EURUSD adjusts lower amid renewed economic projections

EURUSD is correcting in response to the Fed’s decision and Jerome Powell’s dovish tone. The current price is 1.1683. More details in our analysis for 11 December 2025.

EURUSD forecast: key trading points

- The Federal Reserve cut interest rates by 0.25 percentage points for the third time this year

- Jerome Powell highlighted rising risks in the labor market

- The market interpreted Powell’s rhetoric as a signal of potentially deeper policy easing

- EURUSD forecast for 11 December 2025: 1.1765

Fundamental analysis

EURUSD is declining after a sharp rally in yesterday’s session. The U.S. dollar weakened following the Fed’s decision to cut rates by another quarter-point—the third cut this year—which fully matched market expectations.

Investors viewed Federal Reserve Chair Jerome Powell’s tone as more dovish than anticipated. Powell emphasized growing concerns about labor market conditions. These remarks were interpreted as a sign that further and potentially deeper rate cuts may follow.

Additionally, the Fed revised down its U.S. inflation forecast for 2026 to 2.4% and raised the GDP growth forecast for next year to 2.3%. Over the longer horizon, the Fed expects inflation at 2.1% in 2027 and 2.0% in 2028.

EURUSD technical analysis

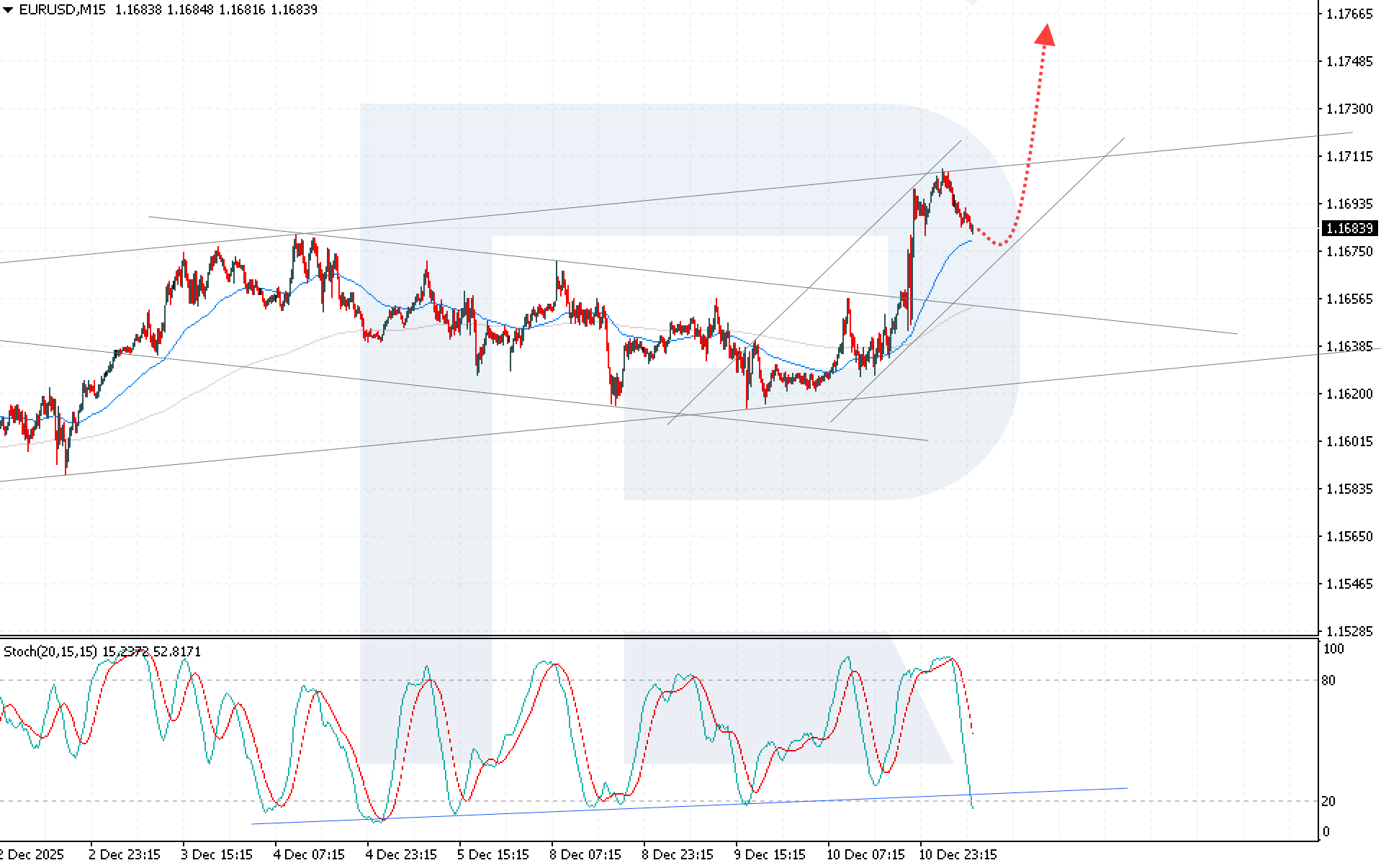

EURUSD is correcting after rebounding from the upper boundary of the bullish channel. Buyers continue to hold the price above the EMA-65 line, which reflects the preservation of bullish momentum.

The EURUSD forecast for today suggests continued growth toward 1.1765. An additional signal in favor of upward movement appears on the Stochastic Oscillator: the signal lines have reached the overbought zone and turned downward—potentially indicating the early formation of a bullish continuation signal.

A breakout and consolidation above 1.1730 would confirm the full development of the bullish scenario.

Summary

The Fed’s dovish rhetoric and revised economic projections strengthened expectations of further policy easing, putting pressure on the U.S. dollar. Technical analysis of EURUSD indicates continued bullish momentum with potential upside toward 1.1765.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.