EURUSD 2026-2027 forecast: key market trends and future predictions

Disclaimer: the information in this article is based on the analysis of reputable financial resources and analytical data from RoboForex specialists. It reflects the conclusions of thorough research, but it should be taken into account that economic changes may significantly affect market conditions, which may lead to changes in forecasts. We recommend conducting your own research and consulting with professionals before making important financial decisions.

This article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Table of contents:

- EURUSD forecast key points

- Factors affecting the EURUSD forecasts

- What happens with EURUSD in 2025?

- EURUSD live price chart

- Technical analysis of EURUSD

- Long-term technical analysis of EURUSD for 2026

- Expert EURUSD forecasts for 2026

- EURUSD predictions for 2026 from AI

- Long-term EURUSD expert forecasts for 2027

- Long-term EURUSD predictions from AI for 2027

- EURUSD forecast: risks and considerations

- Conclusion

- FAQ

EURUSD forecast key points

Before we get into a detailed analysis and forecast for EURUSD for 2026 and 2027, let us take a look at the crucial factors that have the biggest impact on this currency pair.

- Eurozone economic outlook. The eurozone’s economic growth remains modest, with GDP forecasts standing around 1.6% for 2026.

- Fed's interest rate policy. The difference in interest rates remains a key factor. A sharper rate cut by the ECB compared to the Federal Reserve could support the strengthening of the US dollar. The Fed maintains a cautious stance, while lowering the rate to 4.0%, although a future adjustment remains possible.

- Eurozone and US inflation. The forecast for 2026 suggests inflation may range between 1.6% and 2.0%, potentially influencing EURUSD dynamics. In the US, inflation stood at 3.0% in September, leading the Fed to cut its rate to 4.00%.Geopolitical risks. Instability in the Middle East and globally continues to affect energy prices, disrupt supply chains, and put pressure on the EURUSD rate.

- Geopolitical risks. Instability in the Middle East and globally continues to affect energy prices, disrupt supply chains, and put pressure on the EURUSD rate.

- EURUSD expert and AI forecasts. Professional forecasts for EURUSD are mixed. Some analysts see the euro continuing to strengthen if European growth stabilises and the Fed continues to ease policy (with predictions of EURUSD potentially reaching the mid-1.20s or higher), while others foresee a renewed dollar rally pushing the pair lower (some worst-case scenarios even point to parity or below). The range of projections for the EURUSD rate 2026 is wide – roughly from 0.9000 up to 1.2000 – reflecting high uncertainty. For instance, certain AI-driven models anticipated levels as low as ~0.90, whereas more optimistic forecasts from other sources see the euro testing 1.2000–1.3000 or beyond if conditions favour it.

As part of the EURUSD forecast for the beginning of 2026, the currency pair’s dynamics is expected to be shaped by a combination of monetary policy shifts by the Fed and ECB, as well as evolving inflation and geopolitical factors. Forecasts for the pair remain varied: a bullish scenario envisions an extension of the current uptrend towards 1.3000 and potentially 1.3500–1.4000 if economic conditions in the eurozone continue to improve and the Fed leans dovish. A bearish scenario would unfold if the euro’s support levels (like 1.1200–1.1000) break, leading to a pullback towards 1.0500 or even parity 1.0000 under a resurgent US dollar. A sideways scenario is also possible, wherein EURUSD consolidates between roughly 1.1000 and 1.2000 if neither bulls nor bears gain a decisive upper hand.

Factors affecting the EUR USD forecasts

Understanding the key factors affecting the EURUSD rate is crucial for accurate exchange rate forecasts. Below are the main factors that will determine the currency pair’s direction in the coming years.

- Central bank policies. The European Central Bank and the Federal Reserve have a key impact on EURUSD behavior. Decisions on interest rates and inflation targets can dramatically change market sentiment, leading to large-scale currency moves. For example, a more aggressive Federal Reserve (tightening policy or staying hawkish longer) may strengthen the US dollar, while a dovish shift could weaken it. Similarly, the ECB’s policy path (rate cuts or hikes) will influence euro demand.

- Economic growth and GDP data. Economic performance in both the Eurozone and the US plays a pivotal role in shaping the EURUSD exchange rate. Strong GDP growth in the Eurozone could support the euro, while a slowdown in the US economy might weaken the US dollar. Conversely, if the Eurozone economy underperforms or the US economy shows exceptional strength, the euro could decline. The difference in economic growth rates between the regions will define the long-term prospects for EURUSD and influence overall market trends.

- Inflation rates. Inflation significantly impacts central bank decisions and thus currency values. If Eurozone inflation outpaces US inflation, the ECB might be forced to delay rate cuts or even consider hikes, making the euro relatively more attractive. On the other hand, if US inflation remains higher or proves stickier than in Europe, the Fed could keep US rates elevated, supporting the dollar. Markets closely watch inflation differentials for clues on policy divergence.

- Political and geopolitical events. Political stability and geopolitical events in the eurozone and the US can have substantial effects on EURUSD movements. For instance, changes in government, major elections, or policy shifts (such as trade policies or fiscal plans) can alter investor sentiment. The US presidential election outcome and subsequent policy changes in 2025 have shown how quickly sentiment can change – the new trade tariffs and international tensions early in 2025 led to market volatility. Likewise, regional conflicts, trade wars, or political instability (e.g., debt ceiling debates and shutdown in the US or political fragmentation in Europe) can prompt investors to seek safer assets like the US dollar during uncertainty.

- Trade balances and current account deficits. The trade balance between the eurozone and the US plays a significant role in EURUSD dynamics. A rising US trade or current account deficit (more imports than exports) can weaken the US dollar over time, especially if financed by borrowing. In contrast, a strong or improving eurozone trade surplus can support the euro.

- Market sentiment and risk appetite. Global market sentiment also sways the EURUSD pair. In times of market optimism and risk appetite, investors may favor higher-yielding or riskier assets, which can benefit the euro if the Eurozone outlook is positive. In contrast, during risk-off periods – such as geopolitical flare-ups, financial crises, or global slowdowns – investors often flock to safe havens like the US dollar. Conflicts and wars can significantly affect economic growth and inflation, as we’ve seen, thereby influencing sentiment. Changes in risk sentiment can lead to rapid swings in EURUSD irrespective of fundamentals, so it’s a factor that constantly needs monitoring.

Evaluating and understanding these factors is crucial for analysing future currency fluctuations and creating EURUSD forecasts. The assessment of the pair's movements and events in 2025 shows that these drivers have determined the trend not only in 2026 but for the next few years.

What happens with EUR USD in 2025?

In 2025, the EURUSD currency pair has undergone a notable trend reversal. The long-term downtrend that began in September 2024 ended in early 2025, and by Q2 the pair had reached new highs not seen since 2024. This euro recovery was driven by shifting expectations around central bank policies and relative economic performance.

Currently, EURUSD is trading around 1.1400, having decisively broken through key resistance levels that capped gains in late 2024. The breakout above the 1.1000–1.1200 zone has opened the door for further upside into the mid-1.20s—and potentially higher.

If bullish momentum continues and the pair sustains above former resistance (now turned support) around 1.1200, buyers could drive the quotes up to the next targets in the 1.1600–1.1800 range. However, if EURUSD falters and slips back below 1.1200, it would signal a loss of upward momentum; renewed seller pressure could then drag the quotes down toward 1.1000 or lower, with a potential retest of the 1.0500–1.0300 area. Let’s consider the fundamental factors that can stimulate traders to buy or sell EURUSD in 2025:

Economic growth rates in the Eurozone and the US

US economy is showing higher growth rates, projected at 1.8–2.0% in 2025, driven by steady domestic demand and a strong labour market. However, in 2026, US economic growth may slightly rise to 2.1% due to monetary policy tightening. Both economies remain impacted by geopolitical instability, structural challenges, and uncertainty regarding global trade.

Comparing the ECB and Federal Reserve monetary policies

ECB: After rapid hikes in 2022–2023, the ECB began to cut rates gradually from April 2024 and then paused to gauge inflation’s slide towards 2%. In October 2025, the rate stands at 2.15%, with an additional cut possible at the end of 2025 depending on economic data.

Fed: After raising its target rate to the 5.00–5.25% range in 2024, the Federal Reserve lowered rates to 4.0% in October 2025, citing persistently elevated core inflation. Markets are currently pricing another small cut at the end of the year, but based on the Fed’s cautious stance, the change may come in an unpredictable format.

Policy divergence has narrowed: Both the ECB and the Federal Reserve have already begun gradually easing monetary policy. If the Federal Reserve starts to cut rates faster than the ECB, the dollar’s yield premium will decrease, which acts as a bullish factor for the euro.

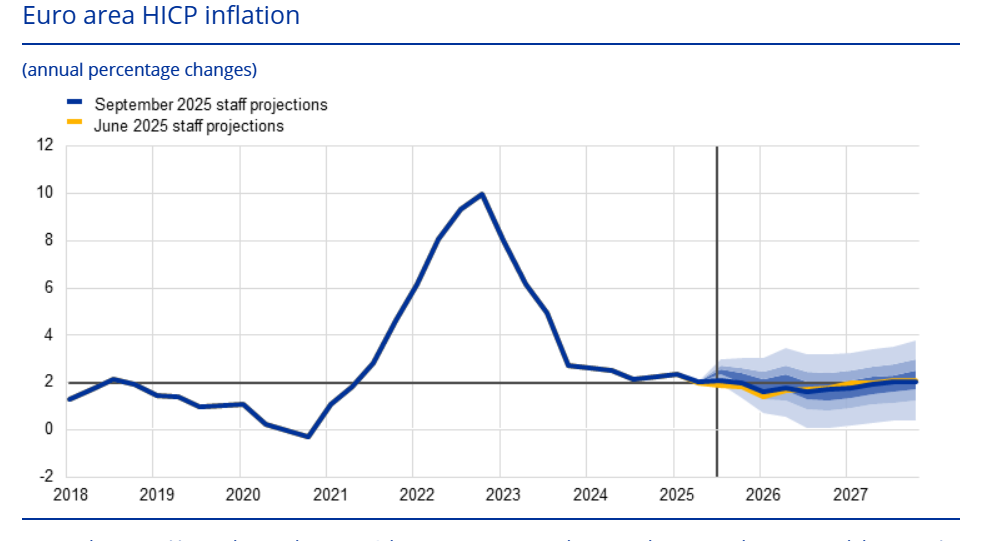

Inflation rate

Eurozone: the Harmonised Index of Consumer Prices (HICP) averaged 2.4% in 2025 and is projected to be around 1.7% in 2026 due to lower energy prices and the easing of supply-chain bottlenecks. If prices accelerate again (for example, because of an energy shock or a wage–price spiral), the ECB may slow down or cancel its rate-cutting cycle, which would limit the euro’s growth.

Source: https://www.ecb.europa.eu/

US: the Consumer Price Index (CPI) stands at around 2.9% y/y in Q3 2025; the core PCE index also remains stable. Federal Reserve officials insist that inflation must confidently fall to 2.0% for further easing. Forecasts suggest CPI at around 2.5% by the end of 2025 and 2.0% in 2026, provided no new shocks occur. A slower-than-expected decline will keep US interest rates and the dollar high for longer.

Trade balances and current account deficit

US: the chronic US trade deficit increased in 2025 because import volumes jumped after the introduction of trade tariffs and now stands at USD 78.31 billion. This situation shows the country’s dependence on capital inflows and creates a long-term risk for the USD if investor appetite for financing weakens.

Eurozone: the region still records a surplus, with the current account balance reaching 12.7 billion in October 2025. Reduced exports to the US and China became the key factors that influenced the trade balance.

Impact of geopolitical risks

Ukraine: Any escalation strains European sentiment and energy supply; de-escalation boosts the euro.

Middle East: Fresh unrest could lift oil prices, hurting energy-import-dependent Europe more than the US.

US-China trade war: Sharp tariff moves in 2025 have triggered flows into safe-haven assets. This doesn't always support the USD, and trade diversification may even benefit European exporters in some cases.

Overall, geopolitical flashpoints created volatility in 2025 and will continue to do so in 2026; prudent risk management is essential as sudden swings can override fundamentals.

EUR/USD live price chart

Technical analysis of EURUSD

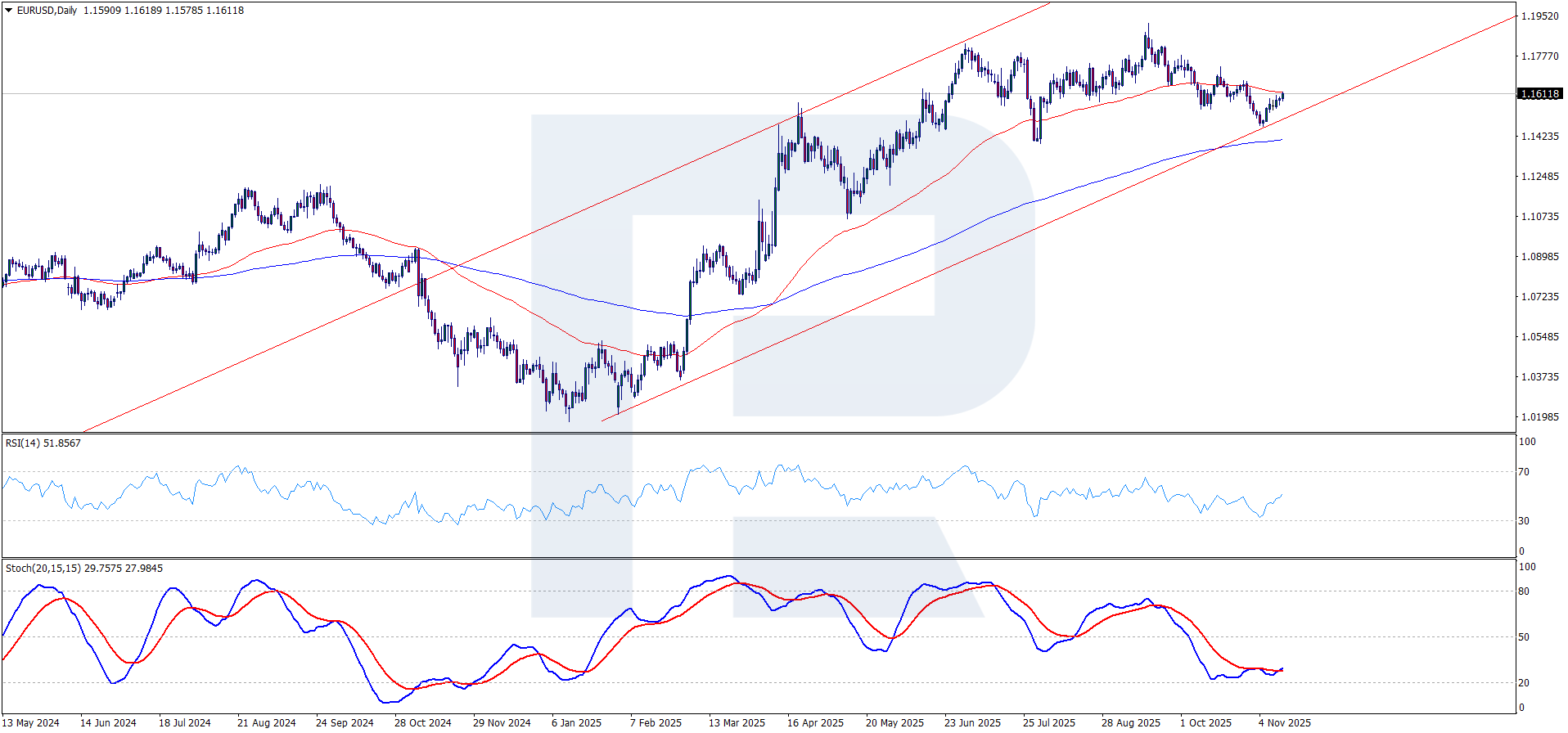

Daily chart analysis (November 2025): on the daily timeframe, the EURUSD technical picture has improved noticeably compared with early 2025. The uptrend that dominated the first half of 2025 shifted to a correction wave. Notably, the price tests the 65-day Exponential Moving Average (EMA-65) from below upwards, while it still trades above the long-term 200-day Exponential Moving Average (EMA-200), which signals a transition to bullish market sentiment.

Momentum indicators support the bullish scenario. For example, the stochastic oscillator displayed a classic bullish divergence earlier in the year—while the price was making lower lows, the stochastic lows were higher, indicating a weakening of bearish momentum. Subsequently, the %K and %D lines turned upward from oversold territory, reinforcing the likelihood of a bullish reversal. As the rally progressed, the daily stochastic occasionally entered the overbought zone, which is expected during a strong uptrend. Currently, however, the oscillator shows a loss of bullish momentum, suggesting that a price correction may be underway.

After a sharp rally, the EURUSD pair tested the 1.1800 area and formed a corrective wave. Following a three-week correction, buyers accumulated sufficient positions, and the price made another upward surge, testing the 1.1875 level. At this stage, the EURUSD pair is forming another corrective wave, having tested support around the 1.1480 mark.

Short-term outlook: The technical outlook for the near term suggests a mixed but overall bullish bias. According to the current technical picture of the EURUSD pair, the most likely scenario is a minor pullback or price consolidation around the 1.1600 level, after which the quotes may form another upward impulse. A breakout above the resistance level at 1.1800 would signal the continuation of the uptrend with the prospect of testing the 1.2000 mark.

The bearish scenario on the daily chart will be confirmed if the current rise of the EURUSD pair fails and the pair falls back into its previous range. An early warning of this would be a drop below 1.1200, and especially a fall below the support zone at 1.1080–1.1050. In the bearish case, we could see the pair decline to 1.0800 or 1.0550.

If sellers decisively push the price below 1.0550, this would indicate a revival of the broader downtrend, exposing targets such as 1.0200 and ultimately the parity zone at 1.0000.

Technical indicators such as the Stochastic Oscillator are likely to shift to overbought territory if this scenario begins to unfold. The price reaching the EMA-200 would be an additional signal of a trend reversal.

There is also a possibility of a sideways consolidation if neither bullish nor bearish breakouts occur in the coming months. In such a case, EURUSD could oscillate roughly between 1.1400 on the lower end and 1.1800 on the upper end, forming a horizontal trading range. This could happen if the market awaits clearer fundamental cues (like concrete signals from the Fed or ECB).

To sum up the daily technical analysis: the key levels to watch stand near 1.1400 (support), 1.1000 (major support), 1.1800 (initial resistance) and 1.2000 (next resistance). A confident breakout above the 1.1800 resistance will strengthen the bullish momentum with growth potential towards 1.2000–1.2200. Conversely, a move below the 1.1000 support may signal a bearish shift, aiming for 1.0500 and lower. If neither breakout happens soon, the EURUSD pair may move in a sideways pattern before a trigger for growth or decline appears.

| Year | Support levels | Resistance levels | Bullish Scenario | Bearish Scenario |

| 2025 | 1.1400 | 1.1800 | 1.2000 | 1.0500 |

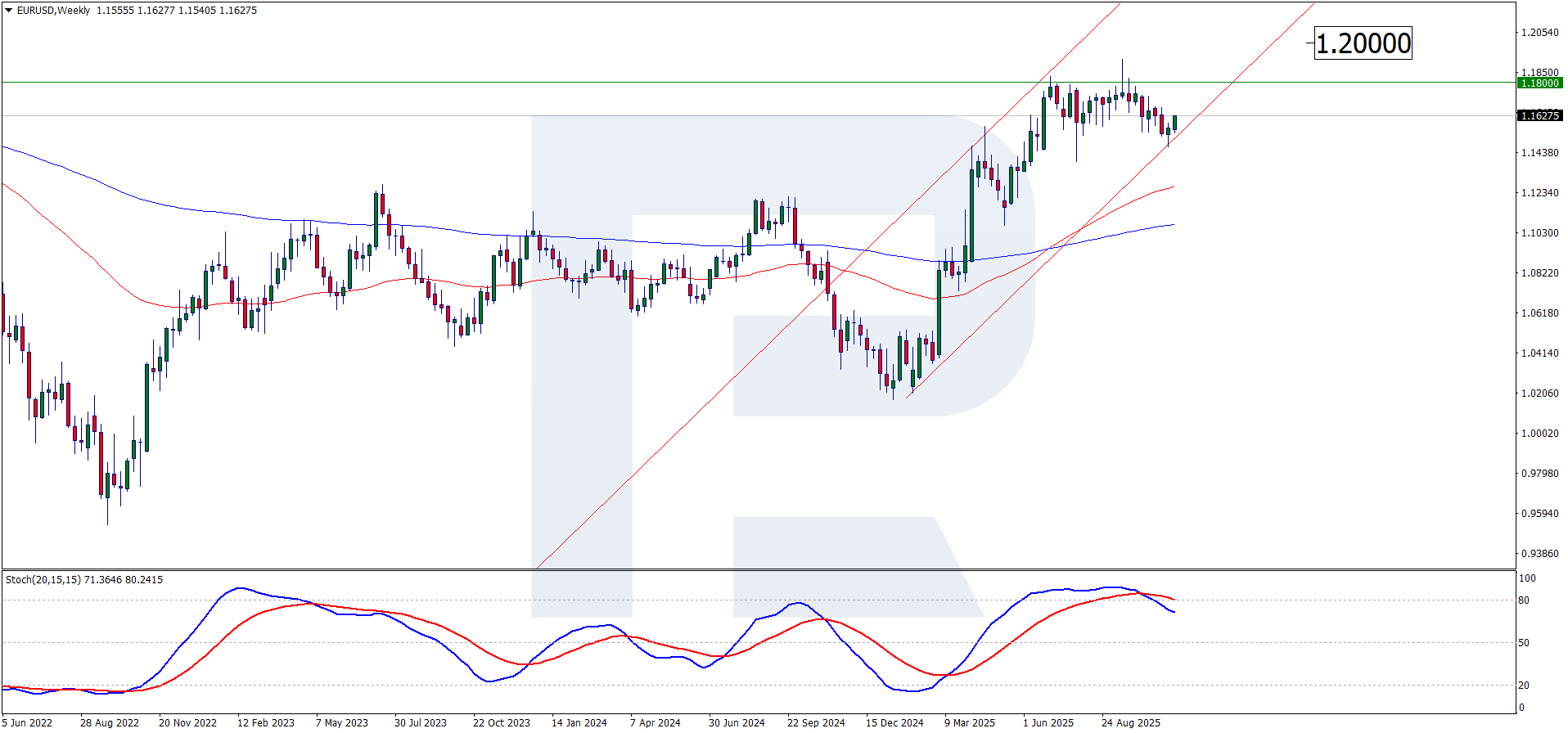

Long-term EURUSD technical analysis for 2026, 2027

To prepare a longer-term EURUSD forecast, we will examine the weekly chart of the pair. By analysing the broader timeframe, we can identify major trends and critical levels that might not be as evident on the daily chart. We will apply technical analysis tools, highlight three possible scenarios (bullish, bearish, and sideways), and mark crucial levels on the EURUSD weekly chart. This will help assess the pair’s potential movements in the long term (through the end of 2025 and into 2026).

Potential long-term scenarios for 2026

Bullish scenario:

On the weekly EURUSD chart, after testing the 1.1800 level and reaching another fresh high of 2025, the pair forms a correction. The 2021 highs remain far away, but after completing the correction, if the eurozone data turns positive. The weekly Stochastic Oscillator is currently in overbought territory (~80), signalling emerging bearish sentiment.

In our bullish scenario, the EURUSD pair continues to rise through the end of 2025 and the first half of 2026. Some resistance may appear around 1.1800–1.2000 near the upper boundary of the long-term ascending channel. If the pair consolidates above this resistance (around 1.2000), this will strongly confirm the continuation of the uptrend.

The next targets within this bullish scenario stand at 1.2000, followed by 1.2250–1.2300 (levels last seen in early 2021). However, it is important to note that reaching these higher targets may be pushed back to mid or late 2026, depending on the pace of movement.

The bullish scenario becomes invalid if the EURUSD pair unexpectedly reverses and breaks back below an important support level, such as 1.1200, on a weekly close. In particular, if the price drops and consolidates below 1.1000, this will cancel the emerging structure of higher lows and put sellers back in control. Overall, the long-term bullish outlook suggests a gradual strengthening of EURUSD with a possible move into the mid-1.2000 range or higher by mid-2026, provided that fundamental factors (such as Federal Reserve easing and eurozone stability) align with a technical breakout.

Bearish scenario:

Despite the recent rally, the broader downtrend may still remain incomplete, and the euro’s strength may be a temporary phenomenon. Within the long-term bearish scenario, the current EURUSD rise appears as a corrective rally within the dollar’s multi-year bullish trend.

On the weekly chart, EURUSD has moved above the year-long sideways range (roughly 1.0500–1.1200); the bearish view interprets this move as a potential false breakout if the price fails to hold at the reached levels. A weekly reversal from the 1.1700–1.1800 area — especially if accompanied by momentum indicator reversals (for example, a Stochastic crossover downwards from overbought territory) — may mark the start of a new downward wave.

In this scenario, once selling pressure resumes, the EURUSD pair may quickly return to the previous range. A rebound from the 1.1800 area may initially push the pair towards 1.0800–1.0600. A breakout below the 1.0500–1.0600 support area would open the path for another test of parity and lower. Bearish targets include 1.0000 (parity) and the 0.9500 area. Previous technical analysis highlighted 0.9530 as long-term support and a target if the downtrend continues. This level lines up with a major historical support level (the 2001 and 2022 lows near 0.9500).

Within a more pronounced bearish scenario, the EURUSD pair may drop back to 0.9700 in 2026. Key technical confirmations supporting this scenario include the euro’s inability to stay above the 50-week or 200-week moving averages.

This bearish scenario may gain further confirmation if global risk aversion intensifies sharply or the Federal Reserve keeps a hawkish stance significantly longer than the ECB. A characteristic signal would be a drop below 1.0625 followed by an inability to recover – this level previously acted as the upper boundary of the old range – which will indicate a false breakout and a return of the pair to the downtrend.

Ultimately, the long-term bearish scenario assumes that the current euro rally will run out of steam, followed by a decline that could eventually return EURUSD to multi-year lows (~0.9500), especially if macroeconomic factors once again favour the dollar.

Sideways scenario:

The third scenario suggests that the EURUSD pair will not form a strong directional trend in the long term and will instead move sideways within a broad range. Essentially, this would extend the uncertainty that characterised most of 2023–2024, although the ranges may shift slightly.

After the initial volatility at the start of 2025, the pair already attempts to stabilise within a range. On the weekly chart, the EURUSD pair could fluctuate between roughly 1.0500 at the bottom and 1.1800 at the top for an extended period (these levels correspond to important support and resistance zones of recent years). Indeed, the current breakout above 1.1200 may turn out to be false and quickly return to the previous range, as mentioned earlier.

Under the sideways scenario, prolonged consolidation around 1.1000–1.1100, seen in late 2024 and early 2025, may repeat, although slightly shifted upwards if the euro’s recent strengthening partially persists. For example, EURUSD may fluctuate between 1.1200 and 1.1800 for the rest of 2025 – a range of 600 points – without any clear annual trend.

Within this range, traders may see frequent reversals: growth towards 1.1700–1.1800 will face selling, while declines towards 1.1000–1.1200 will attract buyers. This may reflect a balance of factors (for example, moderate Federal Reserve easing but growth challenges in Europe) that leave EURUSD without a clear long-term direction.

From a technical perspective, if the weekly Stochastic Oscillator stays around the midpoint (50) for a long time and the price repeatedly returns to the 100-week moving average, this will confirm the sideways scenario. It is also preferable that the boundaries of the range are tested at least twice each (forming clear support and resistance levels) to confirm the range scenario. For example, if the EURUSD pair pulls back from the current highs and finds a bottom near 1.0800, and later in the year rises again towards 1.1800 and reverses downwards, this will define the range.

Over time, such consolidation may be seen as the market accumulating energy for a later breakout in 2026 or afterwards. However, towards the end of 2025, the sideways scenario suggests a volatile market without major shifts, meaning the EURUSD pair may finish 2025 roughly in the 1.1400–1.1800 range.

Each EURUSD forecast scenario depends on key price reactions at support and resistance levels. Traders should closely monitor these levels and use technical indicator signals to assess market dynamics.

On the weekly chart, pay attention to long-term support levels (around 1.0500, 1.0000, 0.9500) and resistance levels (around 1.1800, 1.2000, 1.2500), as indicated above. For example:

Long-term resistance and support levels for 2026

| Year | Key support/resistance levels | Value | Outlook |

|---|---|---|---|

| 2026 | Support | 1.0205 | The nearest support level located above the critical mark. A rebound from this level could temporarily slow down the downward movement and give the bulls a chance for an upward correction. |

| 2026 | Support | 1.0065 | A key support level, the attainment of which could become a starting point for a price reversal upwards. A breakout below this level would increase selling pressure, opening the way towards 0.9530. |

| 2026 | Support | 0.9530 | A support level that serves as a long-term target for the bears if the downtrend is confirmed. A breakout below this level would signal strong downward momentum. |

| 2026 | Resistance | 1.1800 | The first significant resistance on the buyers’ path. Consolidation above this mark will increase the chances of continued upward movement. |

| 2026 | Resistance | 1.1900 | A key level, testing of which may indicate strengthening buyer positions. |

| 2026 | Resistance | 1.2200 | The upper boundary of the sideways range, a breakout above which would confirm a bullish trend. Reaching this level would be an important confirmation of the development of the upward movement. |

Expert EURUSD forecasts for 2026

EURUSD forecasts for 2026 from leading financial institutions help traders and investors understand how the balance between the US and eurozone economies may evolve beyond the near term. These projections are generally based on assumptions about GDP growth, inflation, interest-rate differentials, and the path of US–EU trade tensions. Below are expert views from major central-bank and private-sector forecasters on where EURUSD could trade in 2026 (note that these are forecasts available as of late 2025 and may be revised as new data arrives).

- European Central Bank: In its September 2025 staff macroeconomic projections, the ECB uses technical assumptions that keep the USD/EUR exchange rate broadly stable at around 1.16 in 2026. This implies an average EURUSD level close to 1.16 over the forecast horizon. The projection embeds a modest appreciation of the euro versus earlier years and is consistent with euro area GDP growth of about 1.0% in 2026 and HICP inflation near (but slightly below) the 2% target

- ING: In its “FX Outlook 2026” report, ING argues that the strong-dollar phase of 2025 is unlikely to return and that a gradual eurozone recovery, lower energy prices and a Fed policy rate moving toward a neutral 3.00–3.25% should favour a somewhat weaker dollar. ING estimates EURUSD “fair value” rising from the 1.15 area toward 1.20 and explicitly forecasts the pair at 1.21 by Q4 2026 and around 1.22 on a 12-month horizon beyond that. This is a clearly bullish scenario for the euro but assumes no major political shock in the eurozone or the US.

- Scotia Bank: Scotiabank’s FX forecast tables show EURUSD at 1.22 by the end of 2026. Their baseline calls for a gradual appreciation of the euro as US–eurozone rate differentials narrow and global risk sentiment remains broadly constructive. At the same time, they note that the path is unlikely to be linear: periods of risk aversion or renewed US–EU trade tensions could temporarily support the US dollar and cap EURUSD rallies.

- Wells Fargo: Wells Fargo’s 2026 Annual Economic Outlook includes detailed foreign-exchange tables that point to a modestly higher, but still range-bound, EURUSD over 2026. Their forecast path places EURUSD at 1.17 in Q4 2025, rising to 1.18 in Q1 2026 and 1.19 in Q2 2026, before easing back to 1.18 in Q3 and 1.17 again by Q4 2026. This profile implies a mid-year peak followed by a mild dollar rebound as the Fed ends its easing cycle and US yields stabilise.

- Erste Group: Erste Group’s medium-term EURUSD view, as reported in public summaries of their research, emphasises volatility and the risk of a deeper euro sell-off before a stronger recovery. In a widely cited scenario, Erste warned that EURUSD could drop toward parity (or slightly below) in periods of heightened eurozone stress and policy divergence, before staging a more pronounced rally back into the 1.20–1.25 area over the subsequent years as US growth slows and eurozone conditions normalise. While not tied to a single precise level for end-2026, this view underscores that downside spikes in EURUSD remain possible even in a medium-term bullish euro narrative.

Overall, the institutional forecasts for 2026 cluster in a relatively tight range, with most base-case scenarios placing EURUSD somewhere between roughly 1.15 and 1.22 by late 2026. The ECB’s technical assumptions and Wells Fargo’s projections point to a broadly stable euro versus the dollar, while ING and Scotiabank expect a more visible appreciation above 1.20. At the same time, Erste’s scenario and other bearish analyses highlight that episodes of renewed euro weakness—potentially even toward parity—cannot be ruled out. For traders, this dispersion of views underscores both the constructive medium-term outlook for the euro and the high uncertainty around the exact path the pair may take.

Summary table of EURUSD expert forecasts for 2026

| Institution | EURUSD Forecast for 2026 | Outlook |

|---|---|---|

| ECB | ~1.16 | Stable, neutral scenario; modest euro appreciation as inflation nears target |

| ING | 1.21 by Q4 2026 | Bullish euro; weaker USD expected as Fed moves toward neutral |

| Scotia Bank | 1.22 by end-2026 | Gradual euro strength; constructive risk sentiment; narrowing rate differentials |

| Wells Fargo | 1.17–1.19 | Range-bound; mild USD rebound later in the year |

| Erste Group | 1.20–1.25 | High volatility; euro downside spikes possible before longer-term recovery |

EURUSD predictions for 2026 from AI

In addition to forecasts from financial companies and major banks, AI-based algorithms are increasingly used to generate EURUSD forecasts. These models apply advanced machine-learning techniques, extensive sets of historical data, and pattern recognition to produce projections. Although artificial intelligence cannot take unforeseen shocks into account such as sudden geopolitical events or unexpected policy decisions, it offers a data-driven approach to analysing future trends. Below are several EURUSD forecasts for 2026 from leading AI-driven platforms, illustrating the range of outcomes predicted by these technologies:

- Wallet Investor expects that the EURUSD pair could show long-term growth, forecasting a Forex rate of 1.1760 for December 2026.

- Coin Index offers a more pessimistic view of the euro in 2026. According to their AI forecast, by the end of 2026 the EURUSD rate will stand near 1.1800.

- Long Forecast sees a more optimistic scenario, projecting the EURUSD rate in the 1.1500–1.2100 range by the end of 2026, influenced by strong US economic data and high interest rates.

- Panda Forecast offers a less optimistic scenario and predicts that EURUSD will decline towards 1.0100–1.0600 by the end of 2026. The platform bases its outlook on macroeconomic indicators such as inflation, GDP growth, and the interest rate differential.

Long-term EURUSD expert forecasts for 2027

By 2027, the EURUSD pair will be shaped mostly by structural economic trends, normalized interest-rate policies, and broader global risk sentiment. Below are the updated long-term forecasts for 2027 from leading financial institutions.

- The ECB’s latest staff projections assume a stable USD/EUR rate near 1.16 through 2027, implying EURUSD around 1.16. The outlook suggests a broadly steady euro if inflation returns to target and eurozone growth remains moderate.

- ING expects the euro’s recovery to continue into 2027 as rate differentials narrow and the US economy slows relative to Europe. Their models place EURUSD in the 1.22–1.24 range by late 2027.

- Scotiabank’s long-term view remains positive on the euro. Building on their 2026 forecast of 1.22, they project EURUSD rising to around 1.23–1.25 in 2027, supported by economic stabilization and easier policies from both central banks.

- Wells Fargo remains cautious. They see limited upside for the euro and expect USD strength to persist during periods of global uncertainty. Their 2027 baseline places EURUSD around 1.15–1.17, close to its long-term average.

- Erste Group expects EURUSD to move sideways with mild appreciation as the eurozone gradually stabilizes. Their scenario points to EURUSD around 1.17–1.18 throughout 2027, assuming no major political or fiscal shocks.

Summary table of long-term EURUSD expert forecasts for 2027

| Institution | EURUSD Forecast for 2027 | Outlook |

|---|---|---|

| ECB | ~1.16 | Stable, neutral scenario |

| ING | 1.22–1.24 | Bullish euro |

| Scotia Bank | 1.23–1.25 | Bullish euro |

| Wells Fargo | 1.15–1.17 | Mild USD strength |

| Erste Group | 1.17–1.18 | Sideways with moderate euro gains |

Long-term EURUSD forecasts from AI for 2027

AI-based models offer a unique perspective on long-term forecasts for the EURUSD currency pair, leveraging computational power to analyse historical data, macroeconomic trends, and technical patterns. While these models are not immune to error (especially in the face of unpredictable events like geopolitical crises or policy changes), they provide data-driven insights into potential currency movements for 2027. Below are the AI 2027 EURUSD forecasts from prominent platforms:

Wallet Investor

The Wallet Investor model forecasts a gradual strengthening of the US dollar against the euro in the long term.

2027 outlook: According to the forecast, EURUSD is expected to maintain its existing trend throughout 2027, starting the year at 1.1720 and ending slightly higher at 1.1790.

Coin Index

The Coin Index model presents a more aggressive long-term outlook, predicting EURUSD appreciation by the start of 2027.

2027 outlook: The forecast indicates that within the next five years the EURUSD rate may reach 1.2300.

Long Forecast

The Long Forecast model offers a moderately positive (bullish) view on EURUSD with minor corrections, suggesting that the US dollar will continue to benefit from its global reserve currency status and the resilience of the US economy. However, the model also considers scenarios in which the dollar could cede some ground to the euro.

2027 outlook: For 2027, the model projects relatively stable movement in the pair, with EURUSD expected to begin the year at 1.1760 and end it at the same level.

Panda Forecast

The Panda Forecast model provides a more cautious outlook for the euro, expecting long-term weakening rather than appreciation.

2027 outlook: The model anticipates further EURUSD decline in 2027, with the pair starting the year at 1.0847 and falling to 1.0127 by year-end.

Long-term AI forecasts summary

EUR USD forecast: risks and considerations

When making a EURUSD forecast for several years ahead, it is important to consider various risks and factors that may affect the accuracy of the forecast. While expert opinions from leading financial companies and banks, as well as AI models, provide valuable insights, unforeseen events can significantly change the direction of the pair. Below are the risks and general thoughts to consider when assessing the EURUSD outlook for 2026-2027.

Geopolitical instability. Geopolitical risks represent one of the most unpredictable factors that can influence the currency market. Events such as political shocks, trade wars and conflicts, especially in key regions, can disrupt economic growth, affect investor sentiment, and trigger increased volatility in EURUSD.

Central Bank policy divergence. The monetary policies of the European Central Bank (ECB) and the Federal Reserve will play a key role in shaping EURUSD’s further trajectory. However, these policies may change depending on new economic data, inflation, and the pace of economic growth. If the ECB adopts a softer stance while the Federal Reserve maintains a tight one, the EURUSD pair may decline.

Inflationary pressures. Persistently high inflation remains a challenge for the eurozone and the US, although inflation is already nearing the regulators’ target levels. If inflationary pressures intensify, central banks may be forced to take strict measures, such as raising interest rates, which may strongly influence EURUSD movements. If inflation rises unexpectedly, especially in the eurozone, the ECB may be forced to tighten monetary policy more than anticipated, which could weaken the EURUSD rate sharply.

Global economic slowdown. A slowdown in global economic growth caused by recession, supply-chain disruptions or a deceleration in major economies such as China may affect both the eurozone and the US. A global downturn may strengthen the US dollar as investors seek safe-haven assets.

Energy crisis and supply chain disruptions. The eurozone’s dependence on external energy sources makes it vulnerable to energy shocks and supply-chain disruptions. If the energy crisis worsens, especially due to geopolitical tensions or market imbalances, this may negatively affect the euro. Rising energy prices or shortages may undermine the eurozone economy, leading to a weaker EURUSD rate.

Technological disruptions and AI integration. With increased integration of AI-based models into financial forecasting and trading, markets may react in new and unpredictable ways. Although AI helps identify patterns and trends, its influence on decision-making processes may lead to higher volatility if market participants react en masse to AI-generated forecasts.

Conclusion

The EURUSD currency pair may experience significant fluctuations throughout 2026, which means both bullish and bearish scenarios are possible. The key factors shaping the exchange rate trajectory will include monetary policy, inflation expectations, and global economic uncertainty.

Experts such as the ECB and Wells Fargo forecast the rate near 1.1000, while Erste Group suggests 1.1700, highlighting the euro’s volatility. At the same time, ING expects the pair to rise towards 1.2000. AI models show even greater variation: Coin Index predicts growth above 1.1800, Long Forecast sees the rate near 1.2100 by the end of 2026, and Panda Forecast expects a decline towards 1.0400.

The EURUSD technical analysis for 2026 in an optimistic scenario suggests a rise towards 1.1800–1.2200 if economic conditions in the eurozone stabilise and technical indicators confirm a reversal. Bearish projections allow for a decline towards 0.9500–1.0000 amid US dollar strength and geopolitical instability. A sideways trend within 1.1400–1.1800 is also possible, reflecting the balance between key economic factors.

The EURUSD performance in 2026 will largely depend on the monetary policies of central banks, inflation trends, economic growth in the US and the eurozone, and the impact of global macroeconomic conditions. According to the ECB’s 2026 forecast, the EURUSD rate will remain near the 1.1000 level.

FAQ

The current EUR/USD price you can find in the EURUSD live price chart

EURUSD is set to rise in 2025. Currently, the EURUSD pair is moving within a sideways range with boundaries at 1.14 and 1.18. A breakout above the resistance level at 1.1880 would signal the continuation of the uptrend with the prospect of testing the 1.2250 mark. In the bearish case, we could see the pair decline to 1.0800 or 1.0550.

Whether now is a good time to buy or sell EURUSD depends on your trading strategy, risk tolerance, and market analysis. Traders often evaluate fundamental factors such as interest rate differentials, inflation data, and global economic conditions. Technical indicators such as trend lines, moving averages, and sentiment analysis also help determine entry and exit points. It is advisable to consult with a financial expert or rely on your own careful analysis before making trading decisions.

Forecasts for 2025 for the EURUSD pair show significant divergence, reflecting a variety of analytical approaches. Economic institutions such as the ECB forecast a level of 1.10, while ING expects 1.15. Erste Group and Scotia Bank suggest a level of 1.16, and Wells Fargo forecasts 1.17. AI models show an even wider range: Panda Forecast predicts a decline to 1.0876, Wallet Investor expects a level of 1.159, while Coin Index and Long Forecast anticipate 1.3735 and 1.376, respectively.

To trade EURUSD, open a trading account or use a demo account for practice. Select the EURUSD pair, analyse the market using technical and fundamental indicators, and decide whether to buy or sell based on your outlook. Set stop-loss and take-profit levels to manage risk. Once you open a position, monitor it closely and adjust as necessary based on market movements.

AI-based predictions for EURUSD are popular due to advancements in machine learning. These models analyse historical data and market trends to generate forecasts, offering valuable insights. However, they are not foolproof and should be used alongside other analysis methods, as they may struggle with unpredictable events like geopolitical crises or policy changes.

News significantly impacts the EURUSD exchange rate. Economic reports like GDP, unemployment, and inflation from the eurozone and the US, as well as central bank decisions on interest rates, can cause major price fluctuations. Geopolitical events such as elections or trade deals also affect forecasts. Traders should stay updated on breaking news to adjust strategies.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.