NZDUSD stabilised after another collapse

The NZDUSD pair paused its decline, with the Kiwi under pressure from the strong US dollar. Find out more in our analysis for 15 November 2024.

NZDUSD forecast: key trading points

- The NZDUSD pair has temporarily halted its decline

- The instrument is hovering near an annual low, and the outlook remains negative

- NZDUSD forecast for 15 November 2024: 0.5777

Fundamental analysis

The NZDUSD rate fell to 0.5858 before stabilising.

The market has temporarily calmed after the NZDUSD pair reached a new annual low. Chinese economic data currently provides local support for the Kiwi, with retail sales growth significantly exceeding expectations. However, industrial production and real estate have fallen short of the forecast.

The strong US dollar exerts substantial pressure on the NZD, particularly evident following comments from Federal Reserve Chair Jerome Powell. He stated that the Fed would not rush to lower interest rates as economic growth continues and inflationary pressure persists.

The RBNZ will hold a meeting at the end of November, and it is expected to lower its interest rate by 50 basis points to 4.25% per annum.

The NZDUSD forecast remains in favour of the US dollar.

NZDUSD technical analysis

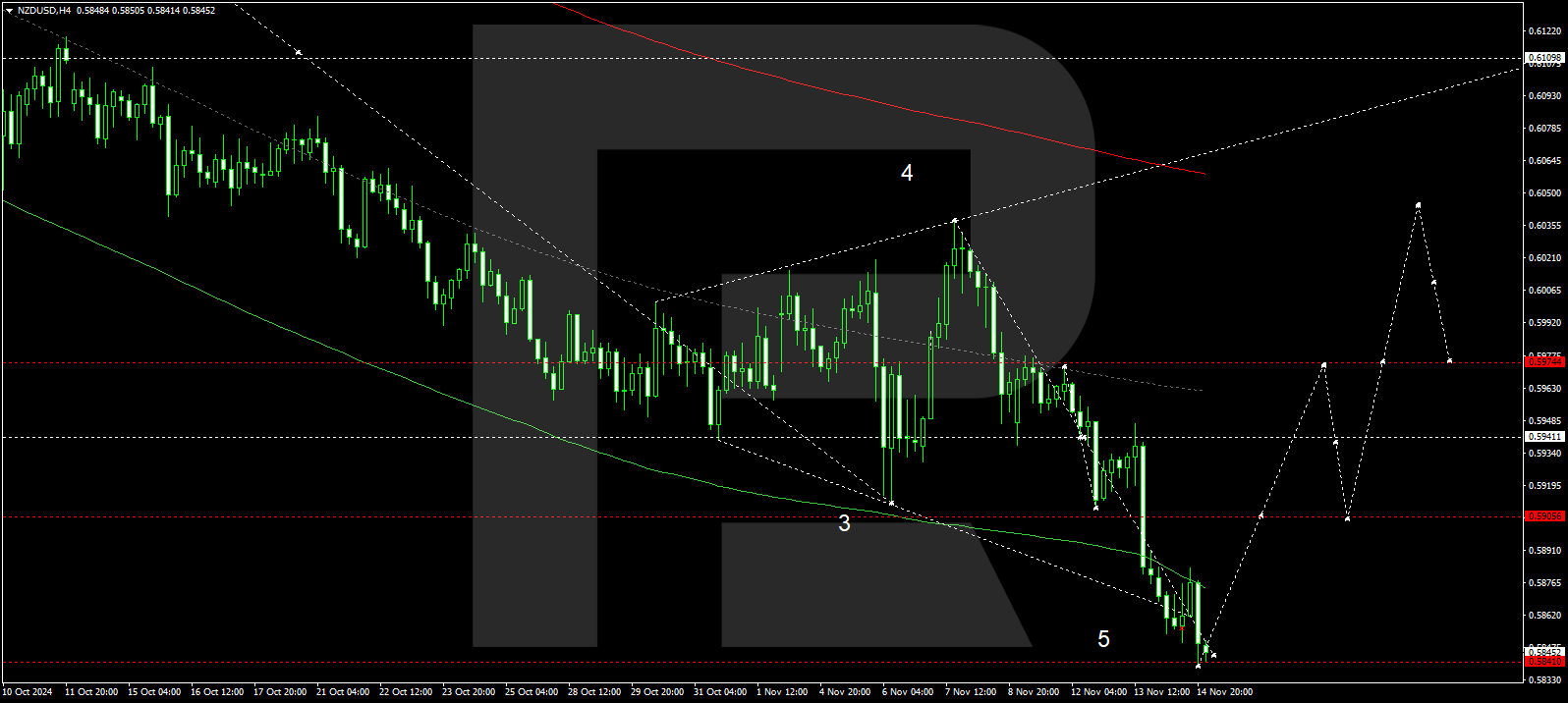

The NZDUSD H4 chart shows that the market has reached the downward wave’s target of 0.5841. A consolidation range could develop above this level today, 15 November 2024. If the price breaks below the range, the wave could extend towards 0.5777. If it breaks higher, a correction might begin, aiming for 0.5975 as the first target.

The Elliott Wave structure and wave matrix for the NZDUSD rate, with a pivot point at 0.5940, technically confirm this scenario. The market is currently at the lower boundary of a price envelope, and a consolidation range is expected to form around this level. A breakout above the range could trigger a corrective wave towards the envelope’s upper boundary at 0.6110, while a downward breakout might extend the wave to 0.5777.

Summary

The NZDUSD pair has tumbled to annual lows and appears highly unstable. Technical indicators for today’s NZDUSD forecast suggest that the downward wave could extend towards 0.5777.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.