EURUSD strengthens amid escalating trade tensions

The EURUSD rate is rising sharply, with buyers attempting to consolidate above the 1.1615 resistance level. The rate currently stands at 1.1628. Discover more in our analysis for 19 January 2026.

EURUSD forecast: key takeaways

- Positive macroeconomic data failed to support the US dollar

- Investors assess the potential negative consequences of trade pressure from the Trump administration for the US economy

- Current fundamental factors are shaping a bullish outlook for the EURUSD pair today

- EURUSD forecast for 19 January 2026: 1.1805

Fundamental analysis

The EURUSD rate is rising amid statements by President Donald Trump, who threatened eight European countries with new trade tariffs as part of pressure over the Greenland issue. A potential 10% tariff, effective 1 February, may affect Germany, the UK, France, Denmark, Norway, Sweden, the Netherlands, and Finland. If no agreement is reached, the rate may increase to 25% in June. The market perceives these threats as a factor that increases trade risks and slows the global economy, reducing the appeal of the US dollar.

Macroeconomic data from the US proved positive. Industrial production in December 2025 increased by 0.4% month-on-month, while analysts expected only 0.1%. The New York Fed services business activity index rose to minus 16.1 points in January from minus 20 points in December, reaching its highest level since August last year.

Nevertheless, positive data failed to support the US dollar. Investors focused on the potential consequences of trade pressure from the Trump administration for the US economy and international relations, which keeps the EURUSD forecast bullish today.

Technical outlook

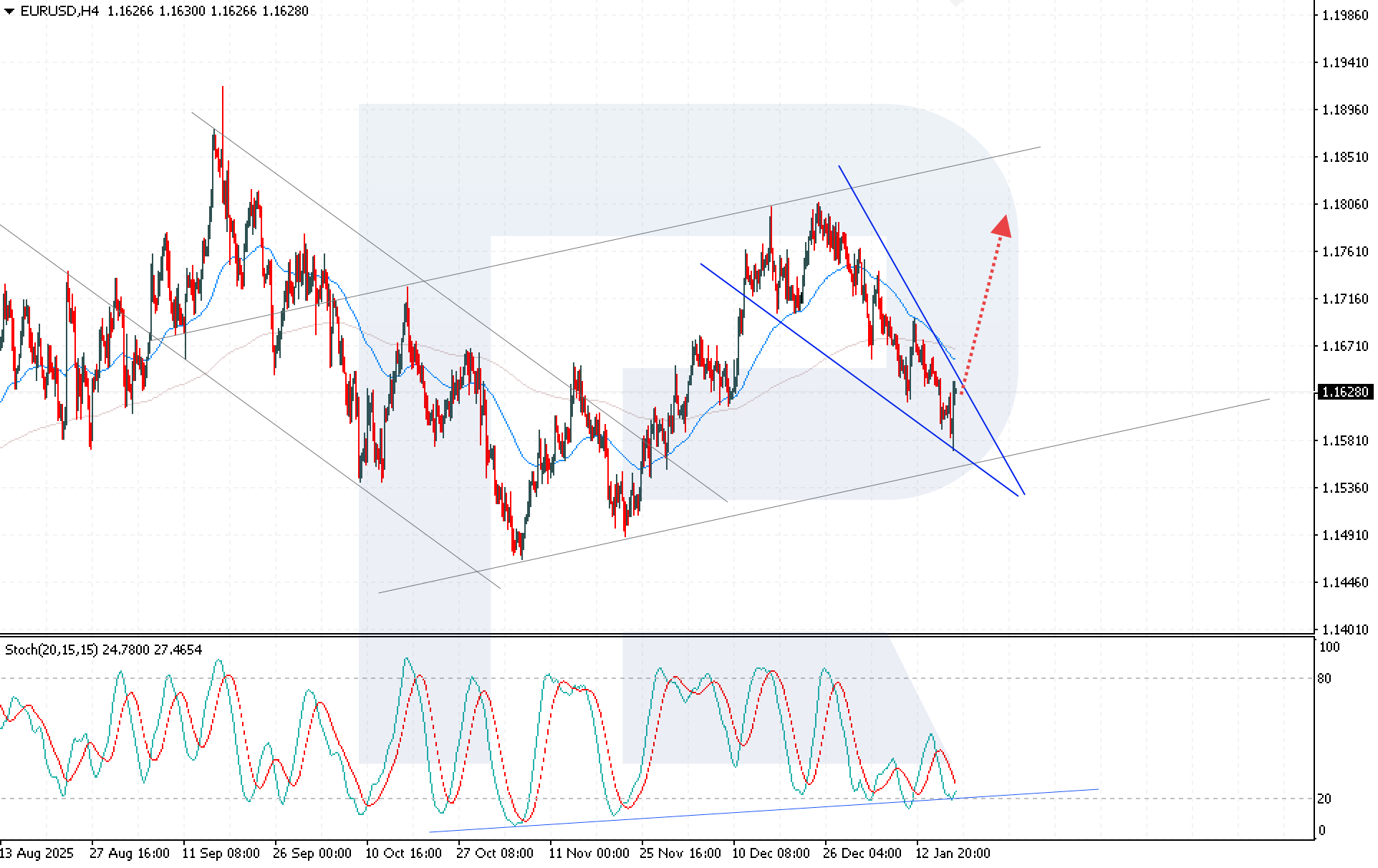

On the EURUSD chart, a corrective move is developing within a Wedge reversal pattern. Following the previous bearish impulse, quotes shifted into a moderate pullback, but the current price structure does not yet indicate a change in the primary direction. Despite the crossover of moving averages, the price remains within the pattern, preserving the potential for a resumption of the upward move.

The EURUSD forecast for today suggests an attempt to restore growth after the current corrective phase ends, with a target at 1.1805. Technical indicators confirm continued bullish expectations. The Stochastic Oscillator once again rebounded from oversold territory. Its lines have turned upwards for the third time recently, while creating the conditions for a bullish crossover, which strengthens signals in favour of renewed euro buying.

Key confirmation of the scenario will come from consolidation of EURUSD quotes above the 1.1650 level. This will indicate a breakout above the upper boundary of the Wedge pattern and signal the completion of the correction. In this case, the probability of a reversal pattern materialising increases.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: Bullish

- Key resistance levels: 1.1670 and 1.1805

- Key support levels: 1.1580 and 1.1490

EURUSD trading scenarios for today

Main scenario (Buy Stop)

A breakout and consolidation of EURUSD quotes above the 1.1650 level will confirm the completion of the corrective phase and the implementation of the Wedge reversal pattern. This will indicate the market is ready to resume the upward move. Growth is driven by US dollar weakness amid trade and geopolitical risks.

The risk-to-reward ratio exceeds 1:2. Potential profit upon reaching the target amounts to approximately 155 pips, while possible losses are limited to 65 pips.

- Take Profit: 1.1805

- Stop Loss: 1.1585

Alternative scenario (Sell Stop)

A decline in the EURUSD rate, with a move and consolidation below the 1.1580 level, will signal weakening bullish momentum and indicate a continued correction. In this case, pressure on the pair may intensify amid profit-taking after the rally.

- Take Profit: 1.1480

- Stop Loss: 1.1675

Risk factors

Despite pressure on the USD, strong published data on US industrial production and rising business activity in the US service sector may eventually restore investor interest in the US currency. In this case, fundamental support for the US dollar may limit EURUSD growth even amid persistent trade risks.

Summary

Despite strong US macroeconomic data, geopolitical and trade risks continue to dominate market sentiment, maintaining a bullish outlook for the EURUSD pair today. The correction in EURUSD remains limited. Oscillator signals and the price structure preserve bullish potential, while consolidation above the 1.1655 level will increase the probability of the pair moving towards 1.1805.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.