AUDUSD strengthens due to China’s stimulus measures

AUDUSD is regaining some of its lost ground after falling more than 1% the previous day. Read more details in our analysis for 26 September 2024.

AUDUSD forecast: key trading points

- Support for the Chinese economy stimulates demand for Australian exports, which helps AUDUSD to strengthen

- The Australian Consumer Price Index declined to 2.7% in August, falling within the central bank’s target range

- The Reserve Bank of Australia maintains a tight policy, keeping the interest rate at 4.35% despite the falling inflation rate

- AUDUSD forecast for 26 September 2024: 0.6910 and 0.7017

Fundamental analysis

The AUDUSD rate rose on Thursday after bouncing from the support level at 0.6815. According to analysts, the Australian dollar is strengthening due to China’s stimulus package, which may boost demand in Australia’s largest export market.

Australia’s Consumer Price Index rose 2.7% year-on-year in August 2024, below market forecasts of 2.8% and worse than July’s 3.5%. This is the lowest inflation rate since August 2021 and the first time it has fallen within the central bank’s target range in three years. The inflation decline resulted from the energy bill compensation programme, which led to a 17.9% fall in electricity prices and a reduction in the cost of motor fuel.

The Reserve Bank of Australia left the key rate at 4.35% at its September meeting and indicated that the current policy rate could be maintained for an extended period. However, the current slowdown in inflation reinforces expectations of a rate cut by the end of the year. Governor Michele Bullock has indicated that interest rates will remain unchanged for now. This hawkish stance sets the Reserve Bank of Australia apart from other central banks, including the US Federal Reserve, which has begun to ease its monetary policy to support the economy. For today’s AUDUSD forecast, this may support the pair’s growth.

AUDUSD technical analysis

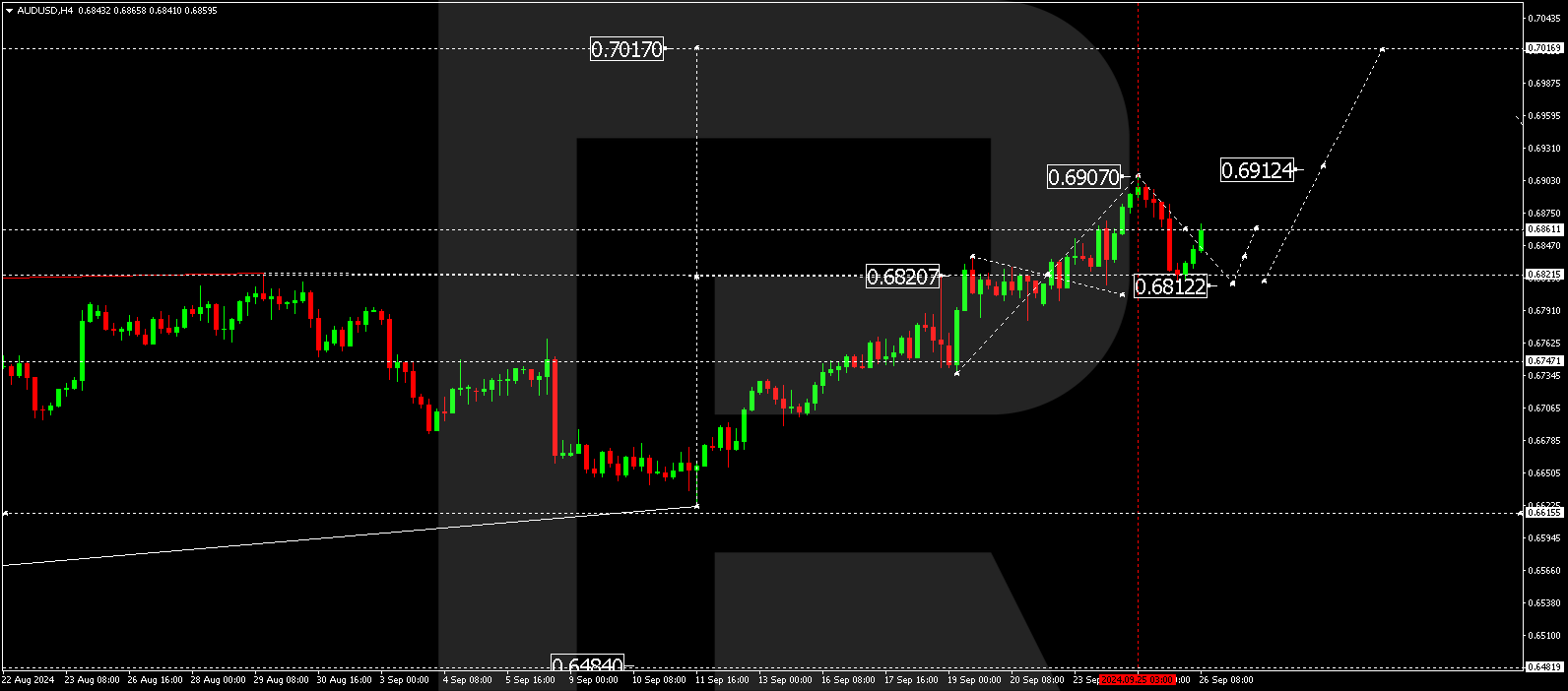

On the H4 chart of the AUDUSD currency pair, the market performed a wave of growth to the 0.6907 level. Today, on 26 September 2024, we expect a correction to the 0.6812 level (test from above). Following this correction, we expect the growth wave structure to develop towards 0.6910. The breakout of this level upwards may signal the trend to continue towards the 0.7017 level. This is the primary target. In the future, we will consider the likelihood of a new wave of decline to the level of 0.6800. This is the first target.

Summary

AUDUSD’s recovery after the recent decline is due to support from China’s stimulus measures and slowing inflation in Australia. The Reserve Bank of Australia’s hawkish stance, maintaining a tight monetary policy, strengthens expectations for further growth in the pair. Technical indicators for today’s AUDUSD rate forecast suggest considering the likelihood of continuing the growth wave to the levels of 0.6910 and 0.7017.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.