EURUSD continues to fall as Trump imposes new tariffs

The EURUSD rate tumbled below the 1.0800 level amid expectations of new US trade tariffs. Find out more in our EURUSD analysis for 26 March 2025.

EURUSD forecast: key trading points

- Market focus: US durable goods orders data for February will be released during the American session today

- Current trend: correcting downwards

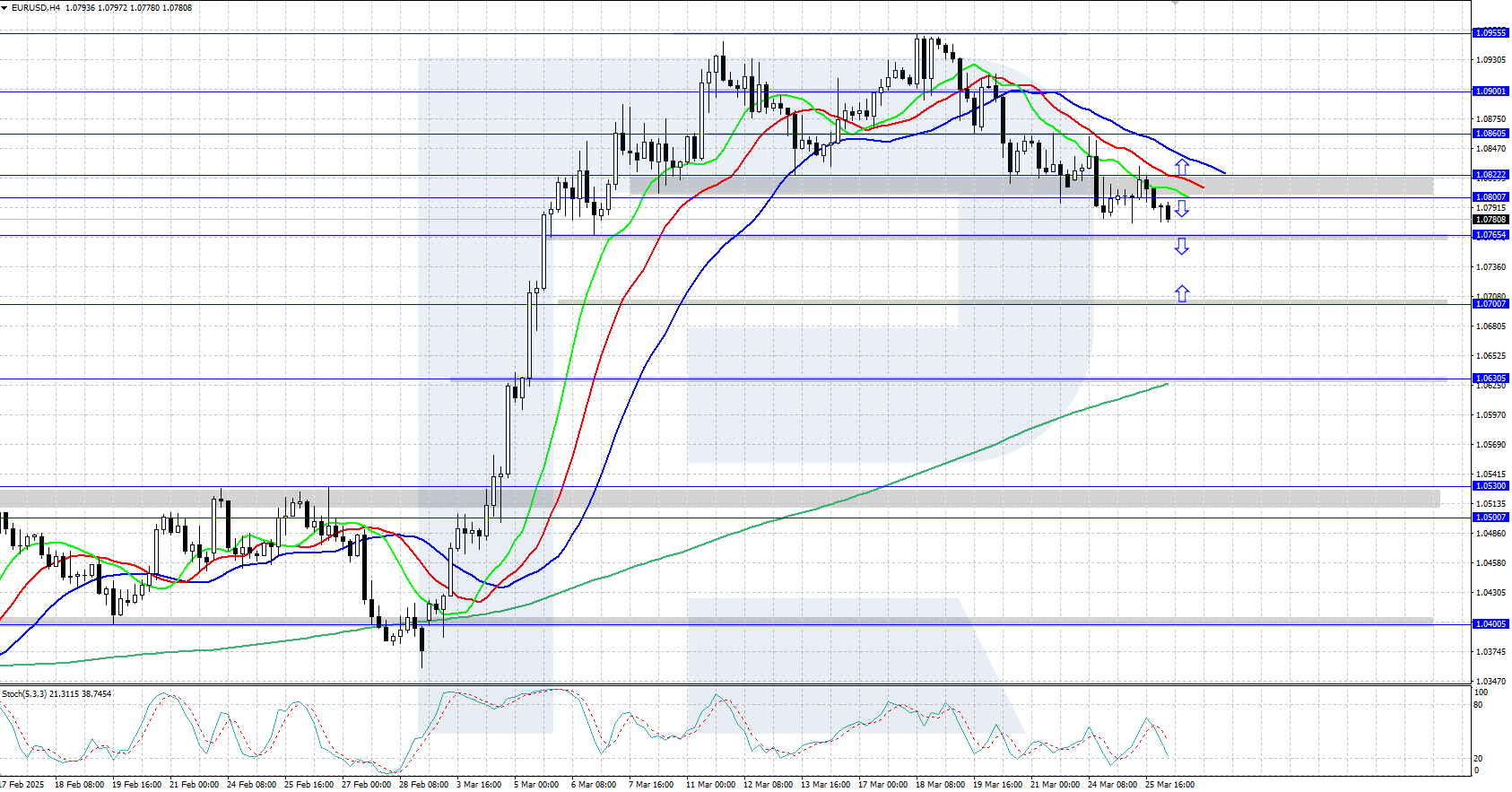

- EURUSD forecast for 26 March 2025: 1.0822 and 1.0765

Fundamental analysis

The EURUSD pair is declining amid persistent uncertainty over US President Donald Trump’s tariff plans. This week, Trump reiterated his intention to impose duties on cars, pharmaceuticals, and other sectors, raising concerns about potential risks to key European exports.

Today, the market will focus on US durable goods orders data for February, with forecasts suggesting a 1.1% month-on-month decline. A more significant drop would support the euro, while better-than-expected figures could further weaken the EURUSD rate.

EURUSD technical analysis

On the H4 chart, the EURUSD rate is undergoing a downward correction, having plunged below the support area between 1.0800 and 1.0822. The Alligator indicator confirms the decline; however, the pair's daily trend remains upward, with the asset likely to resume its growth once the correction is complete.

Today’s EURUSD forecast suggests that the pair could rise further to 1.0900 and higher if the bulls reverse the quotes upwards and break above the 1.0800-1.0822 resistance area. Conversely, if the bears maintain control and push the price below the 1.0765 support level, the pair may continue to decline to 1.0700.

Summary

The EURUSD pair fell below 1.0800 amid expectations of new US trade sanctions. Today, the market is focused on the February durable goods orders statistics from the US.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.