EURUSD weekly forecast: moderately bullish sentiment remains intact

The EURUSD pair is expected to maintain a moderately bullish bias during the week of 2–6 February following a strong rally at the end of January. The US dollar remains under strong pressure due to geopolitical tensions and uncertainty over the economic policies of the Trump administration, as well as the Fed's January decision to keep rates in the 3.50–3.75% range.

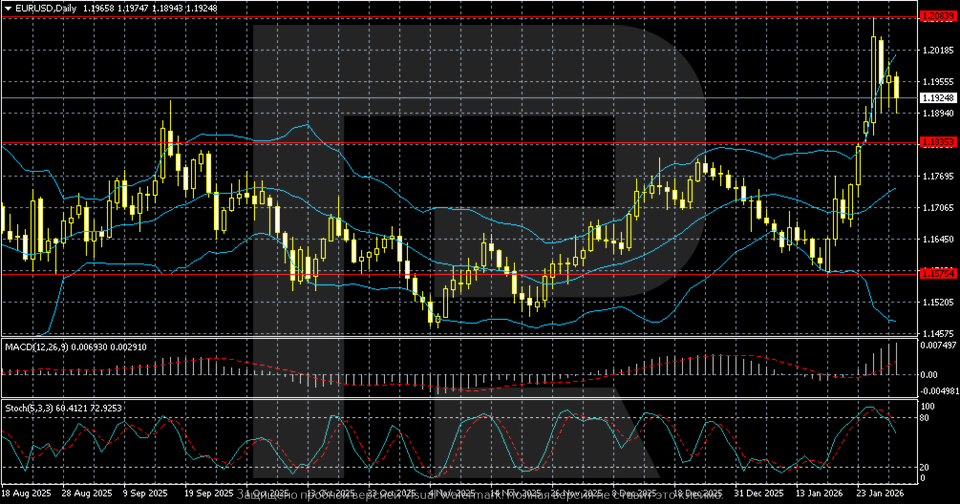

From a technical perspective, the EURUSD pair is hovering above the 1.1850–1.1900 zone, which supports the bullish scenario, while a drop below this area would increase the risk of a correction towards 1.1700–1.1650.

EURUSD forecast for this week: quick overview

- Market focus: the EURUSD pair closed the week at 1.1924, near multi-month highs. The dollar remained under pressure due to geopolitical tensions and uncertainty surrounding US economic policy. US tariff threats and escalation risks with Iran added to market nervousness. The Fed kept rates at 3.50–3.75%, and division within the Committee, coupled with dovish inflation rhetoric, strengthened expectations for policy easing later this year. Treasury Secretary Scott Bessent's statements and the agreement to avoid a government shutdown provided somesupport for the dollar at the end of the week

- Current trend: on the daily chart, the EURUSD pair remains in an upward phase after breaking out of the 1.16–1.18 range. The correction from the 1.2050–1.2100 zone appears technical, with the price staying above 1.1850–1.1900. The market structure remains bullish. MACD is in positive territory, while the Stochastic Oscillator indicates a short-term pause

- Weekly outlook: the baseline scenario is consolidation above 1.1850 with potential for renewed growth. A breakout below this zone would increase the risk of a pullback towards 1.1700–1.1650

EURUSD fundamental analysis

The EURUSD pair closed the week at 1.1924. The US dollar remained under pressure amid growing geopolitical tensions and uncertainty around US economic policy. President Donald Trump signalled potential tariffs on countries exporting oil to Cuba and warned Iran of possible military action should it withdraw from the nuclear agreement. These statements heightened market nervousness and reduced the dollar’s appeal as a safe-haven asset.

Additional uncertainty arose from Trump's remarks about naming a new Fed chair, following prolonged pressure on the central bank to aggressively cut rates.

In January 2026, the Federal Reserve held rates steady at 3.50–3.75%, as expected. However, division within the FOMC and softer inflation commentary bolstered market expectations for rate cuts later this year.

Last week, the dollar hit a near four-year low after Trump implied support for a weaker currency. It was later bolstered by Treasury Secretary Scott Bessent, who reiterated the commitment to a strong dollar policy. A preliminary agreement between the White House and Senate Democrats to avoid a government shutdown also helped stabilise the greenback.

EURUSD technical analysis

On the daily timeframe, the EURUSD pair formed a strong bullish momentum following a prolonged sideways range. The pair decisively broke above the 1.16–1.18 range and accelerated towards the 1.20–1.21 zone, reaching multi-month highs. The breakout above 1.1850 was a key trigger for the rally, accompanied by a widening of Bollinger Bands, signalling a transition to a momentum phase.

After reaching the 1.2050–1.2100 region, the pair entered a correction phase. This pullback appears technical, with the price retreating from the upper Bollinger Band and holding above the broken resistance zone at 1.1850–1.1900, which now serves as support. The market structure remains bullish, with higher highs and lows still forming.

MACD is in positive territory, maintaining a bullish configuration, although the growth rate is slowing, indicating deceleration in momentum following the sharp move.

The Stochastic Oscillator has turned down from overbought territory, signalling a short-term pause or continued correction, but without signs of a trend reversal.

Overall, the outlook remains bullish. As long as the pair stays above 1.1850, the baseline scenario suggests stabilisation with potential for resumed growth after a correction. A deeper drop below this area would increase the risk of a broader pullback towards 1.1700–1.1650.

EURUSD trading scenarios

The EURUSD pair ended the week higher, consolidating at 1.1924. The US dollar remained under pressure amid geopolitical tensions and economic policy uncertainty in Washington. President Trump’s tariff-related statements and the risk of escalation around Iran heightened market jitters. The Fed kept rates unchanged at 3.50–3.75%, with internal divisions and dovish inflation commentary raising expectations for future easing later this year. Some late-week support for the dollar came from Treasury Secretary Bessent’s remarks and a shutdown-averting agreement.

Technically, the picture remains bullish. The EURUSD pair broke out of the 1.16–1.18 range, transitioning into a momentum rally towards 1.20–1.21. The current correction from 1.2050–1.2100 appears technical, with the price holding above 1.1850–1.1900. The overall market structure remains upward.

- Buy scenario

As long as the price holds above 1.1850, the potential for renewed growth remains intact.

- Sell scenario

A breakout and consolidation below 1.1850 would increase the risk of a correction towards 1.1700–1.1650.

Conclusion: the base case is consolidation following a momentum rally, with the bullish bias preserved.

Summary

The EURUSD pair is hovering near 1.1924 amid ongoing US dollar weakness. The dollar is under pressure from geopolitical tensions and uncertainty surrounding the Trump administration’s economic policy, including tariff threats and Iran escalation risks. In January 2026, the Fed left rates unchanged at 3.50–3.75%, while internal FOMC divisions and dovish inflation remarks supported expectations of easing later in the year.

From a technical perspective, the EURUSD pair maintains a bullish tone after breaking out of the 1.16–1.18 range. The correction from 1.2050–1.2100 is seen as technical, with the price hovering above 1.1850–1.1900, preserving the potential for stabilisation and renewed gains. A move below this area would increase the risk of a deeper correction.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.