Pound at the start of a new rally: what lies ahead for GBPUSD on 14 January 2026

The GBPUSD forecast for today favours the GBP, with quotes likely to regain ground and test the 1.3510 level. Find out more in our analysis for 14 January 2026.

GBPUSD forecast: key takeaways

- US retail sales: previously at 0.4%, projected at 0.4%

- Speech by the Bank of England Deputy Governor for Markets and Banking Dave Ramsden

- GBPUSD forecast for 14 January 2026: 1.3510 and 1.3400

Fundamental analysis

The GBPUSD forecast for today, 14 January 2026, is favourable for the pound, with quotes having every chance for further growth after a minor correction.

Today, a speech by Dave Ramsden, Deputy Governor of the Bank of England for Markets and Banking, will take place. In his remarks, he may make statements or provide hints regarding the Bank of England’s next steps in monetary policy. In the event of an interest rate hike or the maintenance of a hawkish monetary policy stance, the British pound may strengthen.

According to the forecast for 14 January 2026, US retail sales may remain unchanged at 0.4%. If the actual figure comes in below expectations, this could become an additional factor weakening the USD. Markets are also awaiting the Federal Reserve’s January interest rate decision. If the rate is reduced, this would further weaken the USD and could trigger additional strengthening of the GBP against the dollar.

Geopolitical risks also influence the pair. For example, escalating international tensions or the introduction of new trade tariffs by the US could weaken the dollar, while the pound may continue to strengthen amid USD weakness.

GBPUSD technical analysis

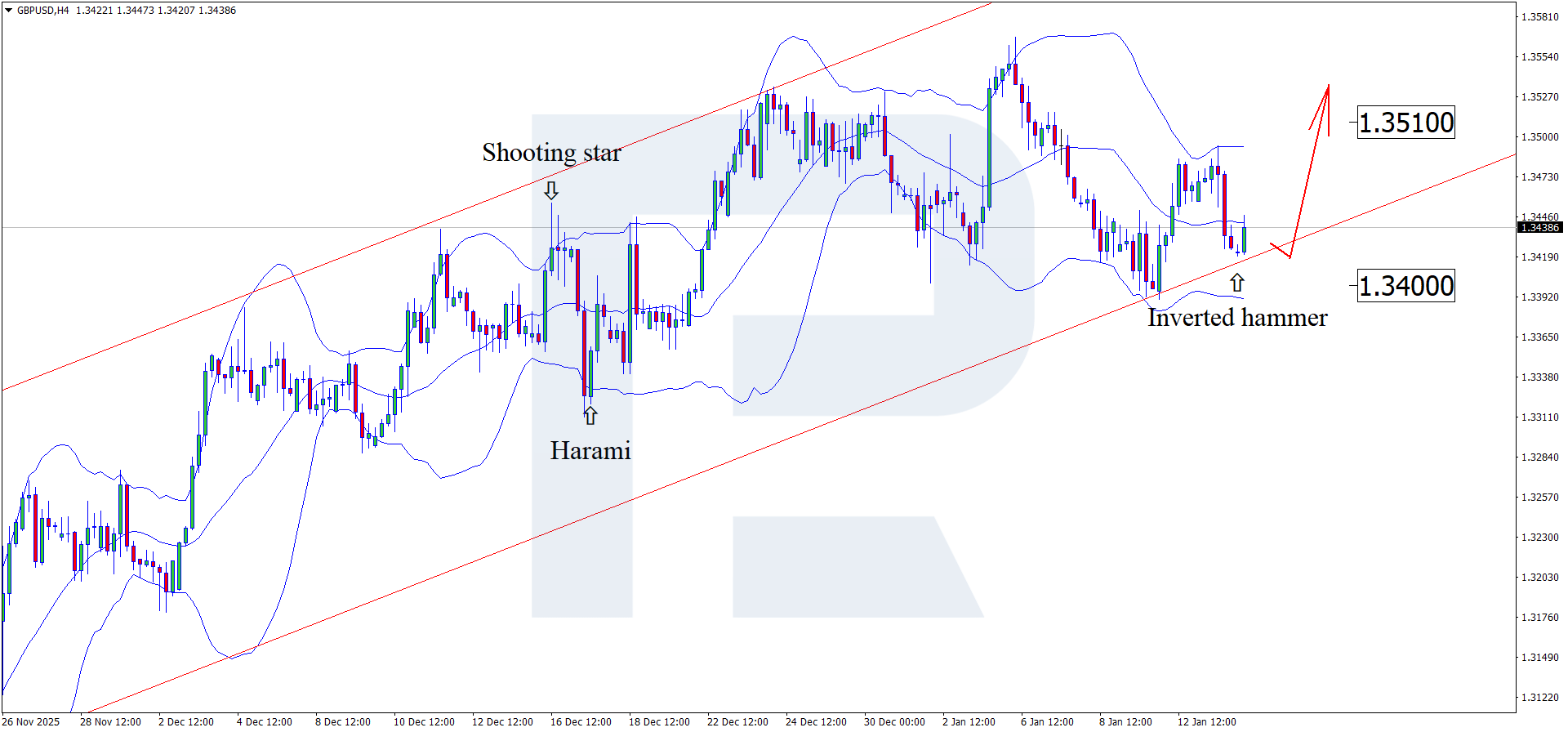

After testing the lower Bollinger Band, the GBPUSD pair has formed an Inverted Hammer reversal pattern on the H4 chart. At this stage, the pair may continue an upward wave following the pattern’s signal, with the current upside target at 1.3510. A breakout above the resistance level would open the way for continued upward momentum.

The GBPUSD forecast for today also considers an alternative scenario, involving a price correction towards the 1.3400 level before growth resumes.

Summary

The speech by the Bank of England Deputy Governor may provide additional support for the GBP. Technical analysis of GBPUSD suggests a rise towards the 1.3510 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.