EURUSD weekly forecast: consolidation mode reactivated

The EURUSD pair will likely trade in consolidation mode during the week of 9–13 February after sliding to two-week lows. The US dollar will be supported by investors moving away from risk assets and by the political factor surrounding the Federal Reserve following the nomination of Kevin Warsh. Labour market data indicates a gradual cooling, keeping expectations for Fed rate cuts later this year intact. The ECB remains on hold.

From a technical perspective, the EURUSD pair is in a correction phase within a medium-term uptrend. Consolidation in the 1.1760–1.1800 zone looks like a stabilisation phase. Holding this area will preserve the potential for recovery, while a breakout below the support level would increase the risk of a deeper correction towards 1.1580–1.1600.

EURUSD forecast for this week: quick overview

- Market focus: the EURUSD pair ended the first week of February near two-week lows around 1.1760–1.1800. The dollar was supported by a broad exit from risk assets and higher demand for the USD as a safe-haven asset. An additional factor was US President Donald Trump’s nomination of Kevin Warsh as Federal Reserve chairman, which markets interpreted as a signal in favour of a more hawkish and disciplined policy stance. US macroeconomic data was mixed, with rising jobless claims fuelling expectations for Fed cuts later this year, despite the stronger dollar. The ECB predictably kept rates unchanged and reiterated that further decisions will remain data-driven

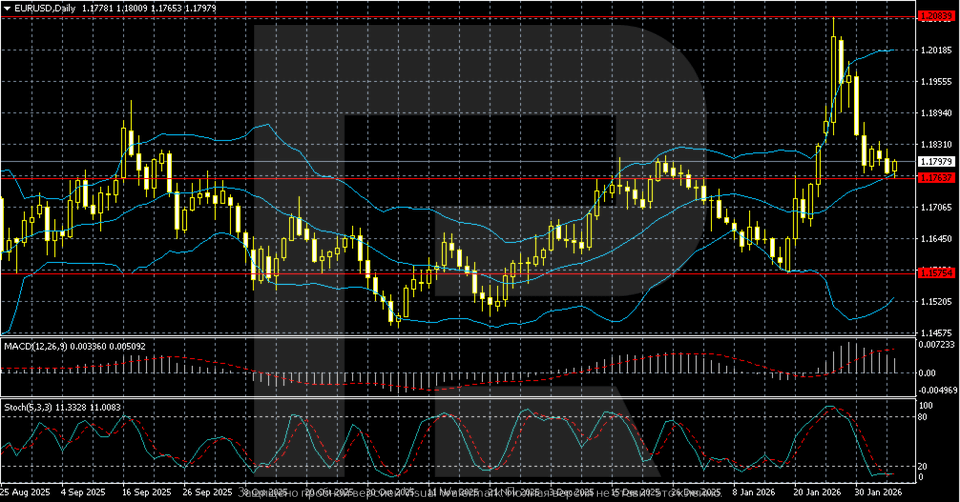

- Current trend: on the daily chart, the EURUSD pair maintains a medium-term uptrend that started in November. January’s momentum rally to 1.20–1.2050 has shifted into a correction, with the price consolidating in the 1.1760–1.1800 zone near the middle Bollinger Band. Volatility is declining. MACD remains in positive territory, while the Stochastic Oscillator points to a correction pause without reversal signals

- Weekly outlook: The base case is consolidation in the 1.1760–1.1800 range with potential for trend resumption if the support level holds. A breakout below 1.1760 would increase the risk of a deeper correction towards 1.1580–1.1600

EURUSD fundamental analysis

The EURUSD pair finished the first week of February near two-week lows. The USD was supported by a broad rotation out of risk assets, including equities, commodities, and cryptocurrencies, which boosted demand for the dollar as a safe-haven currency. Another factor was US President Donald Trump’s nomination of Kevin Warsh as Federal Reserve chairman. Markets viewed this nomination as a signal in favour of a more hawkish and disciplined monetary policy, with an emphasis on balance sheet reduction and a cautious approach to rate cuts. This also eased concerns about the Federal Reserve’s independence.

The US macroeconomic backdrop was mixed during the week. Labour-market data pointed to a gradual cooling. Initial jobless claims rose to 231 thousand, above the expected 212 thousand, while continuing claims came in at 1.844 million versus the 1.850 million forecast. These signals supported expectations for Fed rate cuts later this year. Markets are still pricing two cuts – in June and likely in September – despite the stronger dollar.

The ECB kept rates unchanged as expected. The main rate was maintained at 2.15%, the deposit facility at 2.0%, and the marginal lending facility at 2.4%. The regulator reiterated that further decisions will depend on incoming data, while markets increasingly lean towards an extended pause without rate cuts.

Overall, the weekly picture for the dollar remains positive. The combination of safe-haven demand, political factors surrounding the Federal Reserve, and relatively stable monetary-policy expectations supports the USD, despite signs of a slowdown in the US economy.

EURUSD technical analysis

The pair has remained in a medium-term uptrend since November. In January, the EURUSD pair posted a sharp momentum rally and reached the 1.20–1.2050 area, followed by a correction.

The price has now pulled back and is consolidating near 1.1760–1.1800, a key support zone that previously acted as resistance. Quotes are holding around the middle Bollinger Band, signalling a stabilisation phase after a strong move. The bands are starting to narrow, indicating declining volatility. MACD remains in positive territory, and the histogram is rising, with the medium-term bullish momentum intact. The Stochastic Oscillator has exited overbought territory and is moving lower, reflecting a corrective pause but without signs of a trend reversal.

The overall picture shows a correction within an uptrend. Holding the 1.1760 support level preserves the potential for renewed growth, while a breakout below it would increase the risk of a deeper correction towards 1.1580–1.1600.

EURUSD trading scenarios

The EURUSD pair ended the first week of February near two-week lows amid a stronger US dollar. Demand for the USD rose due to investors leaving risk assets and after Donald Trump nominated Kevin Warsh as Federal Reserve chairman. The market interpreted the move as a signal in favour of a more hawkish and disciplined policy stance. The US macroeconomic backdrop was mixed. Higher jobless claims indicated a cooling labour market and supported expectations for Fed rate cuts later this year. The ECB predictably held rates steady and reiterated that further decisions will be data-driven.

Technically, the EURUSD pair remains in a correction phase within an uptrend. Following the January rally towards 1.2000–1.2050, the pair is consolidating in the 1.1760–1.1800 zone, a key support area. The price is holding near the middle Bollinger Band, and volatility is falling. MACD remains in positive territory, while the Stochastic Oscillator confirms a pause without reversal signals.

- Buy scenario

Holding the 1.1760 level keeps the potential for stabilisation and renewed growth.

- Sell scenario

A breakout below 1.1760 would increase the risk of a deeper correction towards 1.1580–1.1600.

Conclusion: the base case is consolidation at the support level within the broader uptrend.

Summary

The EURUSD pair ended the week at two-week lows near 1.1760–1.1800 amid US dollar strength. Demand for the USD increased due to investors’ retreat from risk assets and after Trump nominated Warsh as Fed chair. US labour market data indicated a gradual cooling, keeping expectations for Fed cuts later this year intact. The ECB predictably left rates unchanged.

From a technical perspective, the EURUSD pair remains in a correction phase within an uptrend. After the January rally towards 1.2000–1.2050, the pair is consolidating in the 1.1760–1.1800 zone, a key support area. Holding this area preserves the potential for stabilisation and renewed growth, while a breakout would increase the risk of a deeper correction towards 1.1580–1.1600.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.