EURUSD at risk: what will eurozone GDP show

The EURUSD pair awaits eurozone GDP and US CPI data, with quotes testing the 1.1865 level. Discover more in our analysis for 13 February 2026.

EURUSD forecast: key takeaways

- Eurozone Q4 GDP: previously at 1.4%, projected at 1.3%

- US Consumer Price Index (CPI): previously at 2.7%, projected at 2.5%

- EURUSD forecast for 13 February 2026: 1.1930 or 1.1810

Fundamental analysis

The EURUSD forecast takes into account that today the price is forming a corrective wave and is trading near the 1.1865 level.

Fundamental analysis for 13 February 2026 factors in the release of the eurozone Q4 GDP data today.

GDP represents the total value of all goods and services produced in an economy, calculated based on final output, excluding the cost of raw materials.

The forecast for 13 February 2026 appears less optimistic and suggests that eurozone GDP may decline to 1.3%, down from the previous reading of 1.4%. If the actual figure matches or falls below the forecast, it may weigh on the euro and trigger a further corrective move in the EURUSD rate.

The Consumer Price Index reflects changes in the cost of goods and services for consumers, helping assess changes in buying trends and economic stagnation. A lower-than-expected reading typically negatively affects the national currency. The forecast for 13 February 2026 suggests that the US CPI may decline from 2.7% in the previous period to around 2.5%. The fundamental outlook for 13 February 2026 assumes that a decline in the CPI would exert negative pressure on the USD.

The EURUSD pair may react with elevated volatility to the data releases from the US and the eurozone. After the current sideways phase ends, the euro will likely continue to strengthen.

Technical outlook

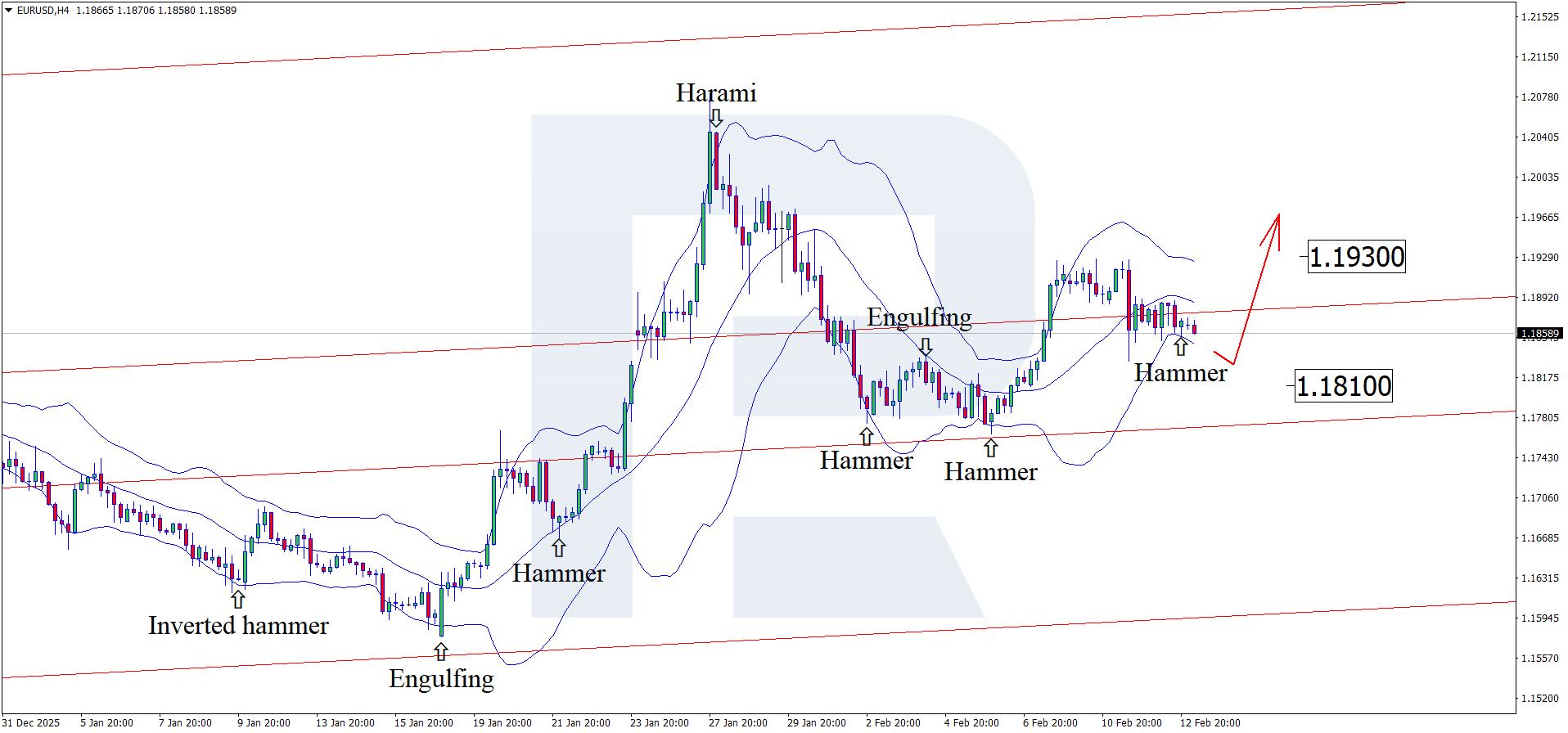

On the H4 chart, the EURUSD pair has formed a Hammer reversal pattern near the lower Bollinger Band and may develop an upward wave in response to this signal. As quotes remain within an ascending channel, they may advance towards the 1.1930 level. A breakout above this mark would open the way for continued upward momentum.

At the same time, today’s EURUSD forecast also considers an alternative scenario, in which the price undergoes a correction towards 1.1810 before growth.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: moderately bullish

- Key resistance levels: 1.1970 and 1.2045

- Key support levels: 1.1810 and 1.1780

EURUSD trading scenarios for today

Main scenario (Buy Stop)

A consolidation above 1.1930 would create conditions for a continued recovery following the correction. The nearest upside target will be 1.2045 if momentum strengthens. The risk-to-reward ratio exceeds 1:3 with moderate volatility.

- Buy Stop: 1.1930

- Take Profit: 1.2045

- Stop Loss: 1.1900

Alternative scenario (Sell Stop)

A breakout and consolidation below 1.1810 would strengthen selling pressure and bring back the risk of a deeper correction towards 1.1780–1.1680.

- Sell Stop: 1.1800

- Take Profit: 1.1700

- Stop Loss: 1.1830

Risk factors

Risks to the bullish scenario include the release of new strong US macroeconomic data and rising bond yields. This could support the dollar and shift Federal Reserve rate expectations towards a more hawkish trajectory.

Summary

Ahead of key data from the US and the eurozone, the euro is attempting to strengthen against USD. EURUSD technical analysis suggests potential growth towards 1.1930 once the correction is complete.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.