EURUSD: the pair trades near the yearly high

The EURUSD exchange rate is trading near the 1.1800 level, close to the yearly high, amid mixed economic data from the United States. Details — in our analysis for 24 December 2025.

EURUSD forecast: key takeaways

- Market focus: US GDP grew by 4.3% in the third quarter, while durable goods orders fell by 2.2% in October

- Current trend: an upward impulse is observed

- EURUSD forecast for 24 December 2025: 1.1919 or 1.1700

Fundamental analysis

Preliminary data showed strong US GDP growth of 4.3% in the third quarter, but this did not change interest rate expectations. The market is currently pricing in two Federal Reserve rate cuts in 2026.

This assumption is based on slowing inflation, cooling labor market growth, and President Trump’s push for a more accommodative policy stance, despite ongoing disagreements among Federal Reserve officials.

Last week, the European Central Bank left interest rates unchanged for the fourth consecutive meeting and indicated that rates are likely to remain at current levels for some time, noting that the eurozone has weathered US tariffs better than expected.

EURUSD technical analysis

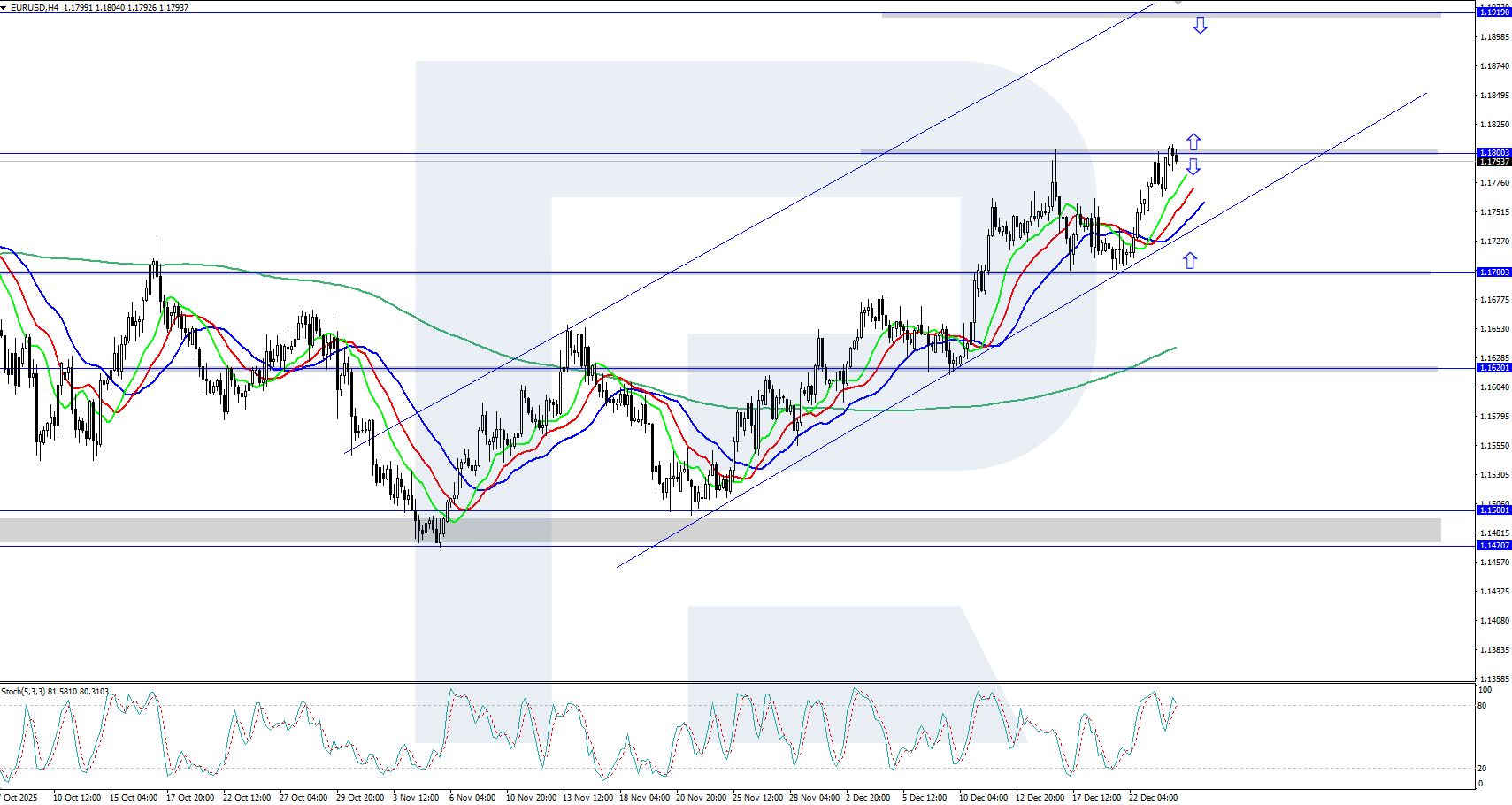

On the H4 chart, EURUSD quotes continue to strengthen, rising toward the 1.1800 level. The Alligator indicator has also turned upward along with price action, suggesting that the euro’s growth may continue. The key support level currently stands at 1.1700.

Within the short-term EURUSD price forecast, if bulls manage to maintain control, a test of the yearly high at 1.1919 is quite possible. If bears regain initiative, a decline toward support at 1.1700 may occur.

Summary

The EURUSD price has climbed to the 1.1800 level amid mixed US economic data. In the near term, the pair may test the strength of the yearly high at 1.1919.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.