EURUSD surges above 1.1700

The EURUSD rate has risen above the 1.1700 level. The euro received support from the Fed’s rate cut and slowing inflation in the eurozone. Details — in our analysis for 12 December 2025.

EURUSD forecast: key trading points

- Market focus: Germany’s consumer inflation for November remained at 2.3%

- Current trend: an upward impulse is observed

- EURUSD forecast for 12 December 2025: 1.1800 or 1.1650

Fundamental analysis

The US Federal Reserve implemented an expected 25-basis-point rate cut, while simultaneously signaling a likely pause in January as policymakers await additional data to assess the economic outlook.

Meanwhile, investors have reduced expectations for further policy easing by the ECB after officials indicated that additional rate cuts may not be necessary in 2026.

ECB President Christine Lagarde stated that the central bank will raise its eurozone growth forecasts next week, as the economy continues to demonstrate resilience despite ongoing trade tensions.

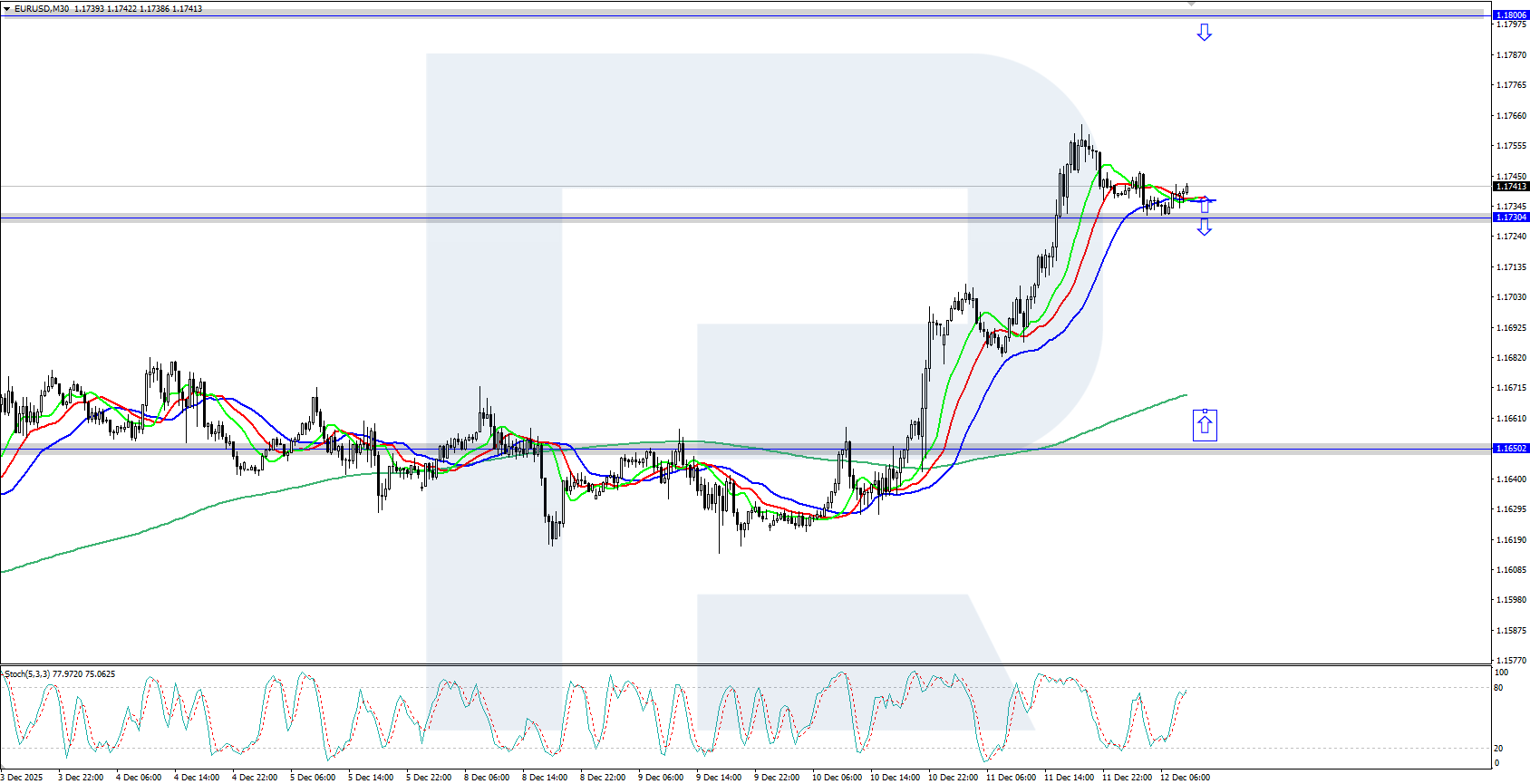

EURUSD technical analysis

On the H4 chart, EURUSD quotes continue to strengthen, rising above the 1.1700 level. The Alligator indicator has also turned upward following the price, suggesting that the euro’s advance may continue in the near term. The key support area is located around 1.1650.

Within the short-term EURUSD outlook, if bulls manage to maintain control, further growth toward the 1.1800 level and above is quite possible. If bears manage to regain the initiative, a pullback toward support at 1.1650 may occur.

Summary

The EURUSD price has risen above the 1.1700 mark. The ECB does not plan to cut interest rates in the near future.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.