EURUSD weekly forecast: more reasons for growth are emerging

The EURUSD pair ended the week near 1.1720, setting new November highs amid continued pressure on the U.S. dollar. The USD weakness followed the Fed’s December decision to cut interest rates and Fed Chair Jerome Powell’s dovish signals — with rate hikes ruled out and the regulator still forecasting only one rate cut in 2026. Additional factors included a rise in jobless claims and falling yields due to the Fed’s purchases of short-term Treasury bills.

Despite the recovery, EURUSD remains within the broad range of 1.1485–1.1800, now nearing the upper boundary. In this analysis, we highlight the key factors expected to drive the pair’s dynamics during the week of 22–26 December 2025.

EURUSD forecast for this week: quick overview

- Market focus: EURUSD has posted its third consecutive weekly gain and remains near 1.1700 under continued pressure on the U.S. dollar. The latest Fed rate cut and Jerome Powell’s dovish stance fueled USD selling. The Fed clearly ruled out rate hikes, and the ongoing Treasury bill purchases lowered yields. Rising jobless claims reinforced expectations for further policy easing. Meanwhile, the euro is supported by a hawkish repricing of expectations in Europe.

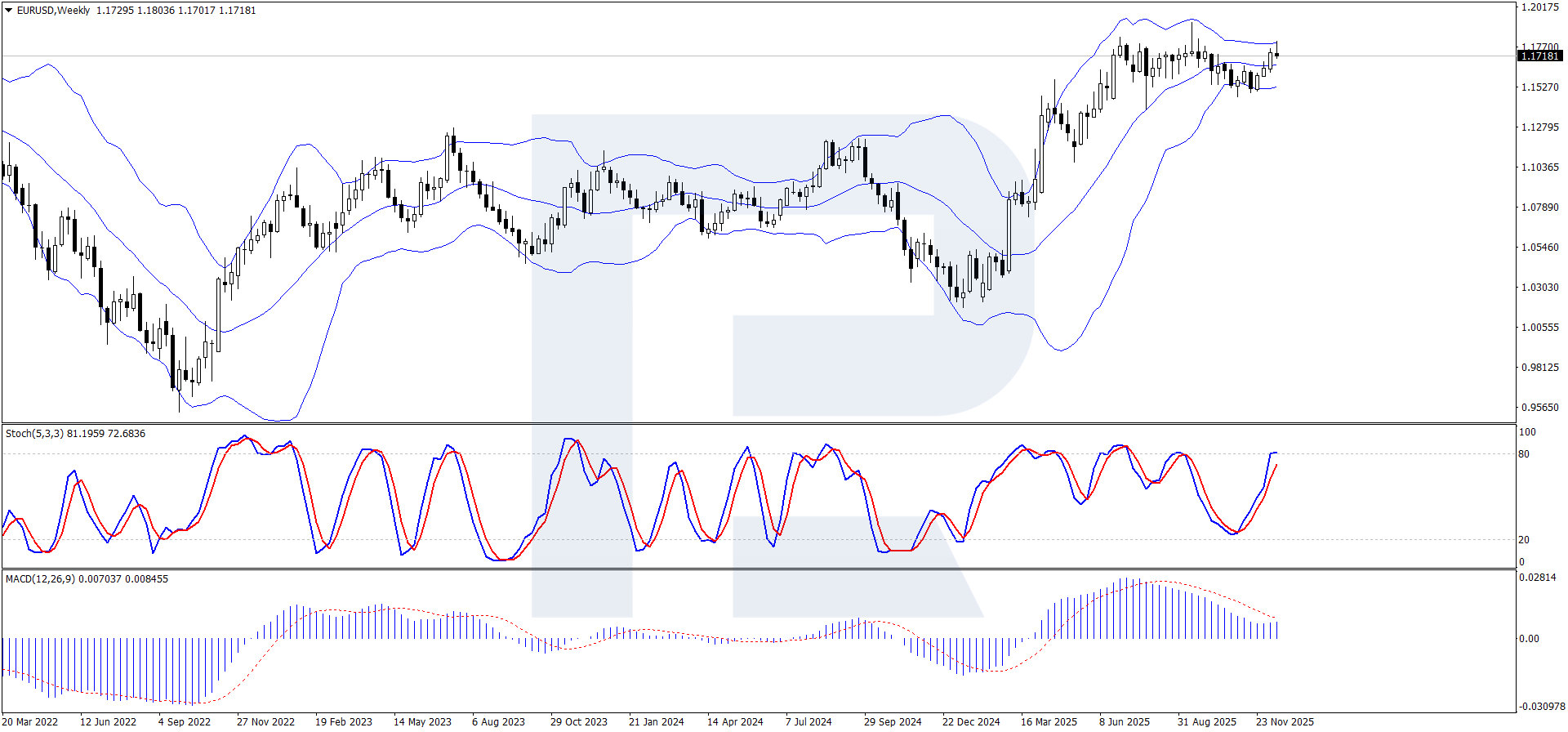

- Current trend: EURUSD is undergoing a correction after recent gains, trading in the 1.1700–1.1750 zone, close to key resistance at 1.1754. The price is testing the lower Bollinger Band, which may signal the end of the correction. MACD remains above the zero line, while Stochastic is moving into oversold territory, suggesting a likely resumption of the uptrend.

- Weekly outlook: The base scenario is a consolidation between 1.1650 and 1.1754. A breakout above 1.1754 opens the path to 1.1850–1.1860. A break below 1.1650–1.1620 increases the risk of a return to support at 1.1485.

EURUSD fundamental analysis

EURUSD has risen for a third straight week under sustained pressure on the U.S. dollar. The pair remains near 1.1700, reaching new highs not seen since October.

The dollar’s decline came after the Fed’s expected rate cut and softer-than-expected commentary from Jerome Powell. The Fed made it clear that rate hikes are not under consideration, and its forecast still implies only one rate cut in 2026. Additional pressure on the USD came from the Fed’s decision to start buying short-term Treasury bills to support liquidity — a move that pushed yields lower.

Macroeconomic data also supported the dovish narrative. Initial jobless claims in the U.S. rose at the fastest pace in nearly four and a half years, reinforcing expectations of future monetary easing. At the same time, markets are pricing in a more aggressive rate cut path in 2026 than the Fed currently projects.

Externally, conditions remain unfavorable for the dollar. In contrast, Australia, Canada, and Europe are seeing a hawkish repricing of rate expectations, lending support to the euro. As a result, the dollar is weakening against most major currencies — most notably in the EURUSD pair.

EURUSD technical analysis

On the daily chart, EURUSD is forming a correction following its recent rally. The price has returned to the 1.1700–1.1750 range after bouncing off resistance at 1.1754. The pair is trading near the lower Bollinger Band, indicating potential for renewed buying interest.

The Bollinger Bands remain relatively wide, reflecting elevated volatility, though the price is still within the range formed after the December peak. The upper band lies near 1.1750–1.1770, which may become the next target if the price decisively breaks above 1.1754 and holds.

To the downside, key support is found at 1.1485 — a previous reversal zone marked by strong demand. Closer support lies at 1.1500–1.1520, aligned with the lower Bollinger Band. A break below this level would increase the risk of a pullback to 1.1485 and the return of a sideways scenario.

MACD is hovering near the zero line, indicating a correction without strong bearish momentum. The Stochastic oscillator remains in overbought territory, suggesting a potential pause or the nearing end of the correction phase.

Overall, the structure remains neutral-to-bullish: EURUSD is recovering within the broad 1.1485–1.1754 range. The next direction will depend on how the price reacts to the upper boundary. A breakout above 1.1754 would confirm further upside, while a drop below 1.1600 would raise the likelihood of a return to lower range levels.

EURUSD trading scenarios

The EURUSD pair has posted its third consecutive weekly gain and holds near 1.1700, setting new highs for November. The dollar’s weakness intensified after the Fed’s rate cut and Powell’s dovish remarks. The Fed ruled out future rate hikes and maintained its projection of only one rate cut in 2026. The central bank’s Treasury bill purchases and the rise in jobless claims further reinforced expectations of looser policy. Meanwhile, the euro is supported by hawkish repricing in Europe and other advanced economies.

The technical outlook remains moderately bullish. EURUSD is trading in the 1.1700–1.1750 zone, nearing key resistance at 1.1754. The price is holding near the upper Bollinger Band. MACD is stabilizing above the zero line, and the Stochastic oscillator is in overbought territory, suggesting the possibility of a short-term pause.

- Buy scenario

Longs are viable while the price holds above 1.1700–1.1754.

A breakout above 1.1754 opens the way toward 1.1850–1.1860.

Stop-loss: below 1.1580.

- Sell scenario

Shorts become relevant if the price breaks below 1.1600.

Targets: 1.1485 → 1.1400.

Stop-loss: above 1.1700.

Conclusion: The base case is consolidation between 1.1600 and 1.1754. A breakout above the upper boundary would confirm continued growth, while a loss of support would signal a deeper correction.

Summary

During 22–26 December 2025, EURUSD is expected to maintain a moderately bullish tone. The dollar remains under pressure following the Fed’s December rate cut and Powell’s softer-than-expected guidance. The Fed ruled out rate hikes and confirmed only one cut in 2026, while markets price in a more aggressive easing trajectory. Additional pressure on the USD stems from the start of Treasury bill purchases and rising jobless claims.

Technically, the market is in a near-sideways phase with a bullish bias. The pair is trading near the top of the 1.1600–1.1754 range, holding near the upper Bollinger Band. MACD is stabilizing above zero, and the Stochastic remains in overbought territory, indicating further upside potential.

The base scenario is continued consolidation between 1.1600 and 1.1754. A breakout above 1.1754 would open the way to 1.1850–1.1860. A drop below 1.1600 increases the risk of a correction toward 1.1485 and a return to sideways movement.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.