Pound poised for growth: what awaits GBPUSD after the Fed meeting

The British pound continues to strengthen against the US dollar, and amid expectations of the Fed’s interest rate decision, the GBPUSD rate may rise towards the 1.3920 level. Discover more in our analysis for 28 January 2026.

GBPUSD forecast: key takeaways

- US Federal Reserve interest rate decision: previous value – 3.75%, projected at 3.75%

- Current trend: moving upwards

- GBPUSD forecast for 28 January 2026: 1.3920

Fundamental analysis

The GBPUSD forecast for today, 28 January 2026, remains favourable for the pound, as prices still have strong potential for further growth after a minor correction.

Today, the Federal Reserve will hold its meeting and announce its interest rate decision. The current rate stands at 3.75%. Considering recent comments from Fed officials, US economic data, and prevailing market sentiment, there is a high probability that the rate will remain unchanged. This, in turn, could slightly weaken the US dollar, which aligns with the preferences of the US president. A weaker dollar is beneficial for President Donald Trump, as it supports stronger competitiveness against Chinese manufacturers.

Special attention should also be paid to the Bank of England’s reaction, as its potential response following the Fed’s decision could further boost the pound and signal a more aggressive policy stance in the future. For now, however, amid global economic instability, any signal from the Fed or the BoE regarding possible rate changes could trigger increased volatility in the GBPUSD rate.

Technical outlook

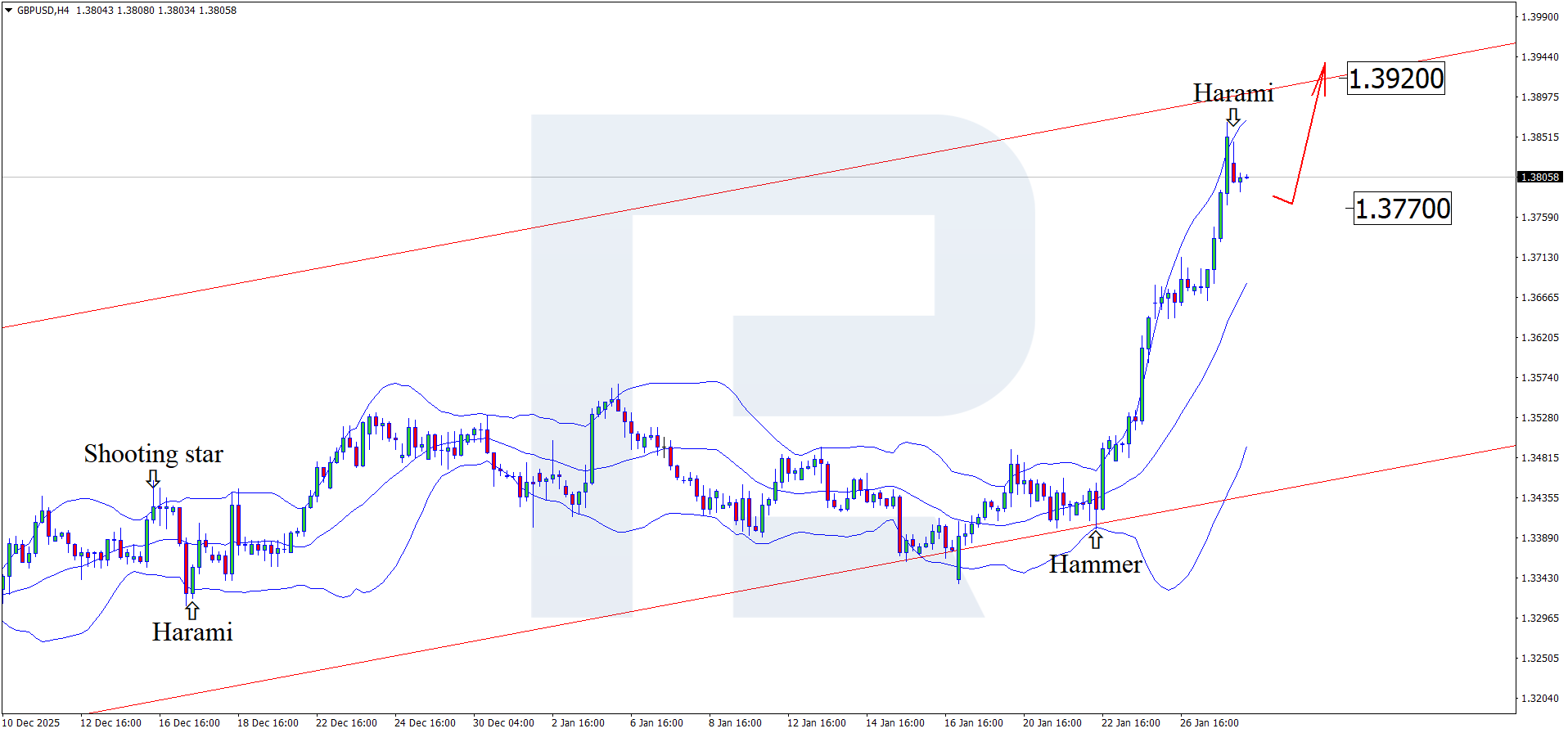

Having tested the upper Bollinger Band, the GBPUSD pair formed a Harami reversal pattern on the H4 chart. At this stage, it may continue a corrective wave following the pattern’s signal. The current target for the pullback is 1.3770. A rebound from the support level would open the door for continued bullish momentum.

At the same time, the GBPUSD forecast for today also considers an alternative scenario, in which the price rises directly towards 1.3920 without testing the support level.

GBPUSD overview

- Asset: GBPUSD

- Timeframe: H1 (Intraday)

- Trend: bullish

- Key resistance levels: 1.3920 and 1.4000

- Key support levels: 1.3660 and 1.3550

GBPUSD trading scenarios for today

Main scenario (Buy Limit)

A rebound from the 1.3770 level may indicate that conditions are forming for a long scenario in GBPUSD today. The risk-to-reward ratio is 1:5.

Potential profit upon reaching the take-profit level is about 150 pips, with possible losses capped at 30 pips.

- Take Profit: 1.3920

- Stop Loss: 1.3740

Alternative scenario (Sell Stop)

Short positions may be considered if the price breaks below the 1.3660 support level and consolidates beneath it, indicating a deeper corrective wave.

- Take Profit: 1.3520

- Stop Loss: 1.3740

Risk factors

Risk factors for continued GBPUSD growth include persistently high unemployment and slowing wage growth in the UK, which may limit the bullish potential. Additional pressure on the pound could also come from a strengthening US dollar following the Fed’s interest rate decision.

Summary

The US dollar continues to lose ground against major global currencies, including the British pound. GBPUSD technical analysis suggests a move towards the 1.3920 level after the correction phase is complete.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.