GBPUSD is neutral as the market awaits Bank of England data

The GBPUSD pair remains stable near 1.3700. The calm news background allows the market to wait for new signals. Discover more in our analysis for 4 February 2026.

GBPUSD forecast: key takeaways

- The GBPUSD pair is trading calmly within a range ahead of the BoE decision

- Current trend: no sharp movements are expected until mid-month

- GBPUSD forecast for 4 February 2026: 1.3720

Fundamental analysis

The GBPUSD rate is hovering around 1.3699 on Wednesday. The pound remains stable amid a quiet macroeconomic calendar and ahead of the Bank of England interest rate decision on Thursday. Since the beginning of the year, the pound has gained around 1.4% due to a series of stronger-than-expected economic data. The Bank of England is likely to keep the interest rate at 3.75%, with one or two rate cuts possible later this year.

UK inflation accelerated to 3.4% in December, exceeding forecasts and becoming the highest among the G7 countries. The regulator expects inflation to return closer to the 2% target by mid-year.

Until mid-to-late February, the UK is unlikely to see major data releases, except for figures on economic growth, the labour market, and inflation. Recent data, including strong GDP in November, a recovery in retail sales in December, and rising business activity in January, has already helped the pound strengthen against the US dollar and the euro this year.

The GBPUSD outlook is neutral.

Technical outlook

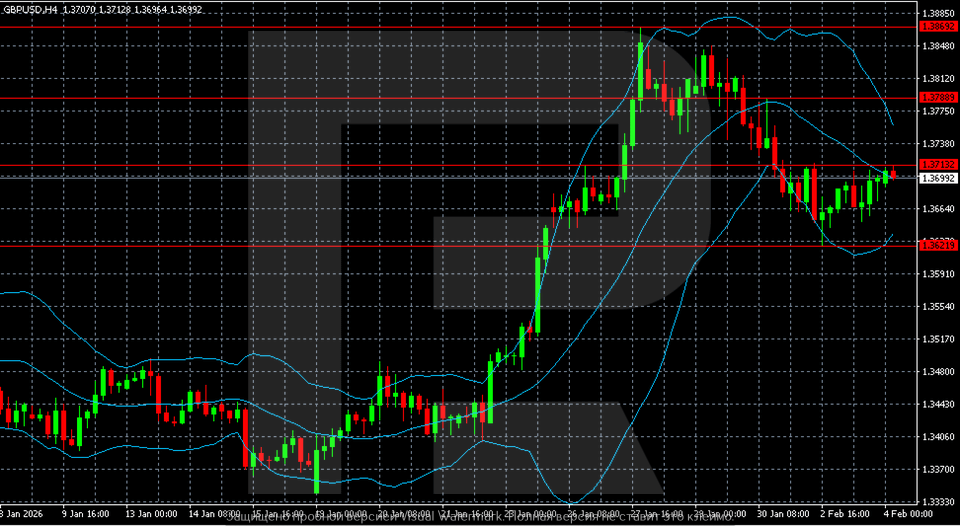

On the GBPUSD H4 chart, after prolonged sideways movement in the first half of January, the pair entered a phase of sharp impulsive growth. The breakout above the upper boundary of the range was accompanied by an expansion of Bollinger Bands and accelerated upward movement, indicating buyer dominance. The peak formed in the 1.3850–1.3870 area.

After reaching new local highs, the pair underwent a correction. The price pulled back from the upper Bollinger Band and moved into a consolidation phase below the highs. The current movement is corrective: quotes are stabilising within the 1.3650–1.3720 range, remaining above the key support level at 1.3620.

Overall, the structure remains moderately bullish, but momentum has noticeably weakened. A return above 1.3780–1.3800 is required to resume growth, while a move below 1.3620 will increase the risk of a deeper correction.

GBPUSD overview

- Asset: GBPUSD

- Timeframe: H4 (Intraday)

- Trend: moderately bullish (weakening momentum)

- Key resistance levels: 1.3780 and 1.3850

- Key support levels: 1.3650 and 1.3620

GBPUSD trading scenarios for today

Main scenario (Buy Limit)

After the momentum-driven rally in January, the GBPUSD pair has entered a phase of corrective consolidation below local highs. Holding above the 1.3650–1.3620 zone preserves the bullish market structure. A rebound from the support area may create conditions for renewed growth towards the upper boundary of the range.

The risk-to-reward ratio is around 1:3.

- Buy Limit: 1.3660

- Take Profit: 1.3780

- Stop Loss: 1.3620

Alternative scenario (Sell Stop)

A breakout and consolidation below the 1.3620 level will indicate a breakdown of the current structure and increase the risk of a deeper correction following the January rally.

- Sell Stop: 1.3610

- Take Profit: 1.3520

- Stop Loss: 1.3680

Risk factors

Risks to the bullish GBPUSD scenario are linked to a potential strengthening of the US dollar and a more cautious tone from the Bank of England following the meeting. This may tip the balance in favour of a continued corrective decline.

Summary

The GBPUSD pair is rising modestly amid a quiet calendar and ahead of the upcoming Bank of England meeting. The GBPUSD forecast for today, 4 February 2026, does not rule out a return towards 1.3720.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.