EURUSD full of strength: focus on the Fed, shutdown, and a bit of geopolitics

The EURUSD pair appears strong and is rising towards 1.1886. Markets are closely watching the Fed, Trump’s policies, and shutdown risks. Find more details in our analysis for 27 January 2026.

EURUSD forecast: key takeaways

- The EURUSD pair has strengthened to a four-month high

- A two-day Federal Reserve meeting begins today, with rates likely to remain unchanged

- EURUSD forecast for 27 January 2026: 1.1900

Fundamental analysis

On Tuesday, the EURUSD rate rose to 1.1886, its highest level in more than four months. The market has moved into a wait-and-see mode ahead of the Federal Reserve’s two-day meeting, which opens today.

The Fed is expected to keep interest rates unchanged. However, investors remain focused on the central bank’s independence from political pressure. Speculation is growing that a new Fed Chair nominee could be announced as early as this week. US President Donald Trump is believed to favour a more dovish candidate.

Additional pressure on the US dollar came from renewed risks of a US government shutdown. Democratic Party leaders have threatened to block a 1.2 trillion USD funding package if it includes additional allocations for domestic security.

Geopolitical and trade tensions continue to fuel a ‘sell America’ strategy. At the same time, expectations of a possible coordinated currency intervention by the US and Japan are increasing demand for the yen. Taken together, these factors are weighing on the US dollar.

The outlook for the EURUSD pair is positive.

Technical outlook

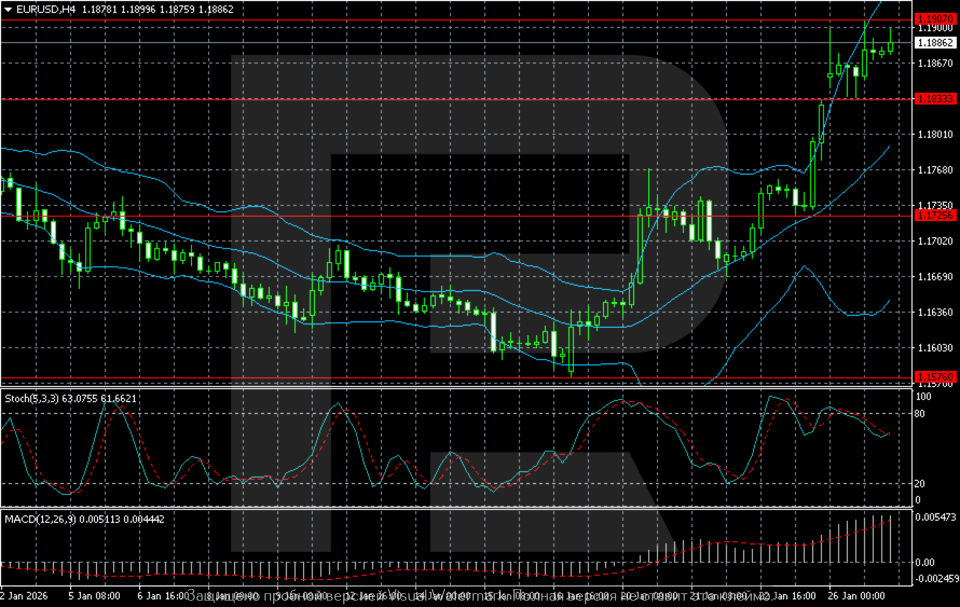

The EURUSD H4 chart shows a shift in the short-term structure towards growth. In the first half of January, the pair moved within a descending channel and consistently set lower lows, but a solid base formed in the 1.1575–1.1600 area. The price tested the lower Bollinger Band several times, after which selling pressure faded, and a reversal began.

The upward momentum developed rapidly, with quotes breaking above the middle Bollinger Band, signalling a change in short-term sentiment. In the second half of the month, growth accelerated: the EURUSD pair confidently broke above the 1.1725 resistance level and then moved through the 1.1830–1.1850 area without a deep correction. The pair is now trading near 1.1885–1.1900, testing the important psychological level of 1.1900 and the upper boundary of the current range.

Indicators confirm continued bullish momentum. MACD remains in positive territory and continues to rise, with no clear signs of trend weakening. At the same time, the Stochastic Oscillator is holding in the upper part of its range, indicating overbought conditions and increasing the likelihood of a short-term pause or a mild pullback without breaking the overall structure.

Overall, the technical picture remains bullish. As long as the price holds above the 1.1830–1.1850 zone, the uptrend appears stable, and the market retains the potential to attempt consolidation above 1.1900, with further movement towards 1.1950–1.2000. However, the risk of consolidation increases near current levels, as the market is pricing in January’s sharp rally.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 1.1925 and 1.2000

- Key support levels: 1.1830 and 1.1725

EURUSD trading scenarios for today

Main scenario (Buy Stop)

A consolidation above the 1.1875–1.1900 zone will confirm the continuation of strong bullish momentum amid pressure on the US dollar and expectations surrounding the Fed meeting outcome. In this case, the market may continue to move towards the upper targets of the range.

The risk-to-reward ratio is around 1:3. Upside potential is approximately 100–120 pips with limited risk.

- Buy Stop: 1.1880

- Take Profit: 1.1980

- Stop Loss: 1.1850

Alternative scenario (Sell Stop)

A move and consolidation below 1.1800 would signal profit-taking and weakening bullish momentum after January’s sharp rally. In this case, a corrective pullback towards lower support levels is likely.

- Sell Stop: 1.1795

- Take Profit: 1.1700

- Stop Loss: 1.1830

Risk factors

Any unexpected hawkish signals from the Fed, strong US macroeconomic data, or easing political tensions could temporarily support the US dollar and trigger a correction in the EURUSD pair.

Summary

The EURUSD pair maintains a bullish trend. The EURUSD forecast for today, 27 January 2026, suggests an attempt to consolidate above the 1.1900 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.