EURUSD forms a bullish scenario amid the US government shutdown

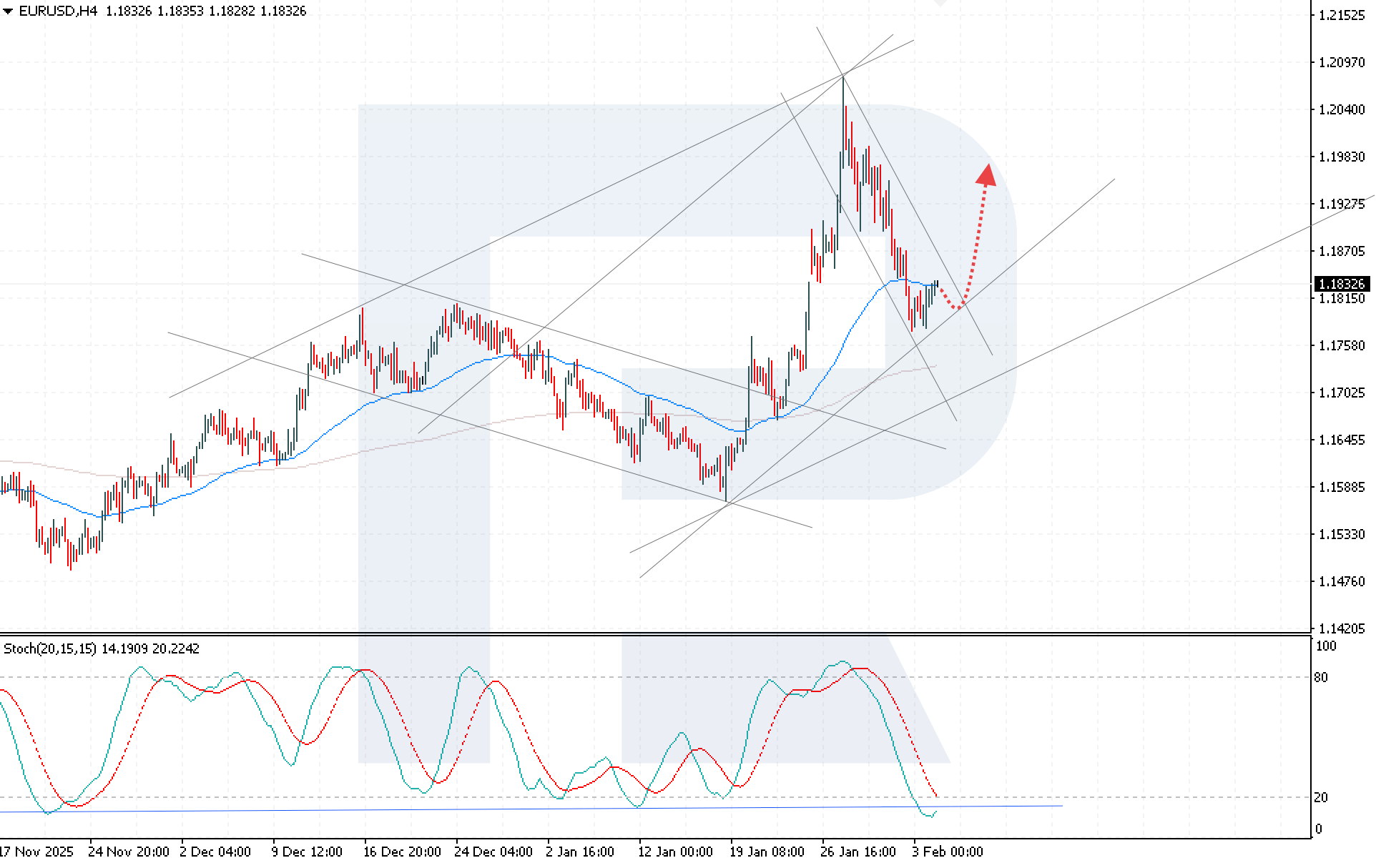

The EURUSD pair is steadily strengthening amid a combination of strong technical signals and a weakening US dollar, with the rate currently at 1.1832. Find more details in our analysis for 4 February 2026.

EURUSD forecast: key takeaways

- The technical structure indicates continued bullish momentum in the EURUSD pair

- Uncertainty surrounding the US labour market has intensified

- The 1.1805 support level has become a zone of concentrated buying interest in EURUSD

- EURUSD forecast for 4 February 2026: 1.1985

Fundamental analysis

The EURUSD rate is strengthening for the second consecutive trading session. Buyers are confidently holding the key support level at 1.1805, preventing a downside breakout. On the daily chart, this area coincides with the upper boundary of a large Triangle pattern, which enhances its technical significance. A test and rebound from the pattern boundary signal a continuation of the bullish trend in the EURUSD pair.

The US dollar came under pressure after reports that the US Bureau of Labor Statistics will not release January unemployment data on 6 February, as previously planned, due to another government shutdown. The bureau also postponed the release of its December job openings report, scheduled for Tuesday, adding to uncertainty around the US labour market.

Additional pressure on the US dollar came from comments by Federal Reserve Governor Steven Miran. He stated that the Fed’s monetary policy remains excessively tight given the current state of the US economy and that interest rates should be lowered by more than 100 basis points this year. This factor strengthened support for the EURUSD pair near the 1.1805 level and increased the likelihood of continued upward momentum.

Technical outlook

EURUSD quotes are rising, with buyers attempting to consolidate above the EMA-65. The price action structure indicates that the bearish momentum is weakening and conditions are forming for a transition into an upward phase. Today’s EURUSD forecast suggests further growth towards the target of 1.1985.

The Stochastic Oscillator further confirms the bullish scenario. Its signal lines are testing oversold territory and are preparing to form a new bullish crossover, increasing the likelihood of renewed buying pressure.

The key technical condition for the scenario is the consolidation of EURUSD quotes above the 1.1855 level. This signal will indicate a breakout above the upper boundary of the descending corrective channel and significantly increase the probability of price movement towards the target of 1.1985.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 1.2000 and 1.2050

- Key support levels: 1.1770 and 1.1680

EURUSD trading scenarios for today

Main scenario (Buy Stop)

After consolidating near the 1.1805 support level, the EURUSD pair may form an impulsive growth wave. A price consolidation above the 1.1865 level will confirm a breakout above the upper boundary of the descending correction and indicate the market’s readiness to resume a sustained upward move with a target at 1.1985. The risk-to-reward ratio exceeds 1:4. Potential profit at the take-profit level is around 130 pips, while possible losses are limited to 30 pips.

- Take Profit: 1.2050

- Stop Loss: 1.1830

Alternative scenario (Sell Stop)

A consolidation below the 1.1805 level will indicate a breakout below the key support level and increase the risk of a deeper corrective wave, calling into question the further development of the bullish move in EURUSD.

- Take Profit: 1.1680

- Stop Loss: 1.1835

Risk factors

Renewed demand for the US dollar following the resumption of US government operations and the release of strong macroeconomic data could restore support for the dollar and trigger a corrective decline in the pair. An additional risk to the bullish scenario would be a failed attempt to consolidate above the EMA-65 and 1.1855 levels, which could lead to renewed downside pressure and a return below 1.1805.

Summary

Holding above the 1.1805 support level, a rebound from the Triangle pattern boundary, and fundamental pressure on the US dollar form a solid basis for the continued uptrend in EURUSD. EURUSD technical analysis indicates the formation of a sustained bullish momentum and an increased likelihood of growth towards the 1.1985 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.