EURUSD moves downwards: the US draws attention to itself

The EURUSD pair declined to 1.1637. The market is closely monitoring US policy and economic data. Find more details in our analysis for 15 January 2026.

EURUSD forecast: key takeaways

- Market focus: the market expects two Federal Reserve interest rate cuts in 2026

- Current trend: the EURUSD pair is falling amid news flow from the US

- EURUSD forecast for 15 January 2026: 1.1600

Fundamental analysis

The EURUSD rate declined to 1.1637 on Thursday. Investors continue to assess the outlook for Federal Reserve policy amid fresh macroeconomic data and concerns surrounding the regulator’s independence.

Wednesday’s data showed a moderate acceleration in US producer inflation in November, while earlier statistics pointed to restrained consumer price growth. At the same time, retail sales increased more strongly than expected. This added arguments in favour of resilient domestic demand.

US President Donald Trump stated that he does not plan to dismiss Federal Reserve Chairman Jerome Powell, despite threats of criminal prosecution from the US Department of Justice. The market continues to expect rates to remain unchanged at the upcoming meeting, while pricing in two rate cuts starting from June.

Externally, Trump also indicated that he may postpone active measures against Iran.

The EURUSD forecast is moderately negative.

Technical outlook

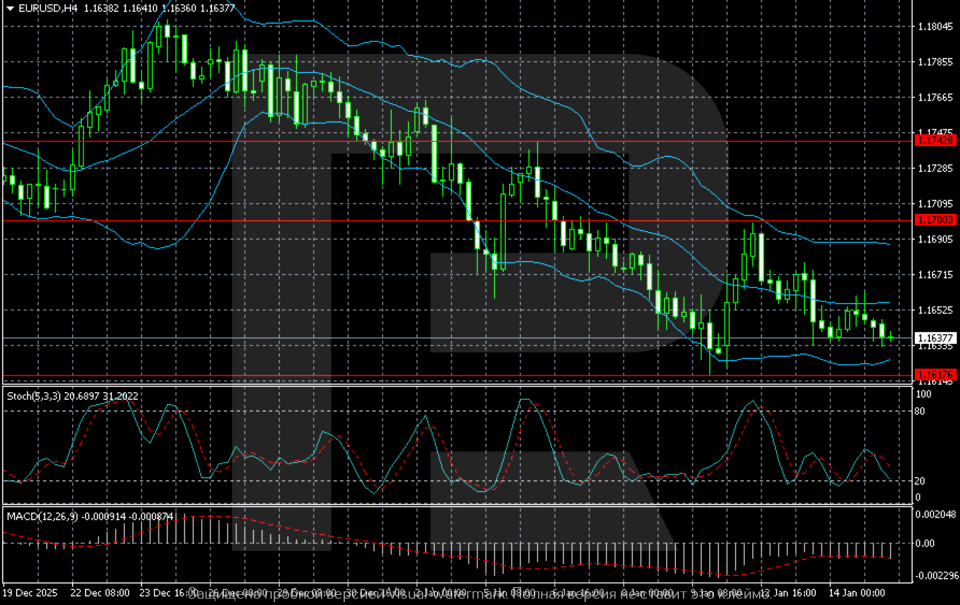

On the H4 chart, the EURUSD pair maintains a stable bearish trend. After forming a local high in the 1.1780–1.1800 area, the pair declined consistently. The price consolidated below the key levels of 1.1740 and 1.1700, which now act as resistance zones. Quotes are currently hovering near 1.1630–1.1650, indicating seller dominance.

The movement is developing within a descending channel, with the price remaining below the middle Bollinger Band for most of the time and periodically testing the lower one. This confirms bearish pressure and the absence of sustained demand on pullbacks. Attempts at corrective growth remain limited and quickly encounter selling pressure near the 1.1680–1.1700 area.

Indicators also signal weakness. The Stochastic Oscillator fluctuates in the lower part of the range without a sustained move into overbought territory, indicating a lack of strong corrective momentum. MACD remains in negative territory, although the pace of decline gradually slows, signalling a possible short-term consolidation.

The nearest support lies in the 1.1600–1.1580 area. A return and consolidation above 1.1700 would be required to shift market sentiment.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: Bearish

- Key resistance levels: 1.1700 and 1.1740

- Key support levels: 1.1600 and 1.1580

EURUSD trading scenarios for today

Main scenario (Sell Stop)

The EURUSD decline develops within a stable descending channel. Consolidation below 1.1600 will indicate sustained selling pressure and create conditions for further downward movement.

The risk-to-reward ratio exceeds 1:3. Potential profit upon reaching the target amounts to around 90 pips, while possible losses are limited to 30 pips.

- Sell Stop: 1.1590

- Take Profit: 1.1495

- Stop Loss: 1.1620

Alternative scenario (Buy Stop)

Corrective growth is possible if the price returns above the 1.1700 zone and consolidates above this level. In this case, the market may shift towards a deeper correction within the bearish trend.

- Buy Stop: 1.1710

- Take Profit: 1.1780

- Stop Loss: 1.1670

Risk factors

The main risk to the bearish scenario remains a sharp weakening of the US dollar amid unexpectedly dovish Federal Reserve rhetoric or weak macroeconomic data. In this case, pressure on the EURUSD pair may temporarily ease and trigger corrective growth above 1.1700.

Summary

The EURUSD pair is gradually declining. The EURUSD forecast for today, 15 January 2026, suggests that the current momentum could continue, with the pair moving towards 1.1600.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.