EURUSD on pause: the market awaits clarity from the Fed and fresh data

The EURUSD rate is hovering near 1.1846, with the market conserving energy ahead of key releases. Find more details in our analysis for 18 February 2026.

EURUSD forecast: key takeaways

- The EURUSD pair is holding in the middle of a well-defined sideways range

- The market is focused on the FOMC minutes and Friday’s US PCE release

- EURUSD forecast for 18 February 2026: 1.1765 or 1.2000

Fundamental analysis

The EURUSD pair is trading near 1.1846. Market participants are reluctant to take on additional risk ahead of crucial macroeconomic releases. Investors are awaiting the release of the latest FOMC meeting minutes, hoping to gain clearer signals regarding the future interest rate path.

The market also focuses on Friday’s PCE report, the Federal Reserve’s preferred inflation gauge. In addition, US GDP data scheduled for release this week may confirm another quarter of economic growth.

The monetary policy outlook remains uncertain following last week’s combination of strong labour market data and moderate inflation figures.

On Tuesday, Federal Reserve Governor Michael Barr stated that the policy rate should remain at its current level until there is greater confidence that inflation is sustainably returning to the 2% target.

Geopolitically, the US and Iran reportedly reached an understanding on several basic principles during the second round of indirect nuclear negotiations. However, a comprehensive agreement is not expected in the near term.

The EURUSD forecast is moderate.

Technical outlook

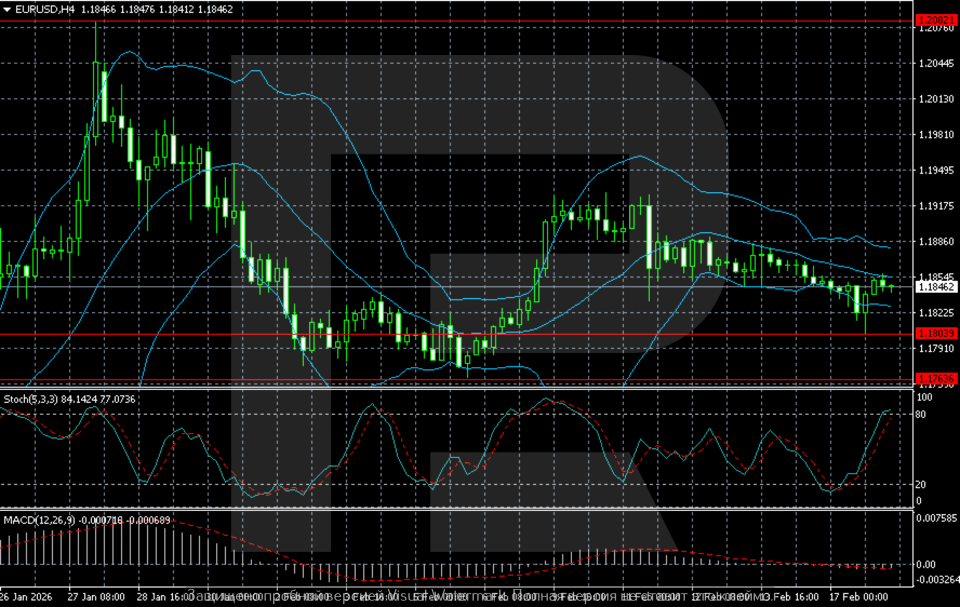

On the H4 chart, the EURUSD pair is trading near 1.1845 after pulling back from January highs above 1.2000. Since early February, the pair has been moving sideways with a mild bearish bias. The price remains within the 1.1765–1.2000 range and is currently positioned near the middle, slightly closer to the 1.1800 support level.

Bollinger Bands have noticeably narrowed, indicating lower volatility and a consolidation phase. Momentum remains weak: MACD is hovering around the zero line, while the Stochastic Oscillator is turning upwards from the lower zone, suggesting a potential short-term rebound.

As long as the price holds above 1.1800, there is potential for a move towards 1.1885, while a breakout below 1.1765 would increase selling pressure, with the risk of continued decline.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: range with a moderate bearish bias

- Key resistance levels: 1.1885 and 1.2000

- Key support levels: 1.1800 and 1.1765

EURUSD trading scenarios for today

Main scenario (Buy Limit)

A pullback to the 1.1800–1.1810 zone may provide an opportunity to open long positions, targeting a move back to 1.1885, the upper boundary of the local impulse within the 1.1765–1.2000 range. The potential gain is around 70–80 pips with a risk of about 30 pips, resulting in a risk-to-reward ratio near 1:2.5.

- Take Profit: 1.1885

- Stop Loss: 1.1775

Alternative scenario (Sell Stop)

A consolidation below 1.1765 would confirm increased selling pressure and open the way for further downside, with the first target around 1.1690.

- Take Profit: 1.1690

- Stop Loss: 1.1810

Risk factors

Risks to the bullish EURUSD scenario include hawkish rhetoric from the Federal Reserve, strong US GDP data, and accelerating core PCE. An additional negative signal for buyers would be a breakout below 1.1800, followed by consolidation below 1.1765, indicating a downside breakout from the current range.

Summary

The EURUSD pair is moving sideways ahead of the FOMC minutes and Friday’s US data releases. The forecast for today, 18 February 2026, does not rule out continued consolidation within the 1.1765–1.2000 range.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.