EURUSD weekly forecast: focus on Fed rate and geopolitics

The EURUSD rate is expected to maintain a neutral-to-moderately bullish tone during the week of 26–30 January. Pressure on the US dollar had previously eased amid geopolitical uncertainty related to the Trump administration's rhetoric regarding Greenland and reduced confidence in dollar-denominated assets. Markets expect the Fed to hold rates steady at its 28 January meeting, with no immediate signs of easing.

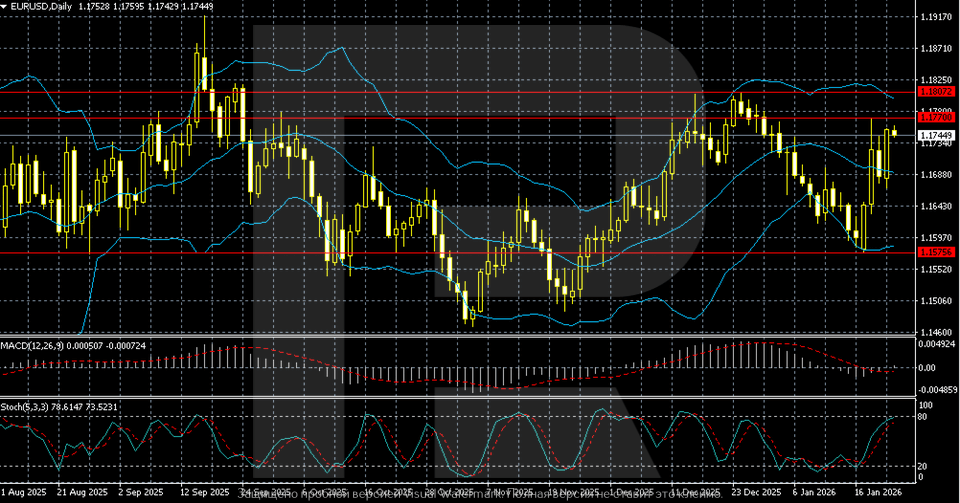

From a technical perspective, the EURUSD pair remains in a sideways range of 1.1575–1.1800, currently trading near the upper boundary around 1.1740–1.1760. Consolidation above 1.1800 would reinforce the bullish scenario, while a breakout below the support level would restore pressure and increase the likelihood of a deeper correction.

EURUSD forecast for this week: quick overview

- Market focus: the EURUSD pair has gained steadily over the week and is hovering near 1.1740–1.1760. Pressure on the dollar intensified due to geopolitical uncertainty surrounding Greenland-related initiatives from the Trump administration. Additional downside pressure came from concerns that Europe might use its large holdings of US assets as leverage. US PCE inflation data came in line with expectations, leaving forecasts for Fed policy unchanged ahead of its 28 January meeting

- Current trend: on the daily chart, the EURUSD rate remains in a broad sideways range between 1.1575 and 1.1800 with a moderately bullish tilt. The price is trading closer to the upper boundary. Bollinger Bands are flattening, indicating a consolidation phase. MACD is hovering near the zero line, and the Stochastic Oscillator is in overbought territory, increasing the risk of a short-term pause or pullback

- Weekly outlook: the baseline scenario is consolidation within the 1.1650–1.1800 range. A breakout and consolidation above 1.1800–1.1825 would strengthen the bullish outlook. Conversely, a drop below 1.1575–1.1600 would increase the risk of a deeper correction

EURUSD fundamental analysis

The EURUSD pair advanced over the past week. Volatility increased due to geopolitical manoeuvring from the Trump administration regarding Greenland. Early in the week, Washington threatened several European countries with tariffs, but the tone was later softened after a framework agreement with NATO on possible future cooperation. The lack of clarity around the deal details keeps markets on edge. Additional pressure on the dollar came from concerns that Europe might use its large US asset holdings as leverage in trade talks. A Danish pension fund has already announced it will divest from US Treasuries.

The US macroeconomic backdrop remained neutral. Personal Consumption Expenditures (PCE) inflation for November matched expectations, coming in at +0.2% m/m and +2.8% y/y, with the core PCE price index also remaining at 2.8% y/y. This confirmed a scenario of slowing but steady inflation, leaving Fed policy expectations unchanged. The Fed is widely expected to hold rates steady at its upcoming 28 January meeting.

Against this backdrop, the US dollar weakened mainly against the euro and currencies from the commodity and Pacific blocs, reflecting diminished confidence in dollar assets and capital reallocation amid heightened political uncertainty.

EURUSD technical analysis

On the daily timeframe, the EURUSD pair is trading in a broad sideways range between 1.1575 and 1.1800 following volatile moves at the end of 2025. Quotes are currently in the 1.1740–1.1760 area, near the upper boundary of the range. Bollinger Bands are flattening, and the price is hovering near the midline, signalling consolidation without a clear trend.

The key resistance level remains at 1.1800–1.1825, where selling pressure previously increased. The support level lies in the 1.1575–1.1600 area, from which the market has repeatedly bounced. As long as this range holds, the market remains neutral with a slight bullish bias.

Indicators support a stabilisation phase: MACD is near the zero line, indicating fading momentum, and the Stochastic Oscillator is in overbought territory, increasing the risk of a short-term correction or sideways pause. A breakout above 1.1800 would strengthen the bullish scenario, while a drop below 1.1575 could open the door to a deeper correction.

EURUSD trading scenarios

The EURUSD pair has gained over the week and is hovering near 1.1740–1.1760. Volatility was driven by geopolitical steps from the Trump administration related to Greenland. The softening of rhetoric following the NATO framework agreement partially eased tensions, but uncertainty remains. Additional pressure on the dollar came from fears that Europe could use US asset holdings as leverage. US macroeconomic data was neutral, with PCE inflation aligning with expectations and leaving the Federal Reserve’s policy outlook unchanged for its 28 January meeting.

The technical picture is neutral with a moderately bullish bias. The EURUSD pair is trading within the 1.1575–1.1800 range, near its upper boundary. Bollinger Bands are flattening, MACD is at the zero line, and the Stochastic Oscillator is in overbought territory, increasing the risk of a short-term pause.

- Buy scenario

A breakout and consolidation above 1.1800–1.1825 would open the path to 1.1850.

- Sell scenario

A drop and hold below 1.1575–1.1600 would increase the risk of a decline to 1.1450–1.1500.

Conclusion: the base case is consolidation within the range with a moderately bullish tilt.

Summary

The EURUSD pair has strengthened over the week and is holding near 1.1740–1.1760 as the US dollar weakened. Pressure on the dollar intensified due to geopolitical uncertainty surrounding the Trump administration’s Greenland initiatives. Despite the softening of rhetoric following a framework agreement with NATO, markets remain cautious. The US macroeconomic backdrop remained neutral: PCE inflation data matched expectations and did not alter the Federal Reserve’s policy outlook. The Fed is expected to keep the rate unchanged on 28 January.

From a technical perspective, the EURUSD pair remains in a broad sideways range between 1.1575 and 1.1800. Quotes are currently near the upper boundary, but there are no signs of a sustainable trend yet. Unless the pair breaks and consolidates above 1.1800–1.1825, the market remains neutral with a risk of a corrective pause. A loss of support at 1.1575–1.1600 would shift risks back towards the downside.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.