EURUSD in doubt: lots of risks, but also lots of confidence

The EURUSD pair is hovering around 1.1793 at the end of the week as the US dollar remains in demand as a safe-haven asset. Discover more in our analysis for 6 February 2026.

EURUSD forecast: key takeaways

- The EURUSD pair may resume its upward trajectory after a pause

- Demand for the US dollar is driven by market interest in safe-haven assets

- EURUSD forecast for 6 February 2026: 1.1760 or 1.1820

Fundamental analysis

On Friday, the EURUSD rate looks uninspiring, hovering around 1.1793. Demand for the US dollar has strengthened amid broad sell-offs in equities, commodities, and cryptocurrencies, which has fuelled interest in the currency as a safe-haven asset.

The USD also gained notable support after US President Donald Trump nominated Kevin Warsh as the next Federal Reserve chairman. Markets view Warsh as favouring balance sheet reduction and a more cautious approach to monetary easing. This has also helped ease concerns about the Federal Reserve’s independence.

At the same time, this week’s series of US labour market reports showed signs of a slowdown and supported expectations of Federal Reserve rate cuts later this year. Markets are currently pricing in two rate cuts: the first in June and the second possibly in September.

The EURUSD outlook is mixed.

Technical outlook

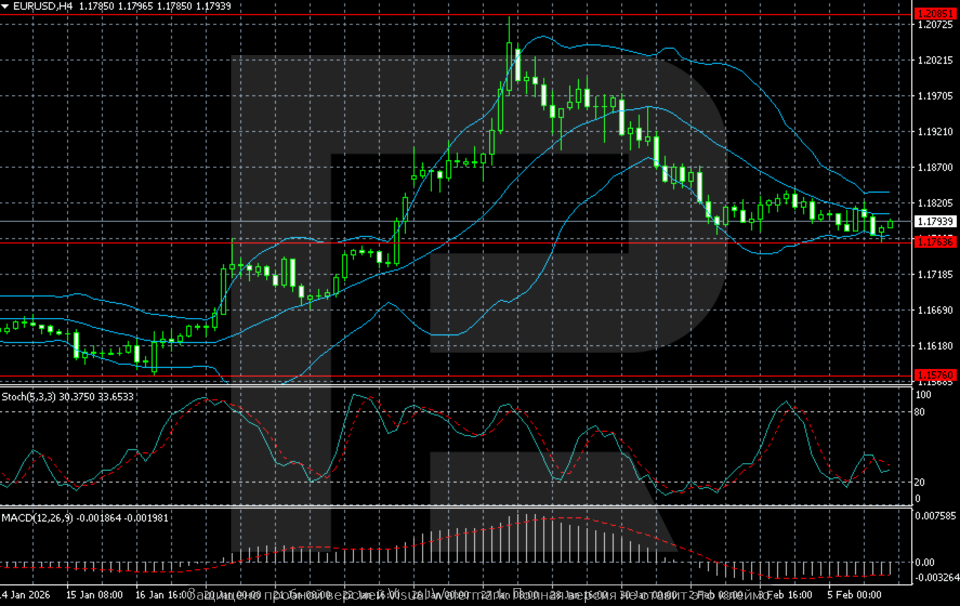

On the H4 chart, after a momentum-driven rally in the second half of January, the EURUSD pair reached a new local high near 1.2050 and then entered a correction phase. The decline extended towards the 1.1760–1.1780 zone, where consolidation is now forming.

The price is trading below the middle Bollinger Band, indicating weakening bullish momentum. The bands are narrowing, suggesting the market is transitioning from a momentum phase to sideways consolidation.

The Stochastic Oscillator is moving lower from neutral territory without signals of deep oversold conditions. MACD remains in negative territory, with the histogram stabilising, which points to fading downside pressure.

Overall, the structure appears corrective following a strong rally. The key support level is located at 1.1760, while resistance is seen at 1.1820–1.1850. As long as the pair holds above the support level, the baseline scenario suggests consolidation with the risk of renewed upside after the pause.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: corrective with bullish structure intact

- Key resistance levels: 1.1820 and 1.1850

- Key support levels: 1.1760 and 1.1680

EURUSD trading scenarios for today

Main scenario (Buy Stop)

After consolidation in the 1.1760–1.1800 range and with weakening dollar pressure, the EURUSD pair may resume its upward movement. A consolidation above 1.1865 would signal the end of the correction phase and indicate the market’s readiness to resume the uptrend towards the January highs. The risk-to-reward ratio is around 1:4, with potential profit of 180–200 pips against a risk of about 45 pips.

- Buy Stop: 1.1865

- Take Profit: 1.2050

- Stop Loss: 1.1820

Alternative scenario (Sell Stop)

A breakout and consolidation below the 1.1760 support level would add to downside pressure, opening the way for a deeper correction after the January rally.

- Sell Stop: 1.1745

- Take Profit: 1.1680

- Stop Loss: 1.1810

Risk factors

Risks to the bullish EURUSD scenario include sustained demand for the US dollar as a safe-haven asset amid sell-offs in risk markets and potential heightened expectations for a more hawkish Federal Reserve stance following new comments from policymakers.

Summary

The EURUSD pair remains sensitive to overall market sentiment towards safe-haven assets. The EURUSD forecast for today, 6 February 2026, suggests movement towards 1.1760 or 1.1820, depending on the prevailing market focus.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.