EURUSD in positive territory, but the market focus may shift

The EURUSD pair has risen to 1.1648. All eyes are on the Federal Reserve’s December meeting. Discover more in our analysis for 9 December 2025.

EURUSD forecast: key trading points

- Market focus: delayed US labour market data is in the spotlight

- Current trend: the EURUSD pair is rising ahead of the Fed’s decision

- EURUSD forecast for 9 December 2025: 1.1682

Fundamental analysis

The EURUSD rate is edging higher on Tuesday, reaching 1.1648. However, overall, the major currency pair continues to move sideways ahead of the two-day Federal Reserve meeting, where the market is nearly unanimous in expecting a rate cut.

The likelihood of a 25-basis-point rate reduction on Wednesday is estimated at about 87%, up from around 67% a month ago. Still, the outlook for 2026 remains uncertain. A hawkish cut is possible, in which Jerome Powell signals caution regarding further easing steps.

Investors are also awaiting key US macroeconomic releases. Today, the postponed JOLTS job openings report for October will be published, followed by initial jobless claims and the trade balance later in the week.

The EURUSD forecast is favourable.

EURUSD technical analysis

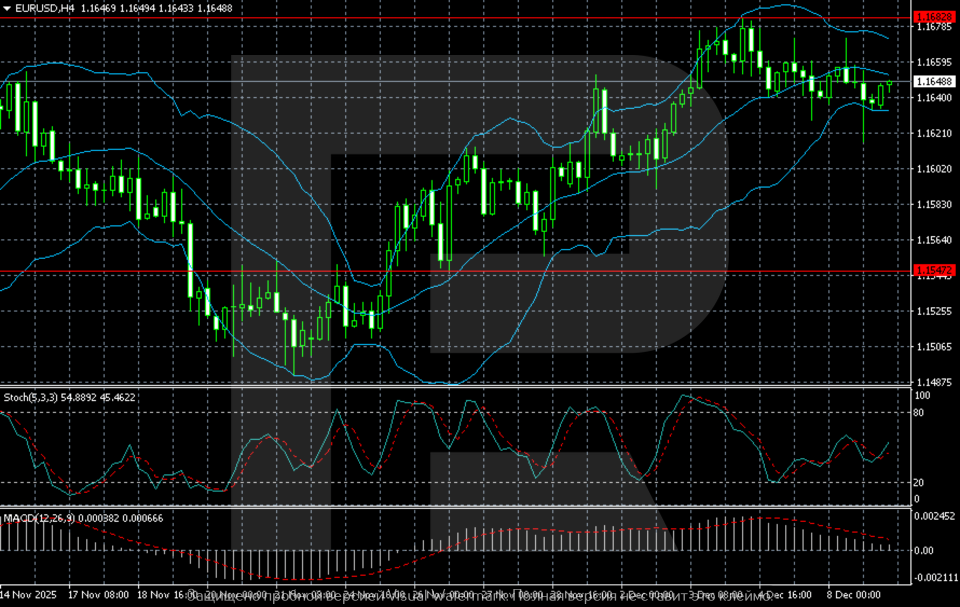

On the H4 chart, the EURUSD pair maintains a moderately bullish trajectory, but upward momentum has noticeably weakened. The price is consolidating below the 1.1682 resistance level, which has repeatedly capped attempts at growth. Quotes are currently moving along the middle Bollinger Band, indicating the absence of a strong trend. The upper band is slightly turning downwards, reflecting lower volatility.

The Stochastic Oscillator is in the mid-range around 45, giving no clear signals. The market is out of oversold territory but lacks a confident bullish trigger. MACD remains positive, yet its histogram is declining, underscoring weakening bullish momentum and a likely phase of sideways consolidation.

The nearest support level is located at 1.1547 – the level from which the previous strong recovery began. The resistance stands at 1.1682. A breakout above this level would open the path towards 1.1750. As long as the pair trades between these boundaries, the baseline scenario is consolidation within the range with a mild upward tilt.

Summary

The EURUSD pair is rising slightly, but very cautiously. The EURUSD forecast for today, 9 December 2025, suggests a mild upward move towards 1.1682.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.