Buyers attempt to stabilise GBPUSD after the sell-off

The GBPUSD rate is correcting after a sharp decline, but weak UK labour market data continues to weigh on the pair. The rate currently stands at 1.3557. Find out more in our analysis for 18 February 2026.

GBPUSD forecast: key takeaways

- Weak labour market data increased pressure on the British pound

- The market strengthened expectations of Bank of England rate cuts in the coming months

- The unemployment rate rose to 5.2%, the highest since early 2021

- GBPUSD forecast for 18 February 2026: 1.3420

Fundamental analysis

The GBPUSD pair is undergoing a correction after an aggressive decline in the previous session. However, buyers defended the key support level at 1.3525, allowing the pair to stabilise near local lows.

The British pound came under pressure following the release of weak UK labour market data, which reinforced expectations that the Bank of England may shift towards cutting interest rates in the coming months.

The UK unemployment rate rose to 5.2%, marking the highest level since early 2021. Director of Economic Statistics Liz McKeown noted that the labour market is showing clear signs of cooling. Hiring activity is slowing, unemployment is rising, and private-sector wage growth has decelerated to its lowest level in the past five years. Overall, the deterioration in labour market conditions increases pressure on the GBPUSD rate and creates conditions for a softer Bank of England stance in the near term.

Technical outlook

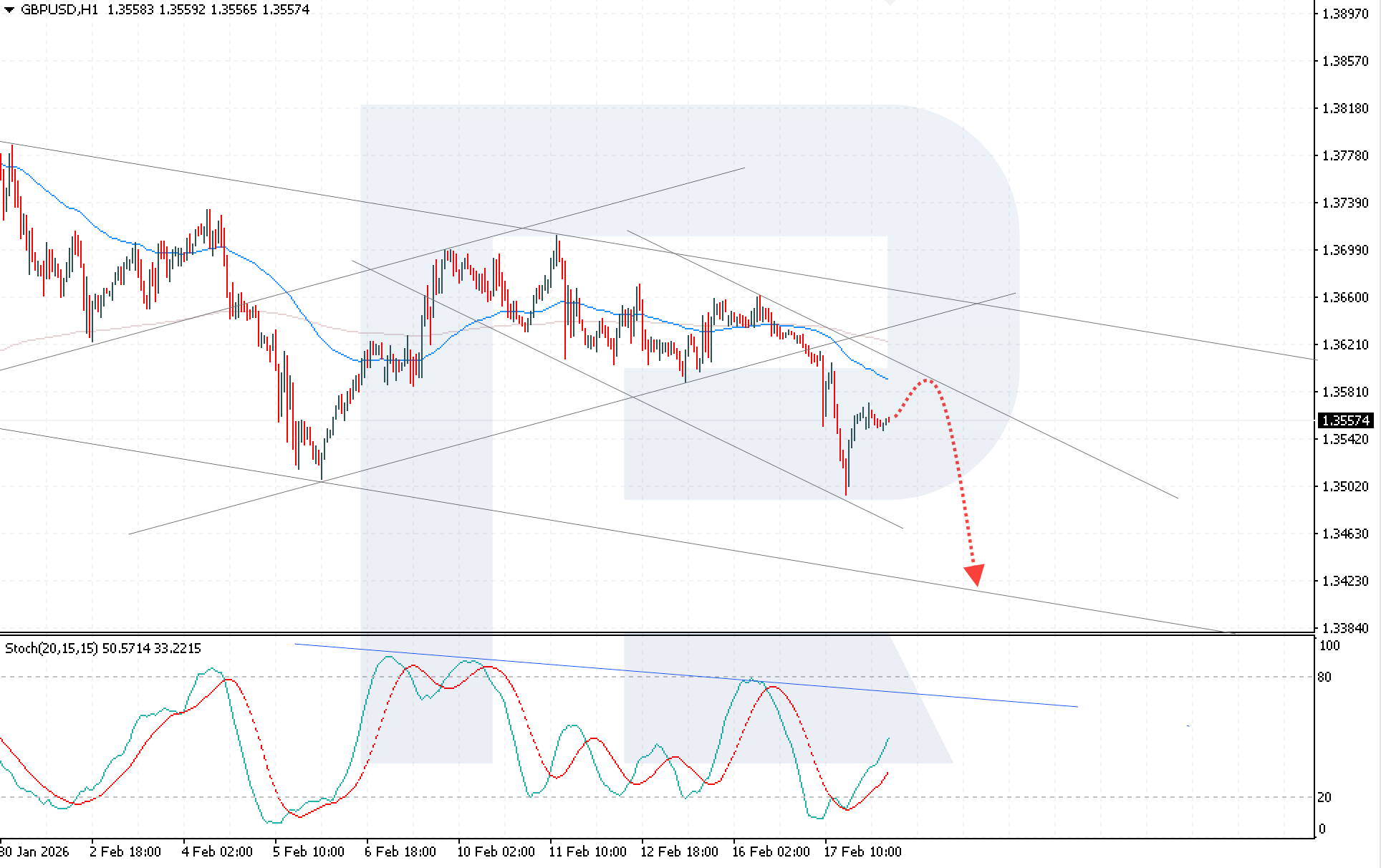

The GBPUSD pair is rebounding from the lower boundary of a descending channel, forming a corrective recovery. Despite attempts to gain bullish momentum, sellers continue to keep the price below the EMA-65, maintaining medium-term pressure on the pair.

The GBPUSD forecast for today suggests a renewed decline towards 1.3420 after a rebound from the upper boundary of the descending channel. The current technical structure indicates that the potential for a bearish scenario remains. The Stochastic Oscillator has exited oversold territory and is approaching a descending resistance line, which may limit further growth and trigger a new wave of selling.

A key confirmation signal for further downside will be a breakout below the local support level and consolidation below 1.3545.

GBPUSD overview

- Asset: GBPUSD

- Timeframe: H1 (Intraday)

- Trend: downward momentum

- Key resistance levels: 1.3585 and 1.3660

- Key support levels: 1.3545 and 1.3505

GBPUSD trading scenarios for today

Main scenario (Sell Stop)

A consolidation below the local 1.3545 support level would signal the end of the bullish correction and create conditions for opening short positions, with the downside target at 1.3420. The potential profit upon reaching the take-profit level is around 125 pips, with possible losses capped at 30 pips. The risk-to-reward ratio exceeds 1:4.

- Take Profit: 1.3420

- Stop Loss: 1.3575

Alternative scenario (Buy Stop)

An aggressive rise with a breakout above the upper boundary of the descending channel and consolidation above 1.3605 would indicate continued growth of the currency pair.

- Take Profit: 1.3695

- Stop Loss: 1.3565

Risk factors

Risks to the downside scenario include sustained consolidation above 1.3595 and a breakout above the upper boundary of the descending channel, which could trigger a deeper upward correction. An additional invalidation factor for the bearish scenario would be stronger demand for the pound amid a shift in Bank of England rhetoric or renewed weakness in the US dollar.

Summary

The deterioration in the UK labour market strengthens expectations of BoE rate cuts and increases the risk of further short-term weakness in the pound. GBPUSD technical analysis suggests a high probability of renewed downside movement, with the nearest target at 1.3420.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.