EURUSD forecast 2024-2026: key market trends and future predictions

Disclaimer: the information in this article is based on the analysis of reputable financial resources and analytical data from RoboForex specialists. It reflects the conclusions of thorough research, but it should be taken into account that economic changes may significantly affect market conditions, which may lead to changes in forecasts. We recommend conducting your own research and consulting with professionals before making important financial decisions.

The EURUSD pair in the first half of 2024 has been a rollercoaster of volatility, marked by sharp fluctuations within each day as economic uncertainties and central bank policies clash. Geopolitical events and macroeconomic indicators put serious pressure on the pair. What will be the forecast for the EURUSD pair in the coming years?

This article provides the EURUSD forecast for 2024, 2025, and 2026 and highlights the main factors, determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This will give investors and traders a comprehensive insight into potential short-term EURUSD movements, providing them with the information needed to make informed decisions.

Table of contents:

- EURUSD forecast key points

- Factors affecting the EURUSD forecasts

- What happens with EURUSD in 2024?

- EURUSD live price chart

- Technical analysis of EURUSD for 2024

- Long-term technical analysis of EURUSD for 2024

- Expert EURUSD forecasts for 2024

- EURUSD predictions for 2024 from AI

- Long-term EUR USD expert forecasts (2025-2026)

- Long-term EUR USD predictions from AI (2025-2026)

- EUR USD forecast: risks and considerations

- Conclusion

- FAQ

EUR USD forecast key points

Before proceeding to a detailed EURUSD analysis and forecast for 2024, let us consider the key factors that have the biggest impact on the currency pair.

- Eurozone economic recovery. The eurozone is expected to see moderate economic growth, with the IMF forecasting a 0.9% increase in 2024 and 1.5% growth in 2025. The region’s economic recovery will become the key factor in strengthening the euro.

- Federal reserve monetary policy. Fed’s inflation and interest rate policy will be the decisive factor for the USD rate. If the Federal Reserve cuts interest rates more slowly than the ECB, this may push down the EURUSD rate.

- Inflationary pressure. Inflation in the eurozone and the US slightly eases in 2024, gradually approaching the targets. The regulators’ countermeasures, including interest rate cuts, will significantly affect the EURUSD movements.

- Geopolitical risks. Geopolitical instability, in particular in the Middle East, boosted energy prices. Supply chain disruptions and military conflicts may have an unpredictable impact on the EURUSD rate.

- EURUSD expert and AI forecasts. The EURUSD forecasts are mixed, with some expecting the euro to strengthen and others predicting the US dollar's dominance. The projected EURUSD rate ranges from 1.0650 to 1.1700.

Key EUR USD forecast levels

Support:

- Key support level: 1.0765

- Lower boundary of the long-term range: 1.0605

- Key support level if the price breaks below the lower boundary of the long-term range: 1.0205

Resistance:

- Nearest resistance level: 1.0995

- Upper boundary of the long-term range: 1.1205

- Key resistance level if the price breaks above the upper boundary of the long-term range: 1.1585

In 2024, the EURUSD trajectory will likely be shaped by the eurozone's economic recovery, the Fed and ECB monetary policies, and inflationary and geopolitical factors. Forecasts remain mixed, ranging between 1.0650 and 1.1700.

Factors affecting the EUR USD forecasts

Understanding the key factors affecting the EURUSD rate is crucial for accurate exchange rate forecasts. Below are the main factors that will determine the currency pair’s direction in the coming years.

- Central bank policies. The European Central Bank and the Federal Reserve have a key impact on the EURUSD behaviour. Decisions on interest rates and inflation targets may dramatically change market sentiment, leading to large-scale sell-offs. A more aggressive Federal Reserve policy may help strengthen the US dollar.

- Economic growth and GDP data. Economic indicators from both the Eurozone and the US play a key role in shaping the EURUSD exchange rate. Strong GDP growth in the Eurozone could support the euro, while a slowdown in the US economy might weaken the US dollar. The difference in economic growth rates between the regions will define the long-term prospects for EURUSD, influencing overall market trends.

- Inflation rates. Inflation significantly impacts central banks’ decisions and hence the national currency rate. If the eurozone inflation outstrips the US, it may force the ECB to delay interest rate cuts, prompting investors to invest in the US dollar.

- Political and geopolitical events. Political stability in the eurozone and the US considerably affects the EURUSD movements. For instance, the US presidential election may greatly influence the currency pair’s moves, changing market expectations and investor sentiment. Energy crises and regional conflicts also add to market volatility, prompting investors to seek safer assets like the US dollar.

- Trade balances and current account deficits. The trade balance between the eurozone and the US plays a significant role in the EURUSD dynamics. An increase in the US trade balance deficit could weaken the US dollar, while the increased trade surplus in the eurozone might support the euro.

- Market sentiment and risk appetite. The EURUSD pair also responds to global market sentiment. Conflicts and wars may significantly affect economic growth and inflation in the US and the eurozone.

Evaluating and understanding these factors is crucial for analysing future currency fluctuations and creating EURUSD forecasts. The assessment of the pair's movements and events in 2024 shows that these drivers will determine the trend not only this year but for several years ahead.

What happens with EUR USD in 2024?

In 2024, the EURUSD pair continues to trade within a narrow range, with the upper boundary at 1.1255 and the lower at 1.0500. Typically, after the price breaks from such a range, a new trend could develop for the width of the range. The quotes are currently at the upper boundary of this protracted sideways trend, but need a strong fundamental shift to break above it. Let us look at factors that may prompt traders to move the pair beyond the range.

Economic growth rates in the Eurozone and the US

Following a post-pandemic recovery, the eurozone is projected to see moderate economic growth. The region’s economy expanded by 3.4% in 2022 and by a mere 0.5% in 2023. According to the IMF forecasts, the eurozone’s economic growth will be 0.9% in 2024 and 1.5% in 2025. In Q2 2024, the US economy grew by 3% year-on-year, while the eurozone’s GDP increased by only 0.6% over the same period.

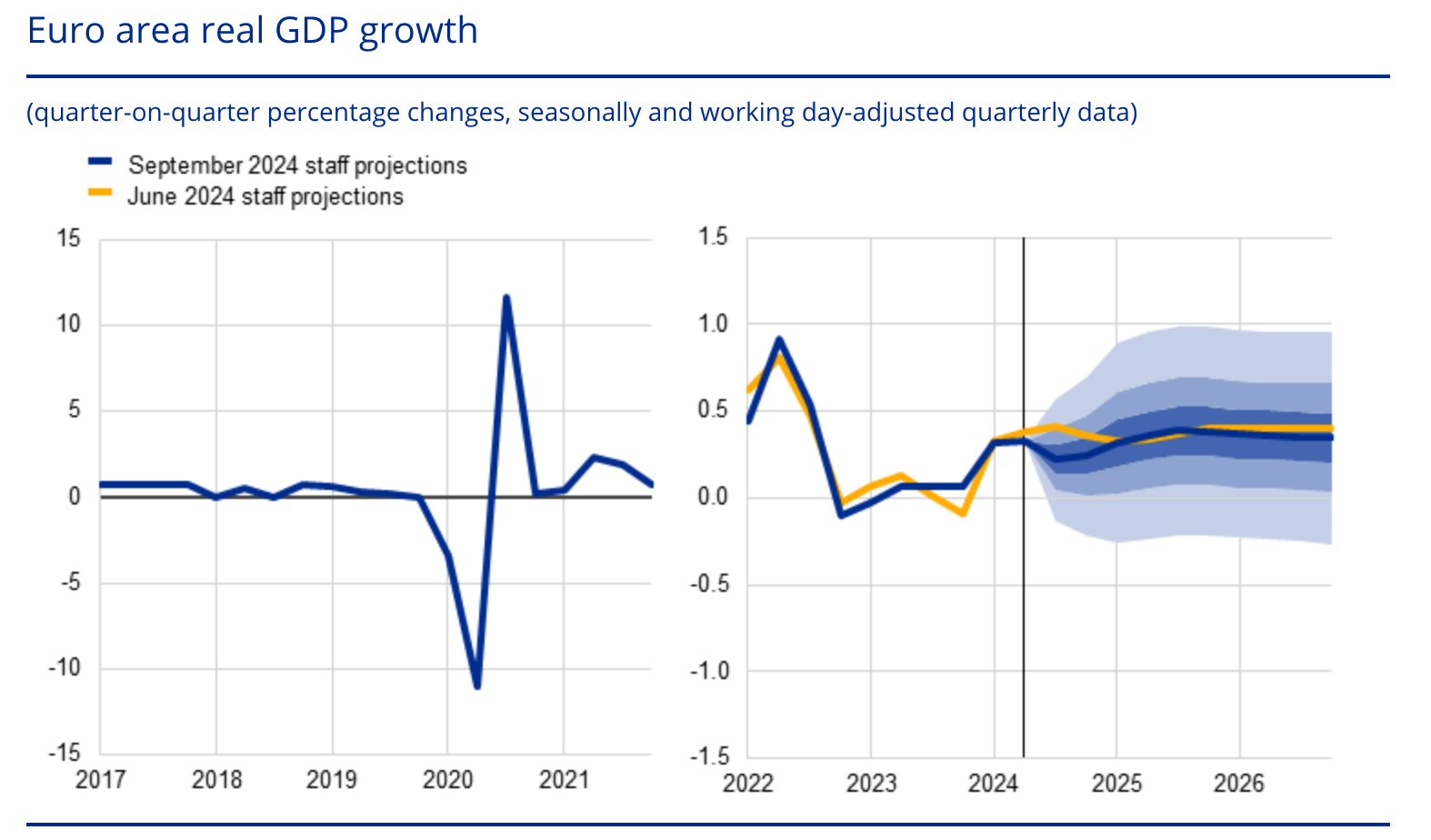

Source: https://www.ecb.europa.eu/

The current data shows that the eurozone’s economy will grow by 0.2% in Q3 in line with the Q2 pace. According to the ECB, the annual real GDP growth rate in the eurozone will average 0.8% in 2024, reaching 1.3% in 2025 and 1.5% in 2026. However, Germany, the largest economy in Europe, showed stagnation in Q2. It is projected to grow by 0.8% in 2025 and 1.3% in 2026.

Comparing the ECB and Federal Reserve monetary policies

The US Federal Reserve's stance on inflation and interest rates will be a key factor in the EURUSD forecast. Strong US labour market data has significantly changed market expectations, sharply reducing the likelihood of a 50-basis-point Federal Reserve rate cut at upcoming meetings. This report has virtually eliminated the possibility of a substantial rate cut in November, raising questions about whether there will be cuts at all in the near future.

Meanwhile, the eurozone’s weak economic growth and easing inflation, which fell below the ECB's 2% target in September, have increased expectations of a potential rate cut at the ECB’s October meeting. This could be the third rate cut this year, adding further pressure on the euro.

Inflation rate

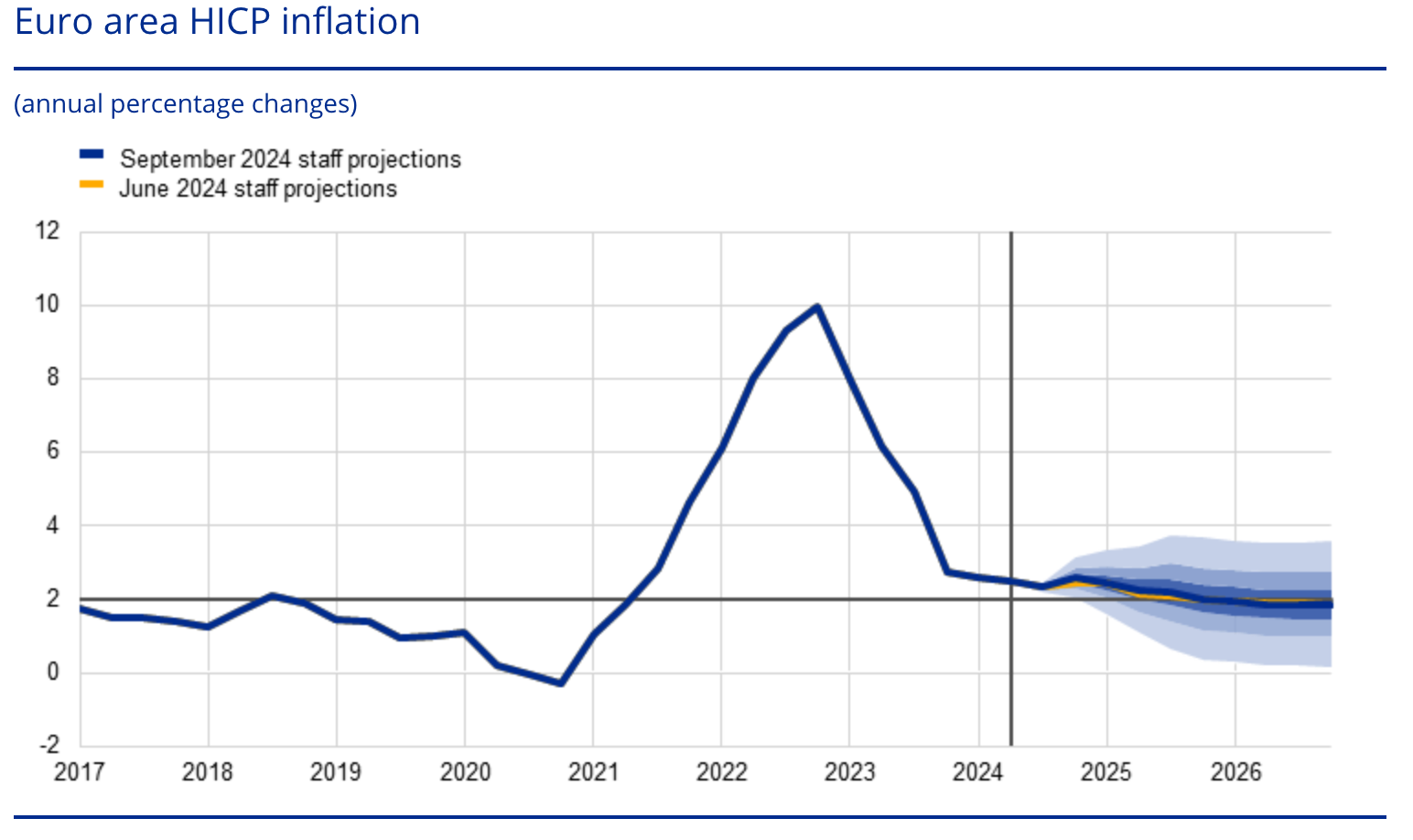

As mentioned above, inflation directly impacts central banks’ interest rate decisions. The ECB’s forecast indicates temporary inflation growth in the eurozone in Q4 2024, after which it will gradually decline. Overall inflation is expected to return to the 2% target by the end of 2025. The main factors affecting inflation include changes in energy and service prices.

Source: https://www.ecb.europa.eu/

In September 2024, consumer prices in the eurozone rose by only 1.8% year-on-year, which was below the 2% ECB target for the first time since June 2021. This fall in inflation could prompt the European regulator to accelerate rate cuts, negatively impacting the euro.

Trade balances and current account deficit

In August 2024, the US trade deficit contracted by 10.8%, reaching 70.4 billion USD. Meanwhile, Germany, the eurozone's largest economy, saw its foreign trade surplus rise to the highest level since May, coming in at 225 billion EUR. The increase in US trade deficit could weaken the US dollar, while the growing trade surplus in the eurozone might support the euro.

Impact of geopolitical risks

Geopolitical tensions, particularly in the Middle East, remains a factor able to increase market volatility. The conflict between Israel and Lebanon may significantly influence economic growth and inflation in the eurozone, especially if pressure on energy prices mounts further.

Since the onset of the conflict, the cost of Brent crude oil and European natural gas have increased by about 9% and 34%, respectively at their peak. The World Bank warned in its quarterly report last week that crude oil prices could reach over 150 USD per barrel if further escalation occurs. As a result, the current escalation in the Middle East could negatively impact the EUR rate.

EURUSD live price chart

Technical analysis of EURUSD for 2024

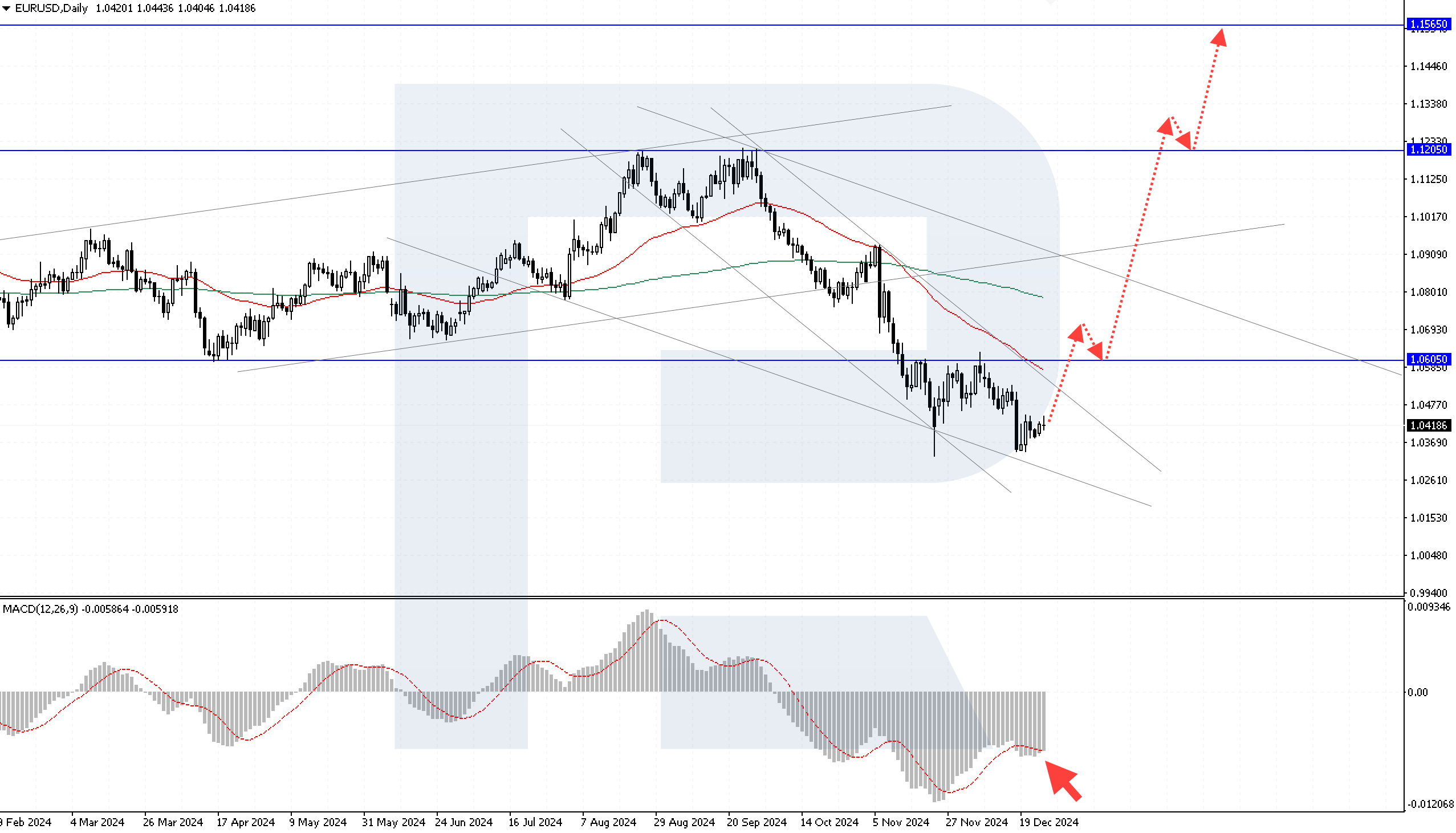

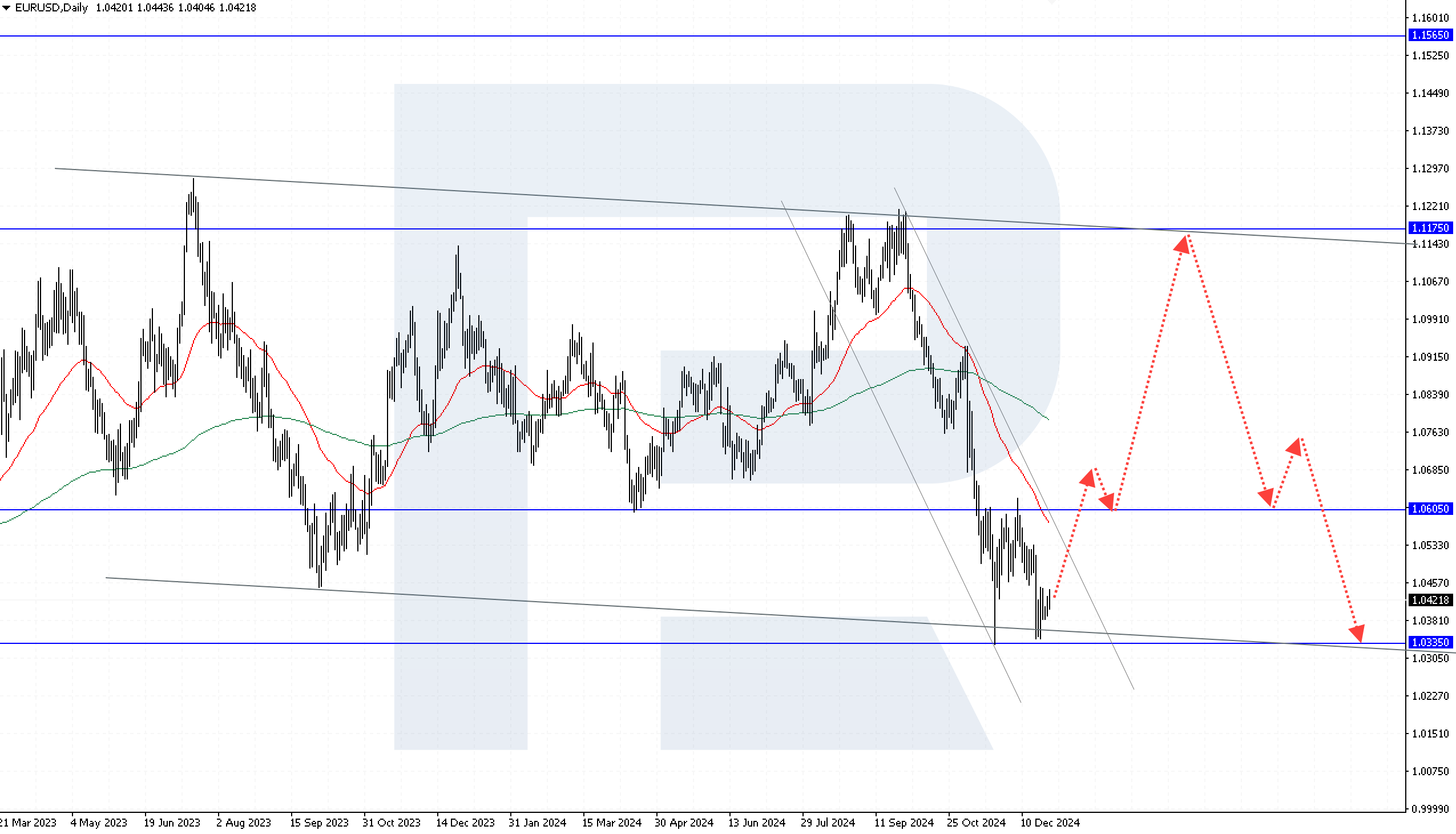

Let's analyse the daily chart of the EURUSD currency pair. As part of the technical analysis of the EURUSD currency pair for 2024, we will assess the location of the nearest support and resistance levels, consider the formation of graphical patterns, as well as analyse technical indicators.

EURUSD quotes broke below the EMA-200 line, which indicates a downtrend. However, the current support area that the pair is clinging to is the lower boundary of the long-term sideways range. The currency pair has been trading in this range since the beginning of 2023. Thus, there is a high probability of a bounce from the 1.0500 level and an upward move towards 1.0655.

If the EURUSD pair rebounds downward from the 1.0705 level, the development of a bearish movement towards 1.0425 becomes likely. A rejection from the upper boundary of the descending channel could trigger this bearish impulse. Furthermore, if sellers manage to prevent the MACD indicator's signal line from breaking through, bearish sentiment for the pair will strengthen further.

Under aggressive buying pressure, if the EURUSD pair consolidates above the 1.0705 level, breaking the upper boundary of the descending channel, the upward movement towards 1.0995 could unfold. In this case, the ongoing decline should be viewed as a downward correction. The ultimate growth target could be the upper boundary of the sideways range at 1.1225.

A significant risk for buyers would arise if strong selling pressure pushes the price below the 1.0425 level. This would indicate a breach of the lower boundary of the sideways range, with an initial downside target of 1.0115. In technical analysis, breaking a long-term price corridor typically results in a price movement equal to the width of the range or signals the beginning of a new trend.

The current EURUSD technical analysis highlights the importance of the 1.0500, 1.0705, and 1.0425 levels. Testing these levels will determine the next direction for EURUSD. Investors and traders should closely monitor technical indicator signals and the market's reaction to these critical levels.

Long-term EURUSD technical analysis for 2024

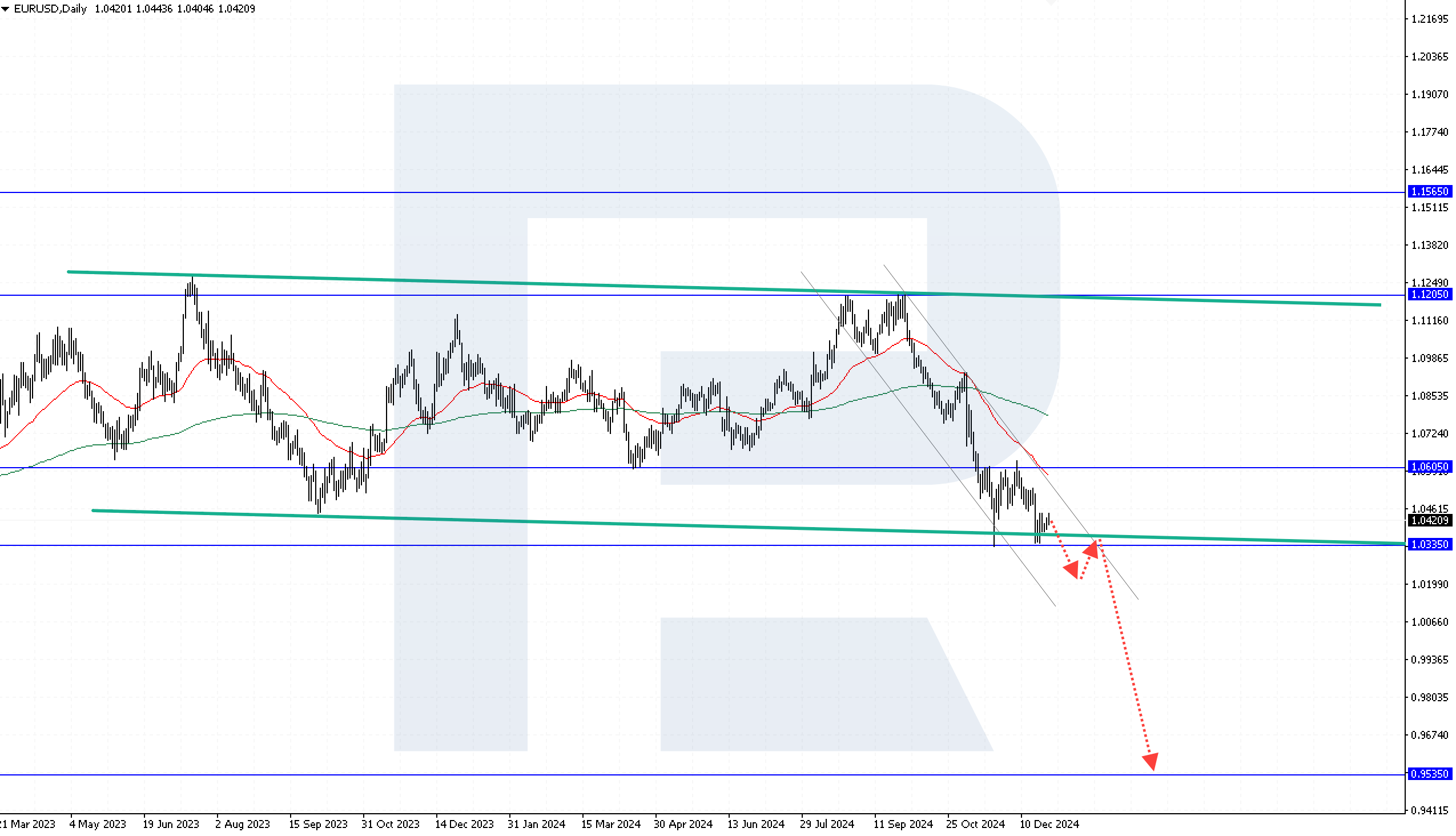

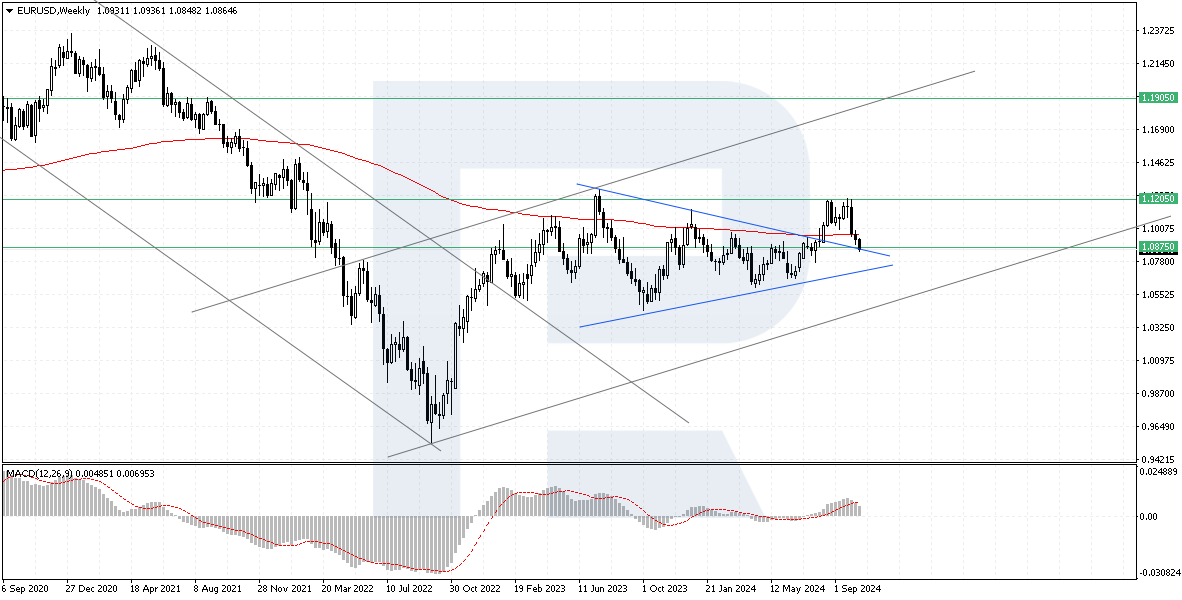

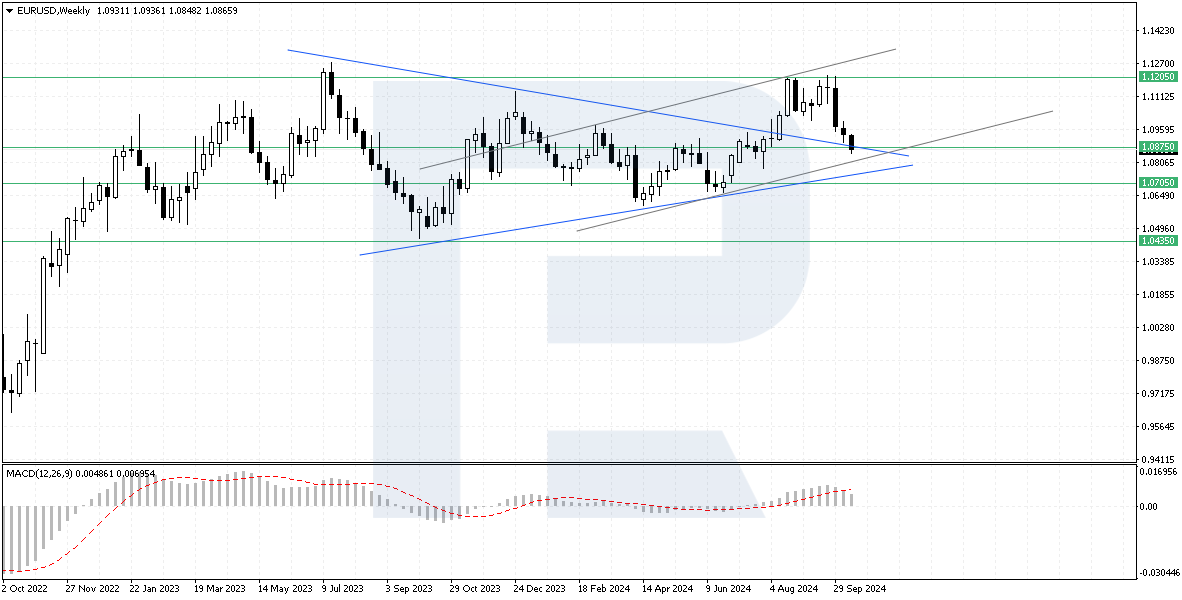

To prepare a longer-term EURUSD forecast, we will examine the weekly chart of the pair. We will apply technical analysis tools, highlight three possible scenarios, and mark crucial levels on the EURUSD weekly chart. This will help assess the pair’s potential movements in the long term.

Potential long-term scenarios for 2024

Bullish scenario: the first thing to note is that a large triangle pattern has been forming since 16 July 2023. Typically, this can be a reversal or trend continuation pattern. In this case, the price broke above the pattern’s upper boundary on 11 August 2024, driven by a more aggressive Federal Reserve interest rate cut. The target for the pattern completion is the 1.1905 level. However, the price is now undergoing a downward correction, and will likely test the upper boundary of the triangle pattern at 1.0875 before continuing its upward trajectory.

A rebound from the upper boundary of the triangle pattern followed by a breakout of the 1.1205 level will be a primary confirmation of potential EURUSD growth for buyers. If the price secures above the crucial resistance level, this will drive potential growth to 1.1905.

Bearish scenario: a robust US labour market report, which ruled out a significant Federal Reserve rate cut in November 2024 and generated discussions on whether there will be a cut at all, is a strong signal for a potential decline. Against this background, the pair reversed from the key 1.1205 resistance level.

The quotes are now declining, and the first support on the way of sellers will be a test of the upper boundary of the triangle pattern. Breaking the 1.0875 level may indicate that prices return within the pattern and continue falling to the lower boundary at 1.0705, which could lead to a further decline to 1.0435. This scenario is possible in case of continued expectations of a more restrained Federal Reserve interest rate cut and weak economic data from the eurozone.

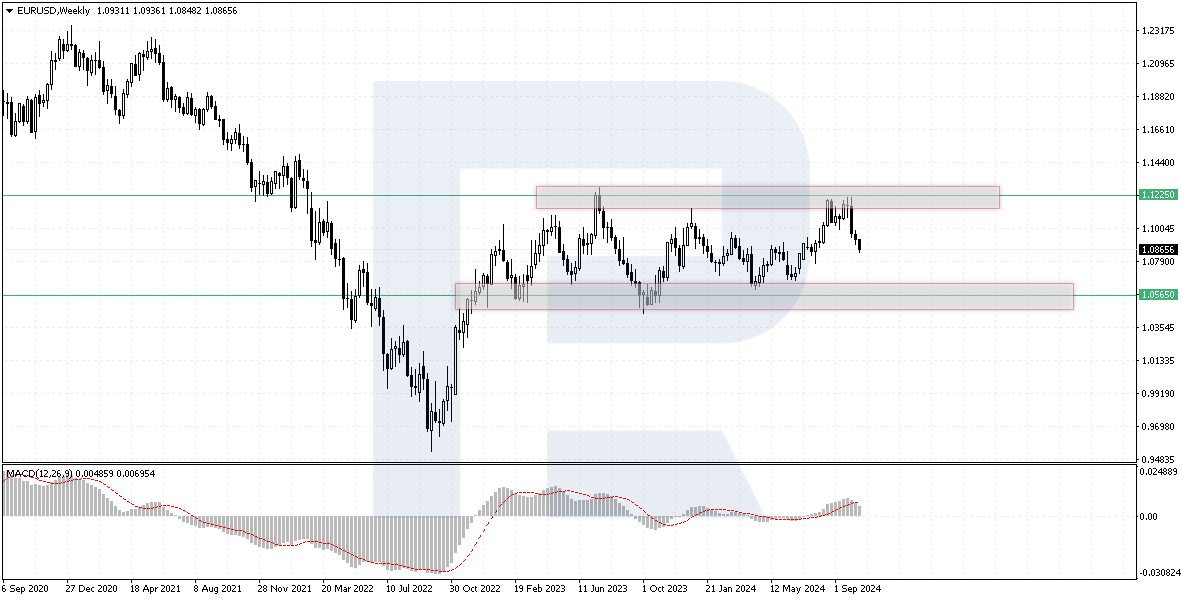

Sideways scenario: the uptrend ended at the beginning of 2023, and since then the EURUSD pair has been moving within a sideways range, with the upper boundary at 1.1225 and the lower at 1.0565. The quotes have approached both the upper and lower boundaries of the range. In September 2024, the price rebounded from the upper boundary again, and could head towards the lower boundary.

In this case, the EURUSD price could remain in a trendless market for a while provided there is a relative balance in economic data and a general reduction in the Federal Reserve and ECB interest rates.

Long-term resistance and support levels

Key support levels:

- 1.0765: a critical support level for buyers, located in the middle of the range. A breakout below this level could indicate selling pressure

- 1.0605: the range’s lower boundary; breaking below this level could lead to a full-fledged downtrend in the EUR to USD pair. In technical analysis, if the pair goes beyond a multi-year range, the target will be the width of this range

- 1.0205: the nearest support on the bears’ path after a breakout below the range’s lower boundary and probably the first full-fledged obstacle for the downtrend

Key resistance levels:

- 1.0995: the nearest resistance level and the lower boundary of a double top reversal pattern. A breakout above this level by buyers would invalidate the pattern

- 1.1205: the upper boundary of the sideways range; a breakout of this level could signal a full-fledged bullish trend in the EURUSD pair

- 1.1585: the next resistance level for buyers following a breakout from the range, marking the first significant obstacle for a potential uptrend

Expert EUR USD forecasts for 2024

EURUSD forecasts for 2024 from leading financial institutions provide valuable insights for traders and investors who do not have the time for their analysis. These forecasts are based on the assessment of macroeconomic data, monetary policy, and market sentiment. Below are expert opinions from banks and financial companies regarding possible EURUSD movements in 2024.

- European Central Bank (ECB) predicts a stable EURUSD rate around the 1.09 level, influenced by an anticipated economic slowdown in the eurozone and moderate inflation. A consistent, tight monetary policy is expected to support the euro

- ING projects the further volatility growth, with potential fluctuations of the currency pair around 1.10. The rate movements will depend on the European Central Bank (ECB) and the US Federal Reserve decisions

- Mitsubishi UFJ Financial Group (MUFG) foresees initial downward pressure on EURUSD due to inflation and the energy crisis in Europe, with a recovery to about 1.12 by the end of the year as the US economy slows and the Fed possibly cuts rates more aggressively

- Scotia Bank anticipates EURUSD will remain around 1.09, with factors like geopolitical tensions and economic volatility in the energy market playing a significant role

- Wells Fargo expects the EURUSD rate to rise to 1.12 by the end of the year, driven by a possible mild recession in the US and a looser Federal Reserve monetary policy. However, political instability in the eurozone and turmoil in the energy market may limit growth

- Erste Group predicts a rally in the EURUSD to 1.13 despite the eurozone’s economic slowdown and easing inflation. The EURUSD analysis emphasises the impact of high energy prices and sluggish demand in the services sector

EUR USD predictions for 2024 from AI

In addition to forecasts of financial companies and large banks, AI algorithms are used increasingly more to make accurate EURUSD forecasts for 2024. These models are based on advanced forecasting algorithms, historical data, and machine learning methods to create more accurate forecasts based on historical data.

While artificial intelligence cannot take into account sudden events such as sharp improvements in the US labour market, it provides a statistically-based approach to analysing future trends. Below are the EURUSD forecasts for 2024 from leading AI platforms showing the growing importance of technology in such forecasting.

- Wallet Investor anticipates EURUSD to weaken moderately, projecting a target of 1.0780 at the end of 2024

- Coin Index offers a pessimistic view, with the pair potentially reaching a peak of 1.0807 and falling to around 1.0748 by November 2024

- Long Forecast sees a bearish trend that could send the EURUSD pair to 1.0680 by the end of the year under the influence of robust US economic data and elevated interest rates

- Panda Forecast provides an optimistic scenario, forecasting a rise in the EURUSD pair to 1.1276 by the end of the year on the back of macroeconomic indicators such as inflation, GDP growth, and interest rate differentials

Long-term EUR USD expert forecasts (2025-2026)

EURUSD movements in the long term (2025-2026) will continue to depend on the interplay of macroeconomic factors, central bank policies, and geopolitical events. While 2024 may be dominated by short-term news such as interest rate cuts, experts' forecasts for 2025 and 2026 focus on the bigger picture. Attention will be paid to economic growth trends, inflation control and changes in ECB and Fed monetary policy. Below are the long-term forecasts from key financial firms.

ECB

The ECB's outlook for 2025 and 2026 will largely depend on how well it manages to control inflation and maintain growth in the eurozone. If inflation continues to fall, the ECB could shift to a looser monetary policy by 2025, focusing on supporting economic growth and employment rather than fighting inflation.

- 2025 outlook: the ECB is expected to adopt a more stimulative policy by 2025, which may lead to a short-term weakening of the euro, but will also support economic growth in the eurozone. The EURUSD pair may trade around 1.10 as the US Federal Reserve will also likely continue to ease its monetary policy, which would equalise both currencies

- 2026 outlook: in 2026, the ECB will likely focus on Europe's economic recovery amid lower energy prices. This could lead to a stronger euro, especially if the US economy continues to slow down. Experts predict that the EURUSD pair is likely to remain around 1.10

ING

ING’s long-term forecast for EURUSD suggests that the euro may start recovering in 2025 and 2026, as the Eurozone economy stabilises and both the ECB and Fed complete their tightening cycles.

- 2025 outlook: ING maintains its 2025 outlook for EURUSD at 1.10, recognising that at current levels, the EURUSD pair is not far from its medium-term fair value and that US monetary, fiscal, and trade policies for 2025 remain very uncertain

- 2026 outlook: by 2026, ING sees little potential for further strengthening of the euro if the US economy enters a slowdown or mild recession. In such a scenario, the EURUSD pair could consolidate above 1.10 due to rising investor confidence in the eurozone economy

MUFG

MUFG's long-term outlook for the EURUSD pair remains bullish but suggests that the euro’s gains will be moderate due to persistent challenges in Europe, such as demographic changes and the need for structural economic reforms.

- 2025 outlook: MUFG expects EURUSD to stabilise at 1.16 by the end of 2025. The euro will be supported by lower inflationary pressures and a neutral ECB policy. However, the US dollar will likely continue to resist due to its status as the world's reserve currency and safe-haven asset

- 2026 outlook: MUFG predicts further strengthing of the euro in 2026 if the US economy slows down and the eurozone shows a strong recovery. The EURUSD pair could surpass 1.16 and reach 1.18, although significant gains would be limited by structural weaknesses in the European economy

Wells Fargo

Wells Fargo offers a more bearish outlook for the EURUSD pair for 2025-2026. Their analysis indicates that structural problems in the US and Europe will keep the currency pair in a narrow range.

- 2025 outlook: Wells Fargo expects the EURUSD pair to remain within the 1.06-1.11 range in 2025. While the euro may receive support from ECB policy, growth in the eurozone is expected to remain weak, limiting the scope for significant gains

- 2026 outlook: in 2026, Wells Fargo predicts a moderate strengthening of the US dollar, which could push the EURUSD pair down to 1.04. However, they emphasise that both economies face long-term challenges, such as slowing productivity growth, which could hinder a significant revaluation of the currencies

Erste Group

Erste Group is cautiously optimistic about the long-term prospects of the EURUSD currency pair. The recent decision by the US Federal Reserve to cut interest rates by 50 basis points had little impact on the exchange rate, as the market has largely anticipated this move. However, pressure on the USD will persist as further Federal Reserve rate cuts are expected.

- 2025 outlook: Erste Group expects the EURUSD rate to rise slightly and test the 1.14 level in 2025, driven by improving economic conditions in Europe. Improved investor confidence could bolster the euro if inflation remains under control and energy prices stabilise

- 2026 outlook: By 2026, the Erste Group predicts that the euro could strengthen further to 1.15 or higher, provided the US dollar weakens and the eurozone economy continues to recover. They emphasise that geopolitical stability and energy security will be key factors influencing the euro's strength

Summary table of long-term expert forecasts

| Company / Date | 1Q 2025 | 2Q 2025 | 3Q 2025 | 4Q 2025 | 1Q 2026 |

|---|---|---|---|---|---|

| ECB | 1.10 | - | - | - | 1.10 |

| ING | 1.10 | 1.10 | 1.10 | 1.10 | 1.10 |

| MUFG | 1.14 | 1.15 | 1.16 | - | - |

| Wells Fargo | 1.11 | 1.10 | 1.10 | 1.06 | 1.04 |

| Erste Group | 1.14 | 1.14 | 1.15 | - | - |

Long-term EURUSD forecasts from AI for 2025-2026

AI-based models offer a different perspective on long-term forecasts for the EURUSD currency pair by applying sophisticated algorithms to analyse historical data, macroeconomic trends, and technical patterns. While these models are not immune to unpredictable events, they provide data-driven insights into potential movements of the currency pair in 2025-2026. Let us take a closer look at EURUSD forecasts from well-known AI platforms for the next two years. All quotes listed are as of 23 October 2024.

Wallet Investor

Wallet Investor's AI model predicts a gradual strengthening of the US dollar against the euro in 2025-2026. The forecast is based on assumptions of stabilising inflation and sustained economic growth in the US.

- 2025 outlook: according to the model, the EURUSD rate may decline from 1.0780at the start of the year to 1.0520 by the end of 2025. This would be due to the improving economic situation in the US and a possible pause in Federal Reserve interest rate cuts

- 2026 outlook: Wallet Investor expects the US dollar to strengthen further in 2026. The EURUSD rate is projected to start the year at 1.0520 and fall to 1.0260 by the end of the year. The main drivers of this trend are the continued recovery of the US labour market and the Federal Reserve's more neutral monetary policy compared to the ECB

Coin Index

The Coin Index model offers a more aggressive long-term outlook, suggesting that the EURUSD pair will begin to decline strongly as early as early 2025, with a sharp drop by the end of 2026.

- 2025 outlook: the Coin Index AI model predicts that the EURUSD rate will reach a high of 1.0812 and a low of 0.9786 in 2025

- 2026 outlook: in 2026, the EURUSD rate is expected to continue falling, with a maximum at 0.9788 before the pair plunges to 0.8486. Based on the Coin Index model data, it can be presumed that the EURUSD pair will be in a downtrend over these two years

Long Forecast

Long Forecast offers a bullish outlook for EURUSD with minor corrections, suggesting that the US dollar will maintain its strength due to its status as a global safe-haven currency and the resilience of the US economy. However, in some cases, the dollar may start to lose ground against the euro.

- 2025 outlook: Long Forecast expects the EURUSD rate to start 2025 at 1.0680 and end it at 1.0880. Global economic uncertainty and geopolitical risks will continue to push investors towards the USD, but its influence will fade as the eurozone recovers

- 2026 outlook: in 2026, the model predicts a moderate strengthening of the euro within an ascending channel. EURUSD will start 2026 at 1.0880 and end at 1.1460, continuing to gain strength amid stabilising economic conditions in Europe

Panda Forecast

Panda Forecast offers a more optimistic outlook for EURUSD, expecting the euro to strengthen in the long term due to economic growth in the eurozone and the US Federal Reserve's shift to a neutral monetary policy.

- 2025 outlook: according to the Panda Forecast AI model, the EURUSD rate could reach 1.0710 by mid-2025 and end the year at 1.0706. This growth will primarily be driven by the sustainable development of the eurozone economy and easing inflationary pressures

- 2026 outlook: in 2026, the model predicts a further strengthening of the euro, with the potential to reach 1.3000 and above. Key factors for the pair's strengthening include improved investment sentiment in the eurozone and a weaker US dollar as global risk appetite increases

Summary table of long-term AI forecasts

| AI model / Date | 2025 | 2026 |

|---|---|---|

| Wallet Investor | 1.0520 | 1.0260 |

| Coin Index | 0.9768 - 1.0812 | 0.8486 - 0.9788 |

| Long Forecast | 1.0880 | 1.1460 |

| Panda Forecast | 1.0706 | 1.3000 |

EUR USD forecast: risks and considerations

When making a EURUSD forecast for several years ahead, it is important to consider various risks and factors that may affect the accuracy of the forecast. While expert opinions from leading financial companies and banks, as well as AI models, provide valuable insights, unforeseen events can significantly change the direction of the pair. Below are the risks and general thoughts to consider when assessing the EURUSD outlook for 2024-2026.

- Geopolitical instability. Geopolitical risks are one of the most unpredictable factors that can affect the currency market. Events like political turmoil, trade wars, and conflicts – especially in key regions – can disrupt economic growth, affect investor sentiment, and increase volatility in the EURUSD pair

- Central Bank policy divergence. The monetary policies of the European Central Bank (ECB) and the US Federal Reserve will play a key role in shaping the future course of the EURUSD pair. However, these policies may change depending on new economic data, inflation and the pace of economic growth. If the ECB adopts a softer stance and the Fed remains tight, this could lead to a decline in the EURUSD pair

- Inflationary pressures. While persistent high inflation remains a challenge for the eurozone and the US, inflation is already approaching the regulators' target levels. If inflationary pressures build up, central banks may be forced to take harsh measures such as raising interest rates, which could have a significant impact on EUR/USD movements. If inflation surges unexpectedly, especially in the eurozone, the ECB may be forced to tighten monetary policy more than expected, which could lead to a sharp drop in the EURUSD pair

- Global economic slowdown. A slowdown in economic growth caused by recession, supply chain disruptions or a slowdown in large economies such as China could affect both the eurozone and the US. A global economic downturn may strengthen the U.S. dollar as investors seek safe-haven assets

- Energy crisis and supply chain disruptions. The eurozone's reliance on external energy sources makes it vulnerable to energy shocks and supply chain disruptions. If the energy crisis worsens, especially due to geopolitical tensions or market imbalances, it could negatively impact the euro. Rising energy prices or energy shortages could undermine the eurozone economy, leading to a weaker EURUSD

- Technological disruptions and AI integration. As AI models become more integrated into financial forecasts and trading, they can influence market behaviour in new and unpredictable ways and techniques. While AI models help identify patterns and trends, their integration into decision-making processes could increase volatility if market participants begin to react en masse to AI-generated forecasts

Conclusion

The EURUSD is expected to see significant changes from 2024 to 2026, with both bullish and bearish scenarios likely to emerge. Forecasts from various financial institutions emphasise the critical role of economic policy and inflation expectations in predicting the EURUSD rate.

Some analysts suggest that the pair will remain in a sideways movement between 1.0500 and 1.1000, while others predict a possible rise to 1.1500 and several AI models signal a fall below 0.9000 by 2026. However, risks such as geopolitical instability and inflationary pressures could significantly impact the pair's further fluctuations.

Overall, EURUSD dynamics will depend on a variety of factors, including central bank actions and general economic conditions in the US and the eurozone.

FAQ

- The current EURUSD price you can find in the EURUSD live price chart

EUR/USD is set to rise in 2025. EURUSD is currently moving in a sideways range between 1.1225 and 1.0565. A breakout above the upper boundary may signal a potential upward movement towards 1.1905, while a breakout below the lower boundary will open the way for a downtrend with targets at 1.0200 and 0.9700.

Whether now is a good time to buy or sell EURUSD depends on your trading strategy, risk tolerance, and market analysis. Traders often evaluate fundamental factors such as interest rate differentials, inflation data, and global economic conditions. Technical indicators such as trend lines, moving averages, and sentiment analysis also help determine entry and exit points. It is advisable to consult with a financial expert or rely on your own careful analysis before making trading decisions.

EURUSD forecasts for 2025 vary, reflecting the impact of different approaches to forecasting. Some AI models, such as Trading Economics and Long Forecast, expect EURUSD to decline to 1.0800 and below, driven by US dollar strength and global uncertainty. Meanwhile, Panda Forecast and Erste Group predict that the EURUSD pair could rise to the 1.1400-1.2400 levels, supported by sustained recovery of the eurozone economy. The general consensus suggests a sideways movement with possible fluctuations between 1.06 and 1.14 depending on inflation, monetary policy, and economic growth.

To trade EURUSD, open a trading account or use a demo account for practice. Select the EURUSD pair, analyse the market using technical and fundamental indicators, and decide whether to buy or sell based on your outlook. Set stop-loss and take-profit levels to manage risk. Once you open a position, monitor it closely and adjust as necessary based on market movements.

AI-based predictions for EURUSD are popular due to advancements in machine learning. These models analyse historical data and market trends to generate forecasts, offering valuable insights. However, they are not foolproof and should be used alongside other analysis methods, as they may struggle with unpredictable events like geopolitical crises or policy changes.

News significantly impacts the EURUSD exchange rate. Economic reports like GDP, unemployment, and inflation from the eurozone and the US, as well as central bank decisions on interest rates, can cause major price fluctuations. Geopolitical events such as elections or trade deals also affect forecasts. Traders should stay updated on breaking news to adjust strategies.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.