EURUSD growth depends on US data

The euro may continue to strengthen following US economic data. The EURUSD rate is hovering around the 1.1810 level. Find more details in our analysis for 3 February 2026.

EURUSD forecast: key takeaways

- US Job Openings and Labor Turnover Survey (JOLTS): previously at 7.146 million, projected at 7.230 million

- The euro continues its attempts to strengthen

- EURUSD forecast for 3 February 2026: 1.1870

Fundamental analysis

The EURUSD forecast takes into account that today, after a sharp decline, the price is forming a recovery wave and is trading around the 1.1810 level.

The US Job Openings and Labor Turnover Survey (JOLTS) is an economic indicator that reflects the number of vacant jobs in the country at the end of the month. The report is published by the US Bureau of Labor Statistics (BLS) and provides insight into labour demand, the level of economic activity, and the balance between employers and job seekers.

JOLTS helps assess labour market dynamics: a high number of job openings points to strong economic activity and rising demand for workers, while a low number indicates emerging business difficulties and slowing economic growth. The data is closely monitored by analysts, investors, and government institutions when making decisions.

The forecast for 3 February 2026 suggests that the number of job openings may rise to 7.230 million from the previous 7.146 million. If the actual reading exceeds expectations, this may support the US dollar, while a lower-than-expected figure could trigger further growth in EURUSD quotes.

Technical outlook

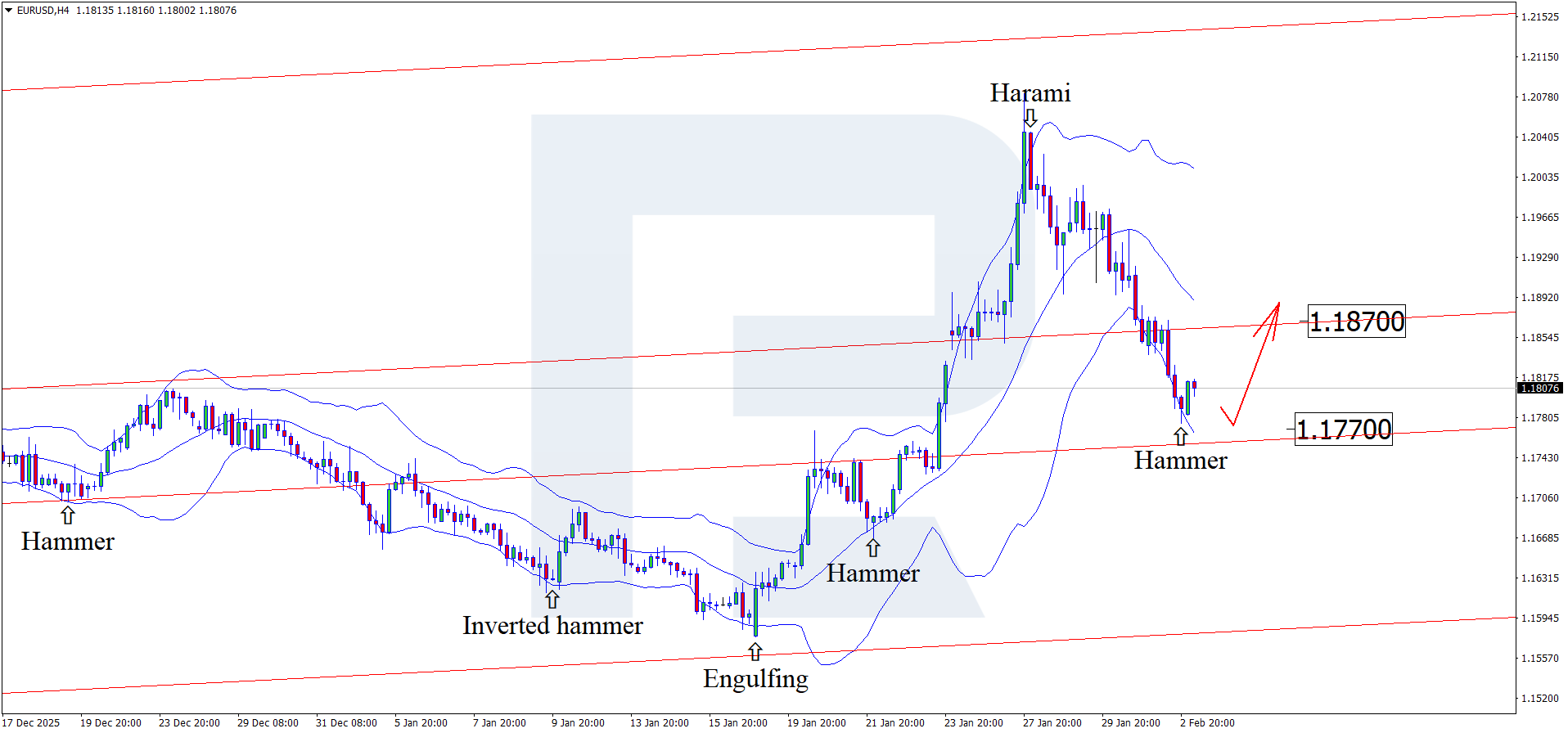

On the H4 chart, the EURUSD pair has formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair is developing an upward wave following the signal. Since the price remains within an ascending channel, it may head towards the 1.1870 level. A breakout above this level would open the way for continued bullish momentum.

At the same time, today’s EURUSD forecast also considers an alternative scenario, where the price declines towards 1.1770 without testing the resistance level.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: bullish (weakening momentum, correction)

- Key resistance levels: 1.2000 and 1.2050

- Key support levels: 1.1770 and 1.1680

EURUSD trading scenarios for today

Main scenario (Buy Stop)

After the decline, the EURUSD pair may form a recovery wave. A consolidation above 1.1870 will confirm the end of the correction and indicate market readiness to resume its upward movement, returning to the 1.2000–1.2050 area.

The risk-to-reward ratio exceeds 1:4 with a moderate stop-loss.

- Buy Stop: 1.1870

- Take Profit: 1.2050

- Stop Loss: 1.1830

Alternative scenario (Sell Stop)

A consolidation below 1.1770 will signal a breakout below the nearest support level and increase the risks of a deeper corrective wave after the impulsive rise.

- Sell Stop: 1.1760

- Take Profit: 1.1600

- Stop Loss: 1.1810

Risk factors

The main risk to the bullish scenario is a potential strengthening of the US dollar amid expectations of a more hawkish Fed stance following the nomination of Kevin Warsh and a reassessment of the pace of policy easing. In this case, the EURUSD rate may continue its corrective decline below 1.1600.

Summary

A decline in actual US job openings data (JOLTS) may weaken the USD. EURUSD technical analysis suggests a rise towards the 1.1870 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.