EURUSD on the verge of decline: what data could strengthen the dollar

A decline in US initial jobless claims may support the USD. The EURUSD rate currently stands at 1.1790. Discover more in our analysis for 19 February 2026.

EURUSD forecast: key takeaways

- US initial jobless claims: previously at 227 thousand, projected at 223 thousand

- Philadelphia Fed Manufacturing Index (US): previously at 12.6, projected at 7.5

- EURUSD forecast for 19 February 2026: 1.1730 and 1.1885

Fundamental analysis

The EURUSD forecast takes into account that the price continues its downward trajectory, trading around 1.1790 today.

US initial jobless claims reflect the number of people who filed for unemployment benefits for the first time during the previous week. This indicator measures the labour market climate, with an increase in initial jobless claims indicating rising unemployment. The previous reading was 227 thousand. The forecast for 19 February 2026 appears optimistic, suggesting a decline to 223 thousand. Although the change is not significant, a decrease in claims could still support the USD and put pressure on the EURUSD rate.

The Philadelphia Fed Manufacturing Index is an economic indicator that reflects the state of the manufacturing sector in the region. It is based on a survey of manufacturers regarding new orders, employment, inventories, and prices. A reading above zero signals expansion, while a figure below zero indicates contraction. This index influences market expectations regarding Federal Reserve interest rates and provides early signals about the condition of the US economy.

The Philadelphia Fed Manufacturing Index is calculated based on a monthly survey of manufacturers in eastern Pennsylvania, southern New Jersey, and Delaware. Respondents indicate whether conditions have improved, worsened, or remained unchanged compared to the previous month. A net diffusion index is then calculated by subtracting the percentage of negative responses from the percentage of positive ones.

Fundamental analysis for 19 February 2026 suggests the index may decline to 7.5 from the previous 12.6. Despite remaining above zero, a lower reading compared to the previous period could negatively affect the USD.

Technical outlook

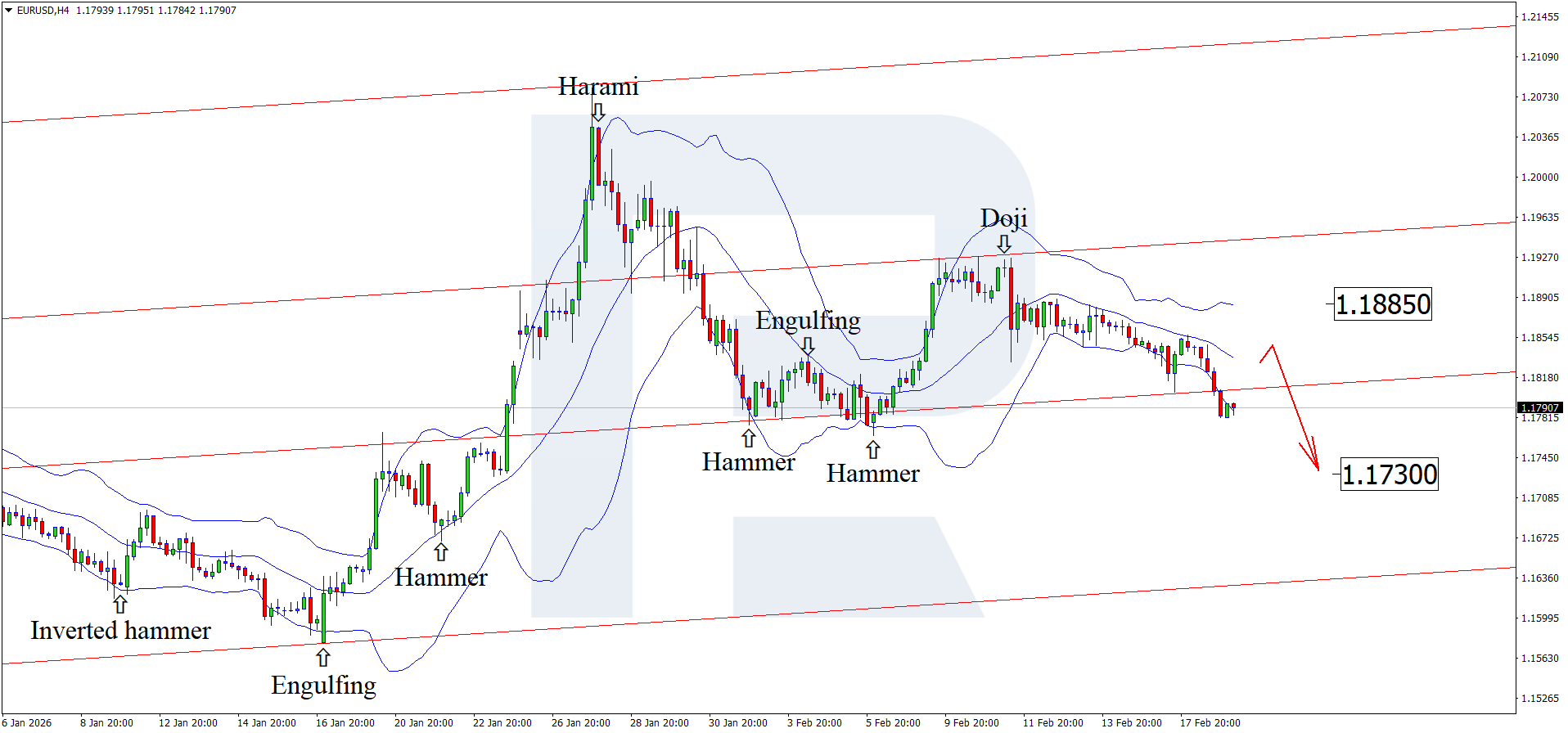

On the H4 chart, the EURUSD pair has formed a Doji reversal pattern near the upper Bollinger Band and continues its downward movement in line with the pattern signal. Since prices remain within an ascending channel, they may head towards 1.1750. A breakout below this level would open the way for a continued corrective move.

At the same time, today’s EURUSD forecast also considers an alternative scenario, in which the price rises towards 1.1885 before a decline.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: bearish

- Key resistance levels: 1.1885 and 1.2000

- Key support levels: 1.1730 and 1.1630

EURUSD trading scenarios for today

Main scenario (Sell Stop)

A breakout and consolidation below 1.1730 would open the door for a continued decline. The potential move is around 100 pips with a risk of about 25 pips, resulting in a risk-to-reward ratio of 1:4.

- Sell Stop: 1.1730

- Take Profit: 1.1630

- Stop Loss: 1.1755

Alternative scenario (Buy Limit)

A consolidation above 1.1885 would confirm strengthening buying pressure and open the way for a continuation of the uptrend, with the first target at 1.2000.

- Buy Limit: 1.1890

- Take Profit: 1.2000

- Stop Loss: 1.1850

Risk factors

Risk factors for the EURUSD decline include hawkish Fed rhetoric, strong US economic data, and an acceleration in the core PCE price index. An additional negative factor for sellers would be a breakout and consolidation above 1.1885.

Summary

Positive US economic data may bolster the USD, while technical analysis of EURUSD suggests a decline towards 1.1730 after a correction.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.