EURUSD at a crossroads: decline or growth ahead

The euro is once again attempting to recover positions against the USD, with EURUSD quotes trading near the 1.1600 level. Discover more in our analysis for 16 January 2026.

EURUSD forecast: key takeaways

- Germany Consumer Price Index (CPI): previously at -0.2%, projected at 0.0%

- The ECB may raise the interest rate this month

- EURUSD forecast for 16 January 2026: 1.1635 and 1.1565

Fundamental analysis

The EURUSD forecast takes into account that today the euro is forming a corrective wave and is trading near the 1.1660 level.

The ECB shows interest in strengthening the European currency and may continue tightening monetary policy this month to support the euro.

The situation with the dollar currently remains uncertain due to expectations surrounding the Federal Reserve’s interest rate decision. Unlike the ECB, the Federal Reserve may decide to ease monetary policy and cut rates, which could weaken the dollar and provide an impulse for EURUSD growth.

Germany’s Consumer Price Index (CPI) reflects changes in the cost of goods and services for consumers, helping to assess purchasing trends and the degree of economic stagnation. A lower-than-expected indicator will negatively impact the European currency.

The forecast for 16 January 2026 suggests the index may reach 0.0%, compared with the previous value of -0.2%. If the actual data exceeds expectations, this could influence the EURUSD rate and trigger price growth.

Technical outlook

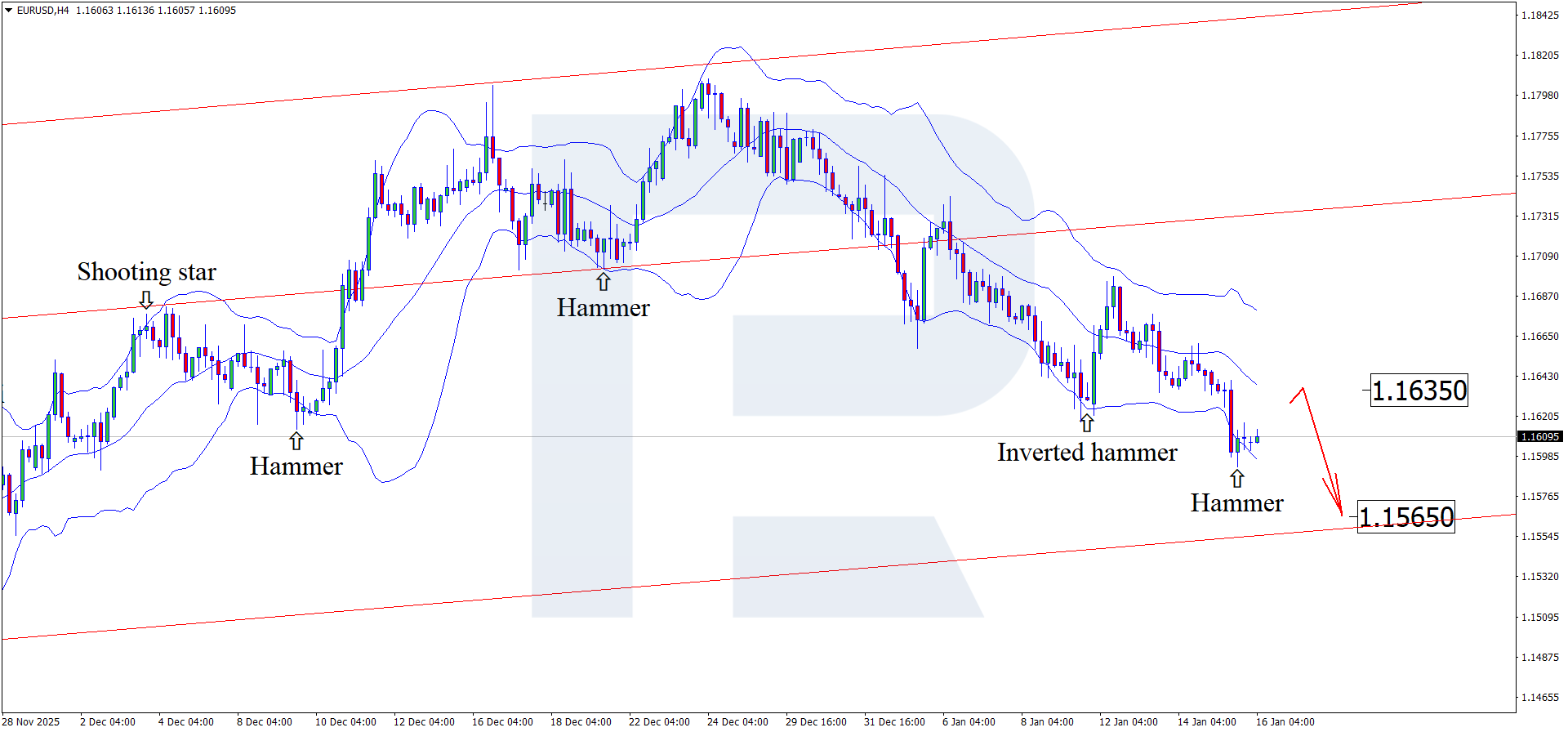

On the H4 chart, the EURUSD pair formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair is developing a corrective wave following the pattern signal. Since quotes remain within an ascending channel, they may head towards the 1.1635 level. A breakout of this level would open the door for an uptrend.

At the same time, today’s EURUSD forecast also considers an alternative scenario, in which the pair declines towards the 1.1565 level without testing the resistance level.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: Bearish

- Key resistance levels: 1.1700 and 1.1740

- Key support levels: 1.1600 and 1.1580

EURUSD trading scenarios for today

Main scenario (Sell Stop)

The EURUSD rate continues to decline. Consolidation below 1.1600 will indicate sustained selling pressure and create conditions for continued downward movement.

The risk-to-reward ratio exceeds 1:3. Potential profit upon reaching the target amounts to around 90 pips, while possible losses are limited to 30 pips.

- Sell Stop: 1.1590

- Take Profit: 1.1495

- Stop Loss: 1.1620

Alternative scenario (Buy Stop)

Corrective growth is possible if the price returns above the 1.1700 zone and consolidates above this level. In this case, the market may shift towards a deeper correction within the downtrend.

- Buy Stop: 1.1710

- Take Profit: 1.1780

- Stop Loss: 1.1670

Risk factors

The main risk to the bearish scenario remains a sharp weakening of the US dollar amid unexpectedly soft Federal Reserve rhetoric or weak macroeconomic data. In this case, pressure on the EURUSD pair may temporarily ease and trigger corrective growth above 1.1700.

Summary

The euro is making another attempt to regain ground, with expectations of ECB and Federal Reserve decisions adjusting exchange rate dynamics. EURUSD technical analysis suggests a correction towards the 1.1635 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.