EURUSD is in a correction phase, but it is unlikely to be prolonged

The EURUSD pair declined within a corrective move to 1.1865. News regarding the future Federal Reserve chairman supported the US dollar. Find more details in our analysis for 2 February 2026.

EURUSD forecast: key takeaways

- The EURUSD pair dipped following the nomination of Warsh as a candidate for Fed chair

- The market is pricing in two US interest rate cuts in 2026

- EURUSD forecast for 2 February 2026: 1.2000

Fundamental analysis

The EURUSD rate slipped to 1.1865 on Monday as the US dollar found support after US President Donald Trump nominated Kevin Warsh as the next Federal Reserve chairman.

The market views Warsh as a more hawkish candidate who, while allowing for interest rate cuts, is expected to act less aggressively compared to other potential contenders. He is also expected to push for a reduction of the Fed’s balance sheet, a move that typically supports the dollar by tightening money supply.

Traders continue to price in two Federal Reserve rate cuts this year. However, divisions remain within the Committee regarding the pace and scale of further policy easing.

The EURUSD outlook is mixed.

Technical outlook

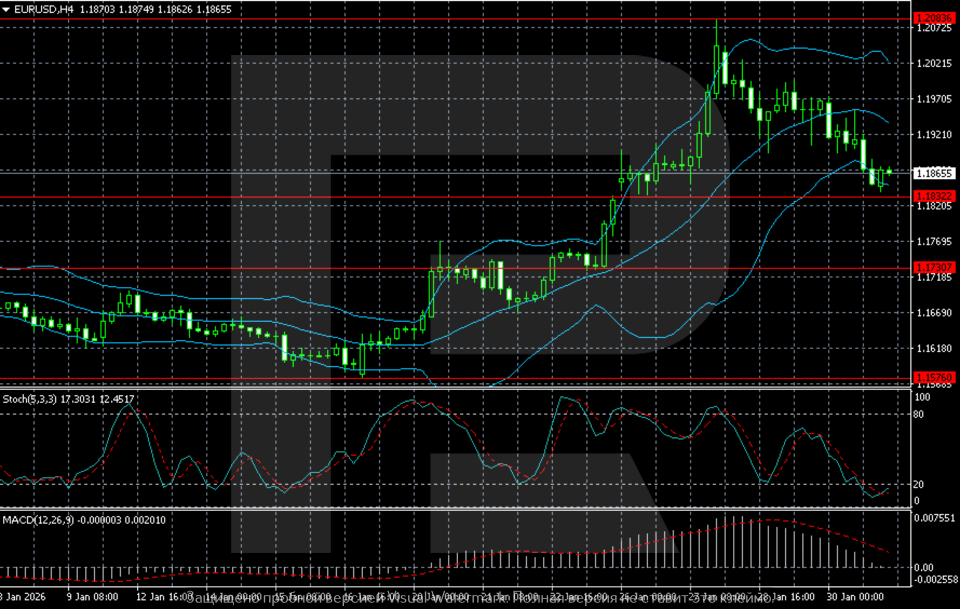

The EURUSD H4 chart shows that after a prolonged sideways phase in the first half of January, the pair entered an impulsive growth phase. The price broke above the 1.1600–1.1700 range, accelerated through the 1.1800 area, and reached the 1.2000–1.2100 zone, marking multi-month highs. The rally was accompanied by an expansion of Bollinger Bands, indicating rising volatility and buyer dominance.

After forming a local peak around 1.2050–1.2100, the pair entered a correction phase. The price has pulled back from the upper Bollinger Band and is now moving lower towards the 1.1850–1.1870 area, holding above the previously broken resistance at 1.1830–1.1850, which now acts as the nearest support. As long as this level holds, the correction appears technical.

Indicators confirm weakening momentum. The Stochastic Oscillator has turned down from overbought territory, indicating a short-term pause or a continuation of the pullback. While MACD remains in positive territory, the histogram is contracting, suggesting a slowdown in bullish momentum without signs of a trend reversal.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: bullish (weakening momentum, correction)

- Key resistance levels: 1.2000 and 1.2050

- Key support levels: 1.1870 and 1.1830

EURUSD trading scenarios for today

Main scenario (Buy Stop)

After a corrective pullback from the 1.2050–1.2100 zone, the EURUSD pair is holding above the 1.1830–1.1850 area, which acts as key support. A consolidation above 1.1980 would confirm the end of the correction and signal readiness to resume the upward move towards the 1.2000–1.2050 area.

The risk-to-reward ratio is around 1:1.7, reflecting a phase of momentum slowdown after a strong rally.

- Buy Stop: 1.1980

- Take Profit: 1.2050

- Stop Loss: 1.1940

(potential ≈ 70 pips, risk ≈ 40 pips)

Alternative scenario (Sell Stop)

A consolidation below 1.1870 would indicate a breakout below the nearest support level and increase the risk of a deeper corrective move following the momentum-driven rally.

- Sell Stop: 1.1860

- Take Profit: 1.1780

- Stop Loss: 1.1910

(potential ≈ 80 pips, risk ≈ 50 pips)

Risk factors

The main risk to the bullish scenario is a potential strengthening of the US dollar amid expectations of a more hawkish Fed stance following the nomination of Kevin Warsh and a reassessment of the pace of policy easing. In this case, the EURUSD rate may continue its corrective decline below 1.1830.

Summary

The EURUSD pair is experiencing a slowdown in bullish momentum. The EURUSD forecast for today, 2 February 2026, does not rule out a return towards 1.2000 after the correction is complete.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.