A failed upside attempt strengthens sellers’ positions in EURUSD

The EURUSD pair is weakening amid seller dominance and persistent uncertainty surrounding future Fed decisions, with the rate currently at 1.1653. Discover more in our analysis for 13 January 2026.

EURUSD forecast: key takeaways

- Uncertainty around the future Fed policy has temporarily supported the EURUSD rate

- Markets continue to price in two Federal Reserve rate cuts this year, starting in June

- Risks of accelerating inflation may limit the regulator’s ability to ease monetary policy

- EURUSD forecast for 13 January 2026: 1.1555

Fundamental analysis

The EURUSD rate is declining after rebounding from the local resistance level at 1.1695. The recovery attempt failed, with the currency pair remaining under selling pressure. On Monday, the US dollar weakened amid reports that the US Department of Justice is preparing to bring criminal charges against Federal Reserve Chairman Jerome Powell. This factor temporarily increased uncertainty around US monetary policy and provided support to the EURUSD pair.

Despite this, markets continue to price in two Fed rate cuts this year, with the first expected in June. At the same time, a potential acceleration in inflation may significantly limit the regulator’s room for monetary easing. An additional argument in favour of a more accommodative policy stance came from the nonfarm payrolls report. Job creation in December came in below forecasts, reinforcing expectations of rate cuts and confirming a weakening US labour market.

EURUSD technical analysis

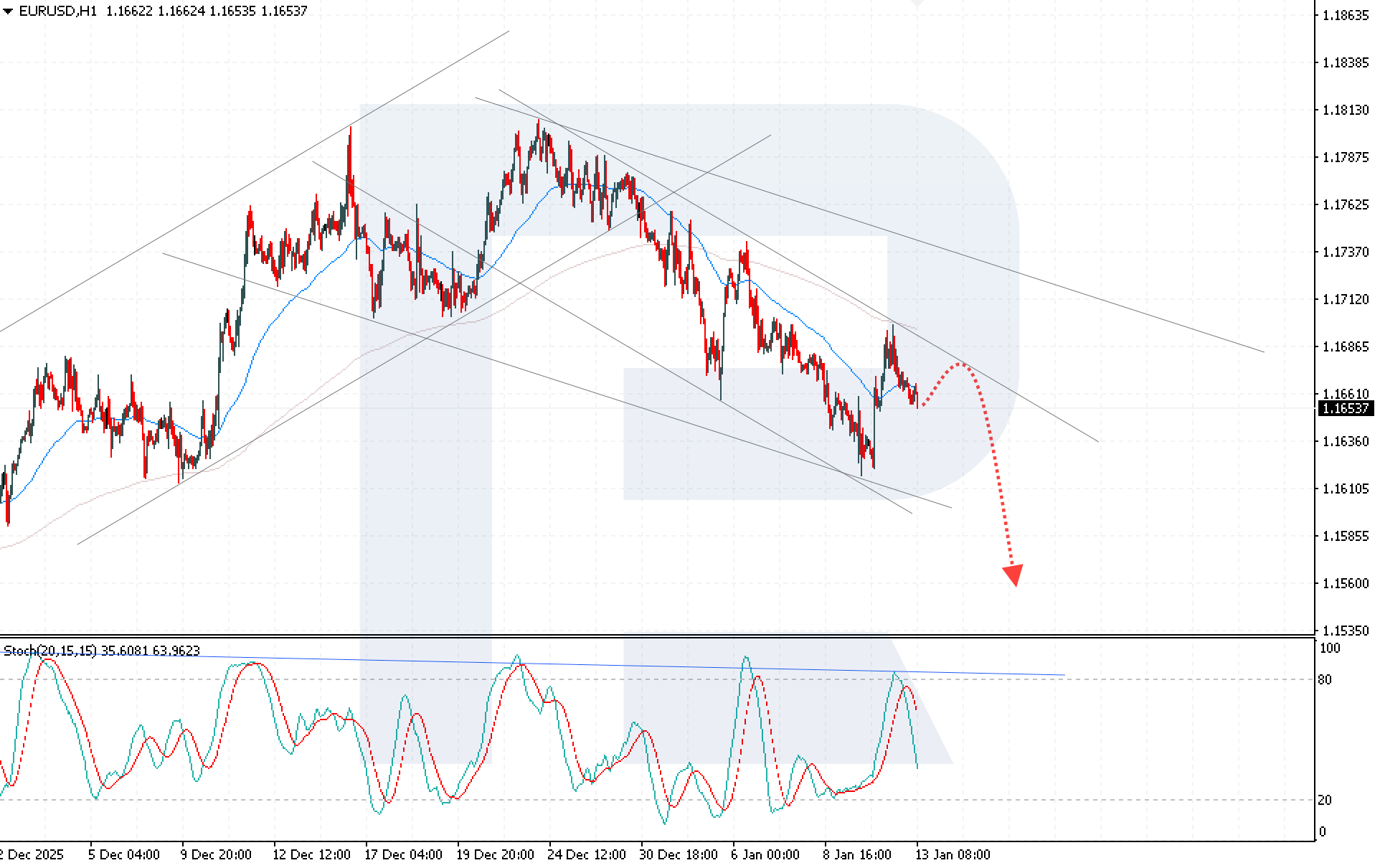

The EURUSD rate continues to decline. Sellers are holding the price below the EMA-65, indicating that the bearish momentum remains strong.

The EURUSD forecast for today suggests continued downward movement with a target at 1.1555. The Stochastic Oscillator further supports the bearish scenario. The signal lines turned downwards after rebounding from overbought territory and formed a crossover, confirming increasing pressure from sellers.

Consolidation below 1.1605 will confirm the continued decline.

Summary

The EURUSD pair failed to gain a foothold above the 1.1695 resistance level, and as a result the price continues to trend downwards. Technical analysis of EURUSD indicates that the bearish scenario will continue, with a high probability of further decline towards 1.1555.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.