EURUSD weekly forecast: Euro continues to strengthen

The EURUSD pair ended the week near 1.1780, updating December highs amid ongoing pressure on the US dollar. The USD weakening followed the Fed's December decision to cut interest rates and dovish signals from Jerome Powell that were softer than the market expected: the regulator ruled out rate hikes and still projects only one cut in 2026. Additional pressure came from a rise in jobless claims and the Christmas holidays.

Despite the rebound, EURUSD remains within the wide range of 1.1485–1.1800, trading near its upper boundary. This forecast reviews the key factors that will shape the pair’s dynamics during the week of 29 December 2025–2 January 2026.

EURUSD forecast for this week: quick overview

- Market focus: EURUSD has completed its fourth consecutive weekly gain and holds near 1.1780 amid pressure on the US dollar. The Fed’s rate cut and Jerome Powell’s dovish signals increased USD selling. The regulator made it clear that rate hikes are not under consideration, and short-term Treasury bill purchases lowered yields. The rise in US jobless claims strengthened expectations for further easing. In the external environment, the euro is supported by a hawkish repricing of expectations in Europe.

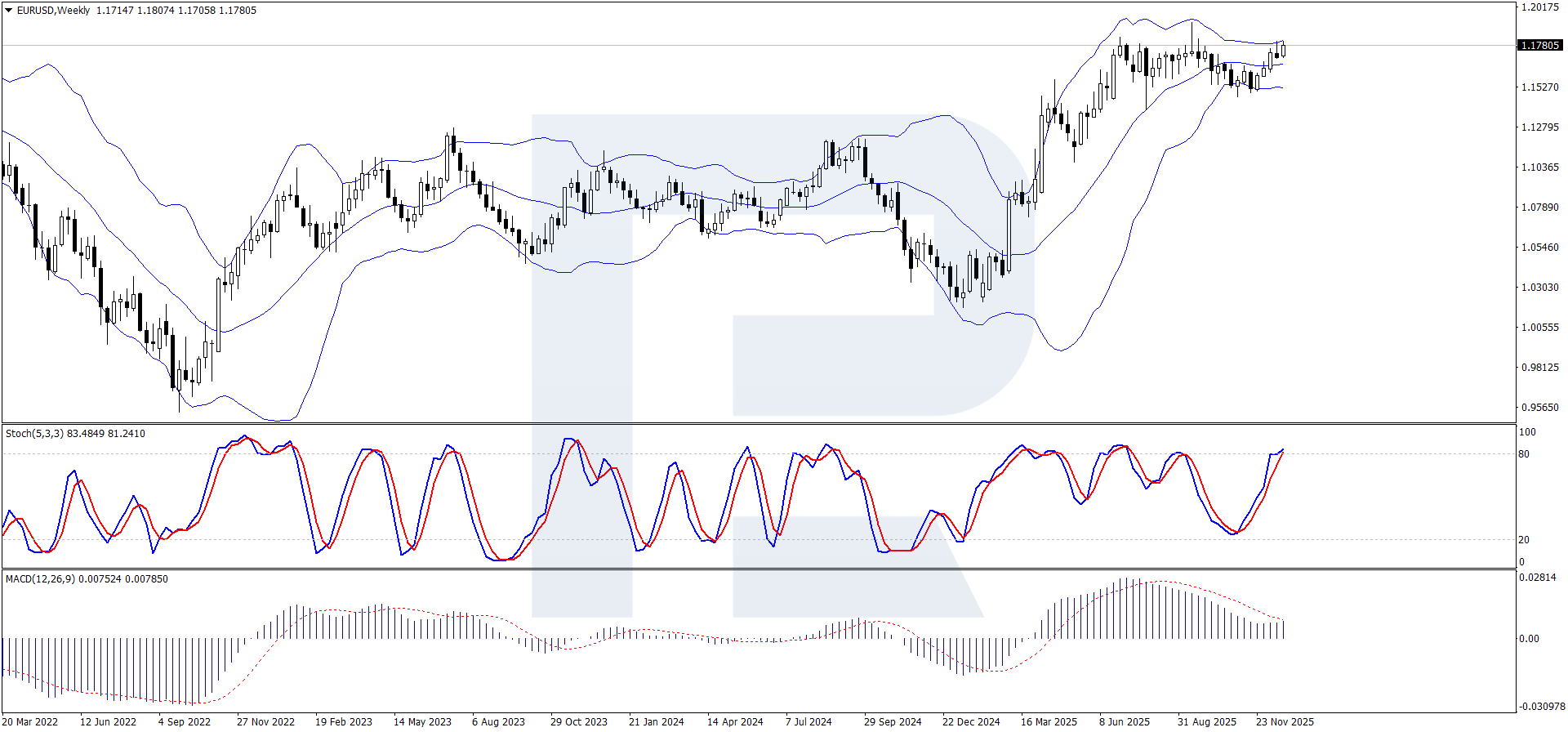

- Current trend: EURUSD is correcting after recent gains and trades in the 1.1770–1.1800 zone. The price is testing the upper Bollinger Band, which may indicate a possible correction. MACD continues to move above the zero line, while Stochastic moves into the overbought zone, pointing to a potential continuation of the uptrend.

- Weekly outlook: The base scenario is consolidation within the 1.1740–1.1810 range. A breakout above 1.1810 opens the way to 1.1850–1.1860. A break below 1.1650–1.1620 increases the risk of a return to support at 1.1485.

EURUSD fundamental analysis

EURUSD has posted a fourth consecutive weekly gain amid sustained pressure on the US dollar. The pair holds near 1.1780, setting new highs for December.

The dollar weakened after the Fed’s expected rate cut and dovish signals from Jerome Powell, softer than what markets had priced in. The Fed ruled out rate hikes, and its projections still include only one cut next year. Additional pressure on the dollar came from the Fed’s decision to begin purchasing short-term Treasury bills to support liquidity, which led to lower yields.

Macroeconomic data also favoured the dovish scenario. The rise in US unemployment is increasing expectations for future monetary easing. At the same time, markets are pricing in a more aggressive rate-cut path for 2026 than the Fed currently projects.

The external backdrop remains unfavourable for the dollar. By contrast, Australia, Canada and Europe are experiencing a hawkish repricing of expectations, supporting the euro. As a result, the dollar declined against most major currencies, including the EUR.

EURUSD technical analysis

On the daily chart, EURUSD is correcting after recent gains. The price has returned to the 1.1770–1.1800 zone after bouncing off resistance at 1.1800. The pair is moving toward the middle Bollinger Band, signalling a possible increase in buying activity.

The Bollinger Bands remain relatively wide, reflecting high volatility, though the price still trades within the range formed after the December peak. The upper band lies near 1.1810–1.1820, which could become the market's focus if the price confidently breaks above 1.1800 and holds.

Below, key support sits around 1.1485 — a zone where strong demand previously emerged, triggering a reversal. Closer support lies at 1.1700–1.1720, aligned with the lower Bollinger Band. Losing this zone would increase the risk of a return to 1.1485 and resumption of the sideways scenario.

MACD remains above the zero line, indicating a possible correction but without strong bearish momentum. Stochastic is declining from overbought levels, signalling a risk of a short-term pause or an end to the correction phase.

Overall, the structure remains neutral-bullish: EURUSD is recovering within the broad 1.1700–1.1810 range, and the next direction depends on the price’s reaction to the upper boundary. A breakout above 1.1800 confirms continued growth, while a drop below 1.1600 increases the likelihood of a return to the lower end of the range.

EURUSD trading scenarios

EURUSD has posted its third straight weekly gain and holds near 1.1780, setting new highs for December. Pressure on the dollar intensified after the Fed’s rate cut and Jerome Powell’s dovish commentary. The regulator ruled out future rate hikes and confirmed just one projected cut next year. An additional factor was the Fed’s move to start purchasing short-term Treasury bills, lowering yields. Rising unemployment further supported expectations for monetary easing. The euro is also supported by hawkish repricing in Europe and other developed economies.

The technical picture remains moderately bullish. EURUSD trades in the 1.1750–1.1810 zone, approaching key resistance at 1.1810. The price holds near the upper Bollinger Band. MACD is above the zero line, while Stochastic is falling from overbought territory, indicating the risk of a short-term pause.

- Buy scenario

Long positions are appropriate if the pair holds above 1.1810–1.1820.

A breakout above 1.1820 opens the path to 1.1850–1.1860.

Stop-loss: below 1.1770.

- Sell scenario

Short positions are relevant on a break below 1.1600, targeting 1.1485 → 1.1400.

Stop-loss: above 1.1700.

Conclusion: The base scenario is consolidation in the 1.1750–1.1810 range. A breakout above the upper boundary confirms continued growth, while loss of support increases the risk of a correction.

Summary

During 29 December 2025–2 January 2026, EURUSD is expected to maintain a moderately bullish tone. Pressure on the dollar remains steady following the Fed’s December rate cut and Jerome Powell’s dovish signals, which were softer than market expectations. The Fed ruled out rate hikes and confirmed only one cut in 2026. Markets are pricing in a more substantial easing path. Additional weakness in the USD stems from the Fed’s purchases of short-term Treasury bills and rising unemployment.

Technically, the structure leans sideways with an upward bias. The pair trades near the upper part of the 1.1760–1.1810 range, holding close to the upper Bollinger Band. MACD is moving above the zero line, and Stochastic is declining from overbought territory — all of which increase the potential for further upside after correction.

The base scenario is consolidation between 1.1800 and 1.1820. A firm hold above 1.1820 opens the way to 1.1850–1.1860. A drop below 1.1700 increases the risk of a correction toward 1.1485 and a return to sideways dynamics.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.