EURUSD: the euro continues to correct but is poised for further growth

Economic forecasts for the European Union could support the euro, with the speech by FOMC member Michelle Bowman likely to shed light on the Federal Reserve interest rates. Find out more in our analysis for 10 September 2024.

EURUSD forecast: key trading points

- Germany’s consumer price index (CPI) (m/m): previously at 0.3%, projected at -0.1%, the actual reading aligned with expectations

- Economic outlook for the European Union

- A speech by US Federal Reserve Open Market Committee (FOMC) member Michelle Bowman

- EURUSD forecast for 10 September 2024: 1.0986

Fundamental analysis

The CPI index reflects changes in consumer prices of goods and services, helping evaluate the dynamics of buying trends and economic stagnation. A lower-than-forecasted reading typically has a negative effect on the national currency. The forecast for 10 September 2024 suggested a negative reading of -0.1%, and the actual value aligned with expectations. CPI shifted to a negative territory compared to the previous period, indicating a reduction in consumer purchases.

The EU economic outlook for the next five years will be announced by former ECB head Mario Draghi today.

The speech by US FOMC member Michelle Bowman, who is also a member of the Federal Reserve Board of Governors, could provide insight into future US monetary policy and shed light on the September 2024 interest rate decision. The EURUSD fundamental analysis shows that the euro has lost some ground against the US dollar over the past few days. Positive economic forecasts may support the euro and the EURUSD rate could continue its upward momentum after a correction.

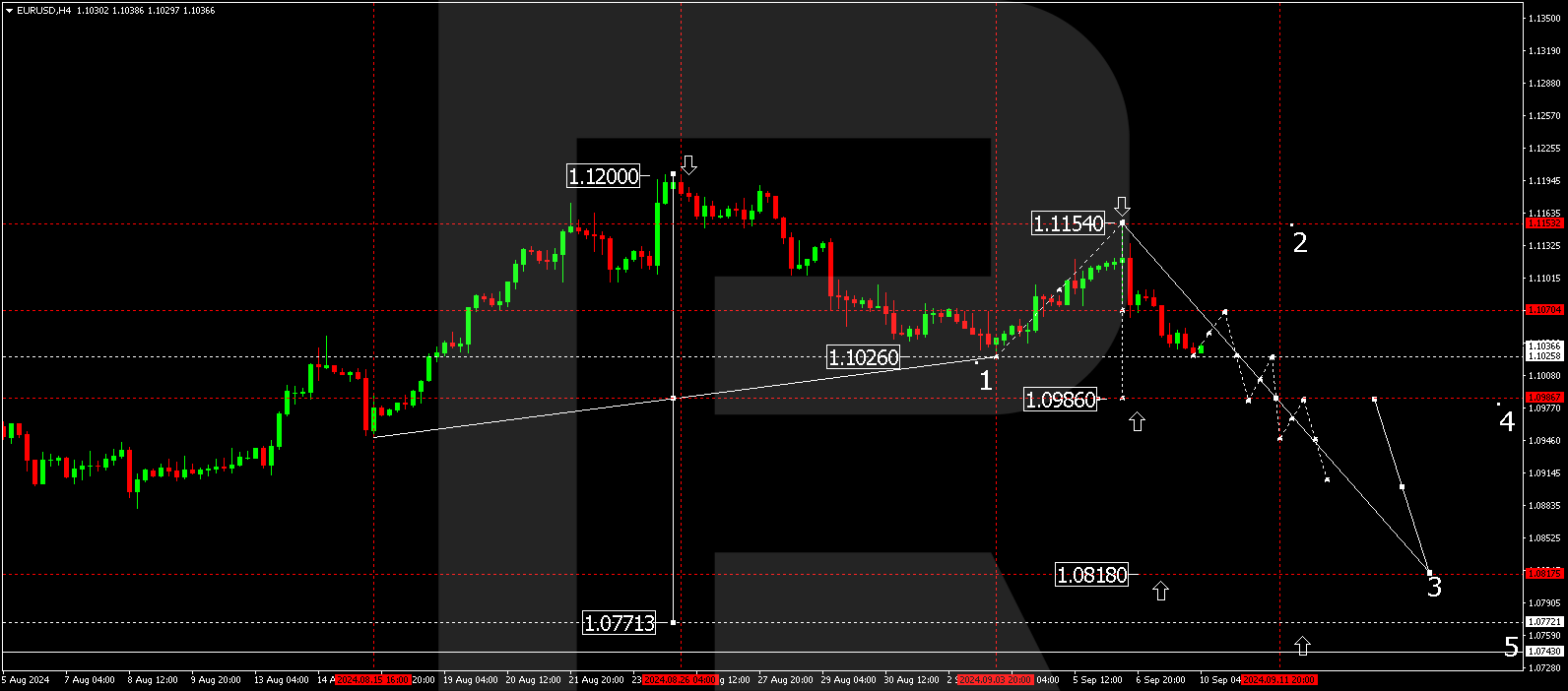

EURUSD technical analysis

The EURUSD H4 chart shows that the market has breached the 1.1060 level and completed a downward wave, reaching 1.1027. The price is expected to rise to 1.1060 (testing from below) today, 10 September 2024. A new consolidation range for the current downward wave could form around this level. A breakout below the 1.1027 level may signal a further downward movement towards 1.0986, the local estimated target. After reaching this level, the price could correct towards 1.1027.

Summary

CPI fell to a negative value; economic forecasts for the European Union and the EURUSD technical analysis in today’s EURUSD forecast suggest that a downward wave could continue towards 1.0986.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.