NZDUSD weakens amid challenges in New Zealand’s economy

NZDUSD has declined for the fourth consecutive trading session. A detailed analysis for 4 October 2024 provides insights into the key factors behind this movement.

NZDUSD forecast: key trading points

- Expectations for a significant rate cut by the Reserve Bank of New Zealand have increased amid weak economic indicators

- The latest Quarterly Survey of Business Opinion highlighted excess capacity in the New Zealand economy and weakening price pressures

- The US Services Business Activity Index rose to its highest level since February 2023, offering support to the US dollar

- NZDUSD forecast for 4 October 2024: 0.6144

Fundamental analysis

NZDUSD is declining amid expectations of a significant interest rate cut by the Reserve Bank of New Zealand, reflecting concerns about the country’s economic slowdown. This outlook is largely based on the latest data from the Quarterly Survey of Business Opinion by the New Zealand Institute of Economic Research, which indicated excess capacity in the economy and reduced price pressures, adding to the bearish sentiment among NZDUSD traders.

In August, the Reserve Bank of New Zealand initiated a cycle of monetary policy easing, reducing the interest rate by 25 basis points. A further rate cut of 50 basis points is expected next week, putting downward pressure on the NZD. Given these monetary policy developments, the outlook for NZDUSD has become increasingly bearish.

Meanwhile, today’s focus is on the US employment report for September, which could shape further movements in the pair. US economic data, including the surge in the US Services Business Activity Index to 54.9 points in September (its highest since February 2023), suggests robust economic momentum, offering continued strength to the US dollar. As a result, today’s NZDUSD forecast suggests the pair may experience further downside pressure, driven by US dollar gains, setting up the potential for continued downward momentum.

NZDUSD technical analysis

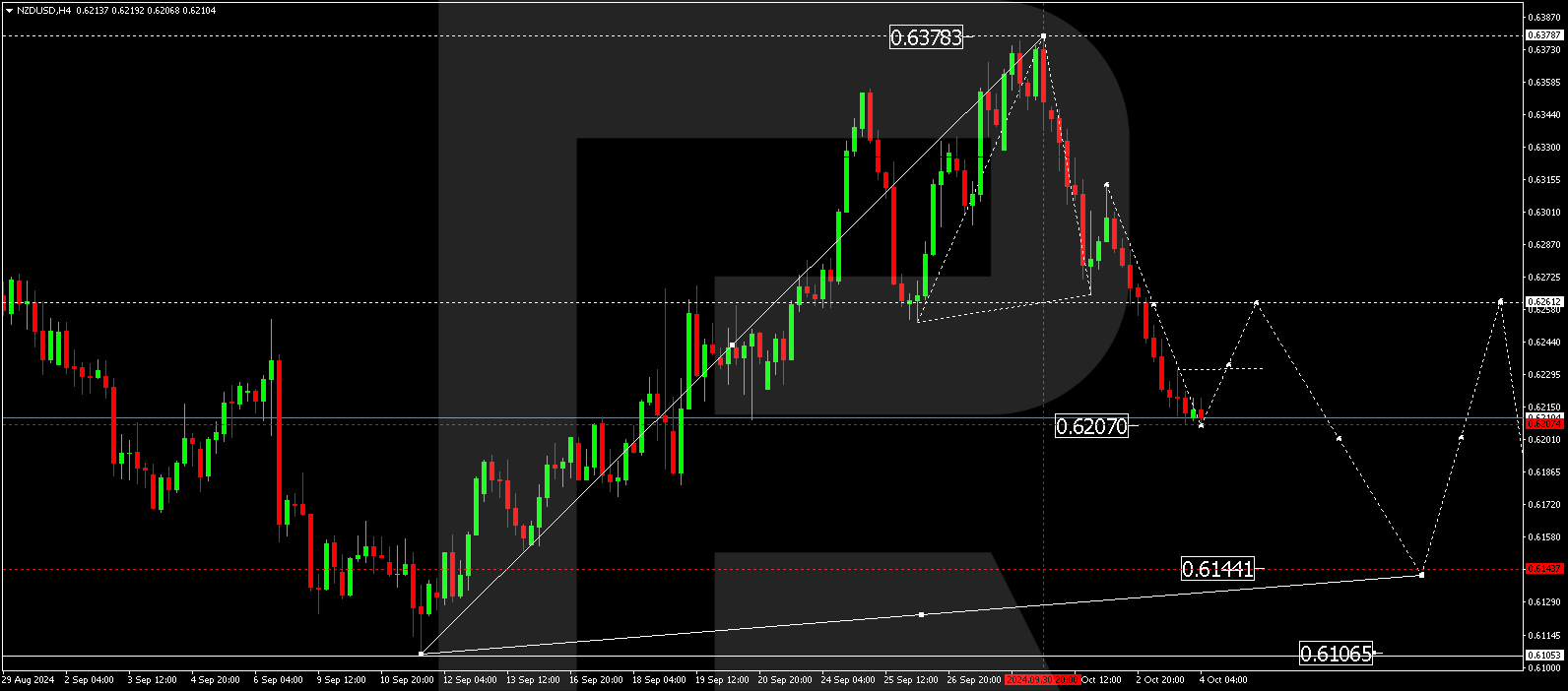

On the H4 chart of the NZDUSD pair, the market has been on a wave of decline, hitting the level of 0.6207. The price action is close to reaching its calculated local target of the downward wave. As of 4 October 2024, consolidation is likely above the 0.6207 level. If an upward breakout occurs from this consolidation, a correction towards 0.6262 (retest from below) is possible. However, if the pair breaks lower, the signal points to further downside toward the target level of 0.6144.

Summary

NZDUSD rate continues its downward trajectory, pressured by expectations of further monetary easing by the Reserve Bank of New Zealand. Additionally, the strengthening US dollar, buoyed by solid services sector data and the anticipation of a robust employment report, adds to the bearish case. In today’s NZDUSD forecast, technical indicators suggest a high likelihood of continued downward movement towards the target of 0.6144.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.