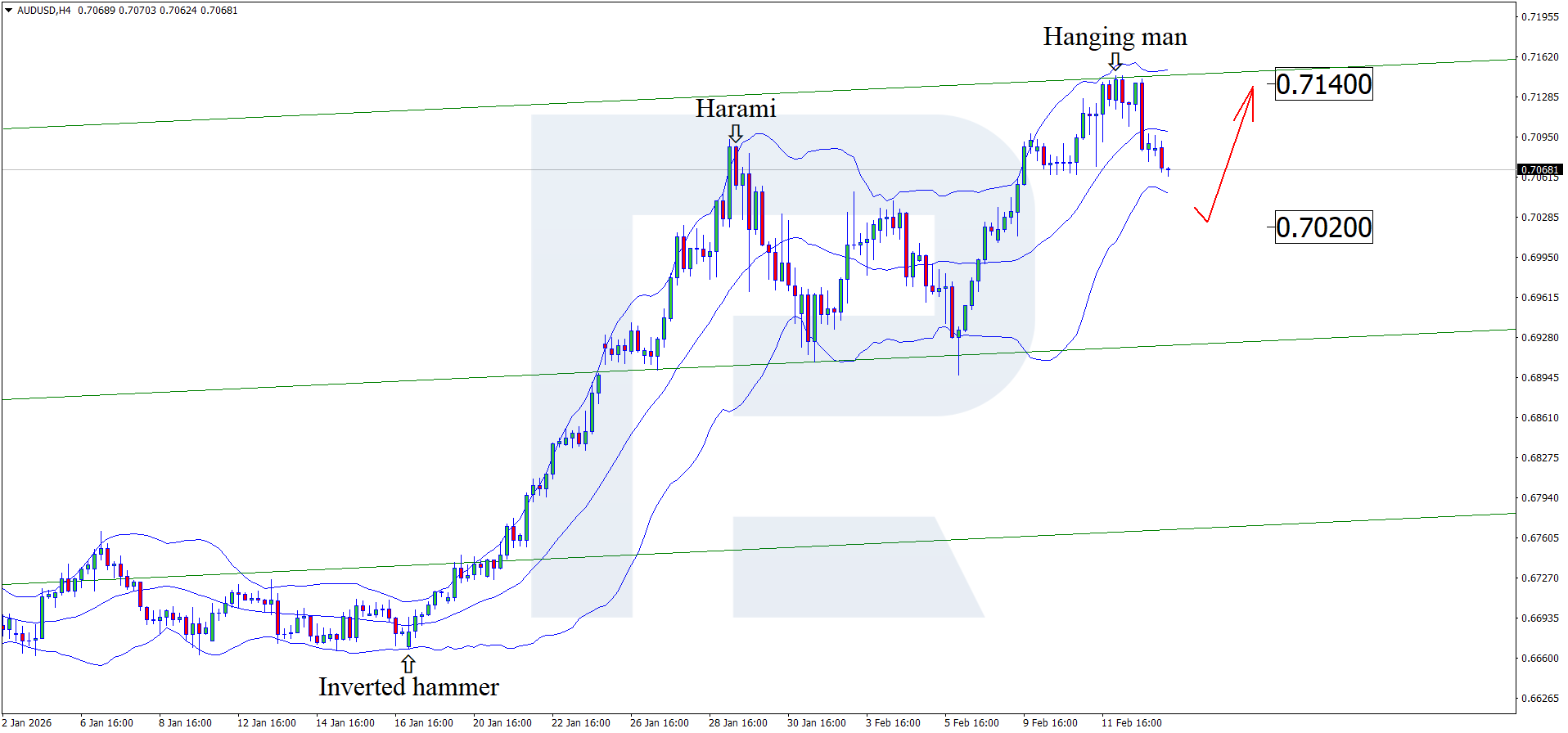

On the H4 chart, after testing the upper Bollinger Band, the AUDUSD pair formed a Hanging Man reversal pattern. At this stage, quotes continue to develop a corrective wave following the signal. The downside target for the pullback may be at the 0.7020 support level.

The AUDUSD forecast for 13 February 2026 also considers an alternative scenario, in which quotes may continue their upward trajectory towards the nearest resistance level at 0.7140 without testing support.

AUDUSD overview

- Asset: AUDUSD

- Timeframe: H4 (Intraday)

- Trend: upward

- Key resistance levels: 0.7085 and 0.7145

- Key support levels: 0.7020 and 0.6920

AUDUSD trading scenarios for today

Main scenario (Buy Limit)

A confident rebound from the 0.7020 support level creates favourable conditions for opening long positions. Weak US macroeconomic data may further confirm the bullish scenario.

The risk-to-reward ratio is approximately 1:4. The potential profit upon reaching the target is 120 pips, while the risk is limited to 30 pips.

- Buy Limit: 0.7020

- Take Profit: 0.7140

- Stop Loss: 0.6990

Alternative scenario (Sell Stop)

A bearish scenario is possible if the price breaks and consolidates below 0.7000, which may signal a bearish correction.

- Take Profit: 0.6920

- Stop Loss: 0.7050

Risk factors

The main risk factor for continued AUDUSD growth remains a strengthening global demand for the US dollar amid sell-offs in equities, commodities, and cryptocurrencies. Additional pressure may come from investors’ reactions to positive US economic data.

Summary

A decline in the US core CPI and other economic indicators may support the AUD. Technical analysis of AUDUSD suggests growth towards 0.7140 after the correction is complete.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.