AUDUSD rises on positive employment data

The AUDUSD rate remains above the EMA-200 line, thanks to the stable Australian economy. Discover more in our analysis for 17 October 2024.

AUDUSD forecast: key trading points

- Analysts expect the RBA not to lower interest rates until the first half of next year

- The Australian economy added 64,100 jobs in September, well above the forecast of 25,000

- Australia’s labour force participation rate increased to a record 67.2% in September

- AUDUSD forecast for 17 October 2024: 0.6645

Fundamental analysis

The AUDUSD rate rose on Thursday after falling for three consecutive days. A robust employment report supported the Australian dollar, reinforcing the hawkish outlook for the Reserve Bank of Australia’s monetary policy.

The data showed that the Australian economy added 64,100 jobs in September, significantly exceeding the forecast of 25,000, while the unemployment rate remained at 4.1%. The labour force participation rate increased to a record 67.2% in September, up from 67.1% in August and above analysts’ forecasts of 67.1%. The results indicate the labour market’s resilience, reducing the likelihood of an RBA interest rate cut in the coming months.

Meanwhile, Reserve Bank of Australia Assistant Governor Sarah Hunter warned that the central bank remains committed to controlling inflation amid steady price growth. According to analysts (given the strengthening labour market), the regulator will not lower interest rates until the first half of next year, which may support the Australian dollar as part of today’s AUDUSD forecast.

AUDUSD technical analysis

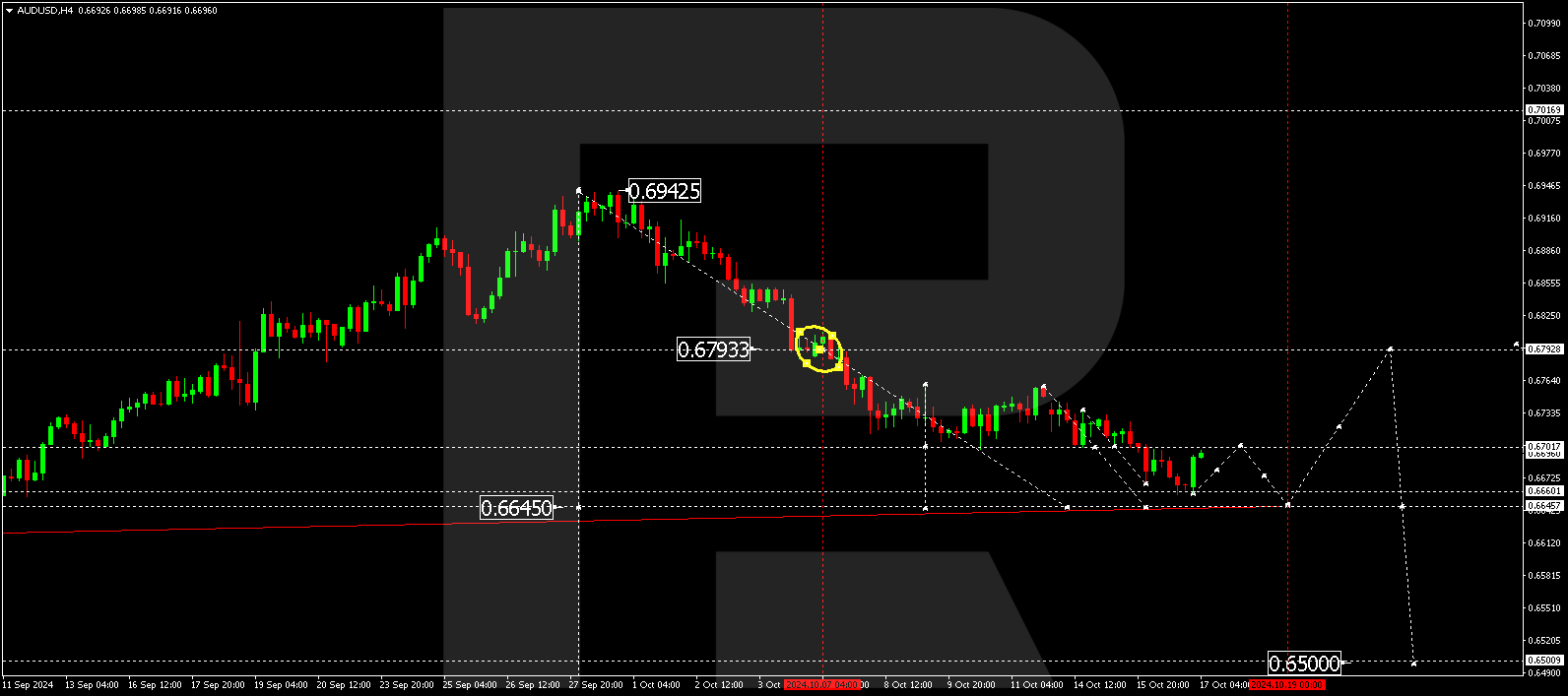

The AUDUSD H4 chart shows that the market continues its downward trajectory towards 0.6645. The pair has completed a downward wave, reaching 0.6660, and corrected towards 0.6702 (testing from below) today, 17 October 2024. It is important to consider the development of another downward wave, aiming for 0.6645 as the first target. Once the price reaches this level, a correction in the AUDUSD rate could start, targeting 0.6792.

Summary

Strong employment data and an increase in the labour force participation rate strengthen expectations of the Reserve Bank of Australia’s hawkish stance, which, in turn, bolsters the AUD. Given the new situation in the labour market, analysts predict that the regulator will not lower interest rates until the first half of next year. Technical indicators in today’s AUDUSD forecast suggest that the downward wave could continue towards the 0.6645 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.