The dollar is losing support: EURUSD prepares for growth

After forming a corrective move, the EURUSD pair has stalled near the 1.1780 level. On Monday, the market is expected to see increased volatility. Details — in our analysis for 26 December 2025.

EURUSD forecast: key takeaways

- Christmas holidays in the United States and the European Union

- Monday may bring multiple surprises

- Current trend: moving upwards

- EURUSD forecast for 26 December 2025: 1.1840

Fundamental analysis

The EURUSD forecast takes into account that today the euro formed a corrective wave and paused near the 1.1780 level.

Key triggers influencing the EURUSD exchange rate:

- The market is operating with low volumes: some European and US trading venues are closed today. Under such conditions, even moderate news or large orders can trigger sharp price impulses

- Investors continue to reassess prospects for further Federal Reserve policy easing after a series of weak US macroeconomic data releases in December. Any hints of interest rate cuts increase pressure on the dollar and provide support for the euro

- On the eurozone side, the news flow remains limited, making the euro largely dependent on USD dynamics. The absence of negative surprises regarding EU inflation and debt allows EUR to hold its ground amid dollar weakness

- The pair’s movement will largely be driven by overall demand for the US dollar: expectations of a slowdown in the US economy and investors’ shift toward safe-haven assets continue to weigh on USD

- The forecast for 26 December 2025 takes into account that a batch of US data will be released on Monday, which may trigger heightened market volatility and provoke EURUSD growth

EURUSD technical analysis

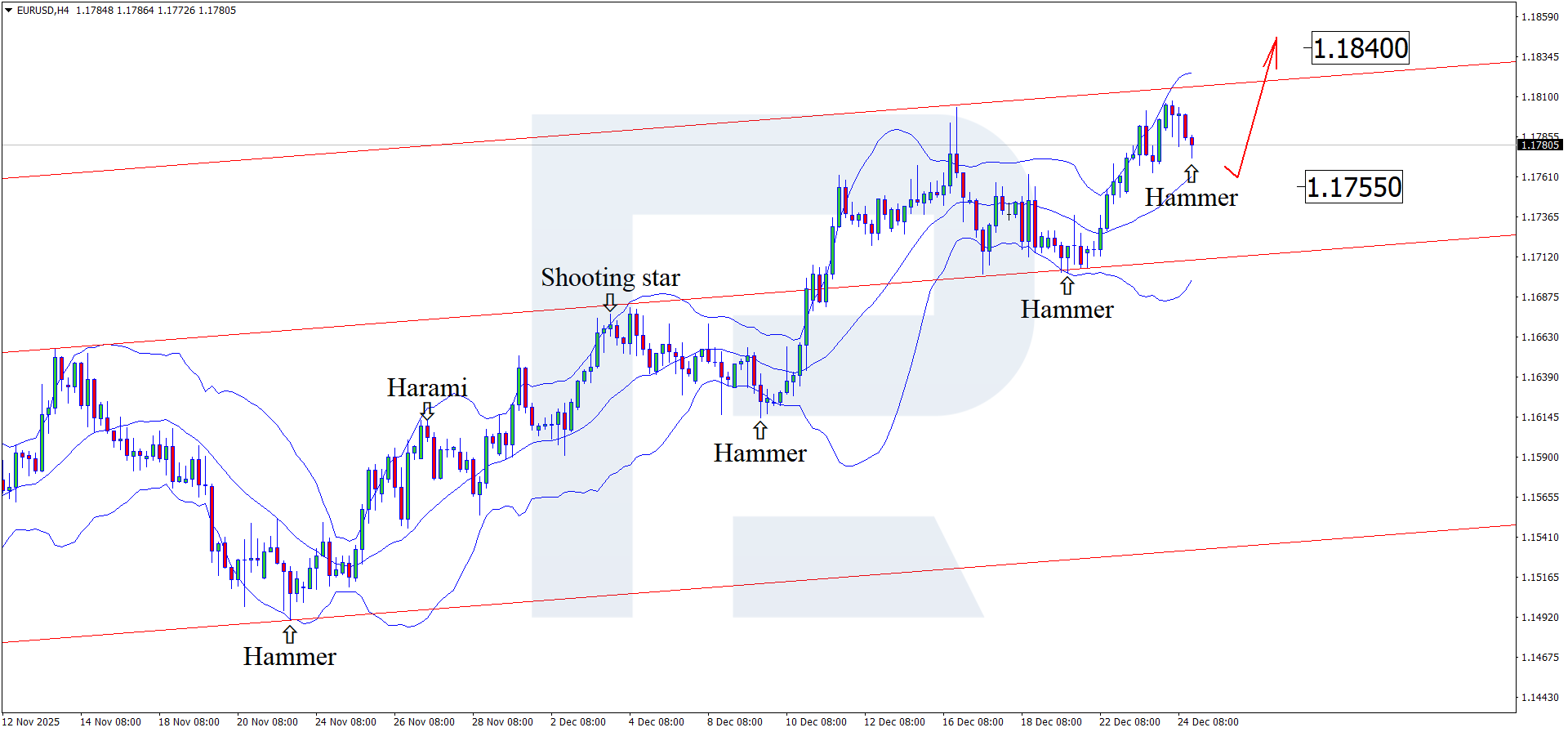

On the H4 chart, EURUSD formed a Hammer reversal pattern near the middle Bollinger Band. At this stage, the pair may develop an upward wave as part of the pattern’s execution. Given that prices remain within the boundaries of an ascending channel, they may move toward the 1.1840 area. A breakout above this level would open the way for a continuation of the upward trend.

At the same time, today’s EURUSD forecast also considers an alternative scenario involving a corrective pullback toward the 1.1755 level before further growth.

Summary

The EURUSD outlook for today favors the euro. Technical analysis suggests a continuation of the upward move toward the 1.1840 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.