EURUSD weekly forecast: more reasons for growth

The EURUSD pair ended the week near 1.1700, reaching new October highs amid continued pressure on the U.S. dollar. The USD weakness followed the Fed’s December decision and more dovish-than-expected signals from Jerome Powell: a rate hike is off the table, and the Fed's projections still only suggest one cut in 2026. Additional pressure came from a rise in jobless claims and falling yields driven by the Fed’s purchases of short-term Treasury bills.

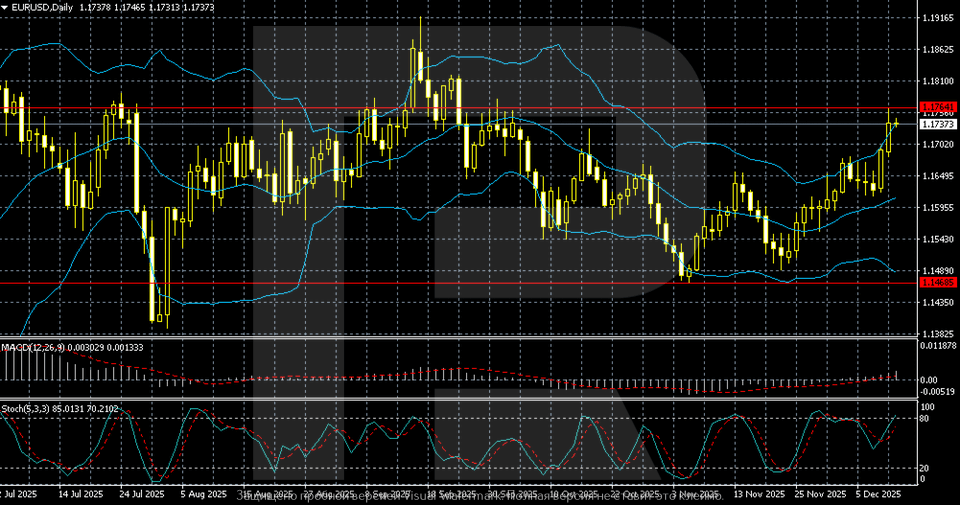

Despite the recovery, EURUSD remains within a broad range of 1.1485–1.1754, approaching the upper boundary. This outlook reviews the key factors likely to shape the pair’s dynamics during the week of 15–19 December 2025.

EURUSD forecast for this week: quick overview

- Market focus: EURUSD logged its third consecutive week of gains, holding near 1.1700 amid USD pressure. The expected Fed rate cut and Powell’s dovish tone accelerated dollar selling. The Fed signaled that a rate hike is not being considered, while purchases of short-term Treasuries pushed yields lower. The rise in jobless claims reinforced expectations of policy easing. Meanwhile, the euro is supported by a hawkish reassessment of rate expectations in Europe.

- Current trend: EURUSD is recovering from its November decline and trading in the 1.1730–1.1750 area, just below key resistance at 1.1754. The pair remains above the Bollinger midline, reflecting bullish momentum. MACD is stabilizing near the zero line, while Stochastic in overbought territory suggests a possible short-term pause.

- Weekly outlook: The base case is for consolidation within 1.1600–1.1754. A breakout above 1.1754 would open the way to 1.1850–1.1860. A break below 1.1600–1.1620 would increase the risk of a return to support at 1.1485.

EURUSD fundamental analysis

EURUSD posted a third straight week of gains amid persistent pressure on the U.S. dollar, holding near 1.1700 and setting new highs since October.

The dollar weakened after the Fed’s expected rate cut and Powell’s commentary, which was more dovish than markets had priced in. The Fed clarified that rate hikes are off the table, maintaining a forecast of only one cut in 2026. Additionally, the Fed's decision to begin purchasing short-term Treasury bills to support liquidity pushed yields lower.

U.S. macro data also supported the dovish outlook. Initial jobless claims rose at the fastest pace in over four and a half years, increasing expectations for further easing. Markets are now pricing in a more aggressive rate cut cycle in 2026 than what the Fed itself projects.

The external backdrop remains negative for the dollar. In contrast, Australia, Canada, and the eurozone are seeing a hawkish repricing of rate expectations, supporting the euro. As a result, the dollar declined broadly against major currencies, with EURUSD showing the strongest upward movement.

EURUSD technical analysis

On the daily chart, EURUSD continues its recovery from the November pullback. The price has returned to the 1.1730–1.1750 area, nearing the upper boundary of the current range and key resistance at 1.1754. The pair trades above the Bollinger midline, indicating growing buyer strength.

Bollinger Bands remain relatively wide, reflecting elevated volatility, but the price is still contained within the range that formed after the September peak. The upper band lies near 1.1850–1.1860, which could become the next market focus if 1.1754 is decisively breached.

Below, key support lies around 1.1485, where strong demand previously triggered a reversal. Closer support is at 1.1600–1.1620, near the lower half of the Bollinger Bands. A loss of this zone would increase the risk of a return to 1.1485 and a sideways consolidation.

MACD is near the zero line and attempting to turn upward, suggesting a gradual recovery in momentum, though not yet accelerating. Stochastic remains in overbought territory, signaling a short-term pause or pullback risk after recent gains.

Overall, the structure remains neutral-to-bullish: EURUSD is recovering within the broad 1.1485–1.1754 range, and the next direction will depend on how price behaves near the top of this range. A breakout above 1.1754 would confirm the continuation of the uptrend, while a dip below 1.1600 would increase the chance of a return to the lower range.

EURUSD trading scenarios

EURUSD logged its third straight week of gains, holding near 1.1700 and marking new highs since October. USD pressure intensified after the Fed’s rate cut and dovish commentary from Powell. The central bank ruled out hikes and reiterated only one rate cut in 2026. The decision to purchase short-term Treasuries further lowered yields. A surge in jobless claims supported easing expectations. Meanwhile, hawkish repricing in Europe and other developed markets supported the euro.

The technical setup remains moderately bullish. EURUSD is trading in the 1.1730–1.1750 area, approaching key resistance at 1.1754. Price holds above the Bollinger midline. MACD is steady near the zero line, while Stochastic in overbought territory signals the risk of a short-term pause.

- Buy scenario

Longs are appropriate if the price holds above 1.1600–1.1620.

A breakout above 1.1754 would open the way to 1.1850–1.1860.

Stop-loss: below 1.1580.

- Sell scenario

Shorts are viable if the price drops below 1.1600.

Targets: 1.1485–1.1400.

Stop-loss: above 1.1700.

Conclusion: The base case is for consolidation in the 1.1600–1.1754 range.

A breakout above the upper boundary would confirm the uptrend continuation, while a loss of support would increase correction risk.

Summary

EURUSD is expected to maintain a moderately bullish tone during 15–19 December 2025. The U.S. dollar remains under pressure following the Fed’s December decision and Powell’s unexpectedly dovish stance. The Fed ruled out rate hikes and maintained only one projected cut for 2026, while markets are pricing in deeper easing. Additional bearish factors for the dollar include the Fed’s purchase of short-term Treasuries and rising jobless claims.

Technically, the pair is trading in the upper part of the 1.1600–1.1754 range, holding above the Bollinger midline. MACD is flat near zero, and Stochastic remains in overbought territory — limiting the potential for sharp gains and raising the likelihood of a short-term pause.

The base scenario is for consolidation within 1.1600–1.1754.

A confirmed breakout above 1.1754 would open the way to 1.1850–1.1860.

A break below 1.1600 would increase the risk of a deeper pullback toward 1.1485 and a return to a sideways trend.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.