EURUSD strengthens after holding key support at 1.1905

The EURUSD pair is forming a recovery move after a correction amid US dollar weakness and dovish signals from the Fed, with the rate currently at 1.1984. Find out more in our analysis for 29 January 2026.

EURUSD forecast: key takeaways

- EURUSD strengthens after yesterday’s correction

- Jerome Powell signalled the Fed’s readiness to keep interest rates at current levels in the near term

- US economic activity continues to grow at a steady pace

- EURUSD forecast for 29 January 2026: 1.2120

Fundamental analysis

The EURUSD rate is strengthening after yesterday’s correction. Buyers confidently defended the 1.1905 support level, allowing the price to resume its upward movement. While the US dollar received short-term support amid expectations of the Fed’s decision, today the US currency is declining again.

As expected, the Federal Reserve held interest rates steady. Fed Chair Jerome Powell made it clear that the regulator is likely to maintain the current rate level in the near future. The Federal Reserve leadership has adopted a wait-and-see approach and prefers to assess new macroeconomic data before making decisions on rate changes.

The regulator also noted that economic activity in the US continues to grow at a steady pace, the labour market is showing signs of stabilisation, and inflation remains moderately elevated. Additional pressure on the dollar comes from statements by President Donald Trump, who said that the US administration was satisfied with the weakening of the US currency.

Technical outlook

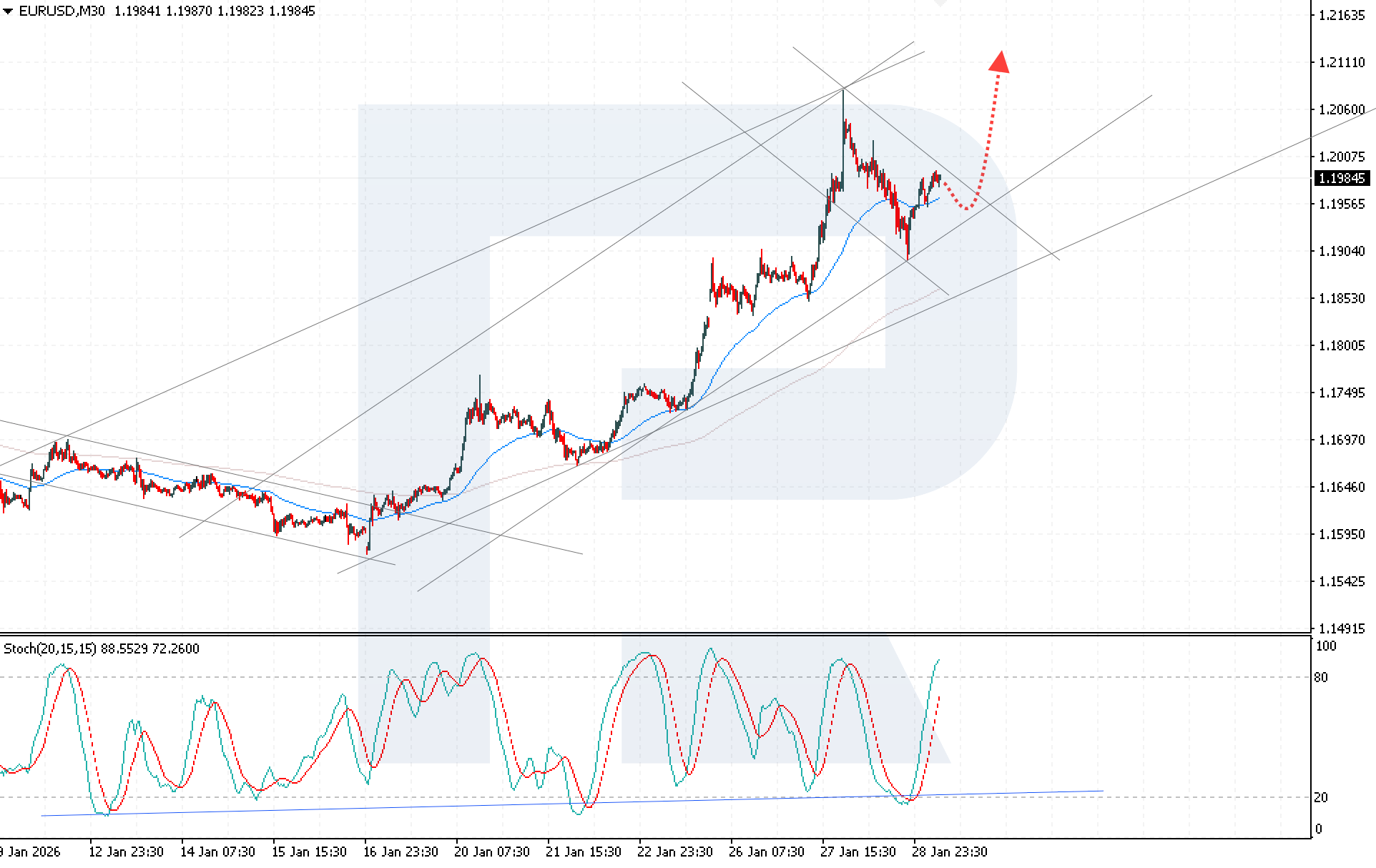

EURUSD quotes have consolidated above the EMA-65 after a deep correction, indicating an attempt by buyers to regain ground. However, the pair remains within a correction channel, which limits the development of a sustained bullish momentum.

The EURUSD forecast for today suggests a continuation of the upward move towards the 1.2105 level after a rebound from the lower boundary of the bullish channel. The Stochastic Oscillator further confirms the bullish scenario: the signal lines turned upwards from the bullish support line and formed a bullish crossover, increasing buying pressure.

The key condition for the development of bullish momentum remains the consolidation of EURUSD quotes above the 1.2005 level. This scenario would indicate a breakout above the upper boundary of the correction channel and significantly increase the likelihood of reaching the target level in the short term.

EURUSD overview

- Asset: EURUSD

- Timeframe: M30 (Intraday)

- Trend: bullish

- Key resistance levels: 1.2005 and 1.2065

- Key support levels: 1.1955 and 1.1905

EURUSD trading scenarios for today

Main scenario (Buy Stop)

Conditions for opening long positions will form after the EURUSD pair consolidates above the 1.2005 level, indicating a breakout above the upper boundary of the correction channel.

The risk-to-reward ratio is 1:2. The upside potential is 100 pips, with the risk limited to 50 pips.

- Take Profit: 1.2105

- Stop Loss: 1.1955

Alternative scenario (Sell Stop)

A decline and consolidation below the 1.1940 level would indicate a breakout below the lower boundary of the bullish channel and allow sellers to gain a foothold below the EMA-65. In this case, the risks of a deeper bearish correction increase.

- Take Profit: 1.1835

- Stop Loss: 1.1995

Risk factors

Risks to EURUSD growth are related to the fact that the pair remains within the correction channel, while sustained bullish momentum has not yet been confirmed. Failure to consolidate above the 1.2005 level and a return below the EMA-65 could maintain selling pressure and trigger another phase of correction.

Summary

Dovish Fed rhetoric and political signals from the White House create fundamental conditions for continued pressure on the USD and support the upside potential of the EURUSD pair. Holding above the EMA-65 line and the formation of bullish signals on the oscillator create technical conditions for further EURUSD growth, if a breakout above the 1.2005 level is confirmed.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.