Euro at highs: what Nagel will say and where EURUSD may head next

The euro continues to strengthen ahead of a speech by the President of the Deutsche Bundesbank, with the rate currently standing at 1.1865. Discover more in our analysis for 26 January 2026.

EURUSD forecast: key takeaways

- Speech by President of the Deutsche Bundesbank Joachim Nagel

- EURUSD quotes are testing the highs of September 2025

- EURUSD forecast for 26 January 2026: 1.1925

Fundamental analysis

The EURUSD forecast takes into account that today the euro continues to form an upward wave and is trading near the 1.1865 level.

Today, President of the Deutsche Bundesbank Joachim Nagel is scheduled to speak.

Key expectations from his speech:

- A hawkish tone on inflation. Nagel is traditionally regarded as one of the more hawkish members of the ECB, so the market expects signals supporting the need to maintain tight monetary policy even amid weak economic growth in Germany

- An assessment of Germany’s economic recovery. After a prolonged period of stagnation, the Bundesbank expects a gradual improvement in 2026, driven by government spending and exports. Any confirmation of this scenario could provide additional support to the euro

- Signals regarding ECB interest rates. The speech may include hints as to whether Nagel considers discussions about rate cuts premature or, conversely, supports a prolonged period of elevated rates

After the rapid rise, the EURUSD rate may form a corrective wave. Following Nagel’s speech, with additional support, the euro may continue to strengthen against the US dollar.

Technical outlook

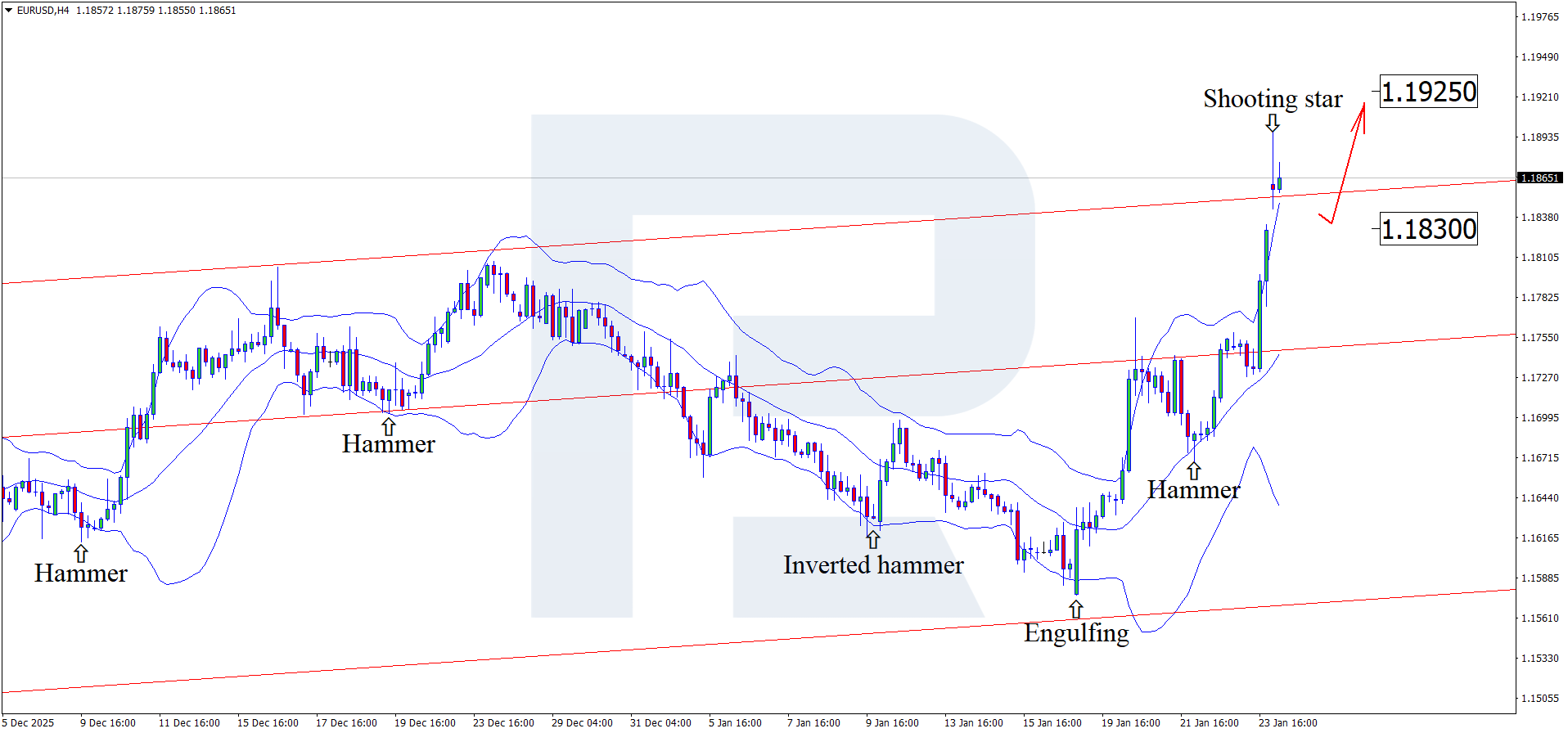

On the H4 chart, the EURUSD pair formed a Shooting Star reversal pattern near the upper Bollinger Band. At this stage, the pair may develop a corrective wave following the pattern’s signal. Since prices have moved outside the ascending channel, they may head towards the 1.1830 area. A rebound from this level would open the way for continued upward momentum.

At the same time, today’s EURUSD forecast also considers an alternative scenario in which the pair rises directly towards 1.1925 without testing the support level.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 1.1925 and 1.2000

- Key support levels: 1.1690 and 1.1585

EURUSD trading scenarios for today

Main scenario (Buy Stop)

A consolidation above the 1.1875 level would confirm the continuation of the uptrend.

The risk-to-reward ratio is 1:3. Potential profit upon reaching the take-profit level is around 100 pips, while possible losses are limited to 30 pips.

- Buy Stop: 1.1880

- Take Profit: 1.1980

- Stop Loss: 1.1850

Alternative scenario (Sell Stop)

A decline and consolidation below 1.1800 would signal weakening bullish momentum and indicate a corrective pullback after the sharp rise.

- Take Profit: 1.1700

- Stop Loss: 1.1830

Risk factors

Attempts by sellers to consolidate below the 1.1800 support level could halt the bullish momentum. Strong US macroeconomic data may introduce uncertainty for further growth, as any positive developments in the US economy could support a decline in the EURUSD pair.

Summary

The speech by the President of the Deutsche Bundesbank may provide additional support for the euro. EURUSD technical analysis suggests continued upward momentum after a correction, with the upside target at 1.1925.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.