Negative economic data exerts pressure on the yen

Negative economic data exerts pressure on the yen

On Friday, 14 June 2024, the Bank of Japan kept interest rates unchanged but announced a plan to lower the bond purchase pace, leading to a decline in the yen-dollar exchange rate. As a result, the USDJPY pair surpassed the 158.00 mark.

Bank of Japan Governor Kazuo Ueda emphasised that the central bank was closely monitoring the impact of the weak yen on inflation. Although he did not rule out an interest rate hike in July, Ueda noted that the decision would depend on the incoming economic data.

Today, the USDJPY exchange rate may experience a negative impact since Japan’s main machinery orders stood at 2.9% in April 2024. This decline is a negative indicator for the country’s capital expenditure over the next six to nine months, potentially suggesting a rise in the USDJPY pair as part of the forecast for 17 June 2024.

However, analysts believe that the Bank of Japan will be compelled to intervene more resolutely if investor pressure on the JPY persists. The central bank typically limits itself to verbal interventions, but it can directly affect the currency market in the worst-case scenario.

USDJPY technical analysis

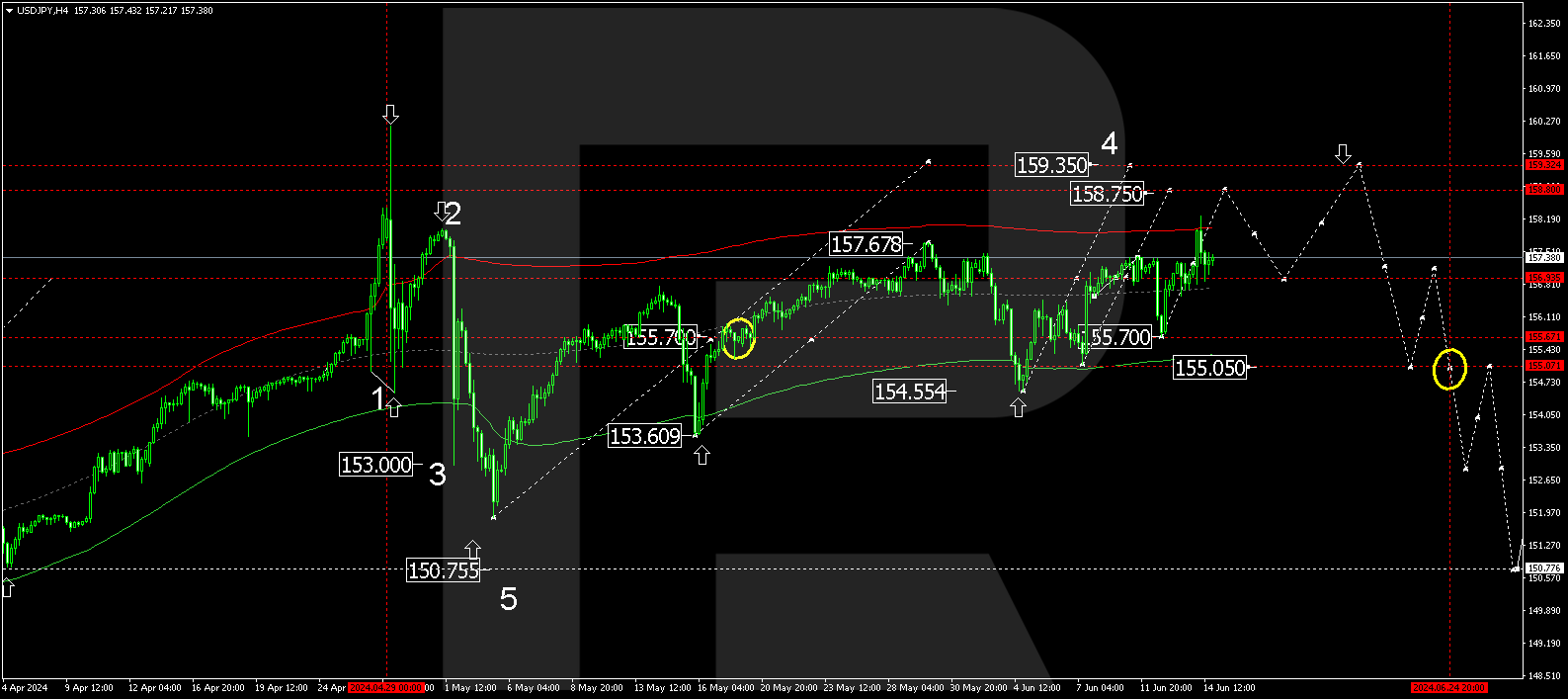

On the H4 chart, the USDJPY pair has broken above the 157.30 level, with a broad consolidation range potentially continuing to form around 155.70. This entire structure is practically interpreted as a correction of the previous decline wave. The market has rebounded from the 155.70 level and continues to develop a growth structure towards 159.35. As the analysis for 17 June 2024 shows, a growth structure is expected to develop, with a 158.75 target.

The USDJPY pair technical analysis

After the price reaches this level, a decline in the USDJPY rate towards 156.97 (testing from above) is possible. Subsequently, another growth structure could develop, aiming for 159.35, representing the main target for correction. Technically, this scenario is confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 155.70. Once the correction is complete, a new decline wave to the lower boundary of the Envelope is expected.

Summary

A decline in Japan’s main machinery orders exerts pressure on the JPY exchange rate. Technical analysis of the USDJPY pair points to the development of a corrective wave aiming for 159.35, with the next targets of the declining wave at 155.05, 153.00 and 150.77.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.